IRS Form 8862, titled “Information to Claim Certain Credits After Disallowance,” is a form taxpayers use to reclaim eligibility for certain tax credits. This form is necessary if the IRS previously disallowed a taxpayer’s earned income credit, child tax credit, additional child tax credit, American opportunity tax credit, or the credit for other dependents, and the taxpayer wants to claim them again in a subsequent year.

Taxpayers must meet specific criteria to use Form 8862 and regain eligibility for these credits. Conditions include:

- The disallowance did not result from a final determination of fraudulent activity,

- The taxpayer meets all the requirements for the credits they are claiming,

- The taxpayer received a notice from the IRS requiring filing Form 8862 to regain eligibility.

This form essentially reassures the IRS that the taxpayer now meets the necessary conditions to claim the credits again.

How to Fill Out Form 8862

The correct layering of papers is the key to successful yearly tax reporting at the IRS. Below you will find a step-by-step guide to filling out the 8862 Certificate. Let’s review each step in detail.

Download the Document

You can download the paper on our website, then fill it out online or manually. For best results, we recommend you use our form-building software.

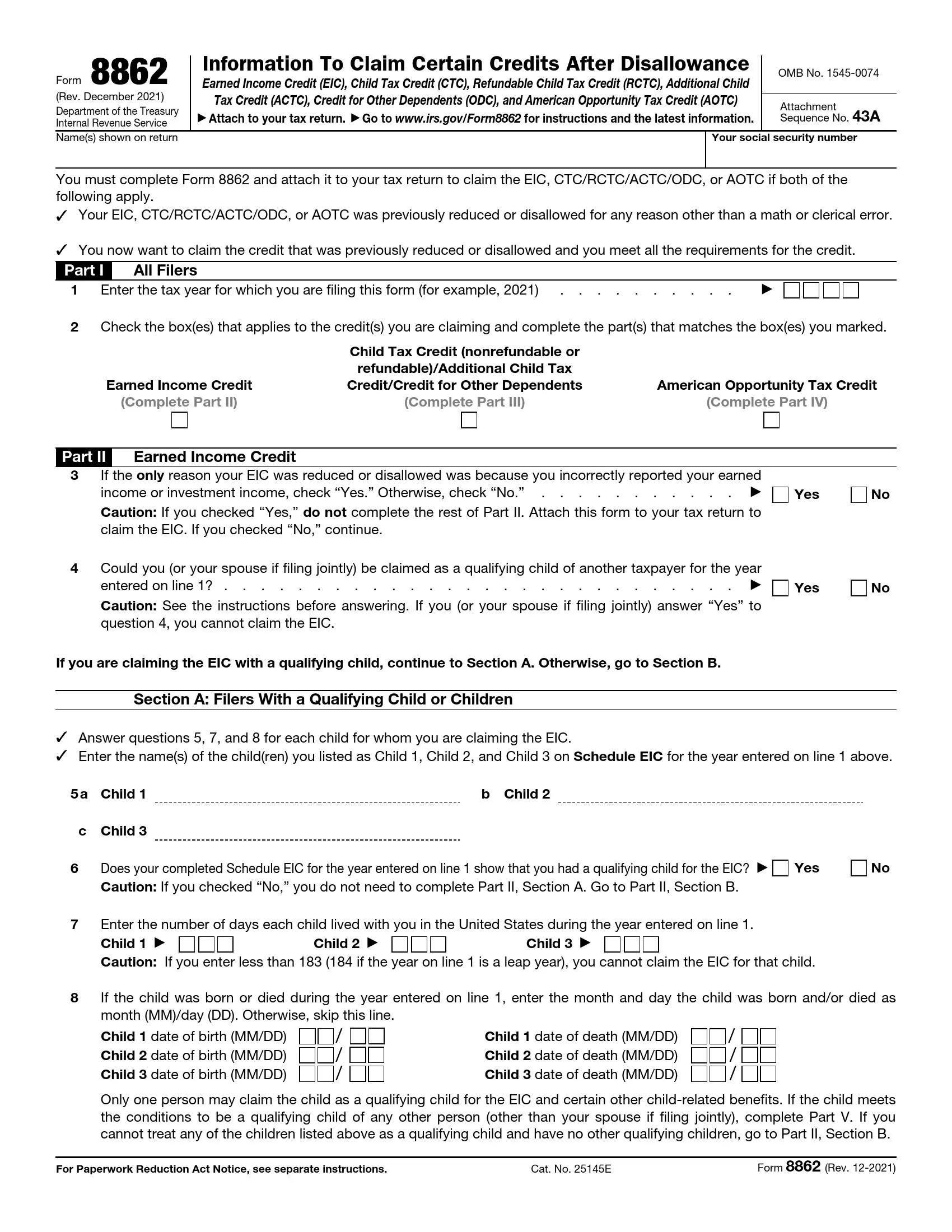

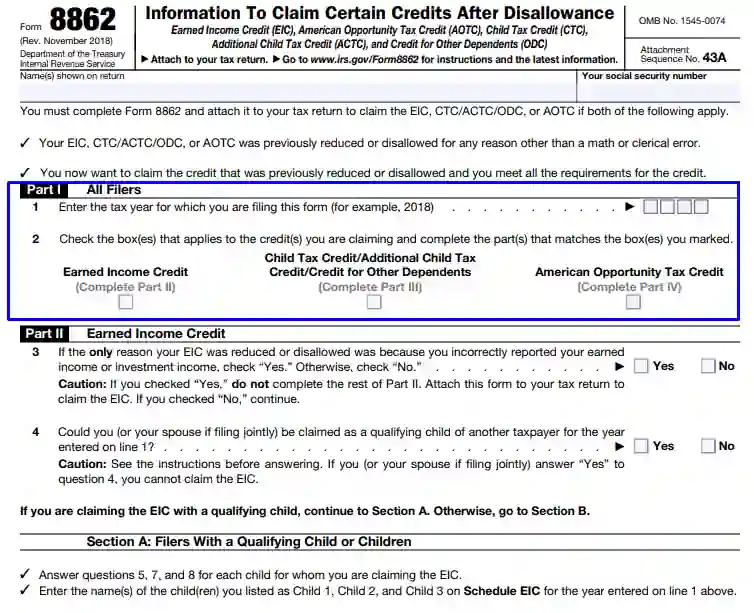

Complete Part 1

In the first section of the paper, you need to enter the tax year (for example, 2021) and then tick one of the three alternatives.

Each option represents one kind of tax credit:

- Earned Income Credit

- Child Tax Credit (Additional Child Tax Credit or Credit for Other Dependents)

- American Opportunity Tax Credit

Depending on which alternative you choose, you will require to select between Part 2, Part 3, or Part 4. Below you will find instructions for completing all of the parts, but remember that you simply need to choose one.

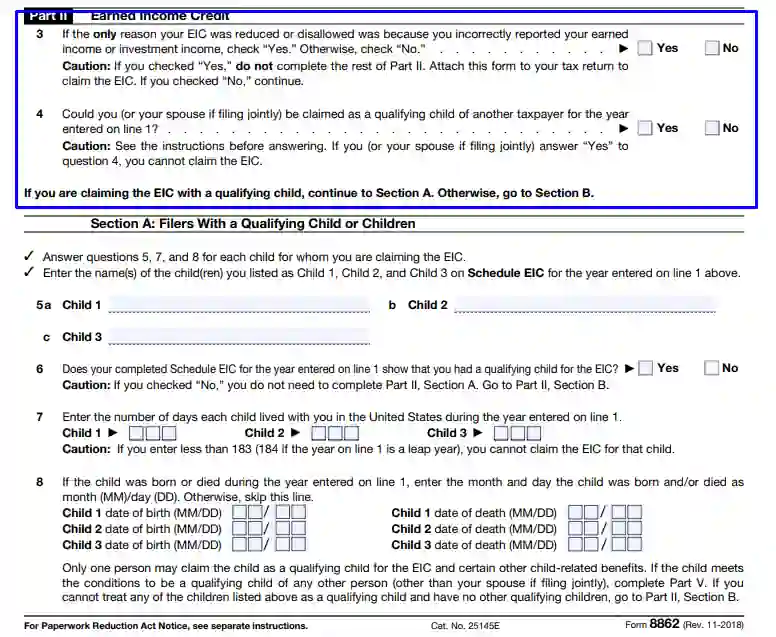

Complete Units 3 and 4

Next to Units 3 and 4, you need to tick one of the answer options. Choose between “Yes” or “No.” Next to Unit 3, tick “Yes” if the reason for filling out the 8862 paper is the incorrect data submitted in previous reports.

You are empowered to tick “Yes” next to Section 4 if you or your partner (when filling out the 8862 Form together) is a qualifying child of another ratepayer. Be aware that you may not be entitled to Earned Income Credit if you are a qualifying child of a different ratepayer.

Complete Section A of Part 2

To complete Section A of Part 2, you need to answer units 5-8:

- In subsection 5, you are required to fill in the names of all children you register on the Earned Income Credit Schedule for the year designated at the top of the Form.

- In subsection 6, indicate whether the children are added to the submitted Earned Income Credit Schedule.

- In paragraph 7, indicate how many days the child spent with you in the specified tax year. Please mention if your child has stayed with you for fewer than 183 days — you cannot be entitled to a tax credit.

- In subsection 8, you should indicate the dates of birth (death) of children born (or deceased) during the specified year. If not applicable for the specified period, please, skip paragraph 8.

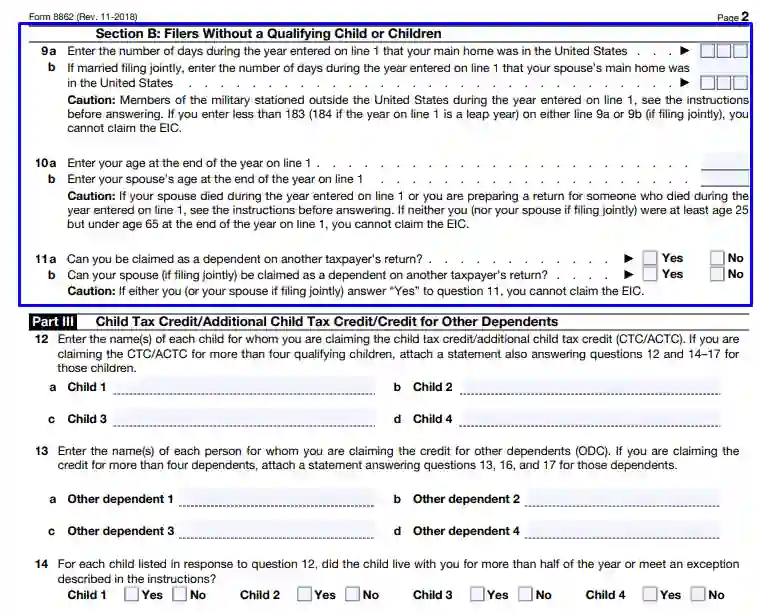

Complete Section B of Part 2

To complete Section B of Part 2, you need to give answers to paragraphs 9-11. This part is necessary if the ratepayer is childless.

- In paragraph 9, you are required to enter the number of days during the designated year when your primary residence was in the United States. If filling out with a spouse, indicate the period the spouse’s primary residence was in the United States.

- In paragraph 10, you should indicate your full age by the end of the specified year. Indicate the partner’s age by the end of the designated year if filling in the 8862 Form together.

- In subsection 11, you need to indicate if you or your partner can be listed as another taxpayer’s dependent.

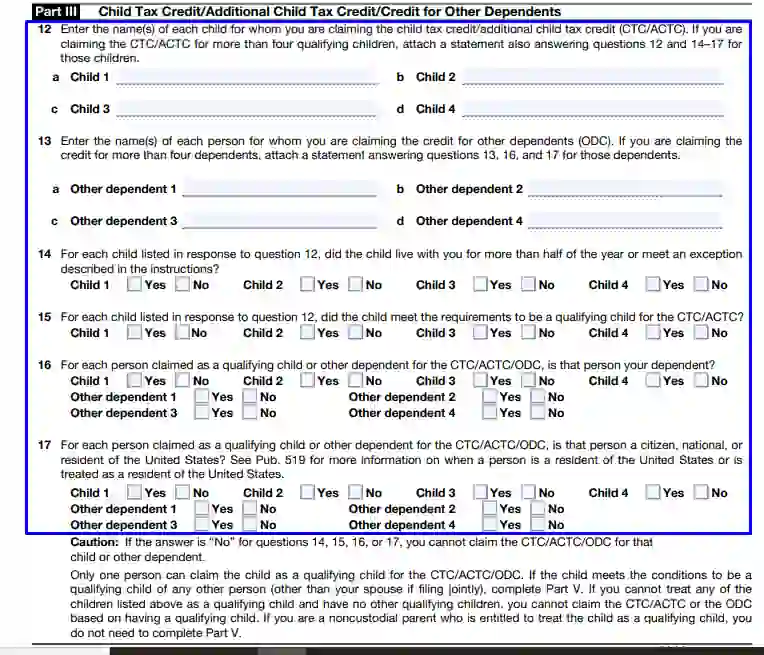

Complete Part 3

Part 3 is generated when applying for Tax Credit. To complete Part 3 correctly, you need to accomplish paragraphs 12-17.

- In paragraph 12, write the names of all individuals eligible for a qualifying child title.

- In subsection 13, write down the names of all dependents.

- In paragraph 14, answer whether each of the noted children has stayed with you for longer than 183 days during the designated year.

- In paragraph 15, indicate whether each of the noted persons can be titled a qualifying child.

- In part 16, indicate whether all of the listed children and dependents are under your guidance.

- In section 17 indicate if all of the listed children and dependents are US citizens.

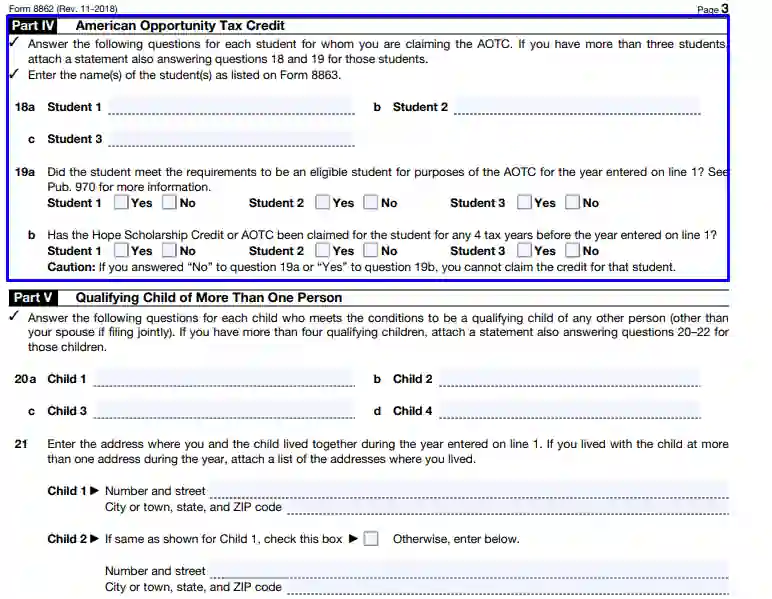

Complete Part 4

To complete Part 4 and receive an American Opportunity Tax Credit, you must answer sections 18-19.

- In unit 18, you should fill in the students’ names for whom you are petitioning for the American Opportunity Tax Credit.

- In unit 19, check the box whether each of the noted students is eligible for the American Opportunity Tax Credit.

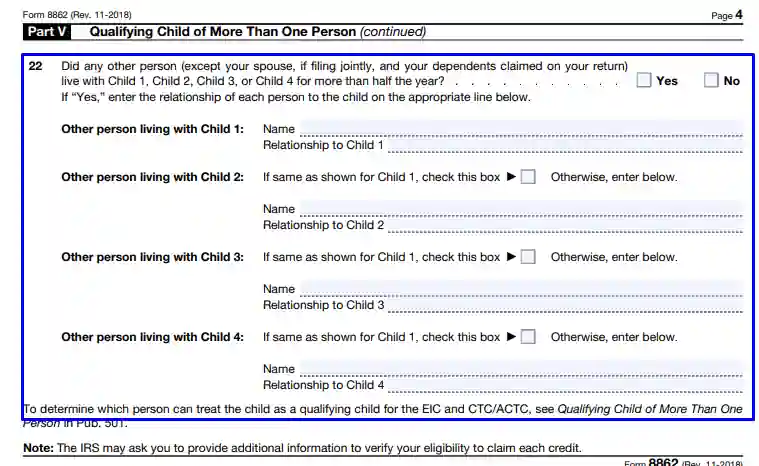

Complete Part 5

In part 5, you need to answer questions 20-22, giving info about a qualifying child.

- In subsection 20, fill in the names of all individuals eligible for a qualifying child title.

- In paragraph 21, you need to indicate the location where you stayed with your children. You can submit different addresses, but just tick the corresponding box if the residency is the same.

- In unit 22, list the names of other people who took care of the child for longer than six months.