Working with PDF forms online is definitely very easy with this PDF editor. Anyone can fill out tad 50 162 here without trouble. FormsPal development team is always working to expand the editor and insure that it is even better for clients with its multiple functions. Enjoy an ever-evolving experience now! Getting underway is easy! What you need to do is adhere to the next basic steps below:

Step 1: Click on the "Get Form" button in the top section of this webpage to open our editor.

Step 2: When you open the file editor, there'll be the document all set to be completed. Besides filling out different blank fields, you might also do some other actions with the form, that is writing custom textual content, changing the initial textual content, adding illustrations or photos, putting your signature on the PDF, and much more.

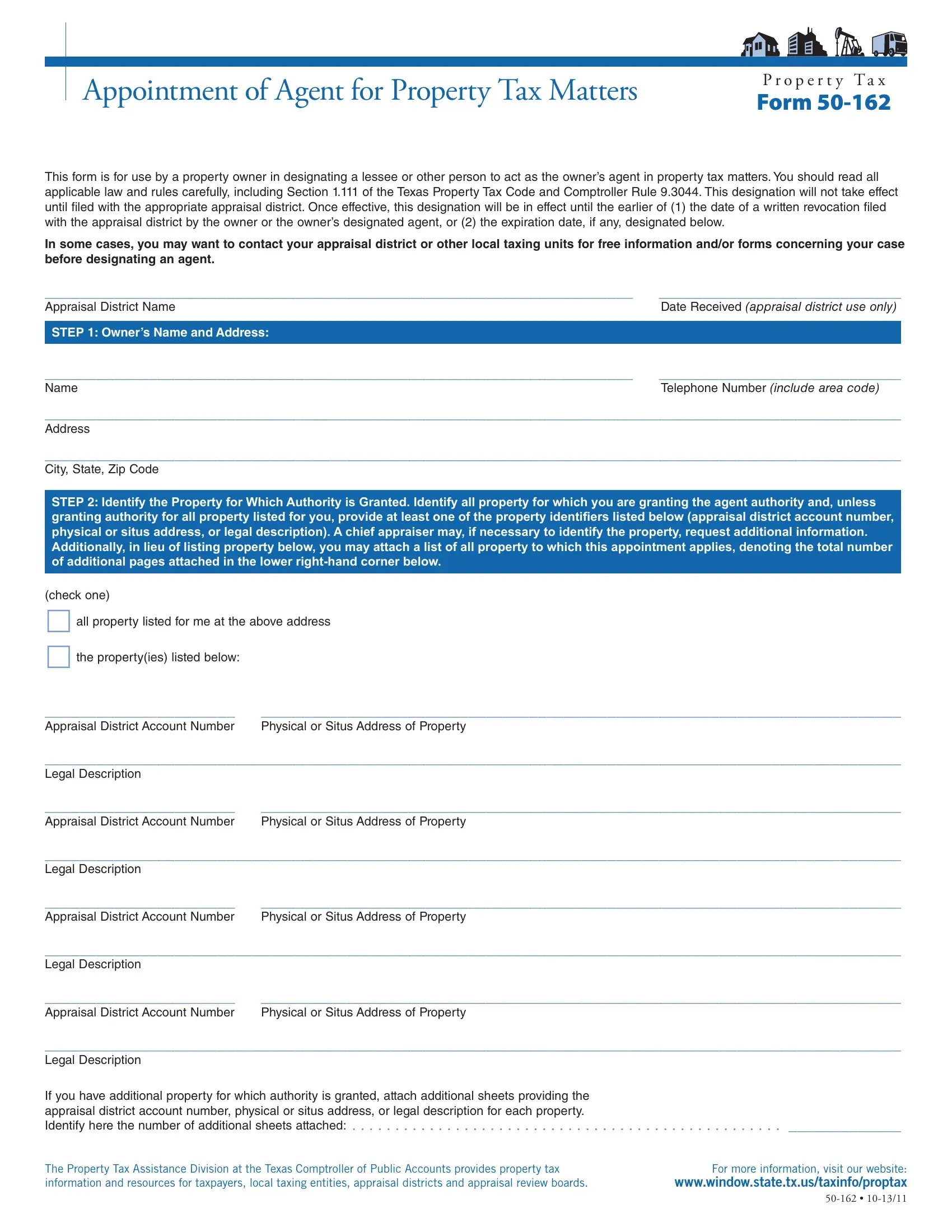

When it comes to blank fields of this precise document, here is what you need to do:

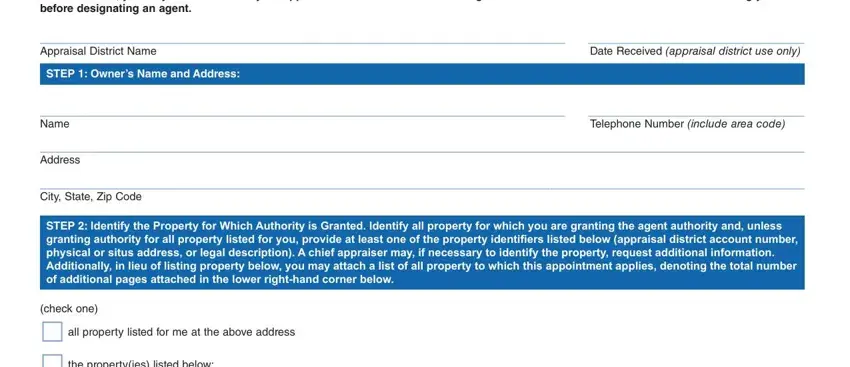

1. When submitting the tad 50 162, ensure to incorporate all essential blank fields in the corresponding part. This will help to facilitate the work, allowing your information to be processed promptly and properly.

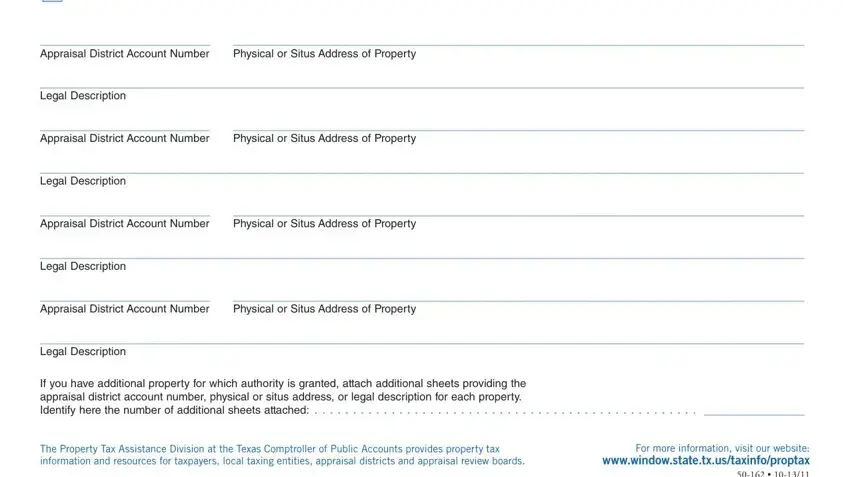

2. The next part is usually to fill out the following fields: all property listed for me at the, Appraisal District Account Number, Physical or Situs Address of, Legal Description, Appraisal District Account Number, Physical or Situs Address of, Legal Description, Appraisal District Account Number, Physical or Situs Address of, Legal Description, Appraisal District Account Number, Physical or Situs Address of, Legal Description, If you have additional property, and The Property Tax Assistance.

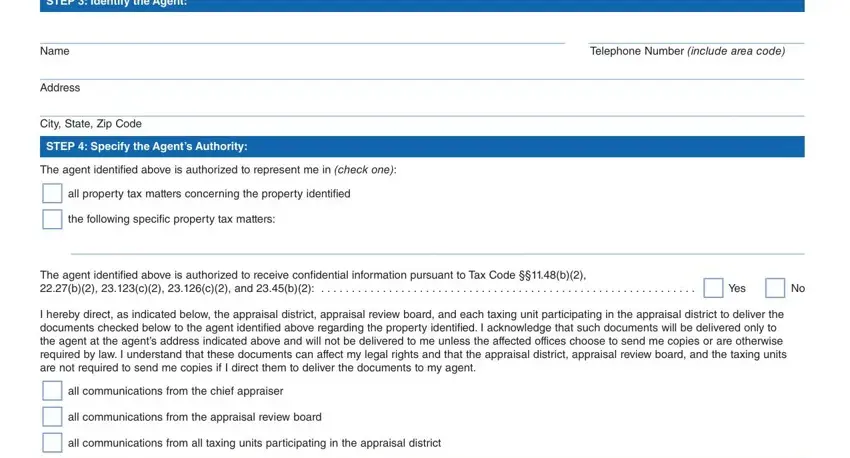

3. The following segment is about STEP Identify the Agent, Name, Telephone Number include area code, Address, City State Zip Code, STEP Specify the Agents Authority, The agent identiied above is, all property tax matters, The agent identiied above is, b c c and b , I hereby direct as indicated below, and all communications from the chief - type in each of these fields.

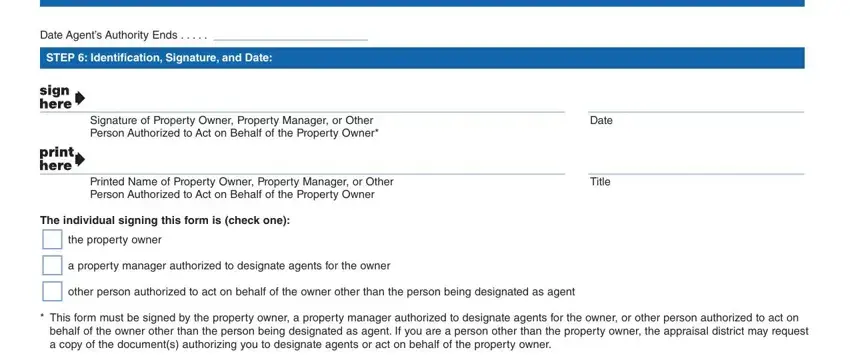

4. To move onward, this next section requires completing a couple of blanks. These include all communications from the chief, Date Agents Authority Ends , STEP Identiication Signature and, Signature of Property Owner, Date, Printed Name of Property Owner, Title, The individual signing this form, the property owner a property, This form must be signed by the, and behalf of the owner other than the, which are fundamental to carrying on with this PDF.

People who work with this form often make mistakes when filling in Date Agents Authority Ends in this section. Ensure you double-check whatever you type in right here.

Step 3: Right after proofreading the completed blanks, press "Done" and you are done and dusted! Join FormsPal right now and immediately gain access to tad 50 162, set for downloading. All modifications you make are saved , so that you can customize the document later when required. At FormsPal, we do our utmost to make certain that all your details are maintained secure.