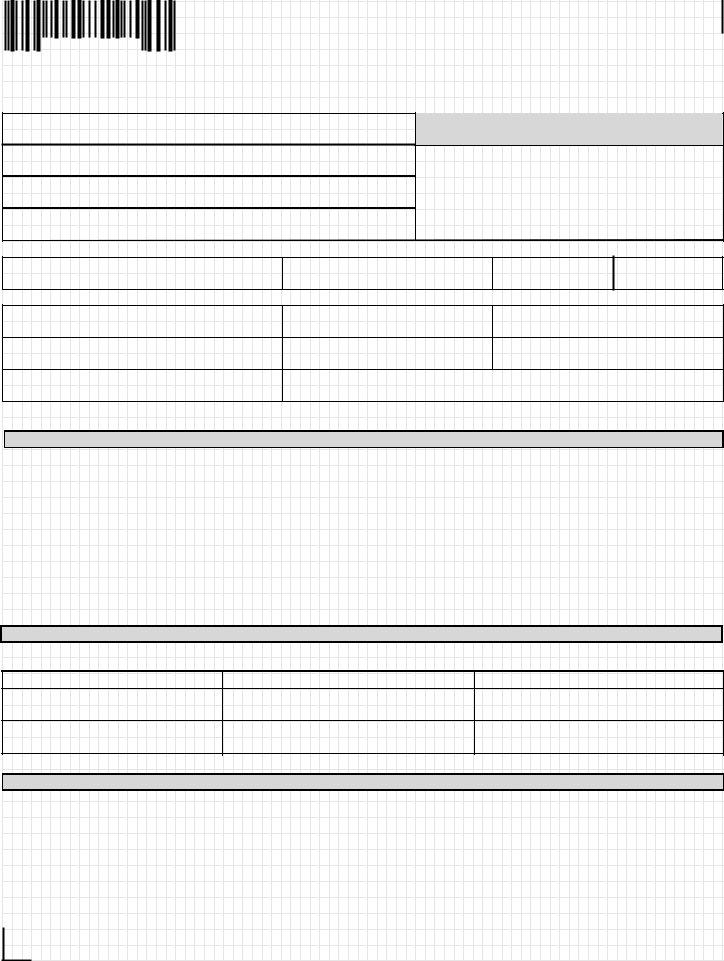

The 89 140 Ms Annual Information Return Form is a document that needs to be filed with the IRS annually by all organizations exempt from taxation under section 501(a) of the Internal Revenue Code. This form provides detailed information about the organization's income, expenses, and assets. Filing this form on time is critical for ensuring that your organization remains in good standing with the IRS. Here we'll provide an overview of what needs to be included on the 89 140 Ms Annual Information Return Form.

| Question | Answer |

|---|---|

| Form Name | 89 140 Ms Annual Information Return Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | mississippi 89140 form, mississippi form 89 140, ms 89 105 form, ms form information |

|

Form |

|

|

|

|

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 |

|||

04 |

Mississippi |

|

|

|

05 |

Annual Information Return |

|

|

|

06 |

891402031000 |

|

|

|

07 |

Tax Year |

9999 |

|

|

08 |

|

|

|

|

09 |

FEIN 999999999 |

|

MS Account ID |

9999999999 |

10 |

|

|

|

|

11 |

Name |

|

FORM TYPE |

|

|

|

|

||

12 |

X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X |

|

(CHECK ONE) |

|

13 |

Address |

|

|

|

|

|

|

|

|

14 |

X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X |

X |

X |

|

15 |

|

|

|

|

16X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X

17 |

City |

State |

Zip |

X |

X |

Other 1099 |

|

18 |

XXXXXXXXXXXXXXXXXX |

XX |

999999999 |

|

|

|

|

19 |

|

|

|

|

|

|

|

20 |

Number of Forms |

|

MS Taxable Wages |

|

MS Tax Withheld |

|

MS Tax Remitted |

21 |

|

99 |

|

9999999999 |

9999999999 |

9999999999 |

|

22 |

|

|

|

|

|

|

|

23 |

Signature |

|

Phone + Extension |

|

Date Signed |

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

9999999999 |

|

|

99999999 |

25 |

Submitting Company (If different than above) |

|

Submitting Company Phone + Extension |

Date Mailed |

|

|

|

26X9X9X9X9X9X9X9X9X9X9X9X9X9X9X |

|

9999999999 |

|

|

99999999 |

||

27 |

Contact Person (Please Print) |

|

Address |

|

|

|

|

28XXXXXXXXXXXXXXXXXXXXXXXXXXXXX X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9 |

|||||||

29 |

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

31 |

GENERAL INSTRUCTIONS |

|

|

|

|

|

|

32Employers that issue 25 or more

34

35

3637 .

38 .

39

40

41

42

43FILING DUE DATES

44* If the due date falls on a weekend or state holiday, the filing due date is the next business working day.

45 |

|

|

|

|

|

46 |

|

FORM TYPES |

MEDIA |

* DUE DATE |

|

47 |

|

Paper and Electronic |

January 31st |

||

48 |

|

Due to Employees and MDOR |

|||

49 |

|

1099s |

Paper and Electronic |

February 28th |

|

50 |

|

Due to Recipients and MDOR |

|||

51 |

|

|

|

|

|

52 |

RETURN INSTRUCTIONS |

|

|

||

53 |

. |

Income reported on 1099 forms should be entered in the MS Taxable Wages box above. |

|

||

54 |

|

||||

55 |

. |

If Mississippi Tax Withheld and Mississippi Tax Remitted are not the same amount, an amended return must be filed. |

|||

56 |

. |

Do not send a tax payment with this form. Credit will not be applied to your account if payment is submitted with this form. Additional |

|||

57 |

. |

payments can be filed through TAP or with a paper Form |

|

||

A separate Form |

|||||

58 |

|||||

with paper returns. Mail the form and copies of information returns to: |

|

||||

59 |

|

|

|

|

|

60 |

|

|

|

|

|

61 |

|

|

Department of Revenue |

|

|

|

|

|

Withholding Tax Division |

|

|

62 |

|

|

P.O. Box 23058 |

|

|

63 |

|

|

Jackson, MS |

|

|

06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80

04

05

06

07

08

09

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63