az prequalification form can be filled out online easily. Simply use FormsPal PDF editor to perform the job fast. In order to make our tool better and more convenient to utilize, we constantly work on new features, taking into consideration suggestions from our users. With just a couple of easy steps, you are able to start your PDF journey:

Step 1: Press the orange "Get Form" button above. It's going to open up our tool so that you can start completing your form.

Step 2: With our advanced PDF editor, you're able to accomplish more than merely fill out blank fields. Edit away and make your forms look professional with customized textual content incorporated, or optimize the original input to perfection - all accompanied by the capability to insert any photos and sign the PDF off.

It is simple to finish the document with this helpful guide! Here is what you should do:

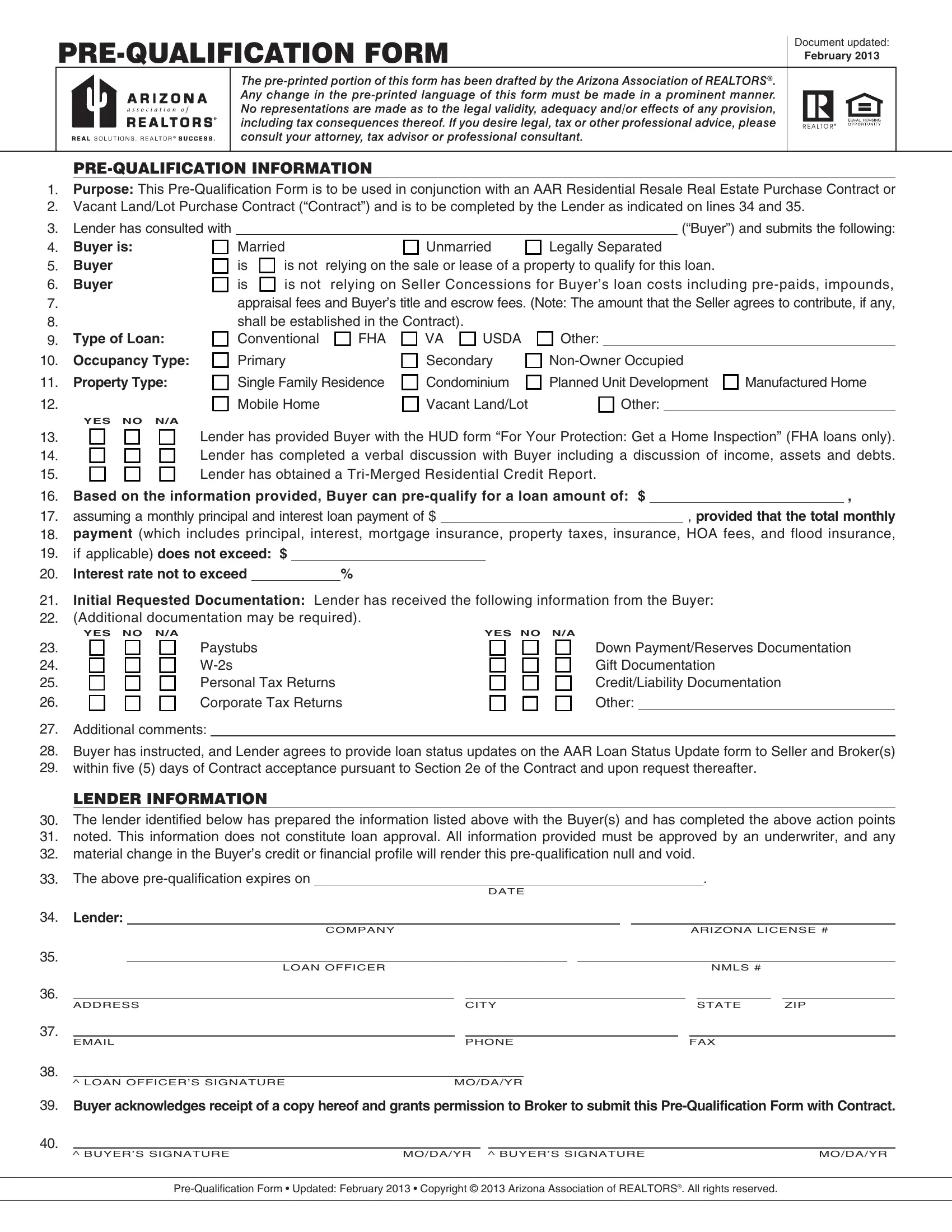

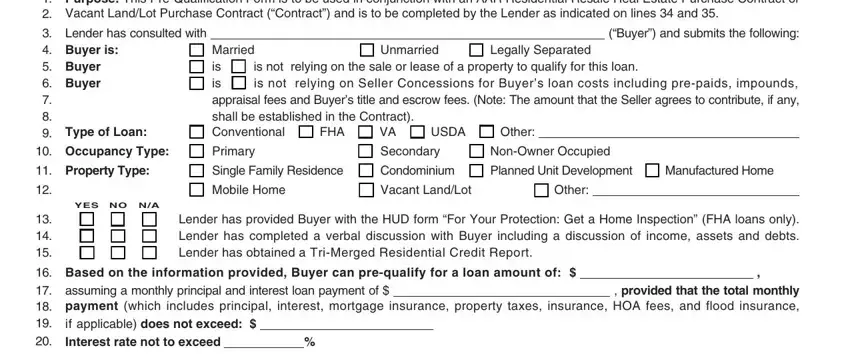

1. The az prequalification form usually requires certain details to be typed in. Make sure the following fields are complete:

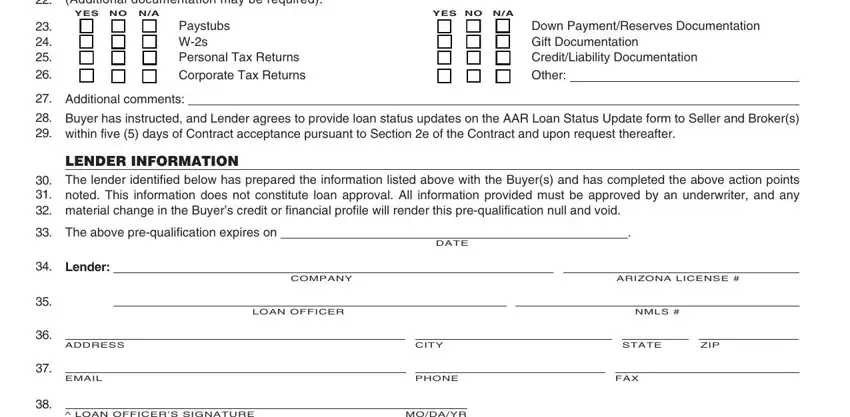

2. Just after filling out the previous step, head on to the subsequent part and fill out all required particulars in all these blank fields - Initial Requested Documentation, YES NO NA n n n Paystubs n n n Ws, YES NO NA n n n Down, Additional comments, Buyer has instructed and Lender, The above prequalification expires, DATE, Lender, COMPANY ARIZONA LICENSE , LOAN OFFICER NMLS , ADDRESS CITY, STATE ZIP, EMAIL, PHONE, and FAX.

3. The following part is considered quite uncomplicated, Buyer acknowledges receipt of a, BUYERS SIGNATURE, MODAYR BUYERS SIGNATURE, MODAYR, and PreQualification Form Updated - these empty fields must be completed here.

It's easy to get it wrong while filling out your PreQualification Form Updated, hence ensure that you look again prior to when you send it in.

Step 3: Confirm that the information is correct and then just click "Done" to continue further. Grab your az prequalification form when you register online for a 7-day free trial. Conveniently use the pdf file within your FormsPal cabinet, together with any modifications and changes being all kept! When using FormsPal, you can complete documents without having to worry about personal data incidents or records getting shared. Our secure platform helps to ensure that your personal details are kept safe.