Any time you need to fill out 941 massachusetts tax, you won't have to download any programs - simply try using our PDF tool. To retain our tool on the forefront of convenience, we aim to implement user-driven capabilities and improvements regularly. We are routinely thankful for any suggestions - help us with reshaping PDF editing. Starting is simple! Everything you need to do is follow the following easy steps directly below:

Step 1: Click the orange "Get Form" button above. It'll open up our pdf tool so that you could start filling in your form.

Step 2: This tool offers the ability to modify PDF files in a range of ways. Change it by writing any text, correct what's originally in the document, and add a signature - all at your disposal!

It's straightforward to finish the document following our helpful tutorial! Here is what you want to do:

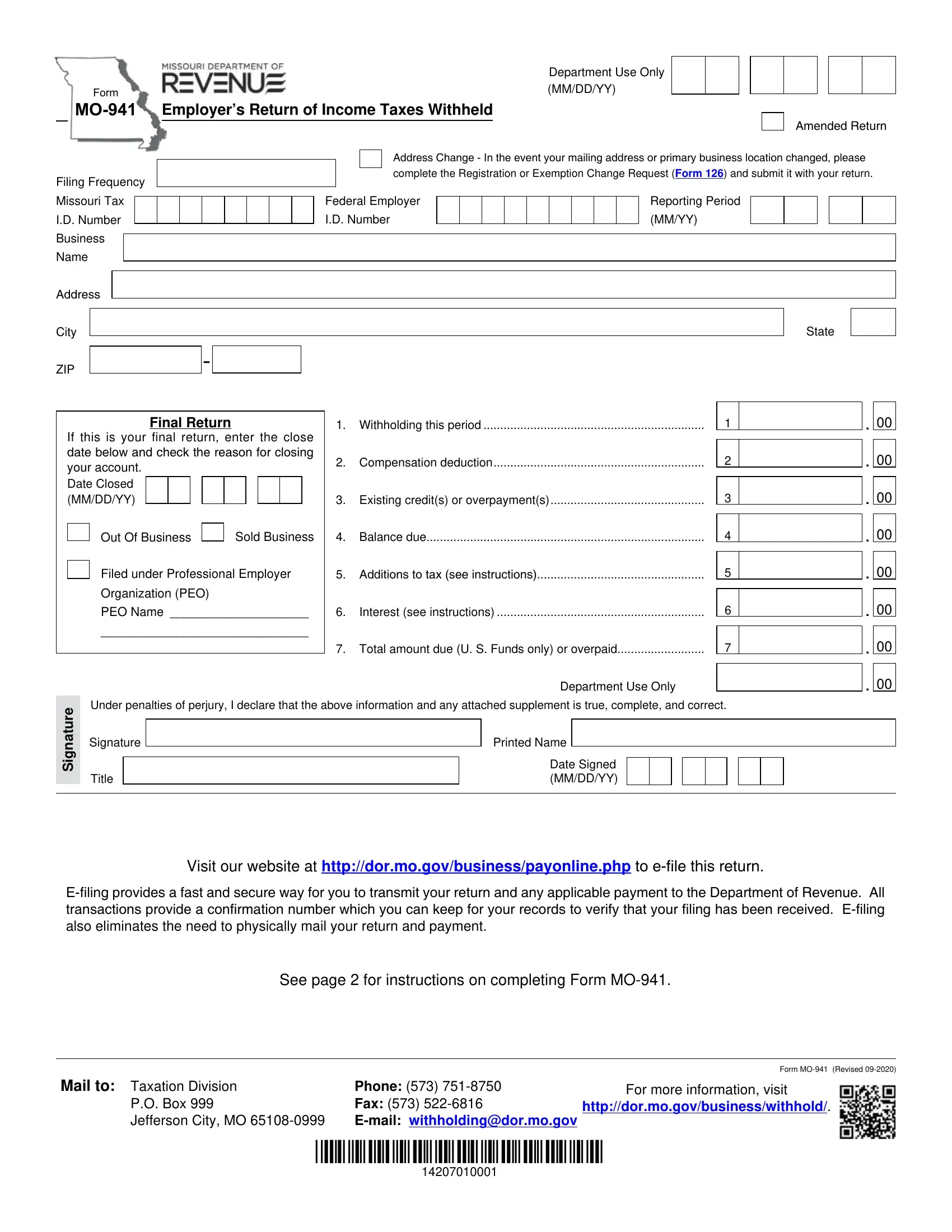

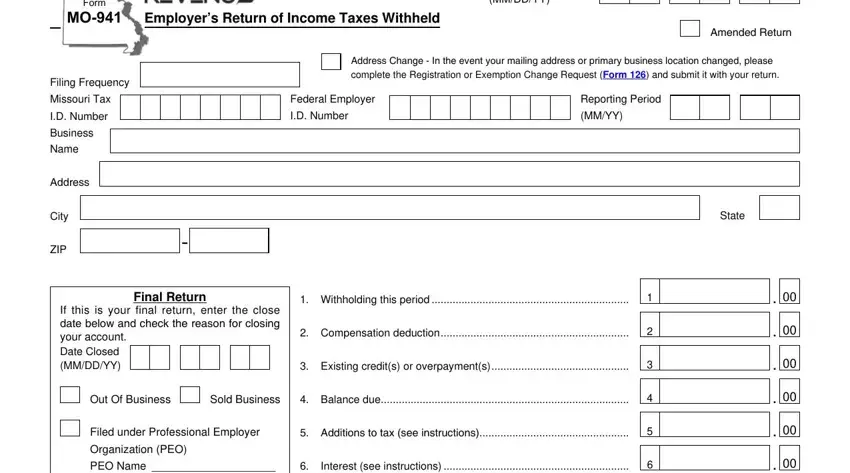

1. It's essential to complete the 941 massachusetts tax properly, thus be attentive when working with the sections that contain these blanks:

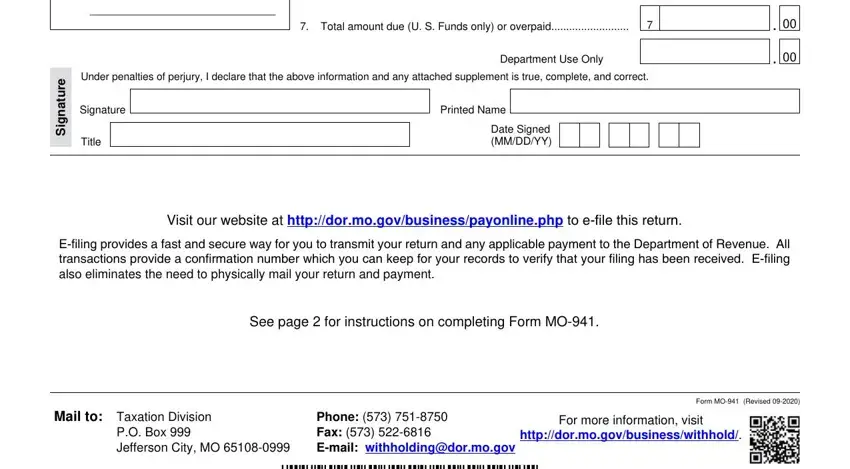

2. The next part is usually to submit these particular blank fields: Total amount due U S Funds only, Department Use Only, e Under penalties of perjury I, Printed Name, Signature, Title, Date Signed MMDDYY, Visit our website at, Efiling provides a fast and secure, See page for instructions on, Mail to Taxation Division, PO Box Jefferson City MO , Phone Fax Email, For more information visit, and Form MO Revised .

You can certainly make an error while filling in your Date Signed MMDDYY, consequently make sure to go through it again before you decide to send it in.

Step 3: Soon after double-checking your fields and details, press "Done" and you're done and dusted! Go for a 7-day free trial option at FormsPal and gain immediate access to 941 massachusetts tax - download, email, or edit in your FormsPal account. FormsPal is focused on the privacy of our users; we make sure all personal information handled by our tool is kept confidential.