You may prepare irs form 8852 effortlessly in our online PDF editor. The editor is continually upgraded by our team, receiving new functions and turning out to be greater. Getting underway is simple! All you should do is take the next easy steps directly below:

Step 1: Open the PDF doc inside our tool by clicking on the "Get Form Button" in the top part of this webpage.

Step 2: After you launch the online editor, you'll notice the form ready to be completed. In addition to filling in different blank fields, you may as well perform other things with the form, that is putting on your own textual content, modifying the original textual content, inserting illustrations or photos, affixing your signature to the PDF, and much more.

This document requires specific details; to ensure accuracy and reliability, you should take heed of the tips down below:

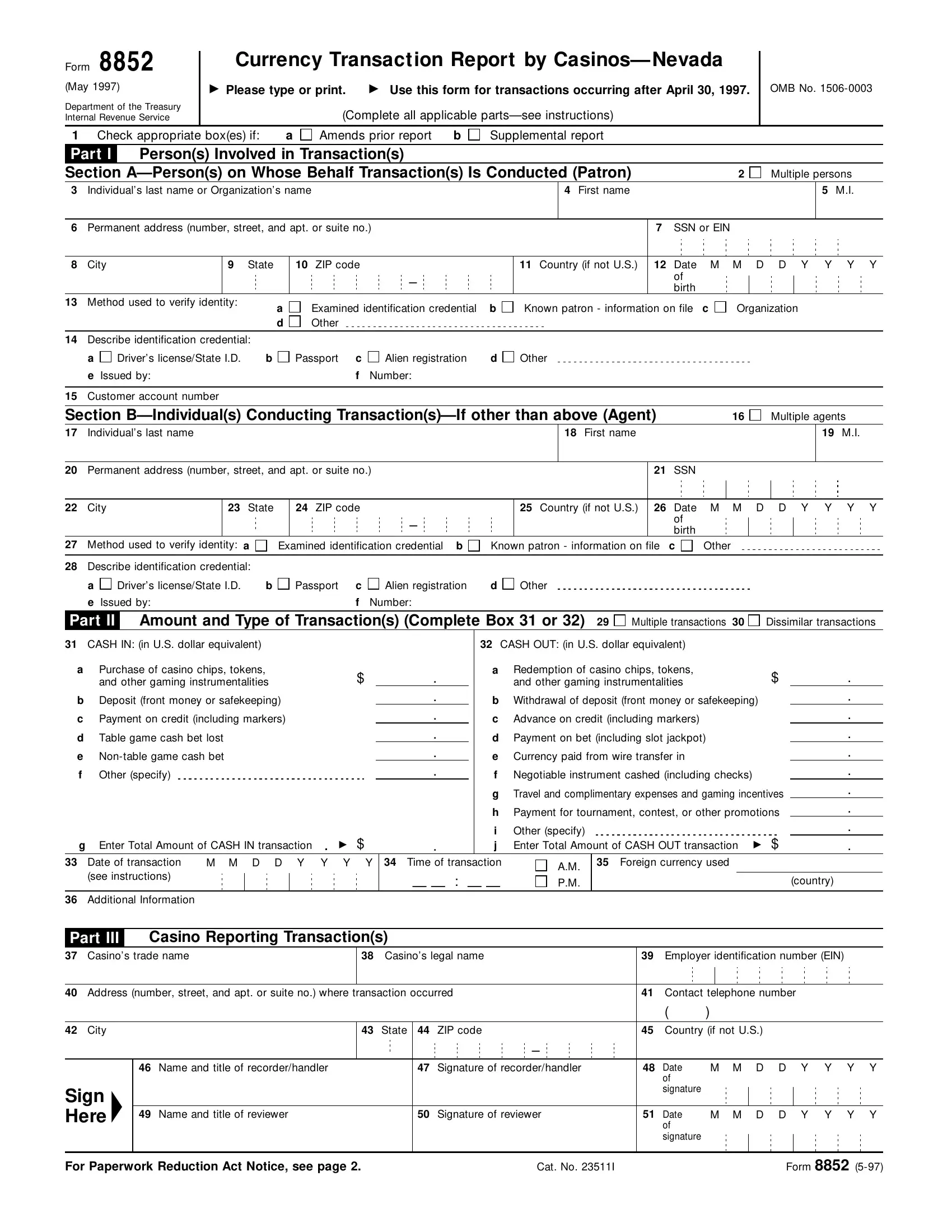

1. First, when filling out the irs form 8852, start in the form section containing following fields:

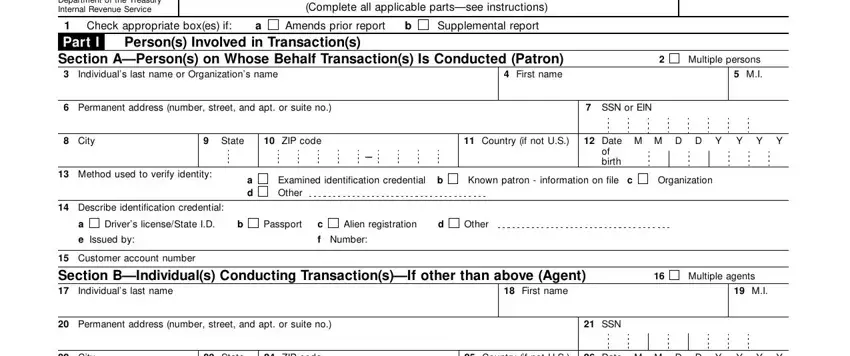

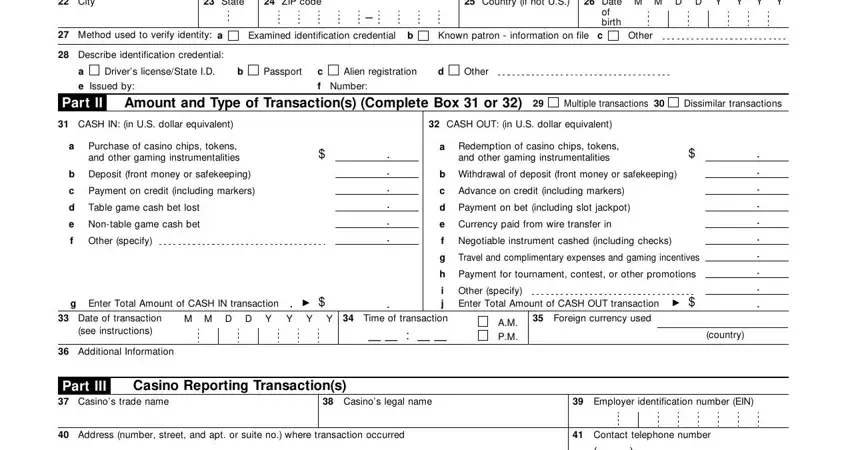

2. The subsequent stage is usually to submit these blank fields: City, State, ZIP code, Country if not US, Method used to verify identity, Examined identification credential, Known patron information on file, Describe identification credential, Drivers licenseState ID, Passport, Issued by, Alien registration, Other, Number, and Date of birth c.

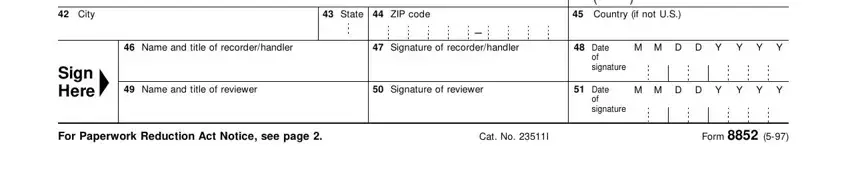

3. The third stage is generally simple - fill out every one of the blanks in City, State, ZIP code, Name and title of recorderhandler, Signature of recorderhandler, Sign Here, Name and title of reviewer, Signature of reviewer, Country if not US, D D Y, D D Y, Date of signature, Date of signature, For Paperwork Reduction Act Notice, and Cat No I in order to finish the current step.

As for Signature of reviewer and Cat No I, make sure you don't make any mistakes in this section. Both of these could be the most significant ones in this page.

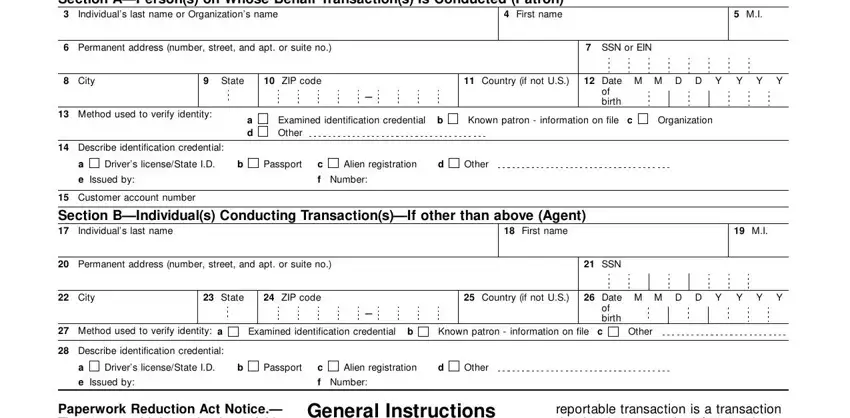

4. This next section requires some additional information. Ensure you complete all the necessary fields - Part I Section APersons on Whose, Individuals last name or, Permanent address number street, SSN or EIN, City, State, ZIP code, Country if not US, D D Y, Date of birth, Method used to verify identity, Describe identification credential, a d, Examined identification credential, and Known patron information on file - to proceed further in your process!

Step 3: Just after looking through your fields and details, press "Done" and you are all set! Right after registering a7-day free trial account at FormsPal, it will be possible to download irs form 8852 or email it promptly. The file will also be at your disposal through your personal cabinet with all of your adjustments. FormsPal offers safe document tools with no personal information record-keeping or sharing. Feel comfortable knowing that your details are safe here!