The whole process of completing the form sep ira prototype adoption form is very effortless. Our team ensured our PDF editor is not difficult to work with and helps fill in any sort of form within minutes. Listed below are some of the steps you will need to take:

Step 1: Press the orange button "Get Form Here" on this web page.

Step 2: Right now, it is possible to edit your form sep ira prototype adoption form. This multifunctional toolbar makes it possible to include, eliminate, modify, highlight, and perform many other commands to the text and fields within the document.

The following areas will frame the PDF document that you will be completing:

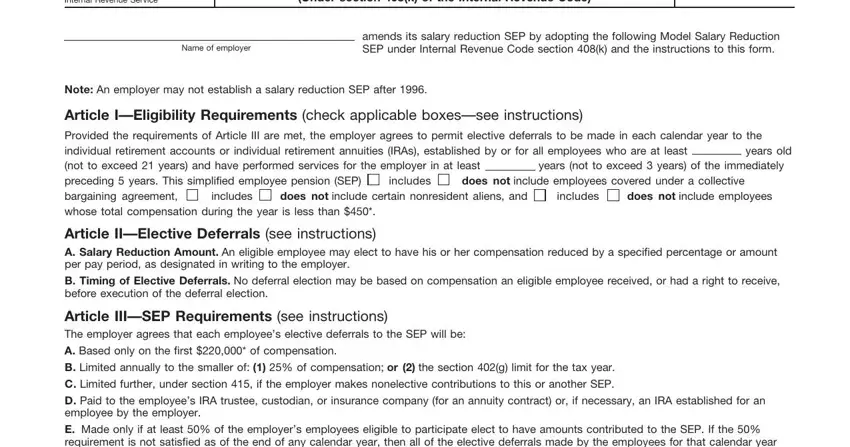

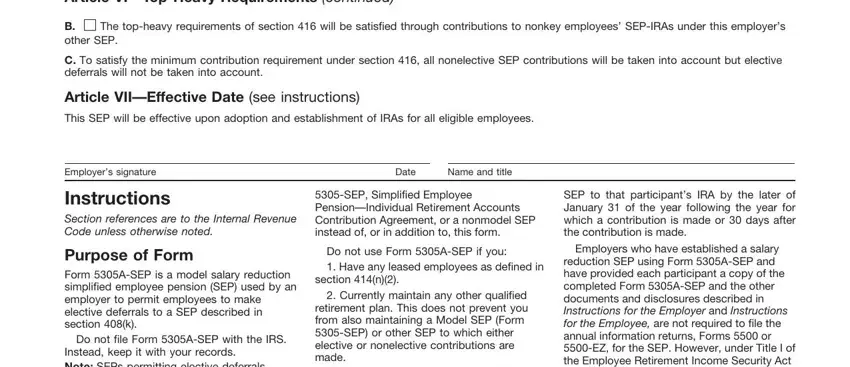

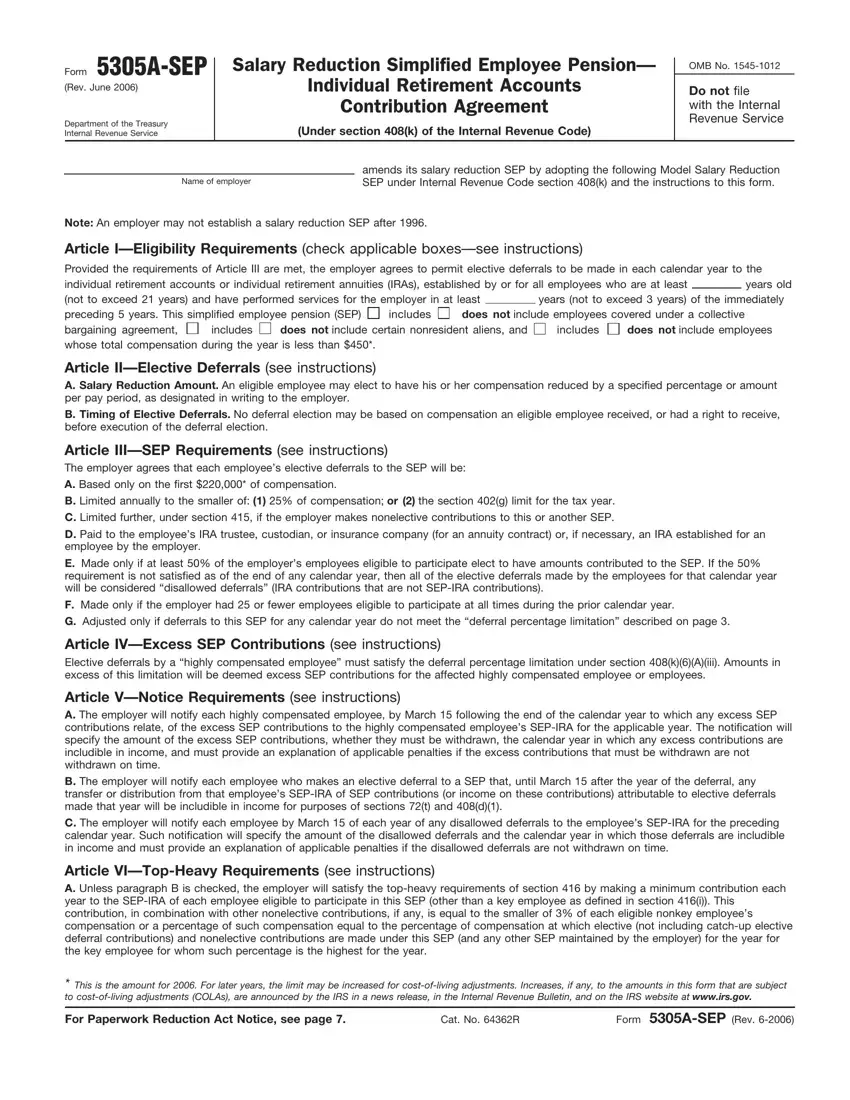

In the Article VITopHeavy Requirements, The topheavy requirements of, B other SEP, C To satisfy the minimum, Article VIIEffective Date see, This SEP will be effective upon, Employers signature, Date, Name and title, Instructions Section references, SEP Simplified Employee, Purpose of Form Form ASEP is a, Do not file Form ASEP with the IRS, Instead keep it with your records, and Do not use Form ASEP if you Have area, put in writing your data.

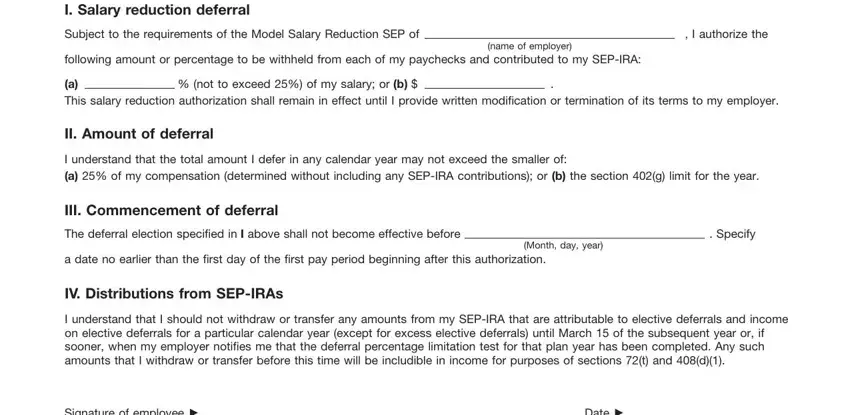

It's essential to highlight the fundamental particulars in the I Salary reduction deferral, Subject to the requirements of the, I authorize the, name of employer, following amount or percentage to, a This salary reduction, not to exceed of my salary or b, II Amount of deferral, I understand that the total amount, III Commencement of deferral, The deferral election specified in, Specify, Month day year, a date no earlier than the first, and IV Distributions from SEPIRAs section.

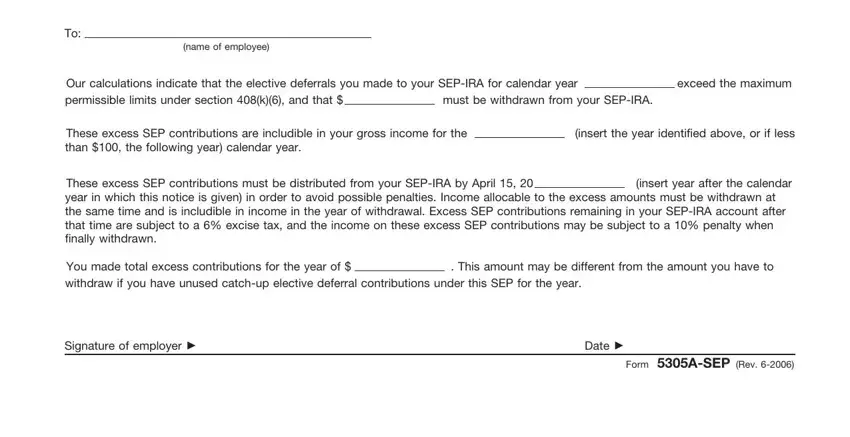

In the part name of employee, Our calculations indicate that the, must be withdrawn from your SEPIRA, exceed the maximum, These excess SEP contributions are, insert the year identified above, These excess SEP contributions, insert year after the calendar, You made total excess, This amount may be different from, Signature of employer cid, Date cid, and Form ASEP Rev, state the rights and responsibilities.

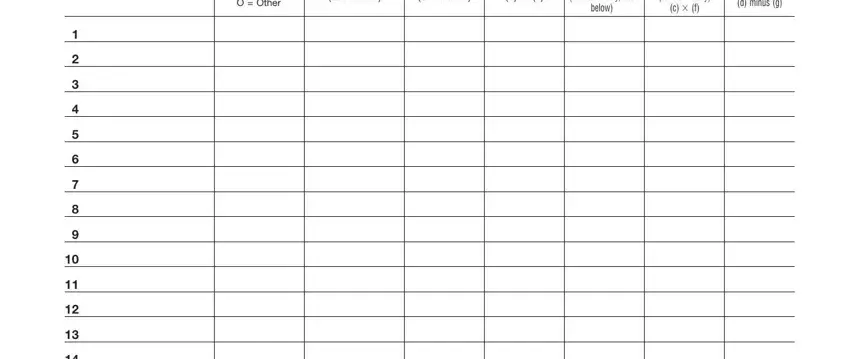

End by analyzing the next sections and filling them in correspondingly: b Status H HCE O Other, c Compensation see below, d Deferrals see below, e Ratio d cid c, f Permitted ratio for HCE only see, g Permitted amount for HCE only c, and h Excess for HCE only d minus g.

Step 3: When you hit the Done button, the ready document is readily exportable to any type of of your devices. Alternatively, it is possible to deliver it via email.

Step 4: To avoid any hassles as time goes on, be sure to create a minimum of a couple of copies of the document.

The

The