You'll be able to fill out Alabama Form Cpt effectively in our PDFinity® online tool. FormsPal expert team is ceaselessly working to expand the tool and insure that it is much better for clients with its cutting-edge features. Bring your experience to the next level with continually improving and amazing possibilities we offer! Getting underway is simple! All you should do is adhere to these simple steps below:

Step 1: Open the PDF in our editor by clicking on the "Get Form Button" at the top of this page.

Step 2: Using this advanced PDF editing tool, it is possible to do more than just fill out forms. Try each of the functions and make your documents look professional with customized text incorporated, or fine-tune the original content to excellence - all backed up by the capability to add almost any graphics and sign the PDF off.

It really is easy to complete the pdf using this practical tutorial! Here is what you want to do:

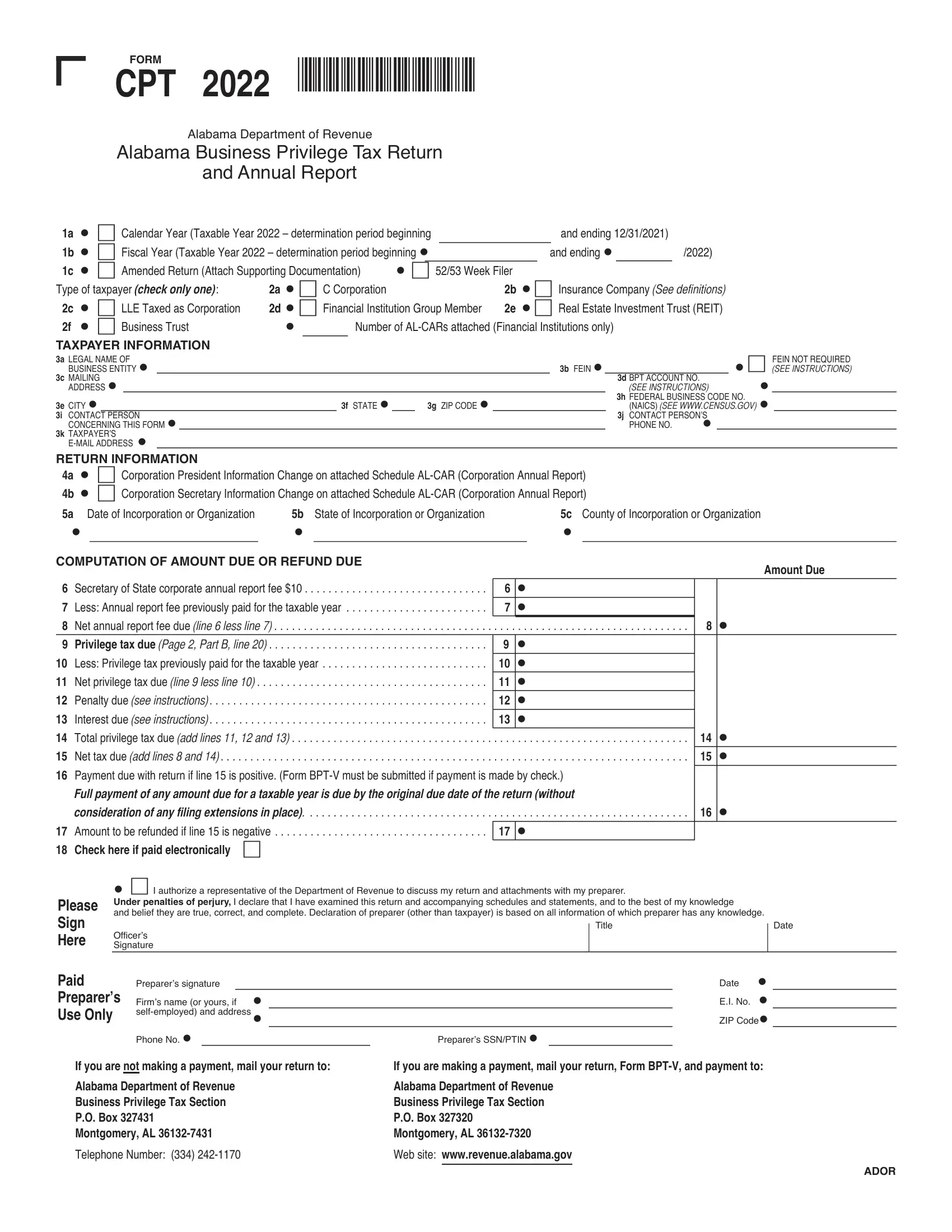

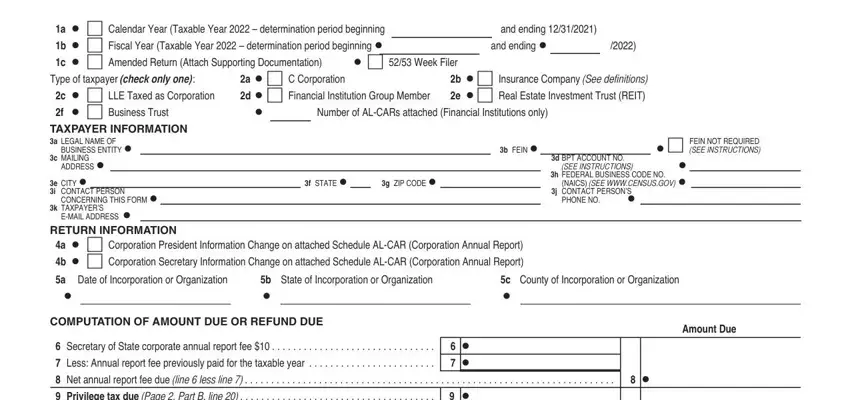

1. It is recommended to complete the Alabama Form Cpt accurately, hence be careful when working with the segments that contain these blanks:

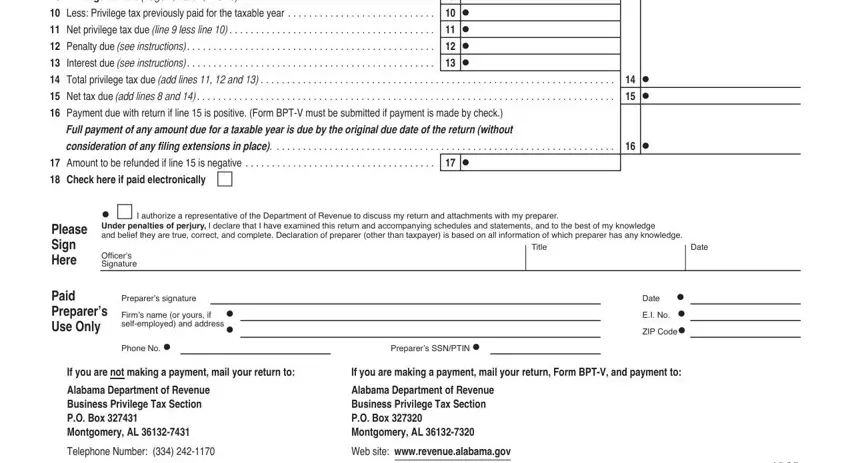

2. Right after finishing this section, go to the subsequent stage and enter the essential details in these blank fields - Privilege tax due Page Part B, Less Privilege tax previously, Net privilege tax due line less, Penalty due see instructions , Interest due see instructions , Total privilege tax due add lines, Net tax due add lines and , Payment due with return if line , Full payment of any amount due for, consideration of any filing, Amount to be refunded if line is, I authorize a representative of, Under penalties of perjury I, Officers Signature, and Title.

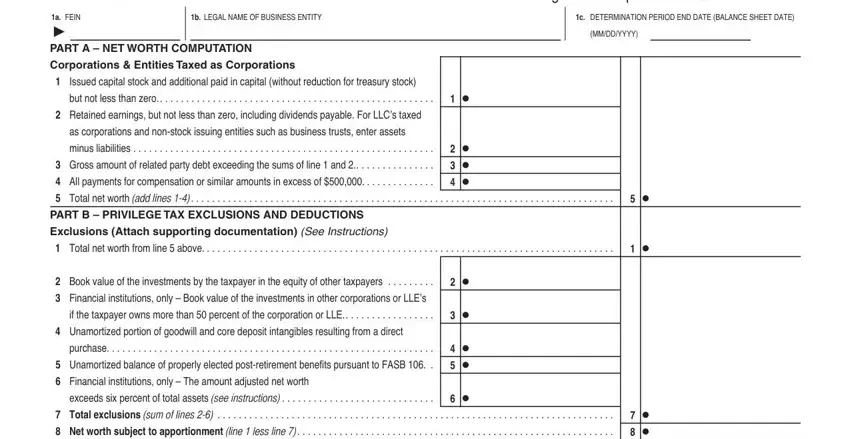

3. In this specific stage, take a look at PAGE , Privilege Tax Computation Schedule, a FEIN V PART A NET WORTH, b LEGAL NAME OF BUSINESS ENTITY, Corporations Entities Taxed as, Issued capital stock and, but not less than zero , Retained earnings but not less, as corporations and nonstock, minus liabilities , Gross amount of related party, All payments for compensation or, c DETERMINATION PERIOD END DATE, MMDDYYYY, and Total net worth add lines . Every one of these will need to be filled out with greatest awareness of detail.

When it comes to PAGE and Corporations Entities Taxed as, be sure that you double-check them in this current part. Those two are considered the most significant ones in this page.

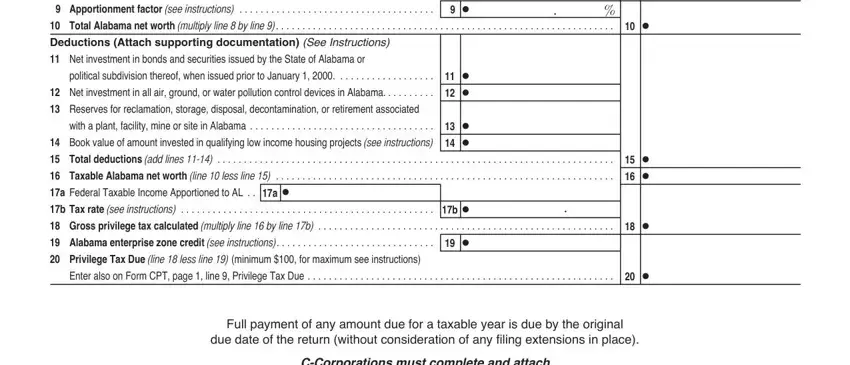

4. Filling out Net worth subject to, Apportionment factor see, Deductions Attach supporting, Net investment in bonds and, political subdivision thereof when, Net investment in all air ground, Reserves for reclamation storage, with a plant facility mine or site, Book value of amount invested in, Total deductions add lines , Taxable Alabama net worth line , a Federal Taxable Income, b Tax rate see instructions , Gross privilege tax calculated, and Alabama enterprise zone credit is key in this next step - make sure to don't hurry and be attentive with each and every field!

Step 3: After you've looked once more at the information entered, click on "Done" to conclude your form at FormsPal. Join us today and instantly get Alabama Form Cpt, set for downloading. All adjustments you make are preserved , so that you can change the form at a later stage if needed. FormsPal provides secure document completion devoid of personal data recording or sharing. Be assured that your data is in good hands with us!