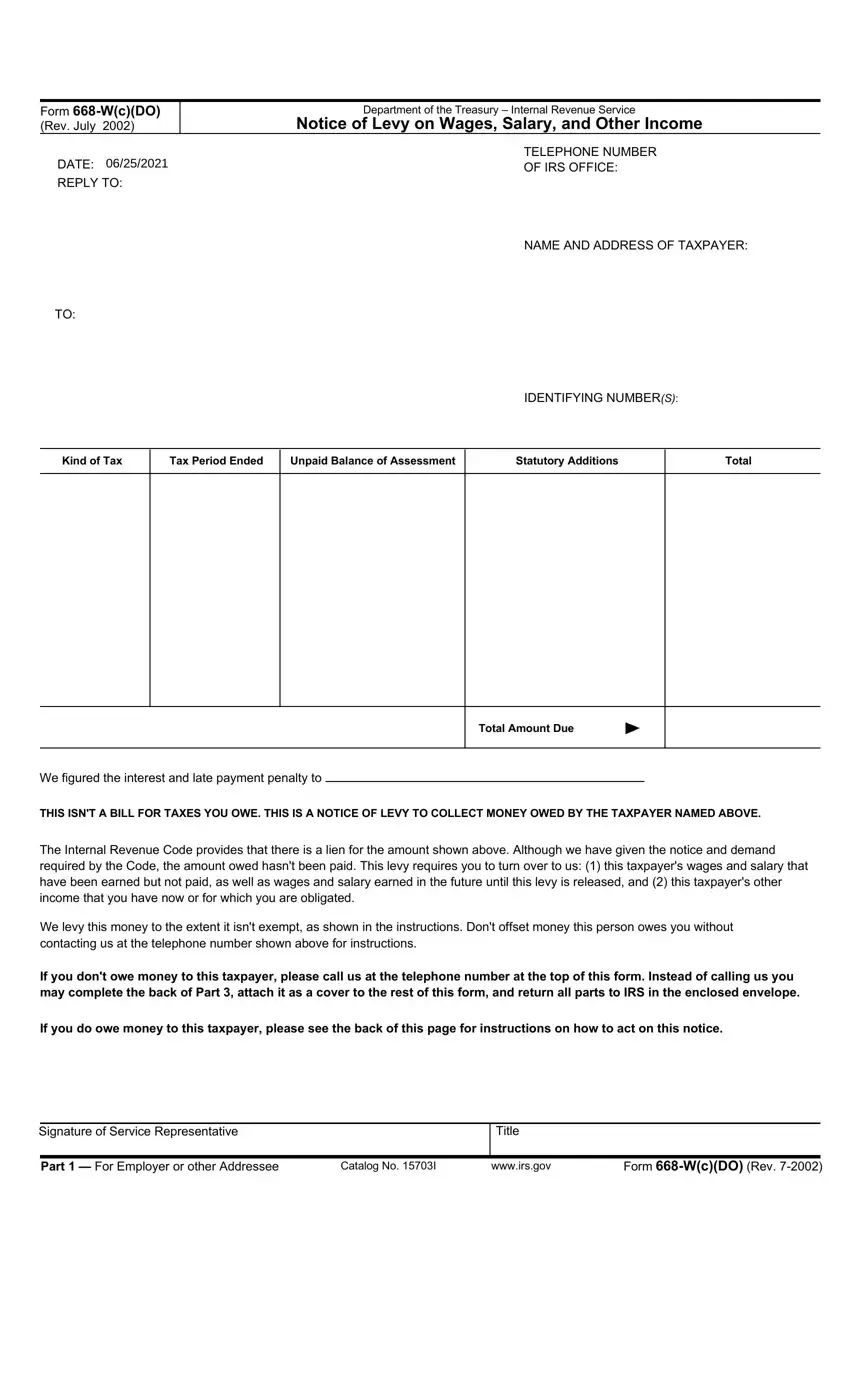

Sec. 6331. LEVY AND DISTRAINT.

(b)Seizure and Sale of Property.–The term “levy” as used in this title includes the power of distraint and seizure by any means. Except as otherwise provided in subsection (e), a levy shall extend only to property possessed and obligations existing at the time thereof. In any case in which the Secretary may levy upon property or rights to property, he may seize and sell such property or rights to property (whether real or personal, tangible or intangible).

(c)Successive Seizures.–Whenever any property or right to property upon which levy has been made by virtue of subsection (a) is not sufficient to satisfy the claim of the United States for which levy is made, the Secretary may, thereafter, and as often as may be necessary, proceed to levy in like manner upon any other property liable to levy of the person against whom such claim exists, until the amount due from him, together with all expenses, is fully paid.

(e)Continuing Levy on Salary and Wages.–The effect of a levy on salary or wages payable to or received by a taxpayer shall be continuous from the date such levy is first made until such levy is released under Section 6343.

Sec. 6332. SURRENDER OF PROPERTY SUBJECT TO LEVY.

(a)Requirement.– Except as otherwise provided in this section, any person in possession of (or obligated with respect to) property or rights to property subject to levy upon which a levy has been made shall, upon demand of the Secretary, surrender such property or rights (or discharge such obligation) to the Secretary, except such part of the property or rights as is, at the time of such demand, subject to an attachment or execution under any judicial process.

(d)Enforcement of Levy.

(1)Extent of personal liability.–Any person who fails or refuses to surrender any property or rights to property, subject to levy, upon demand by the Secretary, shall be liable in his own person and estate to the United States in a sum equal to the value of the property or rights not so surrendered, but not exceeding the amount of taxes for the collection of which such levy has been made, together with costs and interest on such sum at the underpayment rate established under section 6621 from the date of such levy (or, in the case of a levy described in section 6331 (d)(3), from the date such person would otherwise have been obligated to pay over such amounts to the taxpayer). Any amount (other than costs) recovered under this paragraph shall be credited against the tax liability for the collection of which such levy was made.

(2)Penalty for violation.–In addition to the personal liability imposed by paragraph (1), if any person required to surrender property or rights to property fails or refuses to surrender such property or rights to property without reasonable cause, such person shall be liable for a penalty equal to 50 percent of the amount recoverable under paragraph (1). No part of such penalty shall be credited against the tax liability for the collection of which such levy was made.

(e)Effect of honoring levy.–Any person in possession of (or obligated with respect to) property or rights to property subject to levy upon which a levy has been made who, upon demand by the Secretary, surrenders such property or rights to property (or discharges such obligation) to the Secretary (or who pays a liability under subsection (d)(1)) shall be discharged from any obligation or liability to the delinquent taxpayer and any other person with respect to such property or rights to property arising from such surrender or payment.

Sec. 6333. PRODUCTION OF BOOKS.

If a levy has been made or is about to be made on any property, or right to property, any person having custody or control of any books or records, containing evidence or statements relating to the property or right to property subject to levy, shall, upon demand of the Secretary exhibit such books or records to the Secretary.

Sec. 6334. PROPERTY EXEMPT FROM LEVY.

(a)Enumeration.–There shall be exempt from levy

(4)Unemployment benefits.–Any amount payable to an individual with

respect to his unemployment (including any portion thereof payable with respect to dependents) under an unemployment compensation law of the United States, of any State, or of the District of Columbia or of the Commonwealth of Puerto Rico.

(6)Certain annuity and pension payments.–Annuity or pension payments under the Railroad Retirement Act, benefits under the Railroad Unemployment Insurance Act, special pension payments received by a person whose name has been entered on the Army, Navy, Air Force, and Coast Guard Medal of Honor roll (38 U.S.C. 562), and annuities based on retired or retainer pay under chapter 73 of title 10 of the United States Code.

(7)Workmen's compensation.– Any amount payable to an individual as workmen's compensation (including any portion thereof payable with respect to dependents) under a workmen's compensation law of the United States, any State, the District of Columbia, or the Commonwealth of Puerto Rico.

(8)Judgments for support of minor children.–If the taxpayer is required by judgment of a court of competent jurisdiction, entered prior to the date of levy, to contribute to the support of his minor children, so much of his salary, wages, or other income as is necessary to comply with such judgment.

(9)Minimum exemption for wages, salary and other income.–Any amount payable to or received by an individual as wages or salary for personal services, or as income derived from other sources, during any period, to the extent that the total of such amounts payable to or received by him during such period does not exceed the applicable exempt amount determined under subsection (d).

(10)Certain service-connected disability payments.–Any amount payable to an individual as a service-connected (within the meaning of section 101(16) of title 38, United States Code) disability benefit under-

(A)subchapter II, III, IV, V, or VI of chapter 11 of such title 38, or

(B)Chapter 13, 21, 23, 31, 32, 34, 35, 37, or 39 of such title 38.

(11)Certain public assistance payments.–Any amount payable to an individual as a recipient of public assistance under-

(A)title IV or title XVI (relating to supplemental security income for the aged,

blind, and disabled) of the Social Security Act, or

(B)State or local government public assistance or public welfare programs for which eligibility is determined by a needs or income test.

(12)Assistance Under Job Training Partnership Act.–Any amount payable to a participant under the Job Training Partnership Act (29 U.S.C. 1501 et seq.) from funds appropriated pursuant to such Act.

(d)Exempt Amount of Wages, Salary, or Other Income.–

(1)Individuals on weekly basis.–In the case of an individual who is paid or receives all of his wages, salary, and other income on a weekly basis, the amount of the wages, salary, and other income payable to or received by him during any week which is exempt from levy under subsection (a) (9) shall be the exempt amount.

(2)Exempt Amount.–For purposes of paragraph (1), the term “exempt amount” means an amount equal to–

(A) the sum of–

(I) the standard deduction, and

(II) the aggregate amount of the deductions for personal exemptions allowed the taxpayer under section 151 in the taxable year in which such levy occurs, divided by

(B) 52.

Unless the taxpayer submits to the Secretary a written and properly verified statement specifying the facts necessary to determine the proper amount under subparagraph (A), subparagraph (A) shall be applied as if the taxpayer were a married individual filing a separate return with only 1 personal exemption.

(3)Individuals on basis other than weekly.–In the case of any individual not described in paragraph (1), the amount of wages, salary, and other income payable to or received by him during any applicable pay period or other fiscal period (as determined under regulations prescribed by the Secretary) which is exempt from levy under subsection (a) (9) shall be an amount (determined under such regulations) which as nearly as possible will result in the same total exemption from levy for such individual over a period of time as he would have under paragraph (1) if (during such period of time) he were paid or received such wages, salary and other income on a regular weekly basis.

Sec. 6343. AUTHORITY TO RELEASE LEVY AND RETURN PROPERTY.

(a)Release of Levy and Notice of Release.–

(1)In General.–Under regulations prescribed by the Secretary, the Secretary shall release the levy upon all, or part of, the property or rights to property levied upon and shall promptly notify the person upon whom such levy was made (if any) that such levy has been released if–

(A)the liability for which such levy was made is satisfied or becomes unenforceable by reason of lapse of time,

(B)release of such levy will facilitate the collection of such liability,

(C)the taxpayer has entered into an agreement under section 6159 to satisfy such liability by means of installment payments, unless such agreement provides otherwise.

(D)the Secretary has determined that such levy is creating an economic hardship due to the financial condition of the taxpayer, or

(E)the fair market value of the property exceeds such liability and release of the levy on a part of such property could be made without hindering the collection of such liability.

For purposes of subparagraph (C), the Secretary is not required to release such levy if such release would jeopardize the secured creditor status of the Secretary.

(2)Expedited determination on certain business property.–In the case of any tangible personal property essential in carrying on the trade or business of the taxpayer, the Secretary shall provide for an expedited determination under paragraph (1) if levy on such tangible personal property would prevent the taxpayer from carrying on such trade or business.

(3)Subsequent levy.–The release of levy on any property under paragraph (1) shall not prevent any subsequent levy on such property.

(b)Return of Property.–If the Secretary determines that property has been wrongfully levied upon, it shall be lawful for the Secretary to return-

(1)the specific property levied upon,

(2)an amount of money equal to the amount of money levied upon, or

(3)an amount of money equal to the amount of money received by the United States from a sale of such property.

Property may be returned at any time. An amount equal to the amount of money levied upon or received from such sale may be returned at any time before the expiration of 9 months from the date of such levy. For purposes of paragraph (3), if property is declared purchased by the United States at a sale pursuant to section 6335(e) (relating to manner and conditions of sale), the United States shall be treated as having received an amount of money equal to the minimum price determined pursuant to such section or (if larger) the amount received by the United States from the resale of such property.

(d)RETURN OF PROPERTY IN CERTAIN CASES-IF–

(1)any property has been levied upon, and

(2)the Secretary determines that–

(A)the levy on such property was premature or otherwise not in accordance with administrative procedures of the Secretary,

(B)the taxpayer has entered into an agreement under section 6159 to satisfy the tax liability for which the levy was imposed by means of installment payments, unless such agreement provides otherwise,

(C)the return of such property will facilitate the collection of the tax liability, or

(D)with the consent of the taxpayer or the National Taxpayer Advocate, the return of such property would be in the best interest of the taxpayer (as determined by the National Taxpayer Advocate) and the United States,

the provisions of subsection (b) shall apply in the same manner as if such property had been wrongly levied upon, except that no interest shall be allowed under subsection (c).