This PDF editor was built with the aim of making it as simple and easy-to-use as it can be. All of these steps will make filling in the form 9465 printable form easy and quick.

Step 1: Click the orange button "Get Form Here" on the following web page.

Step 2: At the moment, you can begin modifying the form 9465 printable form. The multifunctional toolbar is at your disposal - insert, eliminate, transform, highlight, and perform other commands with the content in the form.

Fill out the form 9465 printable form PDF by typing in the information required for each individual part.

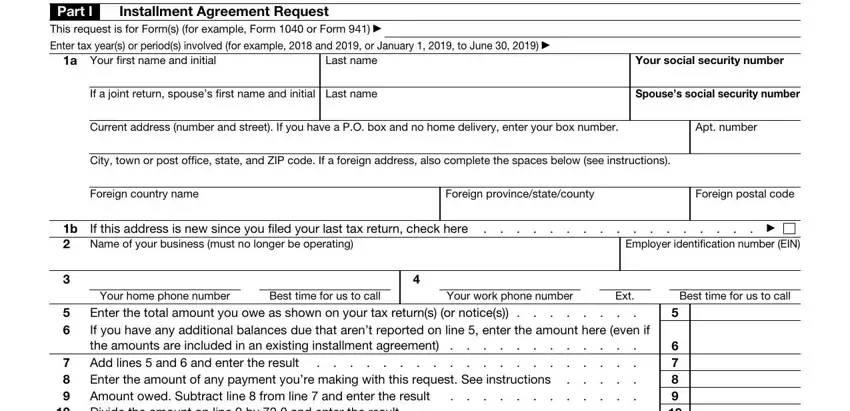

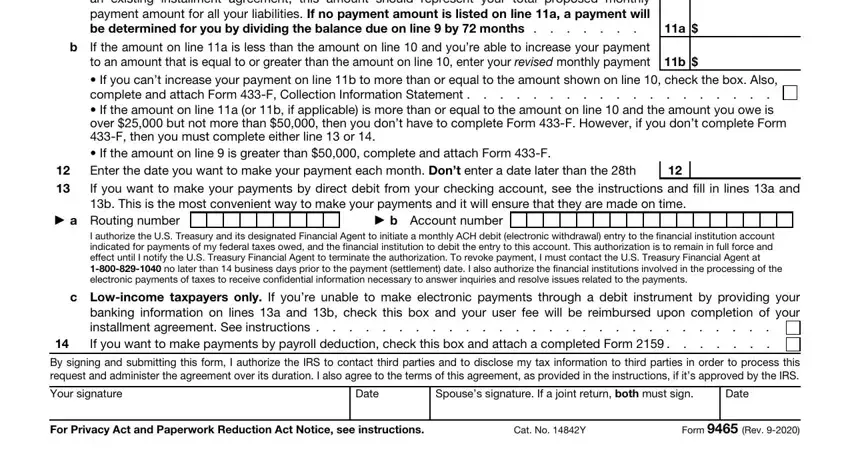

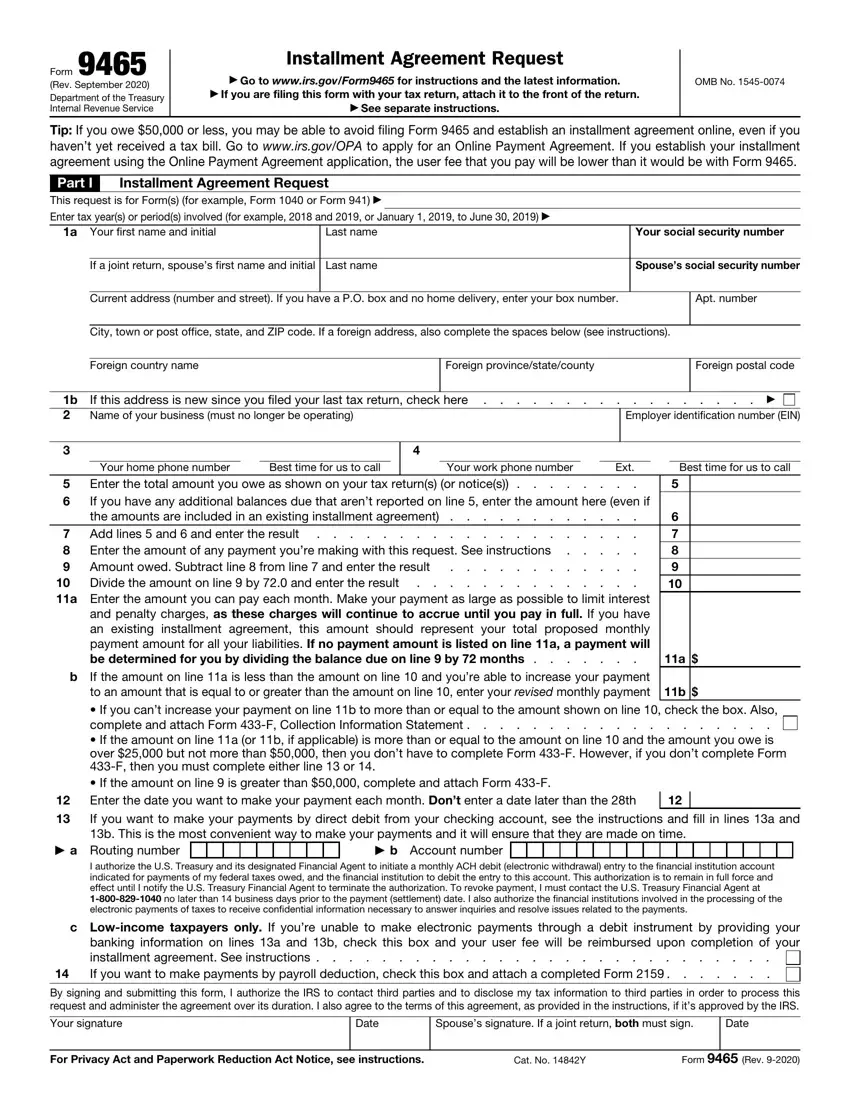

Provide the expected particulars in the Enter the total amount you owe as, a Routing number, b Account number, I authorize the US Treasury and, Lowincome taxpayers only If youre, By signing and submitting this, Your signature, Date, Spouses signature If a joint, Date, For Privacy Act and Paperwork, Cat No Y, and Form Rev part.

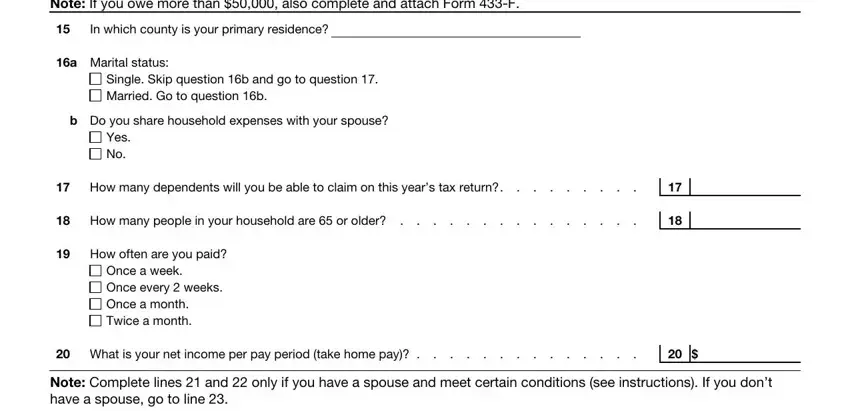

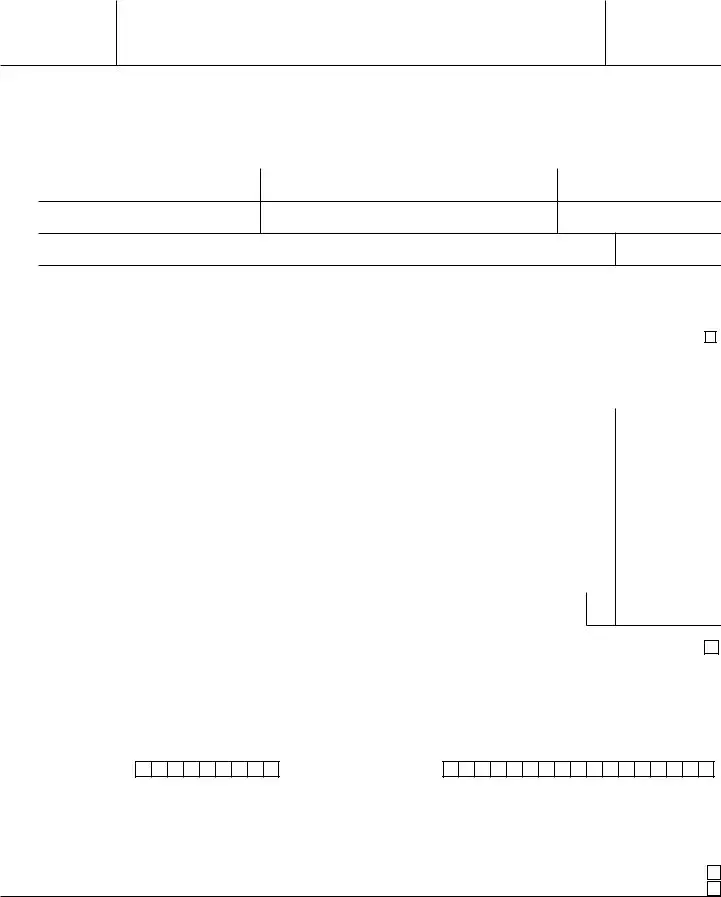

Inside the section referring to Note If you owe more than also, In which county is your primary, a Marital status, Single Skip question b and go to, b Do you share household expenses, Yes No, How many dependents will you be, How many people in your household, How often are you paid, Once a week Once every weeks Once, What is your net income per pay, and Note Complete lines and only if, make sure you put in writing some expected information.

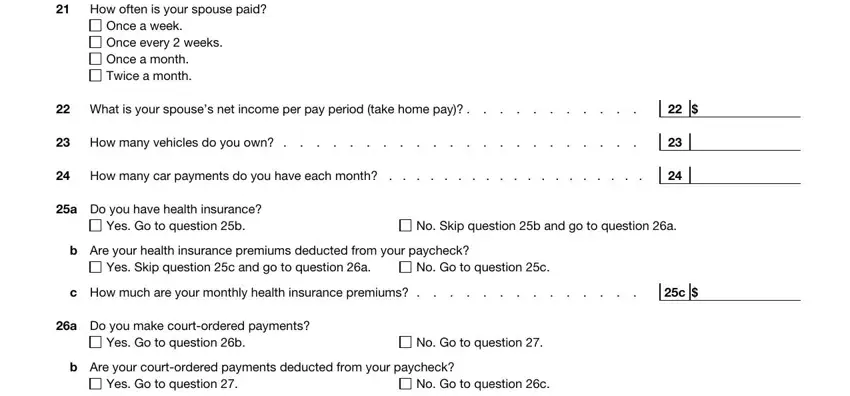

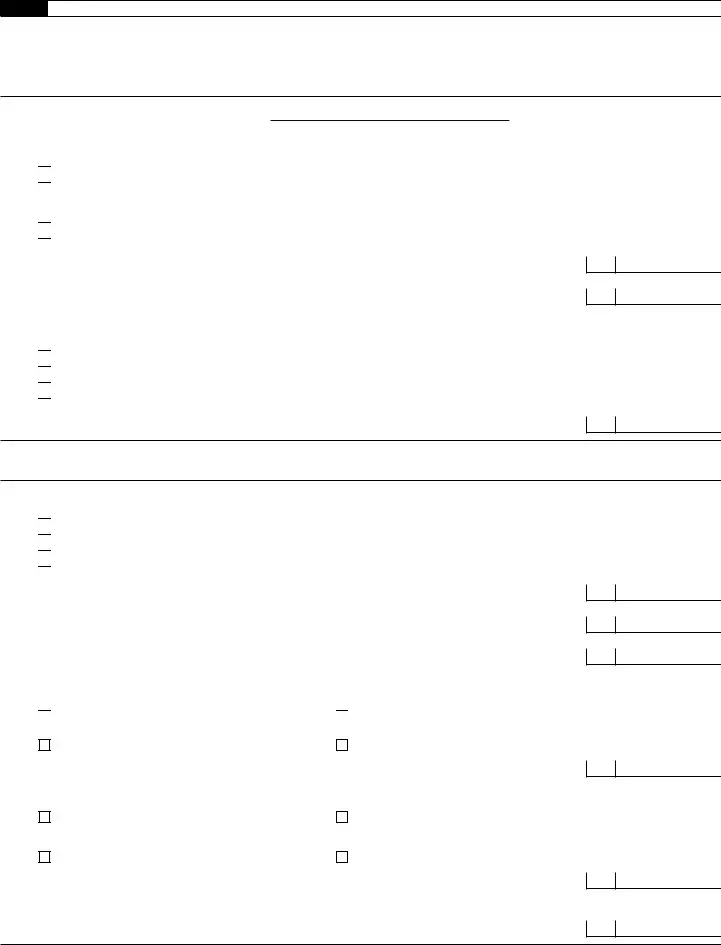

Identify the rights and responsibilities of the parties in the part How often is your spouse paid, Once a week Once every weeks Once, What is your spouses net income, How many vehicles do you own, How many car payments do you have, a Do you have health insurance, Yes Go to question b, No Skip question b and go to, b Are your health insurance, Yes Skip question c and go to, No Go to question c, c How much are your monthly health, a Do you make courtordered payments, Yes Go to question b, and No Go to question.

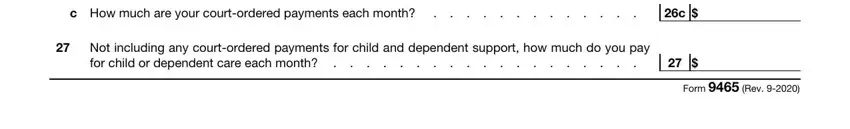

Look at the sections c How much are your courtordered, Not including any courtordered, for child or dependent care each, and Form Rev and thereafter fill them in.

Step 3: At the time you pick the Done button, the finished document is readily transferable to any kind of of your devices. Alternatively, you can deliver it through mail.

Step 4: You could make duplicates of the file toremain away from all potential worries. You should not worry, we don't distribute or monitor your details.

Single. Skip question 16b and go to question 17.

Single. Skip question 16b and go to question 17.

Married. Go to question 16b.

Married. Go to question 16b. Yes.

Yes. No.

No. Once a week.

Once a week. Once every 2 weeks.

Once every 2 weeks. Once a month.

Once a month. Twice a month.

Twice a month. Once a week.

Once a week. Once every 2 weeks.

Once every 2 weeks. Once a month.

Once a month. Twice a month.

Twice a month. Yes. Go to question 25b.

Yes. Go to question 25b.

No. Skip question 25b and go to question 26a.

No. Skip question 25b and go to question 26a.