IRS Form 8863, known as “Education Credits (American Opportunity and Lifetime Learning Credits),” is a form taxpayers use to claim two higher education tax credits — the American Opportunity Credit and the Lifetime Learning Credit. These credits are intended to reduce the tax burden for individuals paying education expenses for themselves, a spouse, or a dependent. To qualify for these credits, taxpayers must meet certain criteria, such as:

- Paying qualified education expenses for higher education,

- Paying the education expenses for an eligible student enrolled at an eligible educational institution,

- The taxpayer’s modified adjusted gross income falls within the specified limits.

Form 8863 helps taxpayers determine the amount of their education credits and includes the necessary calculations to ensure they claim the correct credit amount.

Filling Out the Form

Despite the fact that you have to fill out just two pages, the form itself is quite complex and demands providing lots of calculations. You have to prepare additional documents (for instance, your tax return) before you complete the form: some numbers from other forms will be needed.

If you have seen the form before and realized that you have no idea what to write, we strongly recommend hiring a specialist who will create the document for you. It, of course, requires paying; however, it will ensure that your form is correct and rid you of a time-consuming procedure. You will then be safe from the Service’s questions and concerns regarding your form.

Whatever you choose — completing the template on your own or asking for professional assistance — we provide you with a general manual that demonstrates how the form looks like and what people should insert there. Scroll down to learn more about the process.

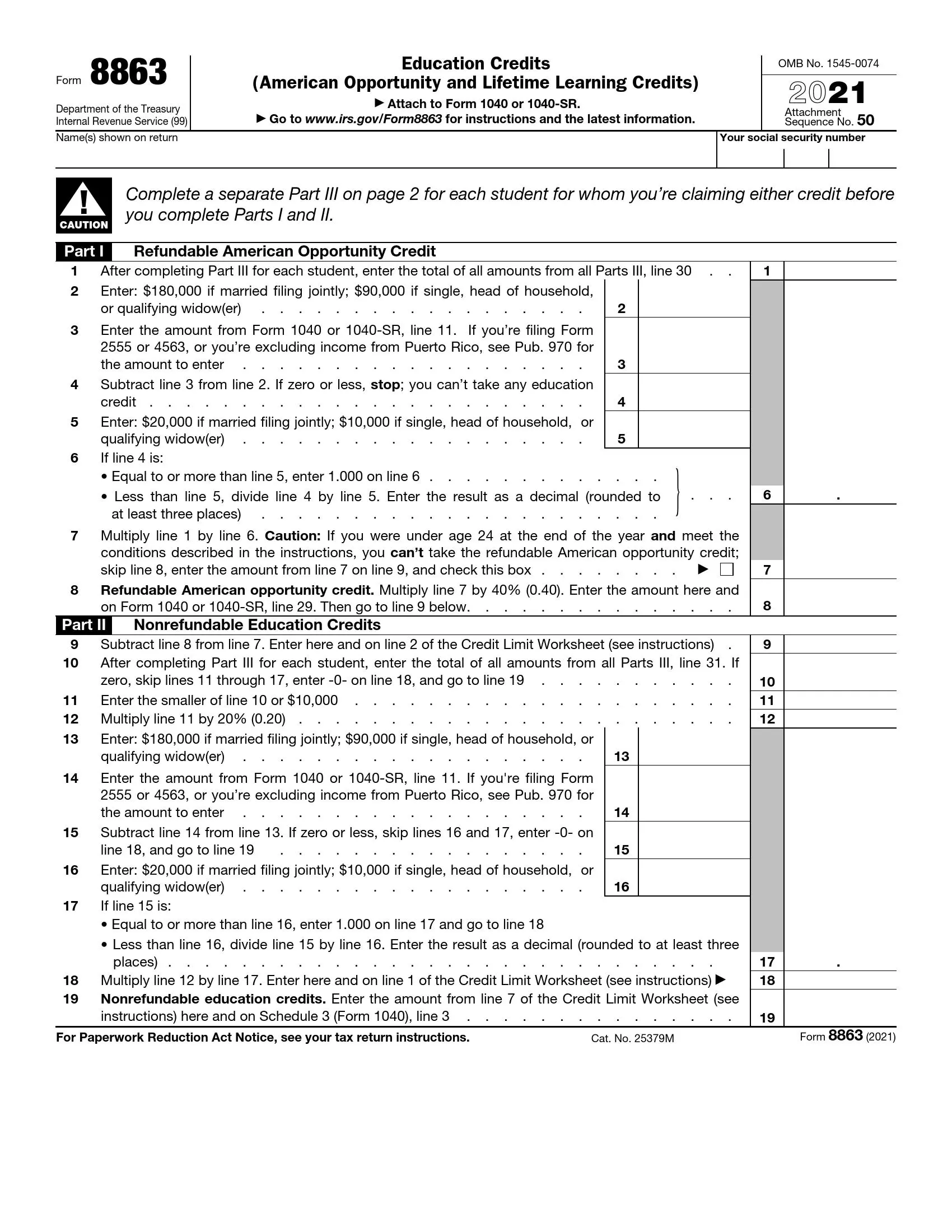

One more thing: before you begin creating your own document, you have to ascertain that the template you are filling out is correct. It is easy to check: just look at the year written on the first page (on the top, right-hand side). If you have no template or yours is old, you can use our well-developed form-building software to download the proper IRS Form 8863. Additionally, the template is available on the Service’s webpage.

Identify Yourself

As a taxpayer, you should almost always start completing all such forms by entering your name and ID number. In the case of this form, you need to insert the same name as written in your tax return and your social security number (SSN).

Read the Caution

This is an unusual form — you have to start working on it from the end. The caution tells about it: you have Part I, II, and III, and you must complete Part III first. It should be filled out for each student that you request credit for.

Move to Part III

This part takes the whole Page 2 of the form. You have to indicate your name and SSN on the above (copy them from Page 1, do not write a different name or number). Then, you must provide information about a student and an institution that they attend. If you have more than one student to include, you can use any number of additional Page 2 copies you need.

Insert the student’s name and their SSN (the same as provided in your tax return). Enter info about the educational institution(s): there is space for two institutions in the template. Add the institution’s name and full address. Then, answer if the student got the Form 1098-T this year and last year (with a certain mark in box 7). If you have answered affirmatively or you ask for the AOTC, enter the institution’s EIN (employer identification number).

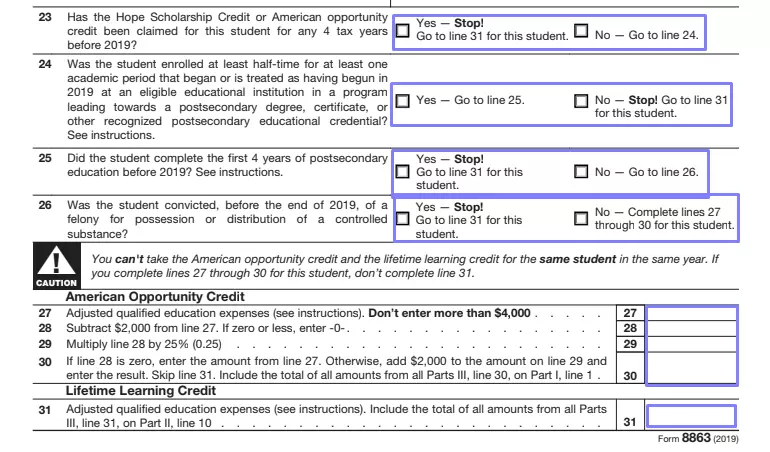

Then, reply to four questions about the student in question. Your answers will guide you to the lines you have to fill out. Near each “yes” or “no” box you check, you will see instructions for your further actions.

Respond to additional questions (from 27 to 31). The first block is about AOTC, and the second is for LLC. Please note that you cannot ask for both credits for one student in the same form (and in the same year).

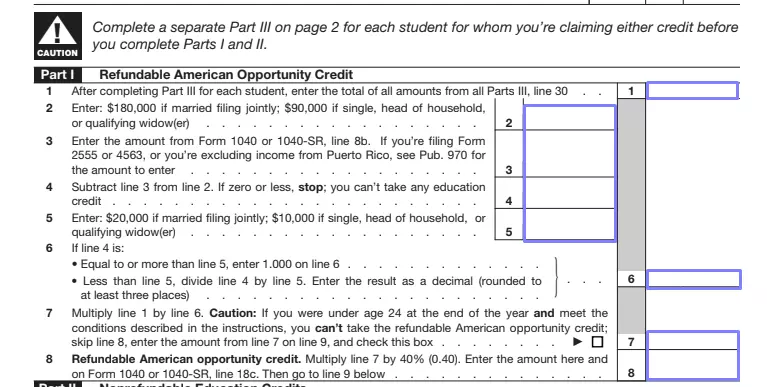

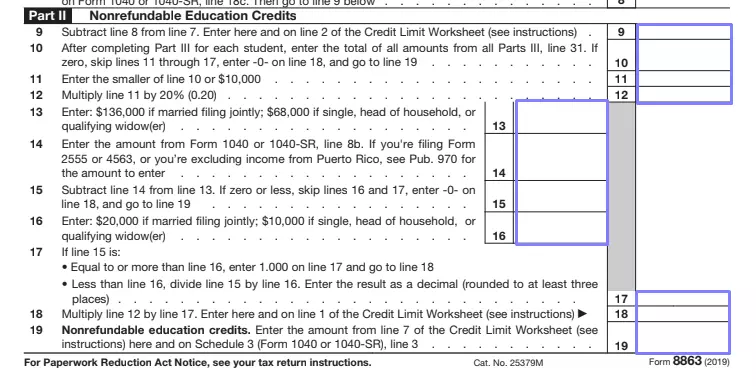

Go Back to Parts I and II

Complete the part applicable to your case. You will see a set of questions that require providing calculations and numbers. For some questions, you will need to extract numbers from your tax return. Also, open the Service’s instructions on the form where you will see credit worksheets that let you count some figures additionally. Use them to conduct calculations.

Near every line you fill out in these parts, you will have additional instructions. Read them all carefully. Some of them require you to stop completing the form because you cannot ask for credits, for example.

Pay attention to all your calculations and numbers you write. Providing false data may lead to not getting credits at all or having other penalties (like fines).