XX12830240X can be completed online in no time. Simply use FormsPal PDF tool to get the job done in a timely fashion. Our tool is continually evolving to present the very best user experience attainable, and that is thanks to our resolve for constant development and listening closely to comments from customers. In case you are looking to get going, this is what it's going to take:

Step 1: Open the PDF form in our tool by pressing the "Get Form Button" above on this page.

Step 2: Once you start the PDF editor, you'll see the form made ready to be filled out. Other than filling in various blank fields, you may as well perform other things with the PDF, namely adding your own words, editing the initial textual content, adding illustrations or photos, signing the form, and much more.

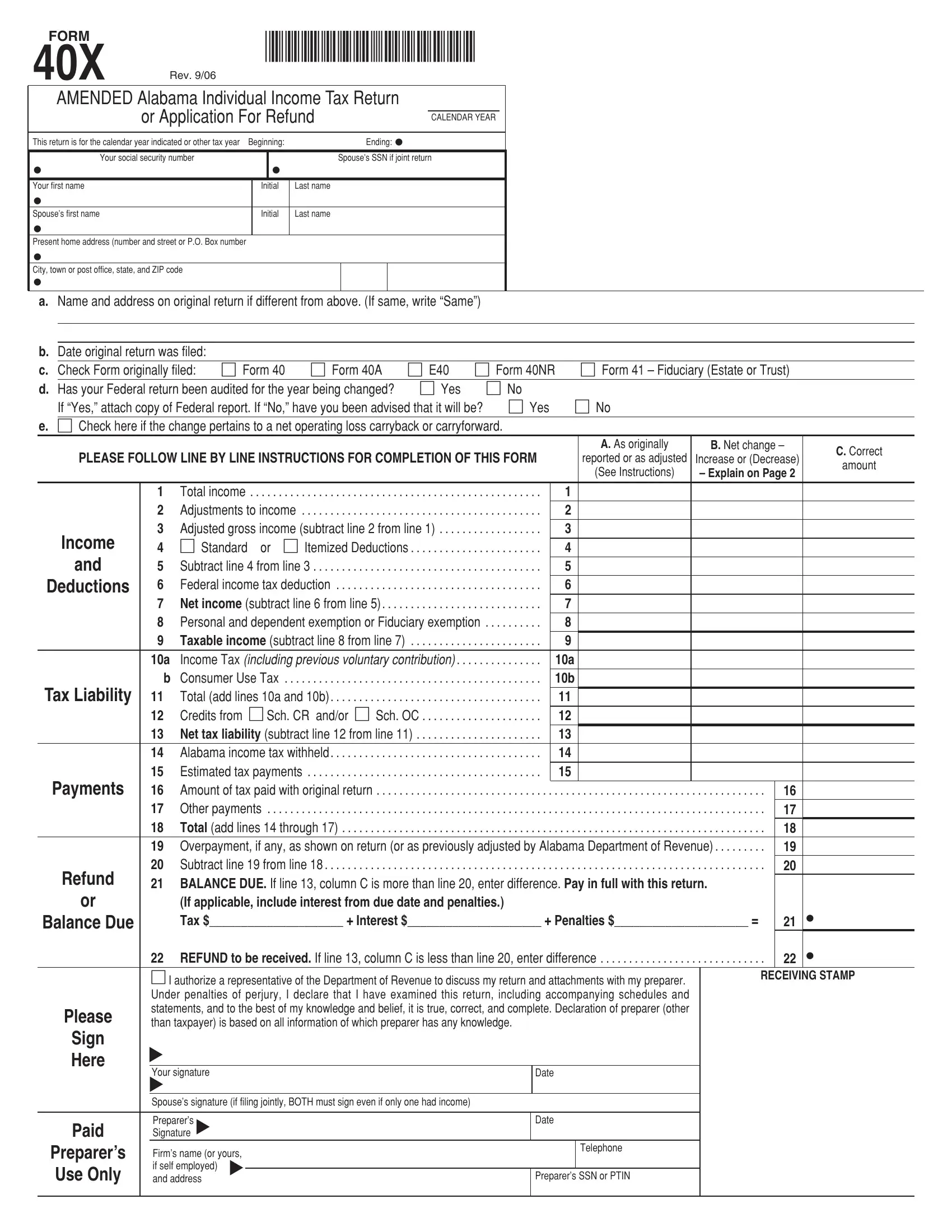

This PDF will need particular info to be entered, so you should take your time to type in what's asked:

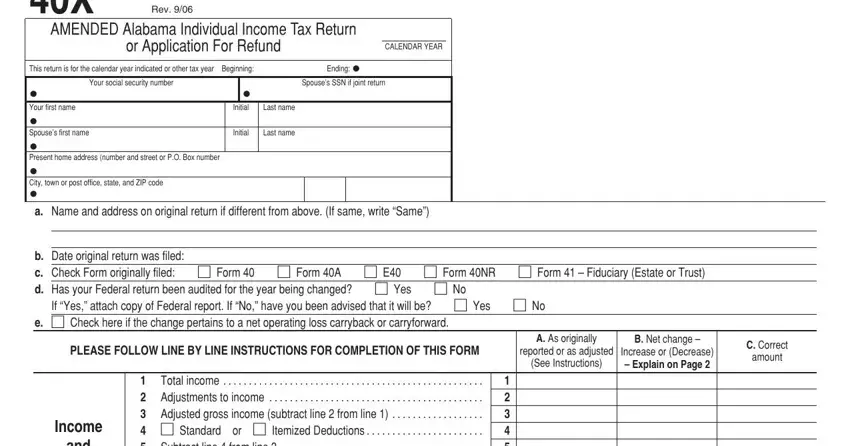

1. The XX12830240X necessitates particular information to be typed in. Ensure that the following blanks are complete:

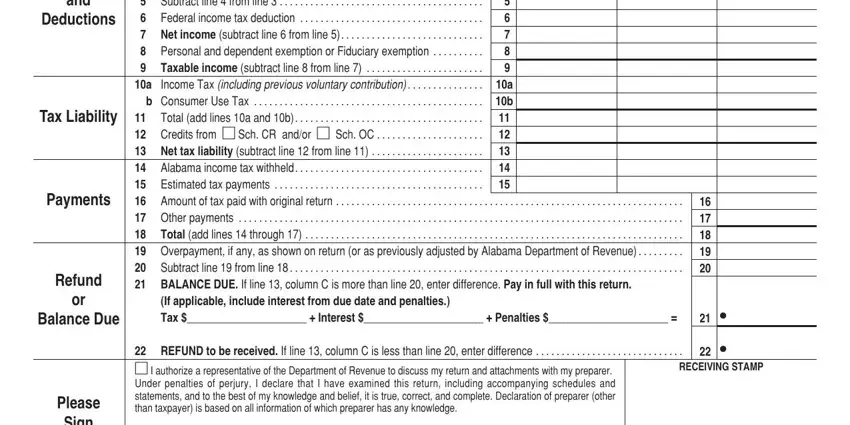

2. After this segment is complete, you need to insert the needed details in Total income , a b , If applicable include interest, REFUND to be received If line , RECEIVING STAMP, and, Deductions, Tax Liability, Payments, Refund, Balance Due, Please Sign Here, and Your signature Spouses signature so that you can move on further.

When it comes to and and a b , be certain you double-check them here. These two are the most significant ones in this page.

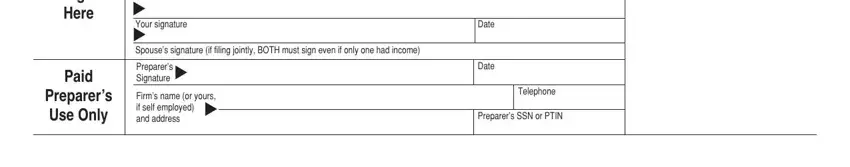

3. Your next part is going to be easy - complete every one of the form fields in Please Sign Here, Your signature Spouses signature, Paid, Preparers Use Only, Preparers Signature, Firms name or yours if self, Date, Date, Telephone, and Preparers SSN or PTIN in order to complete the current step.

4. To go onward, this step requires typing in several empty form fields. Included in these are Enter the line reference from page, which you'll find crucial to moving forward with this particular PDF.

Step 3: Once you've looked over the details in the blanks, just click "Done" to finalize your document generation. Sign up with us right now and immediately get XX12830240X, available for downloading. Each modification made is handily kept , letting you customize the pdf at a later time when required. We don't share or sell any information you use while completing forms at our website.