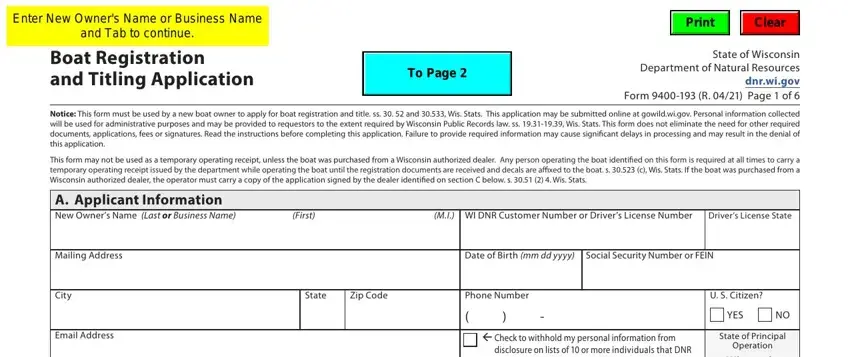

Enter New Owner's Name or Business Name

and Tab to continue.

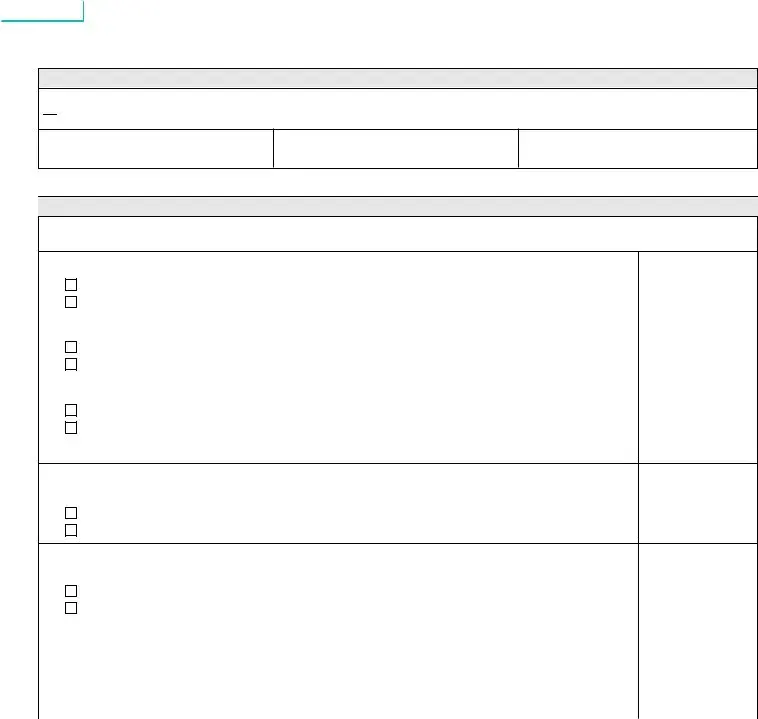

Boat Registration

and Titling Application

State of Wisconsin

Department of Natural Resources

dnr.wi.gov

Form 9400‑193 (R. 04/21) Page 1 of 6

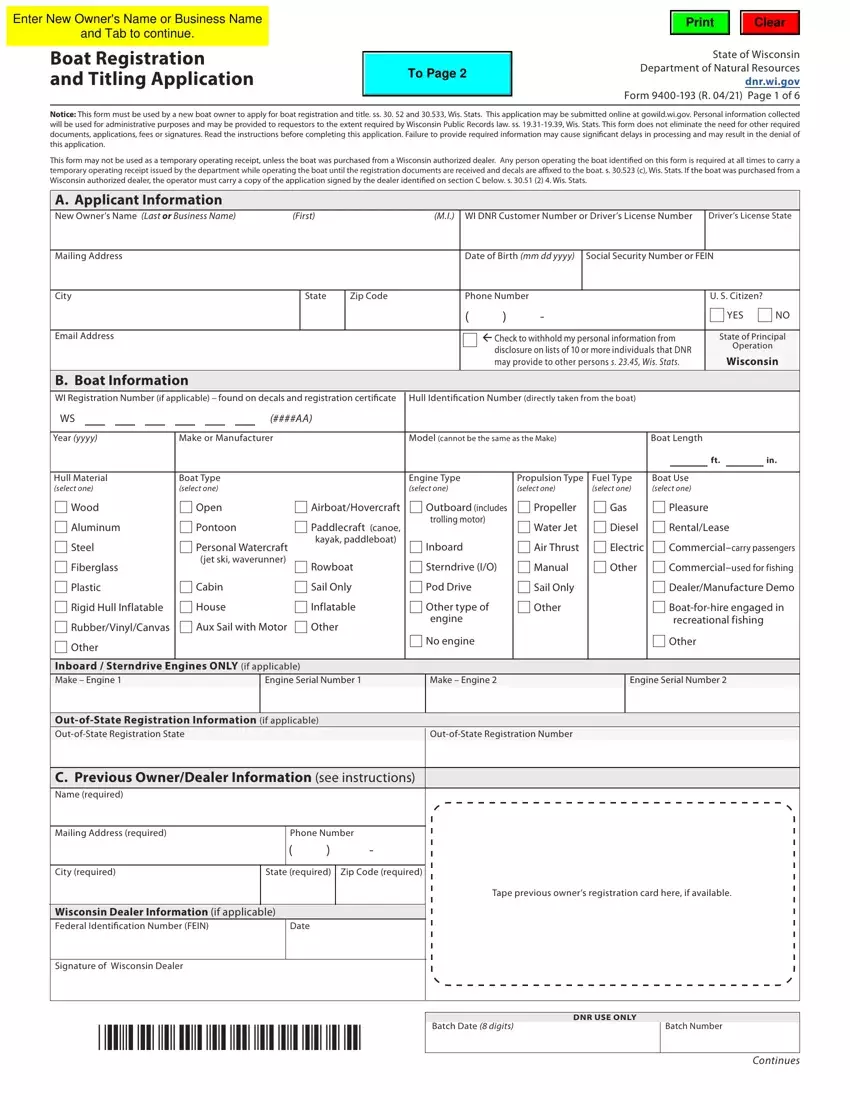

Notice: This form must be used by a new boat owner to apply for boat registration and title. ss. 30. 52 and 30.533, Wis. Stats. This application may be submitted online at gowild.wi.gov. Personal information collected will be used for administrative purposes and may be provided to requestors to the extent required by Wisconsin Public Records law. ss. 19.31-19.39, Wis. Stats. This form does not eliminate the need for other required documents, applications, fees or signatures. Read the instructions before completing this application. Failure to provide required information may cause significant delays in processing and may result in the denial of this application.

This form may not be used as a temporary operating receipt, unless the boat was purchased from a Wisconsin authorized dealer. Any person operating the boat identified on this form is required at all times to carry a temporary operating receipt issued by the department while operating the boat until the registration documents are received and decals are affixed to the boat. s. 30.523 (c), Wis. Stats. If the boat was purchased from a Wisconsin authorized dealer, the operator must carry a copy of the application signed by the dealer identified on section C below. s. 30.51 (2) 4. Wis. Stats.

A. Applicant Information

New Owner’s Name (Last or Business Name) |

(First) |

|

|

(M.I.) |

WI DNR Customer Number or Driver’s License Number |

Driver’s License State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm dd yyyy) |

Social Security Number or FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

Zip Code |

|

|

Phone Number |

|

|

|

|

U. S. Citizen? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

- |

|

|

|

|

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

Check to withhold my personal information from |

State of Principal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

disclosure on lists of 10 or more individuals that DNR |

|

Operation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wisconsin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

may provide to other persons s. 23.45, Wis. Stats. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

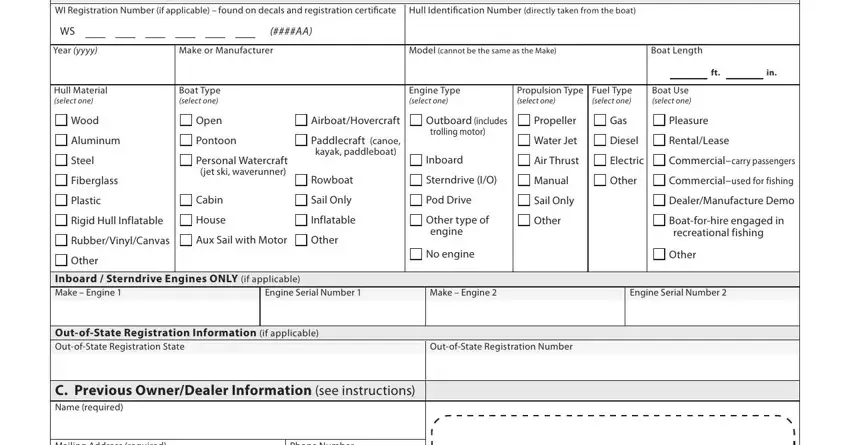

B. Boat Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WI Registration Number (if applicable) – found on decals and registration certificate |

Hull Identification Number (directly taken from the boat) |

|

|

|

|

|

|

WS |

|

|

|

|

|

|

(####AA) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year (yyyy) |

Make or Manufacturer |

|

|

|

Model (cannot be the same as the Make) |

|

|

Boat Length |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ft. |

in. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hull Material |

Boat Type |

|

|

|

Engine Type |

|

Propulsion Type |

Fuel Type |

Boat Use |

|

|

|

|

(select one) |

(select one) |

|

|

|

(select one) |

|

(select one) |

(select one) |

(select one) |

|

|

|

|

Wood |

|

Open |

|

Airboat/Hovercraft |

|

Outboard (includes |

Propeller |

Gas |

Pleasure |

|

|

|

|

Aluminum |

|

Pontoon |

|

Paddlecraft (canoe, |

|

trolling motor) |

|

Water Jet |

Diesel |

Rental/Lease |

|

|

|

|

|

|

|

|

Steel |

|

Personal Watercraft |

|

kayak, paddleboat) |

|

Inboard |

|

Air Thrust |

Electric |

Commercial–carry passengers |

|

|

|

|

|

|

Fiberglass |

|

(jet ski, waverunner) |

|

Rowboat |

|

Sterndrive (I/O) |

Manual |

Other |

Commercial–used for fishing |

|

|

|

|

|

|

|

|

|

Plastic |

|

Cabin |

|

Sail Only |

|

Pod Drive |

|

Sail Only |

|

|

Dealer/Manufacture Demo |

Rigid Hull Inflatable |

|

House |

|

Inflatable |

|

Other type of |

|

Other |

|

|

Boat-for-hire engaged in |

Rubber/Vinyl/Canvas |

|

Aux Sail with Motor |

|

Other |

|

|

engine |

|

|

|

|

|

|

recreational fishing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

No engine |

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inboard / Sterndrive |

Engines ONLY (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make – Engine 1 |

|

|

|

|

|

|

Engine Serial Number 1 |

|

Make – Engine 2 |

|

|

|

Engine Serial Number 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Out-of-State Registration Information |

(if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Out-of-State Registration State |

|

|

|

|

Out-of-State Registration Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

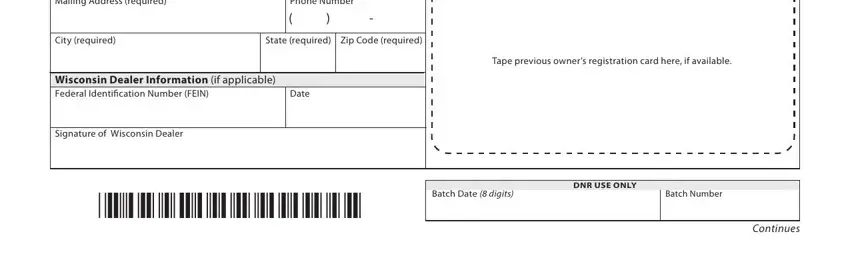

C. Previous Owner/Dealer Information (see instructions)

Name (required)

Mailing Address (required) |

|

Phone Number |

|

|

|

( |

) |

- |

|

|

|

|

|

|

|

|

City (required) |

State (required) |

Zip Code (required) |

|

|

|

|

|

|

Tape previous owner’s registration card here, if available. |

|

|

|

|

|

|

|

Wisconsin Dealer Information (if applicable) |

|

|

|

|

Federal Identification Number (FEIN) |

|

Date |

|

|

|

|

|

|

|

|

|

|

|

Signature of Wisconsin Dealer |

|

|

|

|

|

|

DNR USE ONLY

Batch Date (8 digits)

|

Tab to continue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

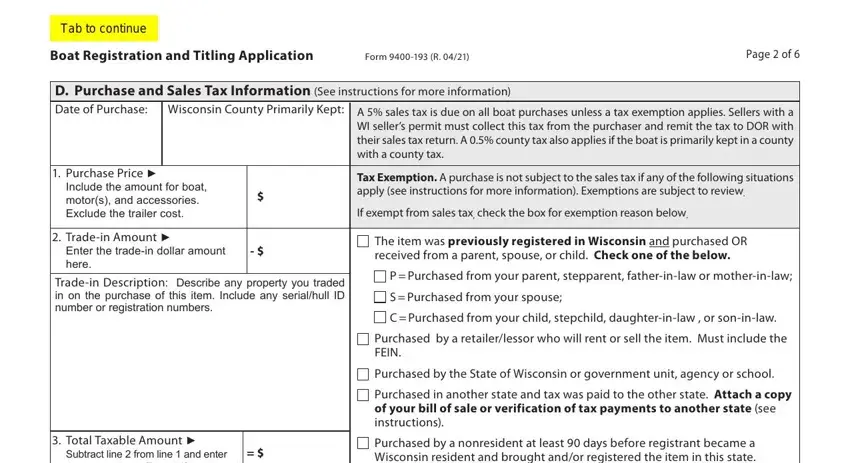

Boat Registration and Titling Application |

Form 9400‑193 (R. 04/21) |

Page 2 of 6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

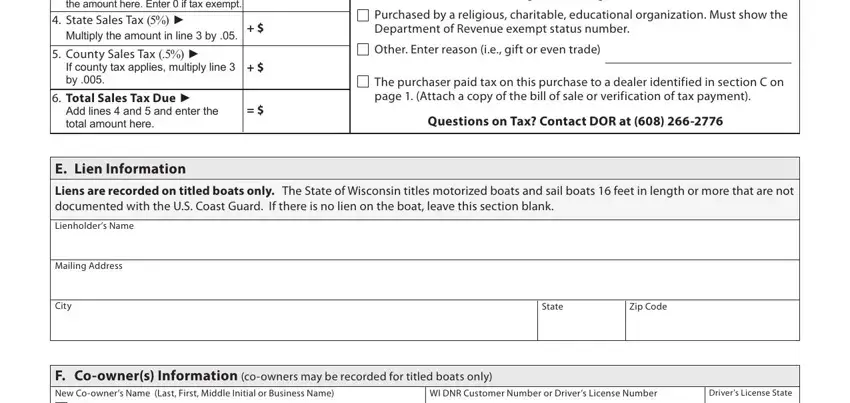

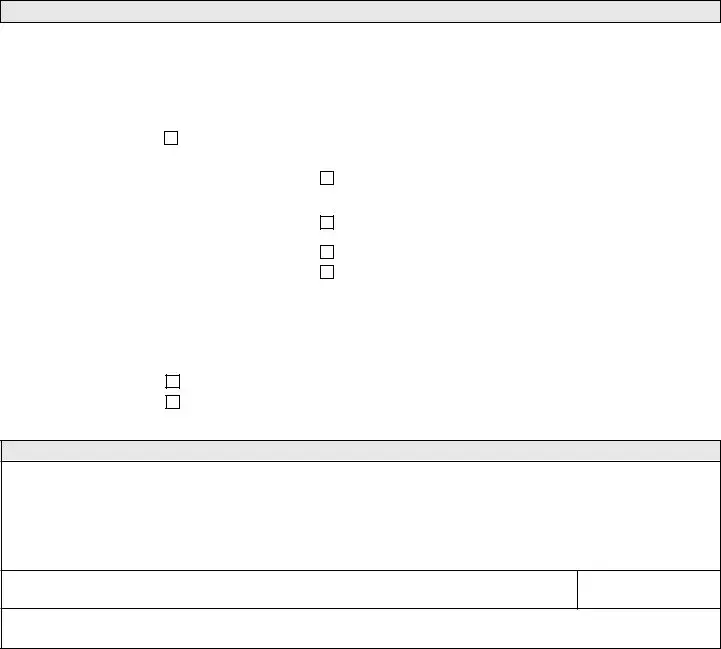

D. Purchase and Sales Tax Information (See instructions for more information) |

|

|

|

Date of Purchase: |

|

Wisconsin County Primarily Kept: |

A 5% sales tax is due on all boat purchases unless a tax exemption applies. Sellers with a |

|

|

|

|

|

|

|

|

WI seller’s permit must collect this tax from the purchaser and remit the tax to DOR with |

|

|

|

|

|

|

|

|

their sales tax return. A 0.5% county tax also applies if the boat is primarily kept in a county |

|

|

|

|

|

|

|

|

with a county tax. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Purchase Price ► |

|

|

|

|

|

Tax Exemption. A purchase is not subject to the sales tax if any of the following situations |

|

Include the amount for boat, |

$ |

|

apply (see instructions for more information). Exemptions are subject to review. |

|

|

|

motor(s), and accessories. |

|

If exempt from sales tax, check the box for exemption reason below. |

|

|

|

Exclude the trailer cost. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Trade-in Amount ► |

- $ |

|

The item was previously registered in Wisconsin and purchased OR |

|

Enter the trade-in dollar amount |

|

received from a parent, spouse, or child. Check one of the below. |

|

|

|

here. |

|

|

|

|

|

|

|

|

|

|

|

|

|

P = Purchased from your parent, stepparent, father-in-law or mother-in-law; |

|

Trade-in Description: Describe any property you traded |

|

|

|

|

|

|

in on the purchase of this item. Include any serial/hull ID |

S = Purchased from your spouse; |

|

|

|

number or registration numbers. |

|

|

C = Purchased from your child, stepchild, daughter-in-law , or son-in-law. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchased by a retailer/lessor who will rent or sell the item. Must include the |

|

|

|

|

|

|

|

|

FEIN. |

|

|

|

|

|

|

|

|

|

|

Purchased by the State of Wisconsin or government unit, agency or school. |

|

|

|

|

|

|

|

|

Purchased in another state and tax was paid to the other state. Attach a copy |

|

|

|

|

|

|

|

|

of your bill of sale or verification of tax payments to another state (see |

|

|

|

|

|

|

|

|

instructions). |

|

|

|

3. Total Taxable Amount ► |

|

= $ |

|

Purchased by a nonresident at least 90 days before registrant became a |

|

Subtract line 2 from line 1 and enter |

|

|

Wisconsin resident and brought and/or registered the item in this state. |

|

the amount here. Enter 0 if tax exempt. |

|

|

|

Purchased by a religious, charitable, educational organization. Must show the |

|

4. State Sales Tax (5%) ► |

|

+ $ |

|

|

|

|

Department of Revenue exempt status number. |

|

|

|

Multiply the amount in line 3 by .05. |

|

|

|

|

|

|

|

|

|

|

|

Other. Enter reason (i.e., gift or even trade) |

|

|

|

5. County Sales Tax (.5%) ► |

|

+ $ |

|

|

|

|

If county tax applies, multiply line 3 |

|

|

|

|

|

|

|

|

|

|

|

|

by .005. |

|

|

|

|

|

The purchaser paid tax on this purchase to a dealer identified in section C on |

|

6. Total Sales Tax Due ► |

|

= $ |

|

page 1. (Attach a copy of the bill of sale or verification of tax payment). |

|

Add lines 4 and 5 and enter the |

|

|

Questions on Tax? Contact DOR at (608) 266‑2776 |

|

|

|

total amount here. |

|

|

|

|

|

|

|

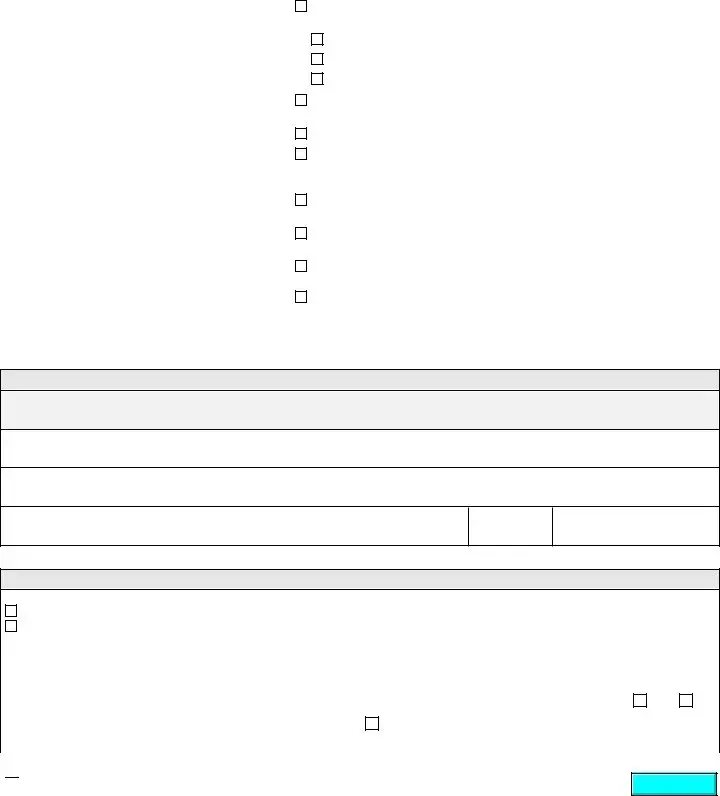

E. Lien Information

Liens are recorded on titled boats only. The State of Wisconsin titles motorized boats and sail boats 16 feet in length or more that are not documented with the U.S. Coast Guard. If there is no lien on the boat, leave this section blank.

Lienholder’s Name

F.Co-owner(s) Information (co-owners may be recorded for titled boats only)

New Co-owner’s Name (Last, First, Middle Initial or Business Name) |

|

WI DNR Customer Number or Driver’s License Number |

Driver’s License State |

AND |

|

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

Date of Birth (mm dd yyyy) |

Social Security Number or FEIN |

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

Phone Number |

|

|

U.S. Citizen? |

|

|

|

|

( |

) |

- |

|

YES |

NO |

|

|

|

|

|

|

|

Email Address |

|

|

|

Check to withhold my personal information from disclosure on |

State of Principal |

|

|

|

|

lists of 10 or more individuals that DNR may provide to other |

Operation |

|

|

|

|

|

Wisconsin |

|

|

|

|

persons s. 23.45, Wis. Stats. |

|

Check if you want to add other co-owners, attach additional pages with the above information.

Check if you want to add other co-owners, attach additional pages with the above information.

To Page 3

To Page 1 |

|

Tab to continue |

|

|

|

Boat Registration and Titling Application

Form 9400‑193 (R. 04/21) |

Page 3 of 6 |

G. U. S. Coast Guard Documented Boat Information

Check if you are documenting your boat with the U. S. Coast Guard. Supporting documentation is required – see section I.

Check if you are documenting your boat with the U. S. Coast Guard. Supporting documentation is required – see section I.

Hailing Port (City and State)

Documentation Number (Official Number)

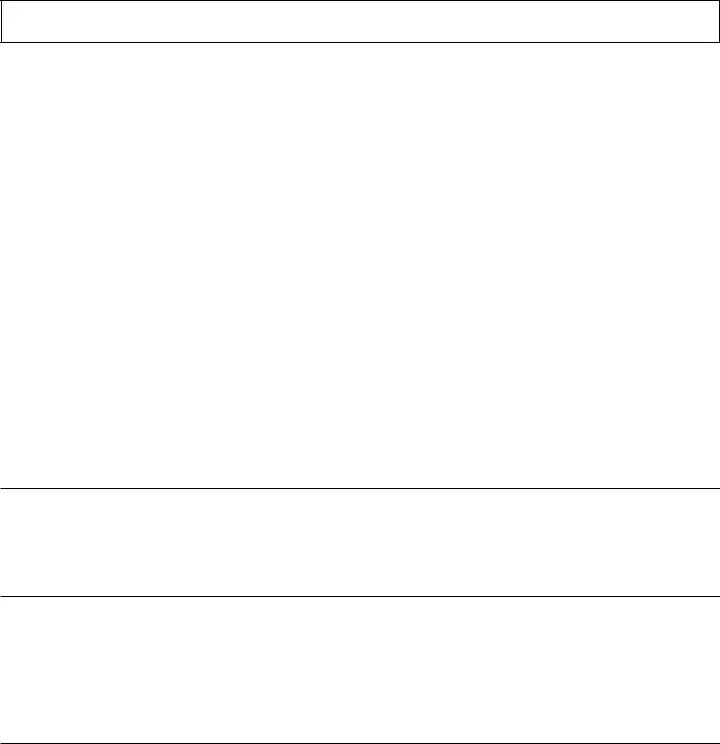

H. Registration, Titling, and Lien Fees

Follow the steps below to calculate your registration fees. Select the answer for each question by checking the box next to your response and enter the amount in the space provided. Use the Fee Table at the bottom of the page for the applicable registration fees according to your boat type and length.

1. |

Has the boat been previously registered in Wisconsin? |

|

|

Yes, enter $3.75 to enter the transfer fee to transfer the registration into your name and proceed to line 2. |

|

|

No, skip to line 4. |

$ |

2. |

Has the Wisconsin registration expired? |

|

|

Yes, enter the registration fee based on your boat type from column A in the Fee Table and skip to line 5. |

|

|

No, proceed to line 3. |

$ |

|

|

|

3. |

Do you need replacement decals? |

|

|

Yes, enter $2.50 for replacement materials fee here and skip to line 5. |

|

|

No, skip to line 5. |

$ |

4. |

Enter the registration fee based on your boat type from column A in the Fee Table and proceed to line 5. |

$ |

5.Title Fees: Based on your boat type, use column B in the Fee Table to determine if a $5 title fee applies. Does a title fee apply?

Yes, enter $5.00 for the certificate of title fee here and proceed to line 6. |

|

No, skip to line 7. |

$ |

6.Lien Fee: Liens are only recorded on boats that are issued a Wisconsin Certificate of Title. Do you have a lien on your boat entered from section E of this application?

|

Yes, enter $5.00 for the lien notation filing fee here and proceed to line 7. |

|

|

|

|

No, proceed to line 7. |

|

|

$ |

7. |

Registration Fees Due: Add lines 1, 2, 3, 4, 5, and 6 from this section and enter the total here. ► |

$ |

|

|

|

|

|

|

8. |

Total Sales Tax: Enter the total sales tax due from section D line 6 here. ► |

|

$ |

|

|

|

|

|

|

9. |

Donation: If you would like to donate $2 or more to help stop Aquatic Invasive Species, enter the amount here. ► |

$ |

|

|

|

|

|

|

10. |

Total Fees Due: Add lines 7, 8, and 9 from this section and enter the total here. ► |

|

= $ |

|

|

|

|

|

|

|

|

|

|

|

|

Fee Table |

|

Column A |

|

Column B |

|

Registration Fee |

|

Title Fee |

|

|

|

|

|

|

Under 16 ft. |

$22.00 |

|

n/a |

Motorized Boats |

16 ft. to less than 26 ft. |

$32.00 |

|

$5.00 |

26 ft. to less than 40 ft. |

$60.00 |

|

$5.00 |

|

|

|

|

|

40 ft. and greater |

$100.00 |

|

$5.00 |

Non – Motorized Boats |

Voluntary Registration |

$11.00 |

|

n/a |

Non – Motorized Sailboats |

Over 12 ft. to less than 16 ft. |

$17.00 |

|

n/a |

16 ft. and greater |

$17.00 |

|

$5.00 |

|

|

|

|

|

16 ft. to less than 26 ft. |

$32.00 |

|

n/a |

U. S. Coast Guard Documented Boat |

26 ft. to less than 40 ft. |

$60.00 |

|

n/a |

|

|

40 ft. and greater |

$100.00 |

|

n/a |

n/a = not applicable, fee not required.

Boat Registration and Titling Application |

Form 9400‑193 (R. 04/21) |

Page 4 of 6 |

I.Required Documents (EVIDENCE OF TRANSFER OF OWNERSHIP) – Titled and Documented Boats Only

Specific documentation and information showing transfer of ownership must be submitted to the department to complete the transfer of ownership. Attach the required documents with this form. Evidence of transfer of ownership must be submitted for all boats that will be issued a Wisconsin Certificate of Title or that will be documented with the U.S. Coast Guard. The State of Wisconsin titles motorized boats and sail boats 16 feet in length or more that are not documented with the U.S. Coast Guard.

Boat Type |

Required Documents for Titled and Documented Boats |

New Boat |

Original manufacturer statement of origin (MSO) assigned to the purchaser(s). |

Boat has never been registered |

in Wisconsin or another state |

|

|

|

|

|

|

|

|

|

|

|

|

Current certificate of title properly assigned to you. The title must be signed by |

|

|

Boat is currently titled in |

|

the owner(s) listed on the title and the assignment section must identify you as |

|

|

|

the new owner. – photocopies are NOT acceptable. |

Used Boat |

Wisconsin or another state. |

|

|

|

|

|

Lien release document (if applicable) – photocopies are acceptable. |

Boat that has been registered |

|

|

|

|

|

in Wisconsin or another state |

|

|

|

|

|

Boat has been previously |

|

Current out-of-state registration document (e.g. proof of out-of-state registration). |

|

|

|

|

|

|

Material evidence that no title was issued from the state of registration (e.g. |

|

|

registered in another state |

|

|

|

and no title was issued. |

|

registration card indicating there is no current title, or letter on the state’s |

|

|

|

|

letterhead identifying the boat by HIN and indicating no title was issued, etc.). |

|

|

|

|

|

|

If you are applying for registration of a boat that has been previously documented or will be documented with the |

|

|

U.S. Coast Guard, you must provide: |

|

Boat that is documented |

Do you intend to document the boat with the U. S. Coast Guard in your name? |

with the U.S. Coast Guard |

|

|

|

|

|

Yes. Submit a photocopy of the letter of documentation in your name. Expired letters are not acceptable. |

|

|

No. Submit a photocopy of the letter of deletion from the previous owner. |

|

|

|

|

|

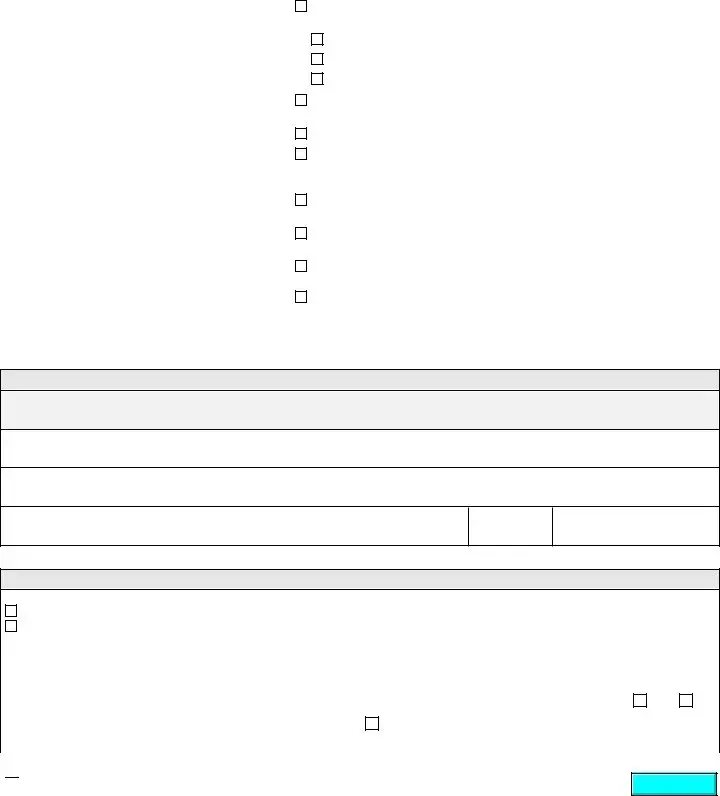

J. Signature and Certification

I certify that the information and statements made within this application are true, accurate, and complete to the best of my knowledge. I understand that intentionally making a false statement on an application for title may be punished under s. 30.547, Wis. Stats., by a maximum fine of $10,000 or imprisonment up to 6 years, or both. By signing this application, I attest that I am unaware of any known or unknown person(s) who would contest this transfer of ownership and thereby indemnify the State of Wisconsin, Department of Natural Resources, or such person or legal entity suffering a damage judgment resulting from any illegalities of the transfer and title.

I also certify I have examined the hull identification number (HIN) and verify it is the number shown on the application pursuant to s. 30.533(1), Wis. Stats.

Signature of Owner |

Signature Date |

If you are signing on behalf of a company or organization, print your full name and title here |

|

Make check or money order payable to WDNR for the total amount.

Mail application, fees, and required documents to:

DNR PROCESSING CENTER

PO BOX 78701

MILWAUKEE WI 53278-0701

Registration Fees: |

$ |

|

|

Sales Tax: |

$ |

|

|

Donation: |

$ |

|

|

Total Fees Due: |

= $ |

|

|

|

Page 5 of 6 |

|

|

INSTRUCTIONS FOR FORM 9400-193 |

BOAT REGISTRATION AND TITLING APPLICATION |

GENERAL INSTRUCTIONS

Purpose of Form. Use Form 9400-193 if you are the new owner of a boat and you want to apply for a registration certificate and/or a certificate of title. You may submit this request online at gowild.wi.gov.

Form 9400-617. Use the Release of Ownership Interest Request form in addition to this application if the certificate of title is missing and the owner of record wants to transfer boat title to someone other than themselves.

Fee. Registration, titling fees and sales tax apply. Boat registration is valid for 3 years expiring on March 31st of the 3rd year.

Required Documents. See section I for a description of what documentation and information is required by the department as evidence of transfer of ownership. Original documents must be submitted. Photocopies are not acceptable unless the instructions specifically state otherwise.

SPECIFIC INSTRUCTIONS

Read the instructions below to ensure that you provide all the required information. Failure to provide required information may cause significant delays in processing and may result in the denial of the application for registration and title.

DEFINITIONS

Owner of Record. A person whose name appears on the certificate of title and/or the department’s records. If there is more than one owner listed on the title, each and all owners are considered owners of record.

Primary Owner on Record. A person who makes the initial application and who receives all documents and communication related to the boat.

Tenants in Common. Co-owners who each have a distinct, separately transferable ownership interest on the boat. Their names are separated by the conjunction “and” on the certificate of title. To transfer ownership of the boat, the signatures of all co-owners are required.

Joint Tenants. Co-owners who have unity of ownership interest on the boat, and either owner has full authority to transfer ownership. Their names are separated by the conjunction “or” on the certificate of title. To transfer ownership interst in the boat, the signature of either co-owner is required.

SECTION A – APPLICANT INFORMATION

Provide your name, DNR customer number or driver’s license number, driver’s license state, mailing address, date of birth, citizenship information and social security number or business federal identification number (FEIN), phone number and email address. The applicant identified in this section will be considered the primary owner on record by the department. All information related to the boat and future correspondence from the department will be sent exclusively to the primary owner on record. It is the primary owner’s responsibility to share information with co-owners. If there are co-owners to be listed on the boat title, enter their information in section F.

SECTION B – BOAT INFORMATION

Enter all the information requested in this section in order to properly identify the boat (all fields are required).

•Wisconsin Registration Number. The registration number can be found on the registration certificate. Wisconsin registration numbers are formatted with WS, four numbers, and two letters (e.g.: WS 1234 AB).

•Hull Identification Number (Hull ID/HIN): The HIN (similar to a serial #) should be verified and taken from the boat. For boats with transoms, the HIN can usually be found on the starboard outboard side towards the top of transom, gunwale, or hull deck joint. HINs are required to meet US Coast Guard and State standards; boats built after 1972 to current must have one of the acceptable 12-digit HIN formats.

•Year. Enter the model year of the boat.

•Make & Model. The make/manufacturer and model name/number of the boat cannot be the same.

•Length: Exact length of the boat in feet and inches shall be entered, do not round measurements.

•Hull Material, Boat Type, Engine Type, Propulsion, Fuel Type, Boat Use. Select the type for the category listed, if it doesn’t apply leave blank.

•Inboard/Sterndrive Engines: (if applicable) - Boats that have an inboard or sterndrive (I/O) engine(s) may have the make and serial number recorded on the registration and title. This information is not recorded for other engine types.

•Out-of-state Information: (if applicable) - If you are registering/titling a boat that was previously registered in another state, enter the out-of-state boat registration number and the state of registration.

SECTION C – PREVIOUS OWNER/DEALER INFORMATION

Provide the complete name and address of the previous owner or dealer.

The department is authorized to transfer a titled boat from either the previous owner of record or a dealer. The certificate of title must be properly signed by the owner(s) of record and the assignment section of the title must be completed to the applicant to effect the transfer of title per s. 30.541(1) and (2), Wis. Stats.

If purchased from a Wisconsin dealer, the dealer must sign and date this section for the application to be used as a temporary operating receipt.

Pursuant to s. NR 5.001(3), Wis. Admin. Code, dealer means a person engaged wholly or in part in the business of selling or distributing boats to customers for profit or commission and who has made a substantial financial investment in the business.

SECTION D – PURCHASE & SALES TAX INFORMATION

Follow the instructions in the section to record purchase information and to calculate sales tax due.

•Purchase Price: Enter the purchase price, including accessories and motors. Do not include the trailer cost.

•Wisconsin County Primarily Kept: Enter the Wisconsin county where the boat will be primarily used or kept in.

•Trade-in Amount: Enter the dollar amount for any trade-in included with the purchase.

•Trade-in Description: Enter the description of the trade-in including any serial, Hull ID, or registration numbers.

Taxes: Taxes are calculated based on the purchase price, county, and trade-in amount. To calculate sales tax, enter all fields requested in the electronic form or follow calculation instructions in this section. A 5% state sales tax must be collected for all nonexempt private party or dealer sales, this includes sales to out of state customers who will be removing and registering the boat outside of Wisconsin. County sales and use taxes are applied based on the location of where the boat is primarily kept. County tax is not applied for sales to out of state customers who will be removing and registering the boat outside of Wisconsin.

|

Page 6 of 6 |

|

|

INSTRUCTIONS FOR FORM 9400-193 |

BOAT REGISTRATION AND TITLING APPLICATION |

Tax Exemptions. State law exempts certain types of transactions from the payment of state or local sales taxes, such as transactions between family members, taxes already paid to the dealership, or farming. If you qualify for a tax exemption, check the box indicating the exemption reason. You may be asked to provide proof of exemption. Additional information on specific tax exemptions can be found below.

•If the item was previously registered in Wisconsin and purchased OR received from parent, spouse, or child. Select the exemption and also check the box for the relationship within the section. A sibling or grandparent is not tax exempt.

•Retailer/lessor who will rent or sell the item, must include the FEIN (Federal Employer Identification Number).

•Tax paid to another state. Attach a copy of your bill of sale or verification of tax payment to another state. Note: Sales tax paid to another state on the item reported on this application may be claimed as a credit to reduce the Wisconsin tax due. If tax was paid in another state, subtract the state, county or similar tax from the Wisconsin state, county/stadium tax. Enter the remaining amount of Wisconsin tax payable.

•Other. Check the box if you are exempt and provide a description of the exemption reason in the space provided.

Questions on tax?

Contact the Department of Revenue at (608) 266-2776 or visit their website at www.revenue.wi.gov.

SECTIONS E AND F ARE USED FOR TITLED BOATS ONLY (IF APPLICABLE)

The State of Wisconsin titles motorized boats and sail boats 16 feet in length or more that are not documented with the U.S. Coast Guard.

SECTION E – LIEN INFORMATION

Liens are only listed on boats that will be issued a Wisconsin Certificate of Title. If you have a lien to be recorded, provide the lienholder’s name and mailing address to be recorded on the boat title.

SECTION F – CO-OWNER(S) INFORMATION

Co-owners are only listed on boats that will be issued a Wisconsin Certificate of Title. If you wish to add an owner, provide the name, DNR customer number or driver’s license number, driver’s license state, mailing address, date of birth, social security number or business FEIN (if applicable), phone number and email address for each co-owner. Attach additional pages if needed. Check the box indicating the type ownership (and/or) for each co-owner. See definitions of tenants in common (and) and joint tenants (or) to help you make your selection.

SECTION G – U. S. COAST GUARD DOCUMENTED BOATS

Check the box if you intend to document the boat with the U.S. Coast Guard. If so, provide the document number, boat name, and hailing port in the fields provided. Documented boats are registered and documented with the U.S. Coast Guard in conjunction with the state registration. U.S. Coast Guard documented boats are not titled in the State of Wisconsin but are required to be registered.

SECTION H – REGISTRATION FEE CALCULATION

Use the fee table on page 3 and follow the instructions in section H of this application to calculate your registration fees.

SECTION I – REQUIRED DOCUMENTATION

Evidence of transfer of ownership must be submitted with this form for all boats that will be issued a Wisconsin Certificate of Title or that will be documented with the U.S. Coast Guard. Indicate the documentation that you are providing to the department for consideration to substantiate your application for transfer of ownership.

SECTION J – SIGNATURE AND CERTIFICATION

Sign and date the form.

SUBMISSION OF FORM

Make check or money order payable to WDNR for the total amount due. Mail this application, fees and supporting documents (if applicable) to:

DNR PROCESSING CENTER

PO BOX 78701

MILWAUKEE WI 53278-0701

PROCESSING INFORMATION

INITIAL PROCESSING. Once the department receives your application, the department will review it for completeness. If the form is not complete and/or required documents are not submitted, the department may reject your application.

REQUEST FOR MORE INFORMATION. The department may request that you provide more information or evidence to support your application.

DECISION. The department will review your application for boat registration and titling and may approve, deny or request more information. The certificate of title will be mailed to the address of the primary owner on record.

DOCUMENTS AND MATERIALS. The department may issue one or all of the following documents. These documents and materials will be sent to the address provided in the application:

Certificate of registration. The certificate of registration contains the registration number issued by the department under the federally approved numbering system. It is a small wallet-sized card and must be carried by the person operating the boat and available for inspection.

Two expiration decals. The registration expiration decals are color coded to match the expiration year of the registration. The decals must be attached to the boat next to the assigned registration number.

Wisconsin Certificate of Title.The certificate of title is a legal document that establishes ownership on titled boats. It is a full 8 ½ X 11-inch sized sheet of paper. The certificate of title is required to transfer ownership of a titled boat.

AUTHORITIES

The information and registration and titling information and fees are collected by the department under ss. 30.52, 30.533 and 30. 537, Wis. Stats.