In case you wish to fill out Alabama Form Eoo, you don't need to install any kind of software - simply use our online PDF editor. Our editor is consistently evolving to deliver the best user experience possible, and that's due to our resolve for constant development and listening closely to comments from customers. To get the ball rolling, consider these simple steps:

Step 1: Hit the "Get Form" button in the top part of this page to open our tool.

Step 2: With the help of this state-of-the-art PDF tool, you are able to do more than simply fill in blank fields. Edit away and make your forms appear professional with custom text added in, or adjust the original content to excellence - all accompanied by an ability to insert any kind of graphics and sign the PDF off.

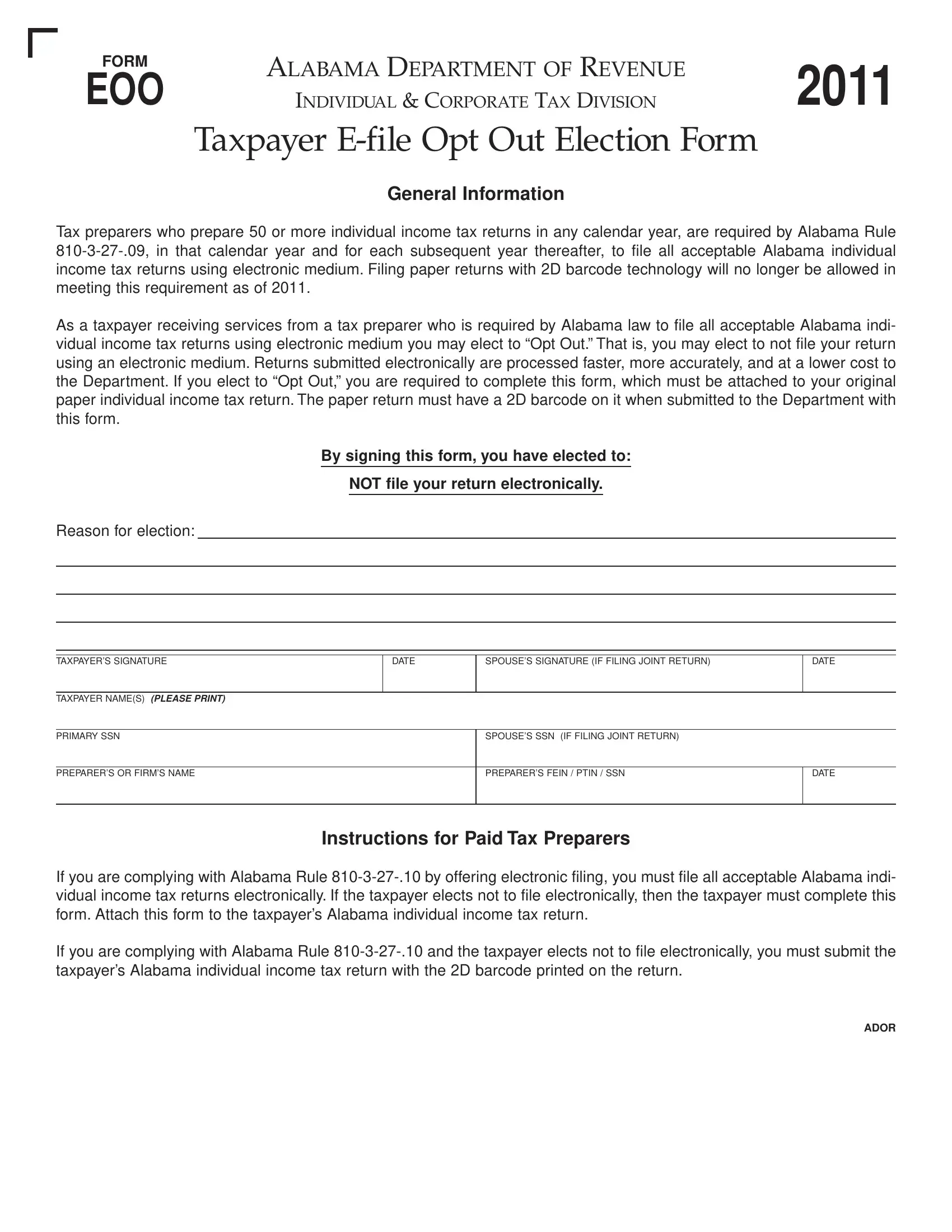

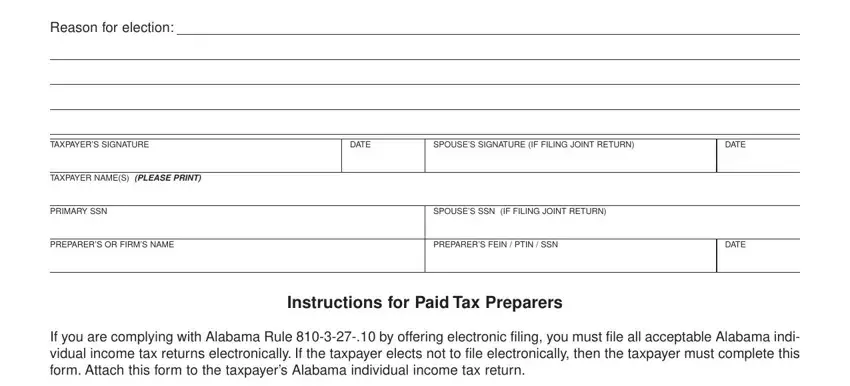

For you to complete this PDF document, make sure you provide the necessary information in every single area:

1. The Alabama Form Eoo involves specific information to be typed in. Be sure that the subsequent blank fields are complete:

Step 3: Right after you have reviewed the details in the fields, simply click "Done" to finalize your form at FormsPal. Go for a free trial plan at FormsPal and acquire direct access to Alabama Form Eoo - accessible inside your personal cabinet. FormsPal provides protected document editor with no personal data recording or any kind of sharing. Feel comfortable knowing that your data is secure with us!