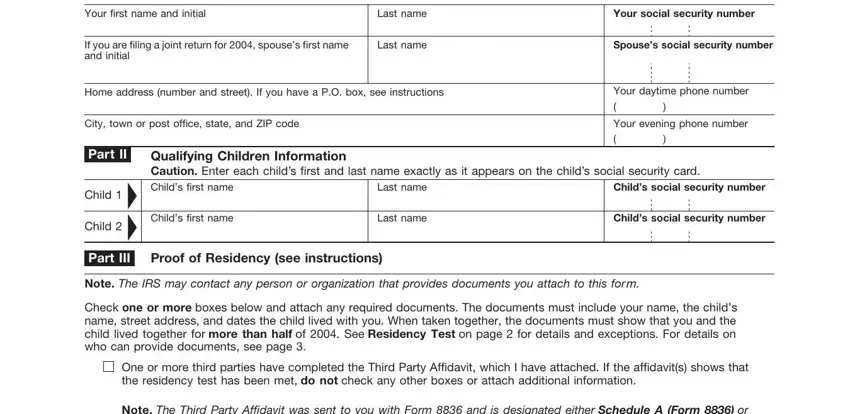

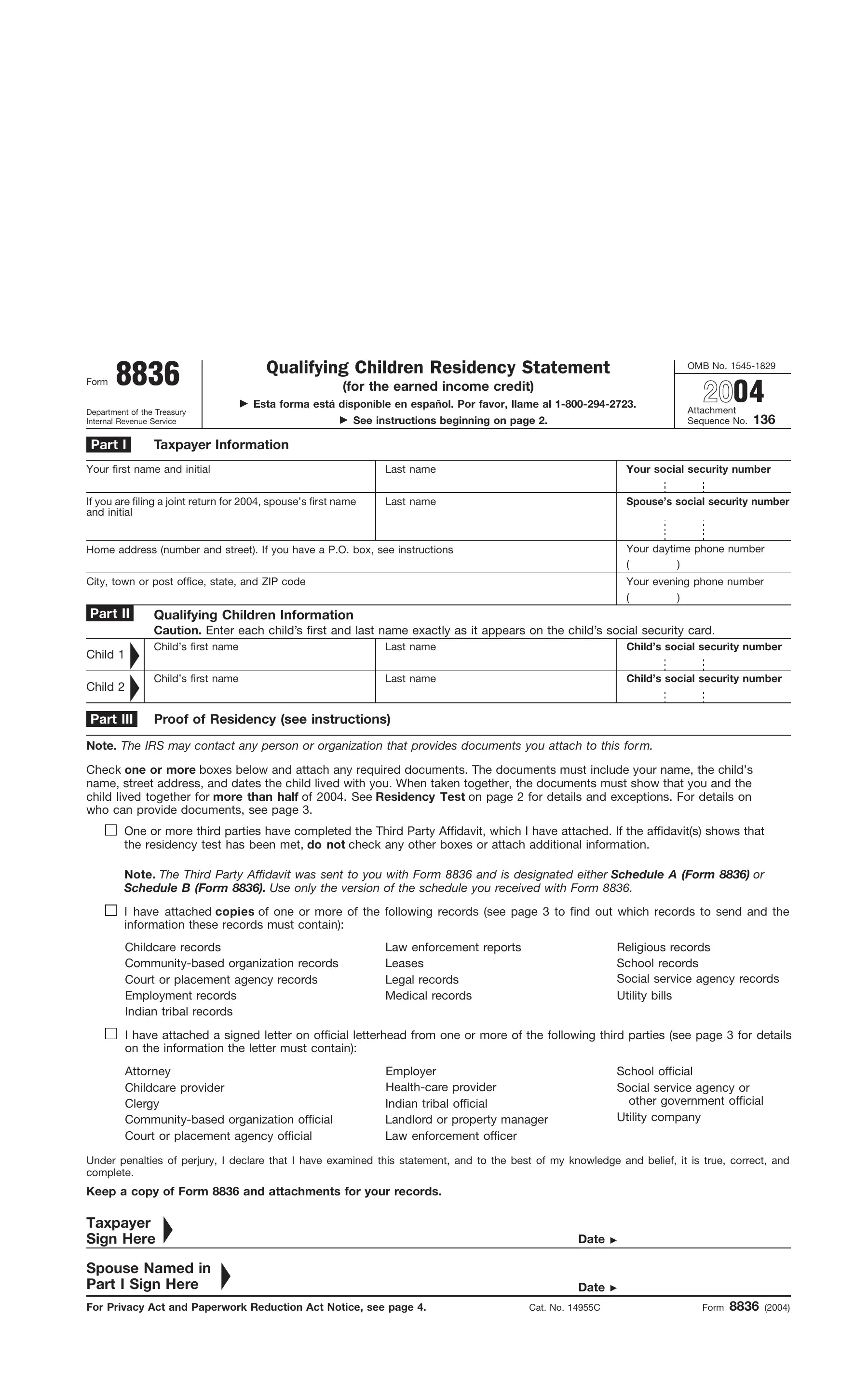

Daytime and evening phone numbers. Providing your daytime and evening phone numbers may help speed the processing of this form. We may have questions about the information you provided. By answering our questions over the phone, we may be able to continue processing the form without mailing you a letter. You may list a mobile phone number as your daytime or evening phone number (or both). If you will be filing a joint return, you may enter either spouse’s phone numbers.

Part II

Be sure that any child named on this form is your qualifying child and you are listing or expect to list that child on Schedule EIC of your 2004 tax return.

Your qualifying child must have a valid social security number (SSN), unless the child was born and died in 2004. If the qualifying child was born and died in 2004 and did not have an SSN, attach a copy of that child’s birth certificate to Form 8836 and enter “Died” instead of the child’s SSN.

For EIC purposes, a valid SSN is a number issued by the Social Security Administration unless “Not Valid for Employment” is printed on the social security card and the number was issued solely to receive a federally funded benefit.

We will not allow the EIC based on a qualifying child who has, instead of an SSN:

●An individual taxpayer identification number (ITIN), which the IRS issues to noncitizens who cannot get an SSN, or

●An adoption taxpayer identification number (ATIN), which the IRS issues to adopting parents who cannot get an SSN for the child being adopted until the adoption is final.

Part III

You must attach a Third Party Affidavit or other documents showing that each qualifying child listed on Schedule EIC lived with you for more than half of 2004. You may need to send more than one affidavit or other document to show that your child lived with you for more than half of 2004.

If you and your spouse are filing a joint return, you only need to show that your child lived with one of you for more than half of 2004.

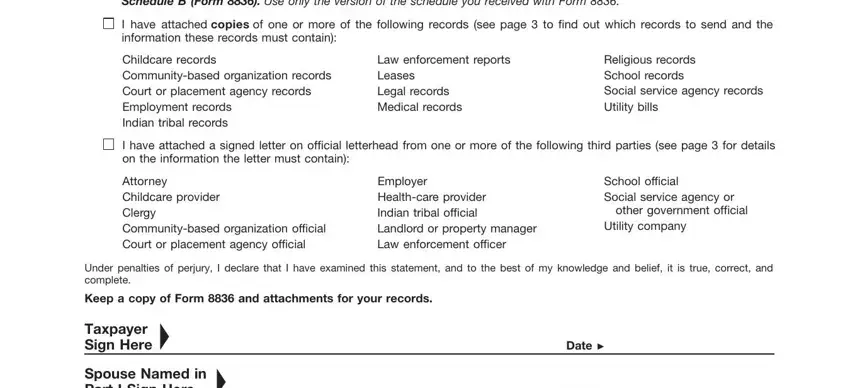

What kind of documents you must provide. You may provide any of the following:

●The Third Party Affidavit. Use only the version of the

affidavit (schedule) you received with Form 8836. Keep a copy for your records.

●A copy of a record (such as school records, medical records, childcare records, a lease, or a pay stub). Do not send any original records.

●A signed letter on official letterhead. Keep a copy for your records.

Temporary absences. Attach documents if you and your child were temporarily living apart due to special circumstances and you need to count the temporary absences to prove that your child met the residency test. See Residency Test on page 2. For example, if you were away from home on military duty, attach a copy of your military orders showing the dates you were away and where you were stationed.

If you cannot obtain a completed Third Party Affidavit, records, or a signed letter from one or more third parties to show that your child lived with you for more than half of 2004, call 1-800-294-2723 and we will help you.

What the documents must show. If you send an official record or letter, it must clearly show:

●Your name, your child’s name, or both names, and

●A street address and the dates that you or your child lived at that address during 2004, and

●The name, address, and phone number of the person or organization that provided the record or letter.

Who can provide documents to you. You can submit a Third Party Affidavit from any third party eligible to complete it. You can submit copies of records or signed letters on official letterhead from any of the following third parties (other than you, your spouse, your dependent, your qualifying child for the earned income credit, or a parent of that qualifying child).

●School official (such as a teacher, principal, or administrative assistant). A school includes Head Start, pre-K programs, and before or after school care provided by a school.

●Health-care provider (such as your doctor, your nurse practitioner, or a clinic official).

●Member of the clergy (such as your minister, priest, rabbi, or imam).

●Childcare provider who is age 18 or older (such as a babysitter or daycare provider).

●Your employer (such as a personnel official, supervisor, or work leader).

●Landlord or property manager (including a building superintendent, public housing official, or rental agent).

●Social service agency or other government official (such as a social worker, case worker at a public assistance office, or operator of a homeless shelter).

●Community-based organization official (such as an official from the YMCA, YWCA, Boy Scouts, Girl Scouts, Boys and Girls Clubs, 4-H, Little League, Police Athletic League, immigrant advocacy groups, neighborhood associations, homeowners and condominium associations, and other nonprofit groups).

●Indian tribal official.

●Attorney who handled your divorce or child custody case.

●Official of the court or agency that issued a decision or order involving your divorce or custody, support, or placement of your child.

●Law enforcement officer (such as a police officer or parole officer).

●Utility company (such as an electric or gas company).

How many documents do you need? You can submit any combination of the documents listed on this page as long as they show, when taken together, that your child lived with you for more than half of 2004. In some cases, a single document will show that you and your child lived at the same address. In other cases, you may need to provide one document showing your name and address as well as a second document showing your child’s name with the same address. You may need more than one document to show that your address and your child’s address were the same for more than half of 2004.

Here are examples of acceptable document combinations:

●One document that shows that both you and your child lived at the same address for more than half of 2004.