With the help of the online tool for PDF editing by FormsPal, you can complete or edit ia 65 5300 here. The editor is constantly improved by us, getting useful functions and growing to be better. Getting underway is effortless! Everything you need to do is follow these simple steps down below:

Step 1: Access the PDF doc in our tool by clicking on the "Get Form Button" at the top of this page.

Step 2: This tool will allow you to work with your PDF in a range of ways. Change it by writing customized text, adjust existing content, and put in a signature - all readily available!

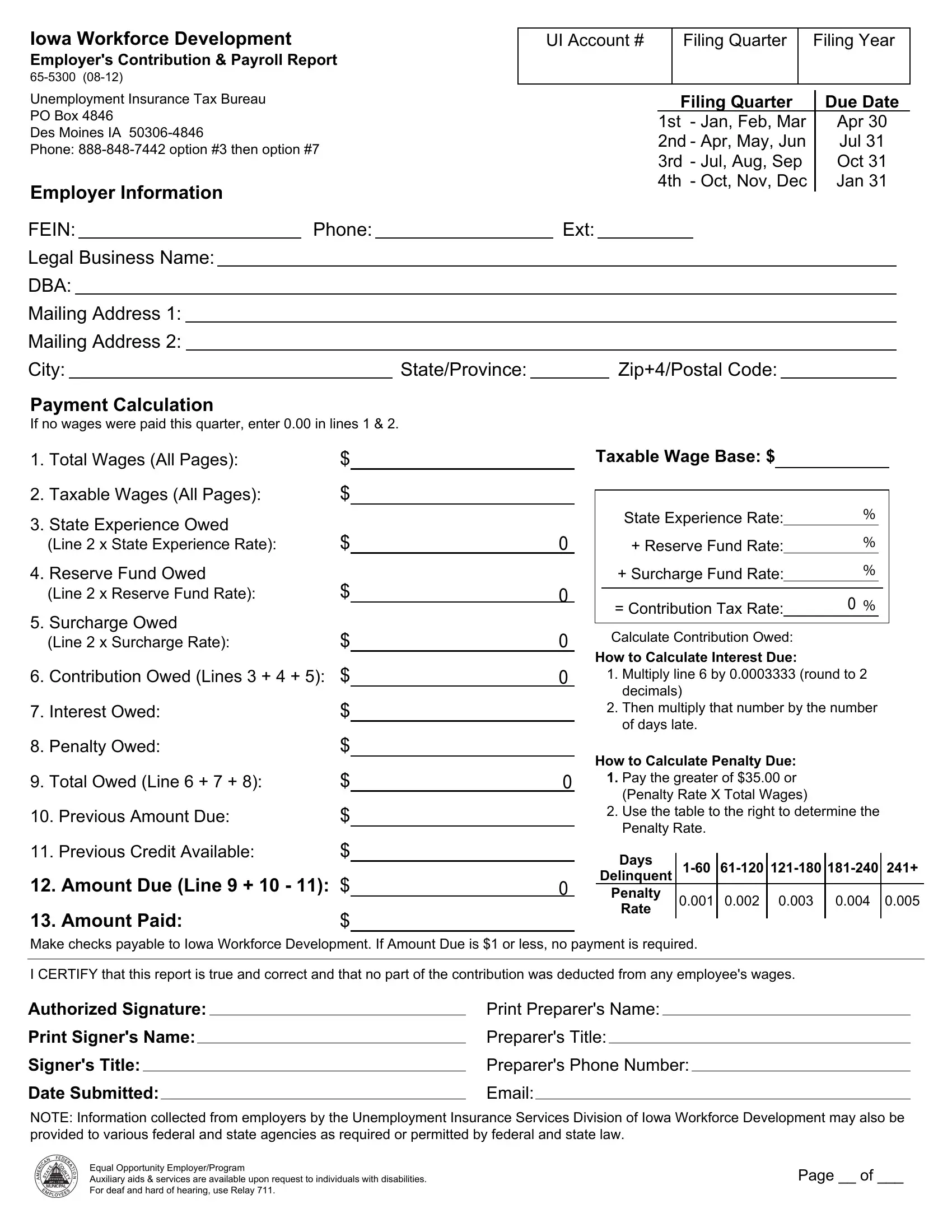

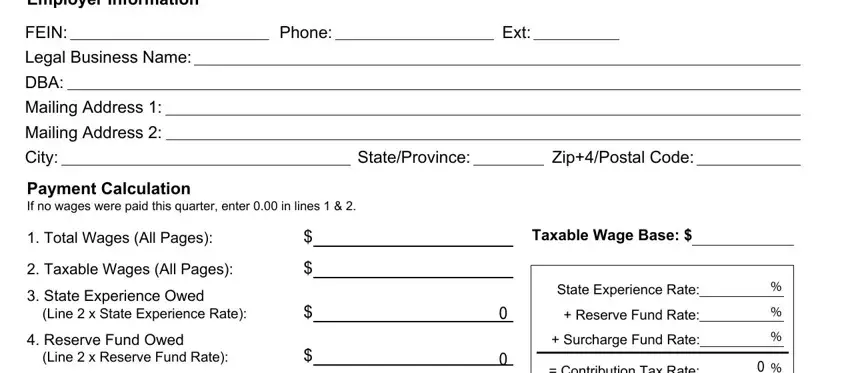

If you want to fill out this PDF form, ensure you type in the information you need in every single field:

1. For starters, while filling out the ia 65 5300, start in the section that has the following fields:

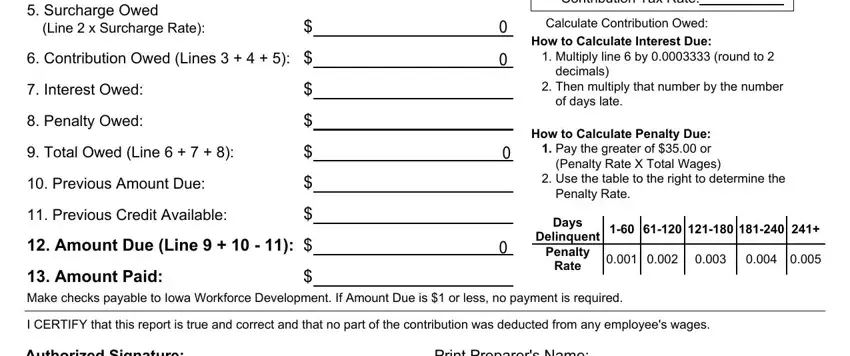

2. Once your current task is complete, take the next step – fill out all of these fields - Surcharge Owed Line x Surcharge, Contribution Owed Lines , Interest Owed, Penalty Owed, Total Owed Line , Previous Amount Due, Previous Credit Available, Amount Due Line , Contribution Tax Rate, Calculate Contribution Owed, How to Calculate Interest Due , How to Calculate Penalty Due Pay, Days, Delinquent, and Penalty with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

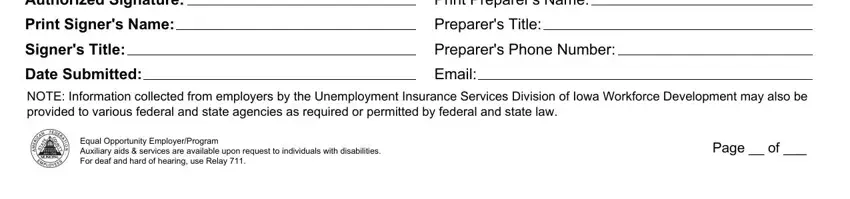

3. Completing Authorized Signature, Print Signers Name, Signers Title, Date Submitted, Print Preparers Name, Preparers Title, Preparers Phone Number, Email, NOTE Information collected from, Equal Opportunity EmployerProgram, and Page of is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Those who work with this form often make mistakes when completing Preparers Title in this part. You should review whatever you type in here.

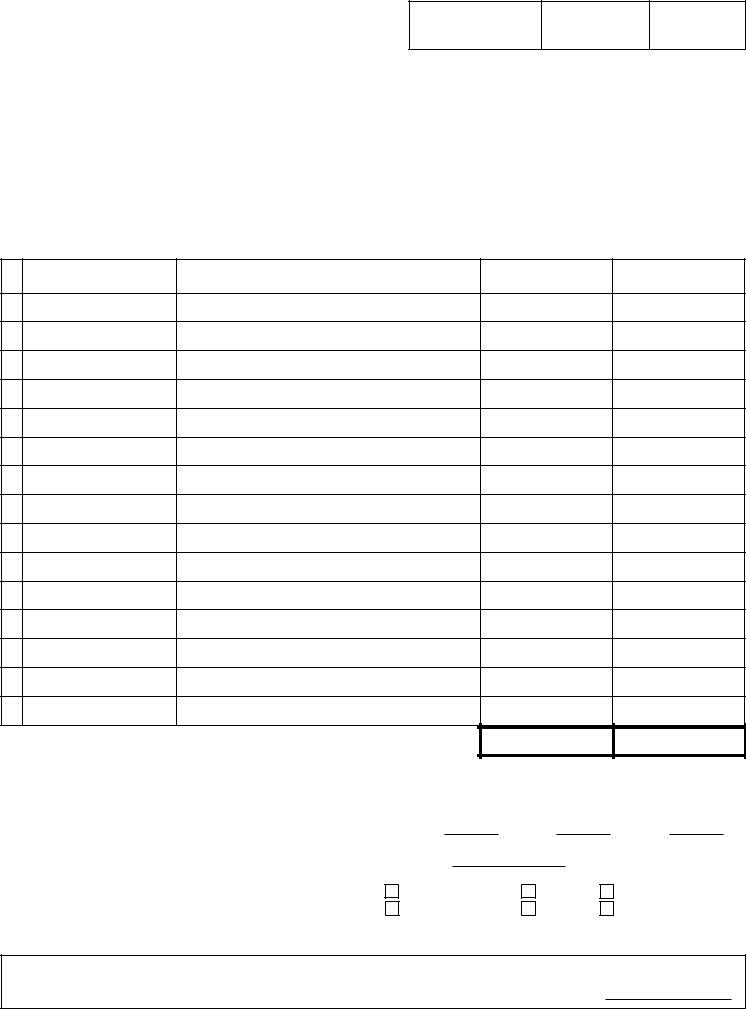

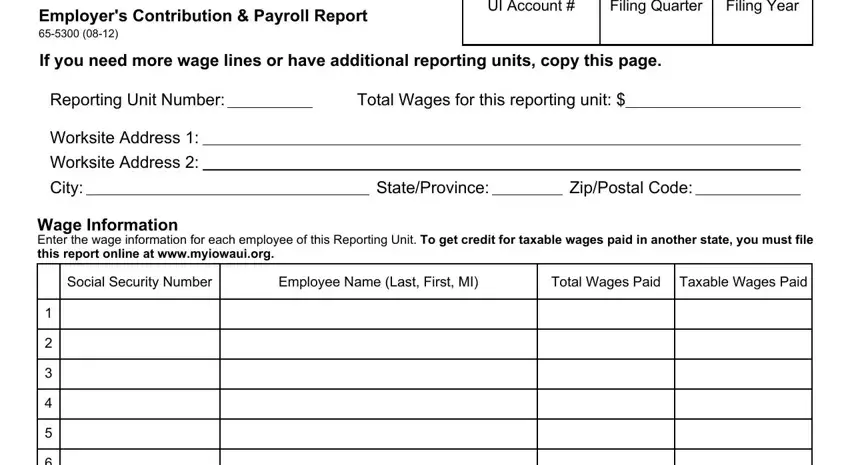

4. This next section requires some additional information. Ensure you complete all the necessary fields - Employers Contribution Payroll, UI Account , Filing Quarter, Filing Year, If you need more wage lines or, Reporting Unit Number, Total Wages for this reporting, Worksite Address , Worksite Address , City, StateProvince, ZipPostal Code, Wage Information Enter the wage, Social Security Number, and Employee Name Last First MI - to proceed further in your process!

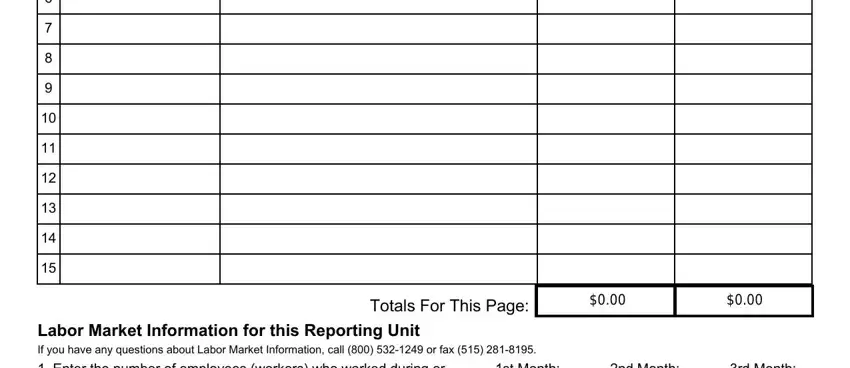

5. When you get close to the conclusion of the file, there are several extra requirements that have to be met. Mainly, Labor Market Information for this, Totals For This Page, and Enter the number of employees should all be filled in.

Step 3: After you've reread the details provided, simply click "Done" to finalize your form. Sign up with FormsPal right now and immediately access ia 65 5300, set for downloading. Each modification made is conveniently saved , helping you to change the pdf at a later time if needed. FormsPal is focused on the personal privacy of our users; we make sure that all information entered into our tool continues to be protected.