al 20c can be filled in online with ease. Simply make use of FormsPal PDF editor to finish the job without delay. The editor is continually improved by us, acquiring handy functions and becoming more versatile. Should you be seeking to get started, this is what it takes:

Step 1: Hit the "Get Form" button above. It is going to open our pdf editor so that you can start filling in your form.

Step 2: This tool grants the capability to customize the majority of PDF files in a range of ways. Enhance it by including customized text, adjust what is already in the file, and include a signature - all when it's needed!

Be mindful while filling in this document. Ensure every single blank is done properly.

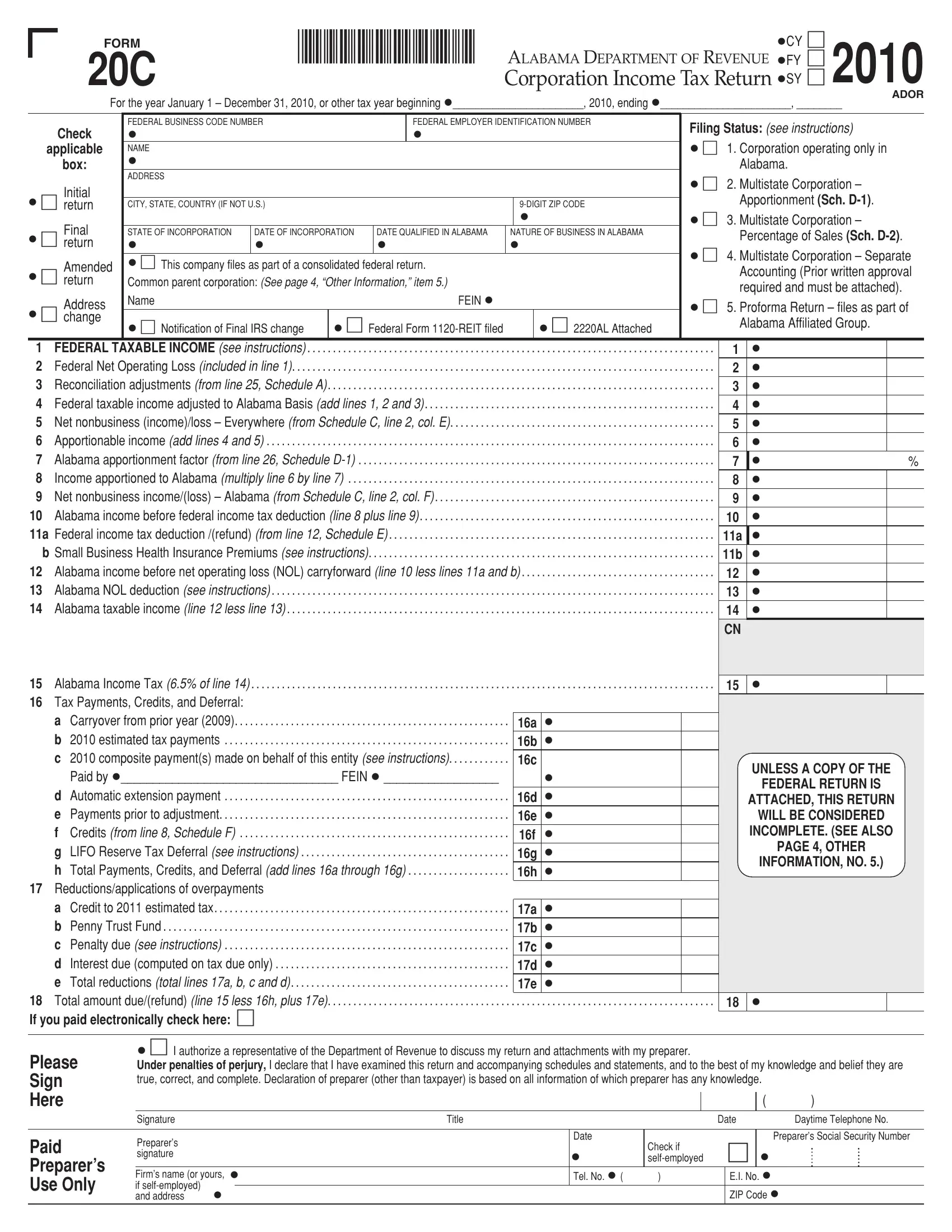

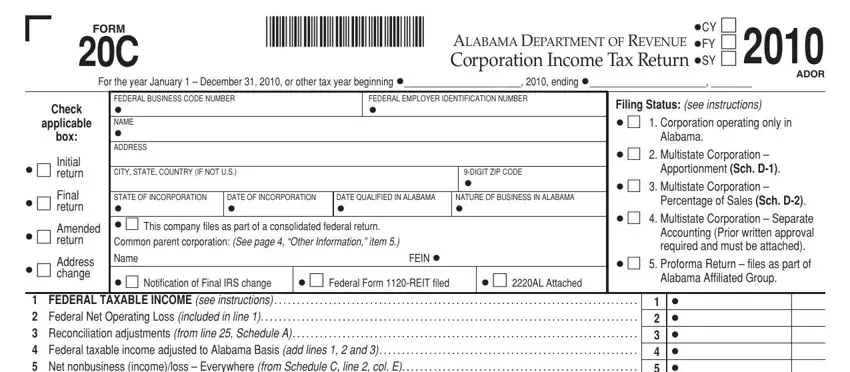

1. The al 20c needs specific information to be typed in. Make sure the subsequent fields are complete:

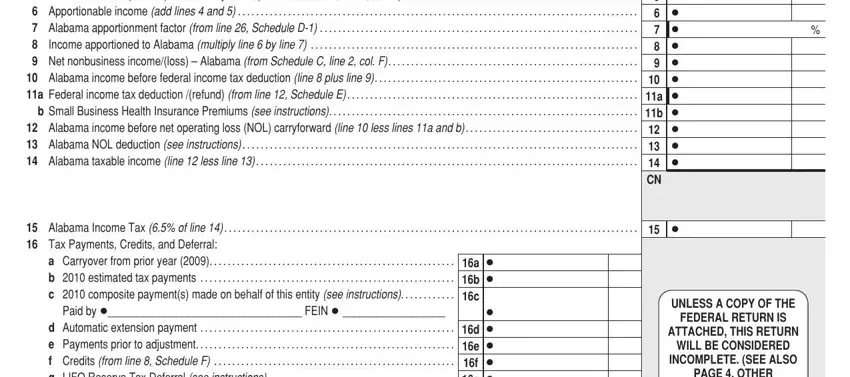

2. Immediately after this part is completed, go on to enter the relevant information in all these: FEDERAL TAXABLE INCOME see, a b CN, Alabama Income Tax of line , a Carryover from prior year , Paid by FEIN , d Automatic extension payment , a b c, d e f g h, UNLESS A COPY OF THE, FEDERAL RETURN IS, ATTACHED THIS RETURN, WILL BE CONSIDERED, INCOMPLETE SEE ALSO, and PAGE OTHER.

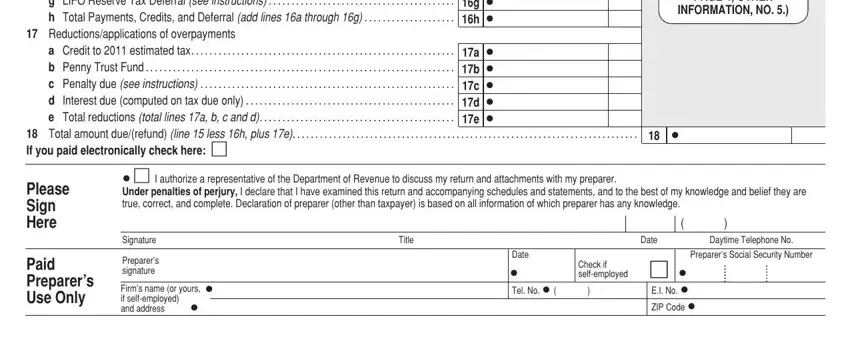

3. This next step is generally hassle-free - fill in every one of the empty fields in d Automatic extension payment , Reductionsapplications of, a Credit to estimated tax , d e f g h, a b c d e, PAGE OTHER, INFORMATION NO , Total amount duerefund line less, Please Sign Here, Paid Preparers Use Only, I authorize a representative of, Signature, Preparers signature, Firms name or yours if, and Title to finish the current step.

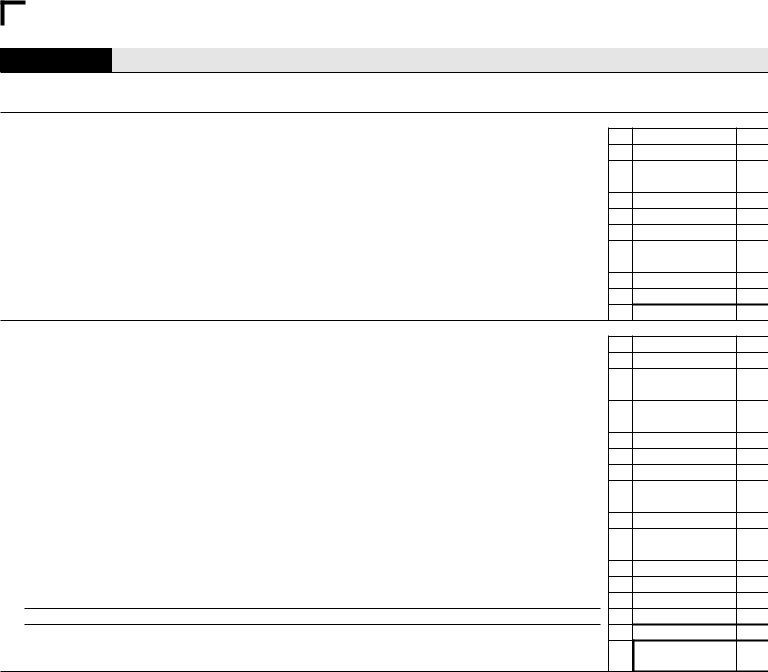

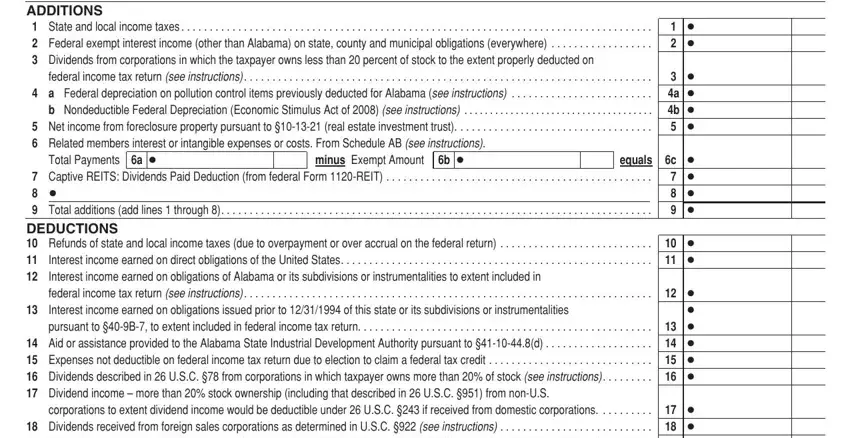

4. The next section requires your attention in the subsequent areas: ADDITIONS State and local income, federal income tax return see, Total Payments a , minus Exempt Amount b , equals Captive REITS Dividends, federal income tax return see, Interest income earned on, pursuant to B to extent included, corporations to extent dividend, a b , and c . Be sure that you fill out all of the needed information to go forward.

When it comes to Interest income earned on and a b , make certain you get them right in this section. These could be the key fields in this file.

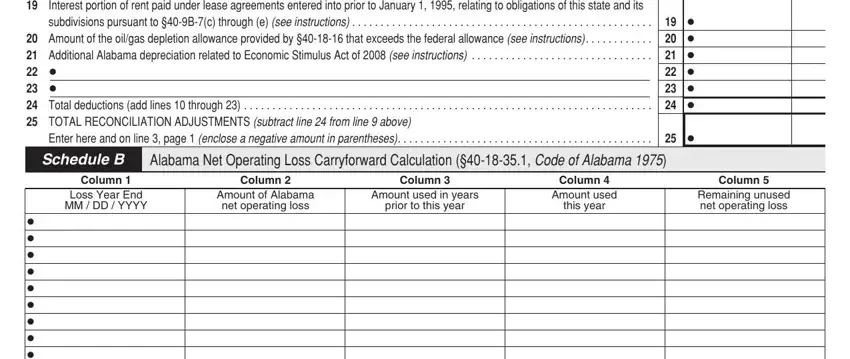

5. Since you approach the conclusion of the form, there are a couple extra requirements that should be fulfilled. Mainly, corporations to extent dividend, Enter here and on line page , Schedule B, Alabama Net Operating Loss, Column , Loss Year End MM DD YYYY, Column , Column , Amount of Alabama net operating, Amount used in years, prior to this year, Column , Amount used, this year, and Column must all be done.

Step 3: Before submitting the file, make certain that all blank fields are filled in the proper way. Once you believe it is all good, click “Done." Get the al 20c the instant you register online for a 7-day free trial. Quickly get access to the pdf within your FormsPal account, with any modifications and adjustments all kept! Whenever you work with FormsPal, you'll be able to fill out documents without having to get worried about personal information incidents or records being shared. Our protected system helps to ensure that your private data is kept safe.