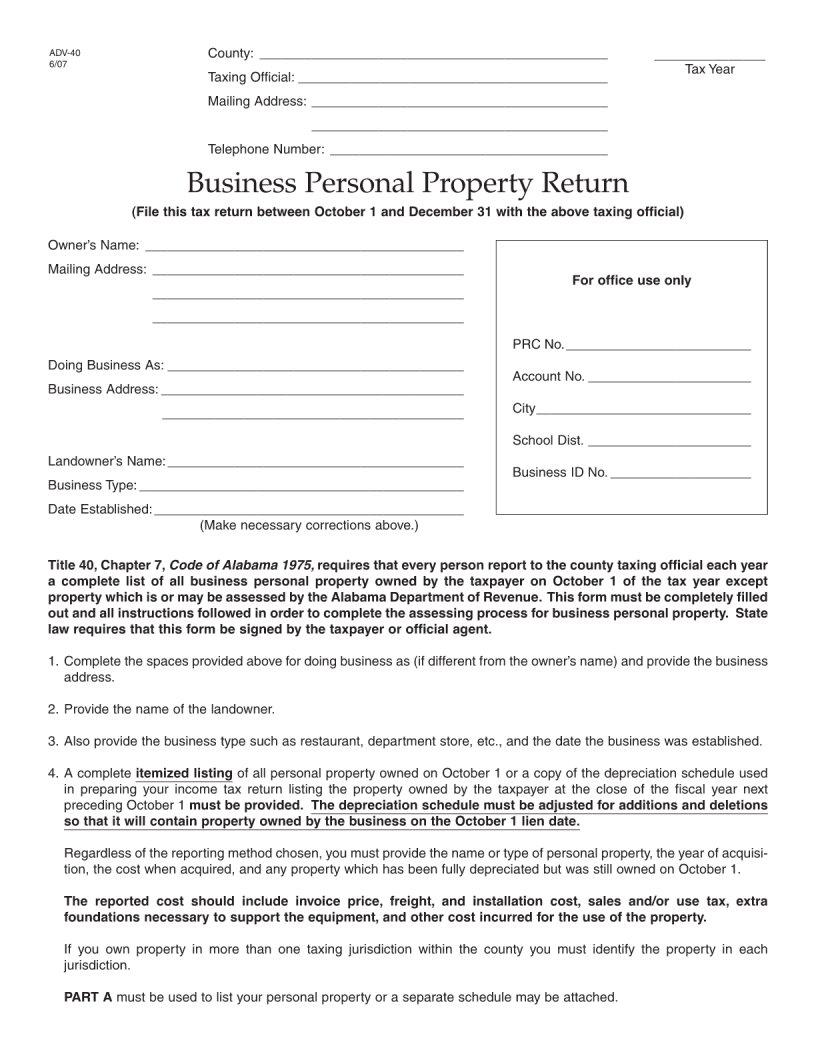

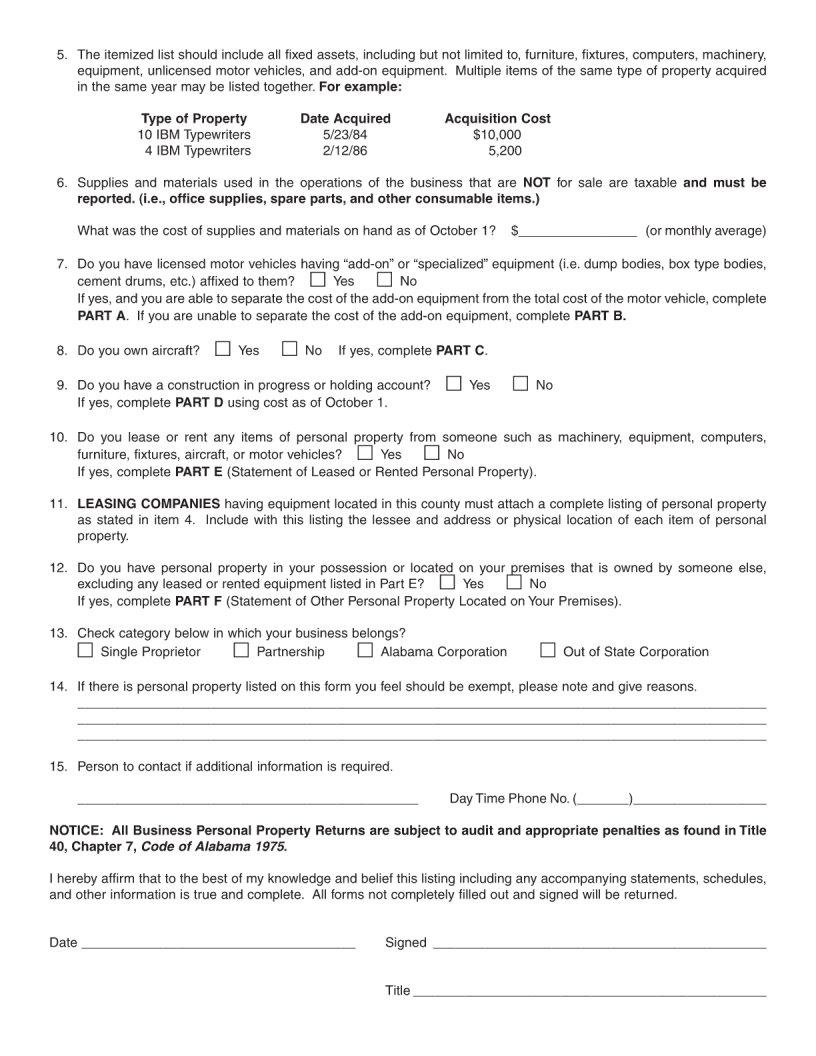

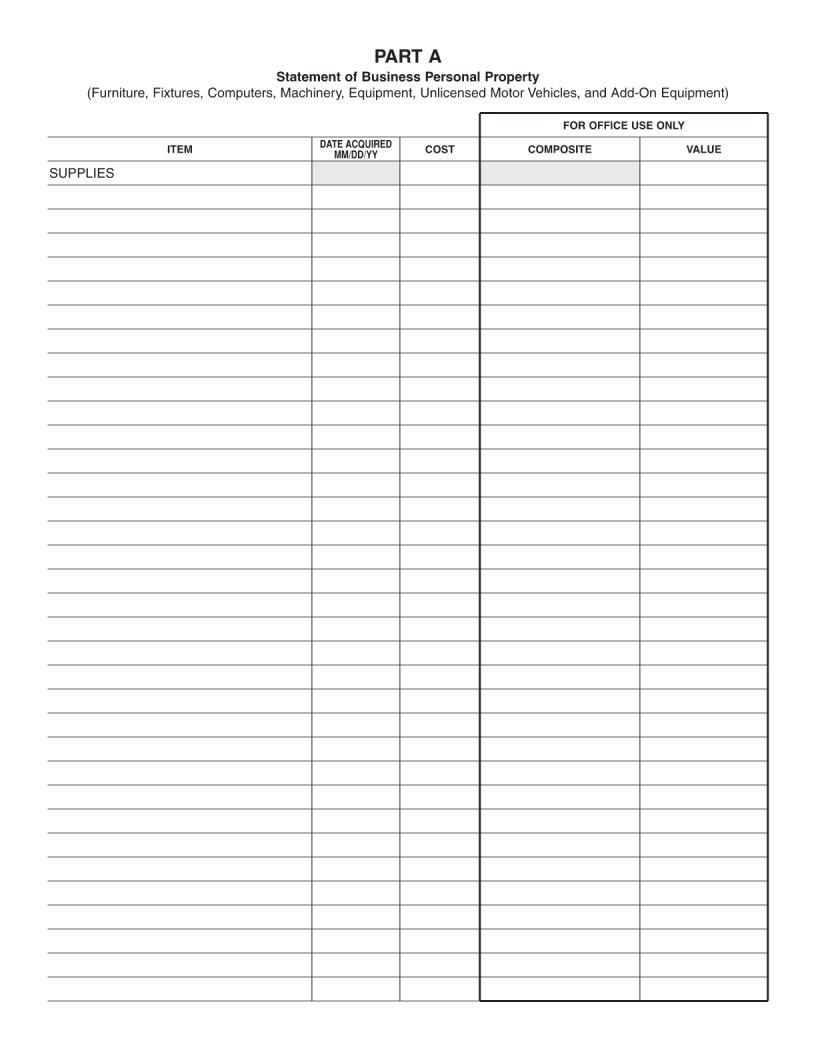

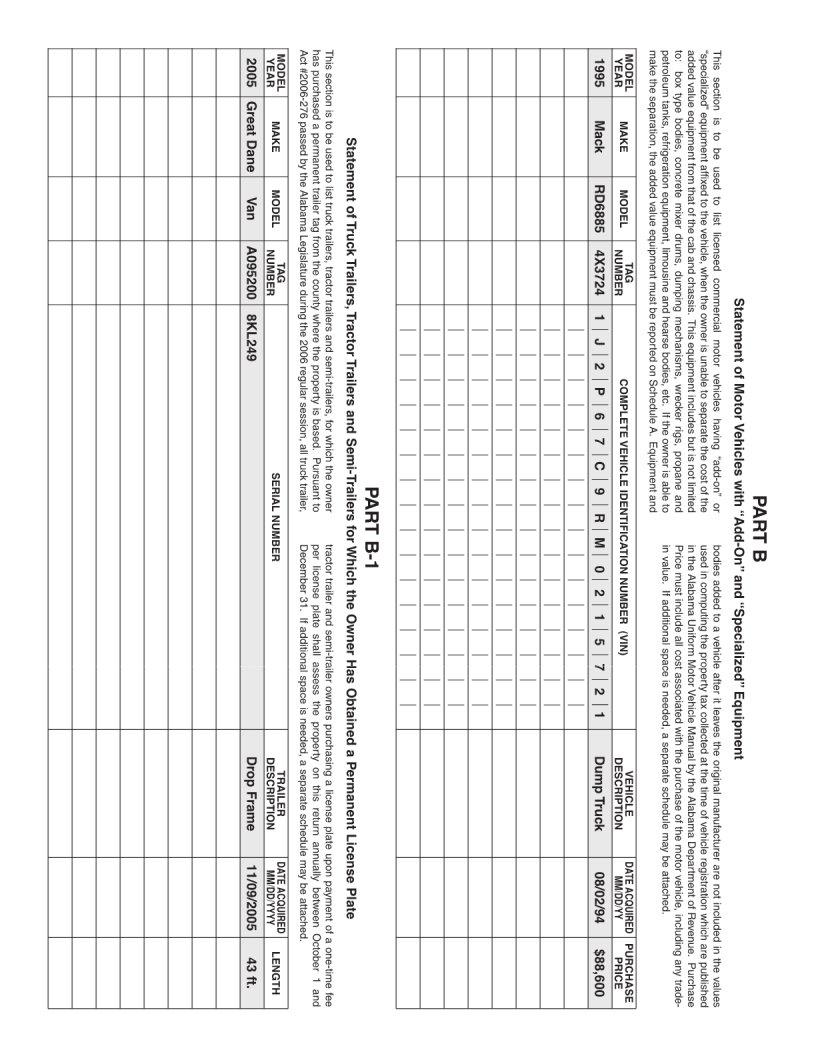

In the intricate world of financial regulations, transparency and disclosure hold paramount importance. Among the myriad forms and documents that facilitate such openness, the ADV Part 2, often known as the ADV 40 form, stands out as a critical tool designed to provide clients and prospective clients with key information about financial advisors and firms. This document, essentially a narrative brochure, is meticulously crafted to shed light on the business practices, conflicts of interest, disciplinary information, and background of financial advisory firms and their advisers. Its significance is underscored by its requirement from the Securities and Exchange Commission (SEC) and state regulators, aiming to ensure that investors can make informed decisions. The contents of the ADV 40 form range from the types of services offered, fee structures, investment strategies, and risk assessment, to more nuanced information about the advisor's educational background and business affiliations. These disclosures are not only fundamental to fostering a trust-based relationship between advisors and clients but also serve as a cornerstone for ethical standards in the financial advisory sector. Through this lens, the ADV 40 form embodies a crucial blend of regulatory compliance and consumer protection measures, emblematic of the broader efforts to enhance transparency within the financial industry.

| Question | Answer |

|---|---|

| Form Name | Adv 40 Form |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names |