Navigating the complexities of tax reporting and compliance can often lead bewildering paths, especially when it concerns fulfilling obligations to the Department of Revenue (DOR) through specific forms like the Mississippi 89-140 MS Annual Information Return. This particular form serves as a conduit for employers to report income via W-2s, 1099s, W-2Gs, and other related information returns. One of the crucial requirements set forth is for employers who issue more than 25 of these information returns to submit them electronically, adhering strictly to the formats and specifications established by the Internal Revenue Service (IRS) and the Social Security Administration (SSA), as detailed in IRS Publication 1220 and SSA Publication Form 89-140-20-3-1-000. These returns encompass a broad spectrum, from the standard W-2 forms—required to be in SSA format—to the various categories of 1099 forms, which must meet IRS criteria. Mississippi encourages all employers, regardless of the number of returns, to utilize the Taxpayer Access Point (TAP) system for secure and efficient electronic submission directly to the DOR. Missed or incorrectly formatted submissions are not taken lightly; failing to follow the due process can lead to penalties. Additionally, special instructions are provided for income reported on 1099 forms, amended returns, and payment submissions, delineating a structured approach to how these forms should be managed and submitted, highlighting deadlines and protocols for both electronic and paper filings.

| Question | Answer |

|---|---|

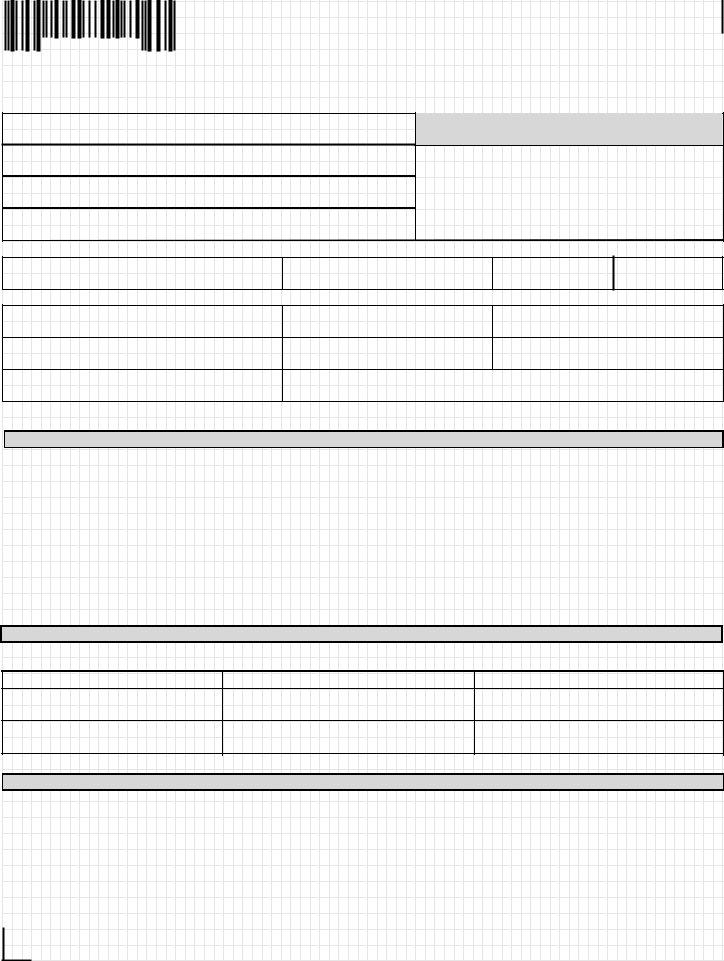

| Form Name | 89 140 Ms Annual Information Return Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | mississippi 89140 form, mississippi form 89 140, ms 89 105 form, ms form information |

|

Form |

|

|

|

|

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 |

|||

04 |

Mississippi |

|

|

|

05 |

Annual Information Return |

|

|

|

06 |

891402031000 |

|

|

|

07 |

Tax Year |

9999 |

|

|

08 |

|

|

|

|

09 |

FEIN 999999999 |

|

MS Account ID |

9999999999 |

10 |

|

|

|

|

11 |

Name |

|

FORM TYPE |

|

|

|

|

||

12 |

X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X |

|

(CHECK ONE) |

|

13 |

Address |

|

|

|

|

|

|

|

|

14 |

X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X |

X |

X |

|

15 |

|

|

|

|

16X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X

17 |

City |

State |

Zip |

X |

X |

Other 1099 |

|

18 |

XXXXXXXXXXXXXXXXXX |

XX |

999999999 |

|

|

|

|

19 |

|

|

|

|

|

|

|

20 |

Number of Forms |

|

MS Taxable Wages |

|

MS Tax Withheld |

|

MS Tax Remitted |

21 |

|

99 |

|

9999999999 |

9999999999 |

9999999999 |

|

22 |

|

|

|

|

|

|

|

23 |

Signature |

|

Phone + Extension |

|

Date Signed |

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

9999999999 |

|

|

99999999 |

25 |

Submitting Company (If different than above) |

|

Submitting Company Phone + Extension |

Date Mailed |

|

|

|

26X9X9X9X9X9X9X9X9X9X9X9X9X9X9X |

|

9999999999 |

|

|

99999999 |

||

27 |

Contact Person (Please Print) |

|

Address |

|

|

|

|

28XXXXXXXXXXXXXXXXXXXXXXXXXXXXX X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9 |

|||||||

29 |

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

31 |

GENERAL INSTRUCTIONS |

|

|

|

|

|

|

32Employers that issue 25 or more

34

35

3637 .

38 .

39

40

41

42

43FILING DUE DATES

44* If the due date falls on a weekend or state holiday, the filing due date is the next business working day.

45 |

|

|

|

|

|

46 |

|

FORM TYPES |

MEDIA |

* DUE DATE |

|

47 |

|

Paper and Electronic |

January 31st |

||

48 |

|

Due to Employees and MDOR |

|||

49 |

|

1099s |

Paper and Electronic |

February 28th |

|

50 |

|

Due to Recipients and MDOR |

|||

51 |

|

|

|

|

|

52 |

RETURN INSTRUCTIONS |

|

|

||

53 |

. |

Income reported on 1099 forms should be entered in the MS Taxable Wages box above. |

|

||

54 |

|

||||

55 |

. |

If Mississippi Tax Withheld and Mississippi Tax Remitted are not the same amount, an amended return must be filed. |

|||

56 |

. |

Do not send a tax payment with this form. Credit will not be applied to your account if payment is submitted with this form. Additional |

|||

57 |

. |

payments can be filed through TAP or with a paper Form |

|

||

A separate Form |

|||||

58 |

|||||

with paper returns. Mail the form and copies of information returns to: |

|

||||

59 |

|

|

|

|

|

60 |

|

|

|

|

|

61 |

|

|

Department of Revenue |

|

|

|

|

|

Withholding Tax Division |

|

|

62 |

|

|

P.O. Box 23058 |

|

|

63 |

|

|

Jackson, MS |

|

|

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04

05

06

07

08

09

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63