Dealing with PDF documents online is certainly a breeze with our PDF tool. You can fill out 8812 form here and use various other options we provide. In order to make our tool better and less complicated to utilize, we consistently design new features, with our users' suggestions in mind. All it takes is a few simple steps:

Step 1: Press the orange "Get Form" button above. It is going to open our editor so that you can start filling out your form.

Step 2: This tool provides you with the opportunity to customize PDF documents in various ways. Transform it with personalized text, adjust existing content, and place in a signature - all at your fingertips!

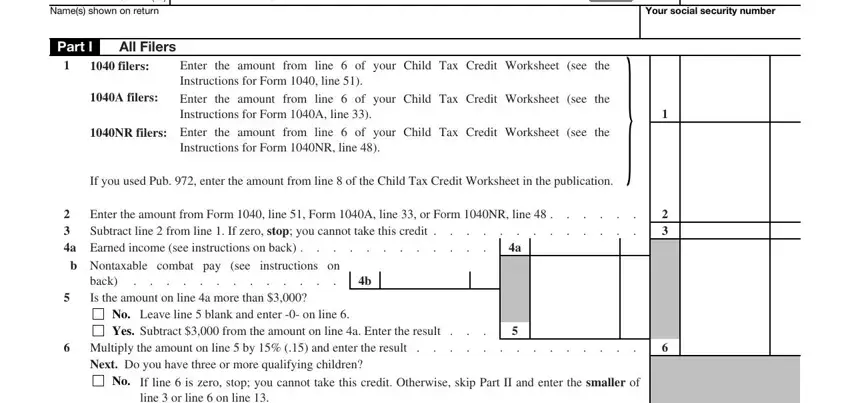

So as to fill out this form, be certain to type in the required details in each blank:

1. You should complete the 8812 form accurately, hence pay close attention while filling in the parts containing all of these blank fields:

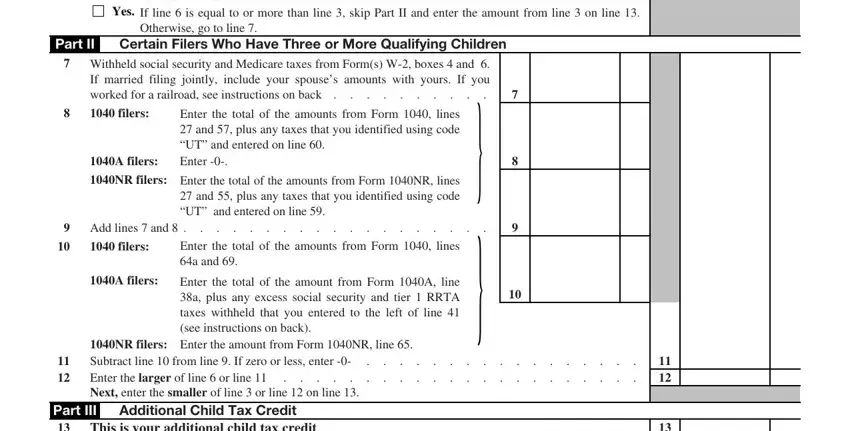

2. Once your current task is complete, take the next step – fill out all of these fields - If line is zero stop you cannot, Yes If line is equal to or more, Otherwise go to line, Part II, Certain Filers Who Have Three or, Withheld social security and, filers, A filers, Enter the total of the amounts, NR filers Enter the total of the, Add lines and, filers, Enter the total of the amounts, A filers, and Enter the total of the amount from with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

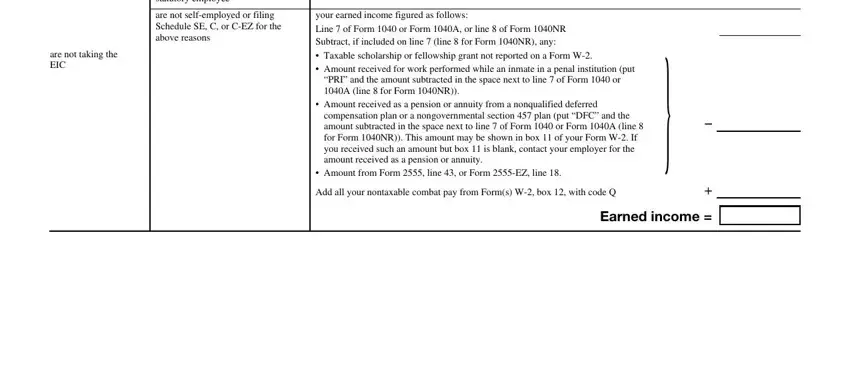

3. This next section is mostly about are not taking the EIC, were selfemployed or you are, are not selfemployed or filing, your earned income figured as, Line of Form or Form A or line, Taxable scholarship or fellowship, PRI and the amount subtracted in, Amount received as a pension or, compensation plan or a, Amount from Form line or Form, Add all your nontaxable combat pay, and Earned income - type in all of these fields.

It is easy to make a mistake while filling out your Earned income, consequently you'll want to look again before you'll submit it.

Step 3: You should make sure the information is correct and then press "Done" to proceed further. Get hold of your 8812 form after you join for a 7-day free trial. Conveniently use the pdf form within your personal account, along with any edits and adjustments automatically preserved! At FormsPal.com, we strive to make certain that all your details are stored secure.