Whenever you want to fill out alabama 2020 form printable, you won't have to install any sort of software - simply try using our PDF tool. The tool is constantly updated by our staff, acquiring new awesome functions and becoming much more versatile. It merely requires a few simple steps:

Step 1: Click on the orange "Get Form" button above. It'll open up our tool so you could begin filling in your form.

Step 2: With the help of this online PDF file editor, it's possible to accomplish more than simply fill out blank form fields. Express yourself and make your documents appear professional with customized text put in, or optimize the file's original input to perfection - all supported by an ability to add your personal images and sign the PDF off.

This PDF form requires some specific information; to guarantee accuracy and reliability, make sure you take note of the guidelines directly below:

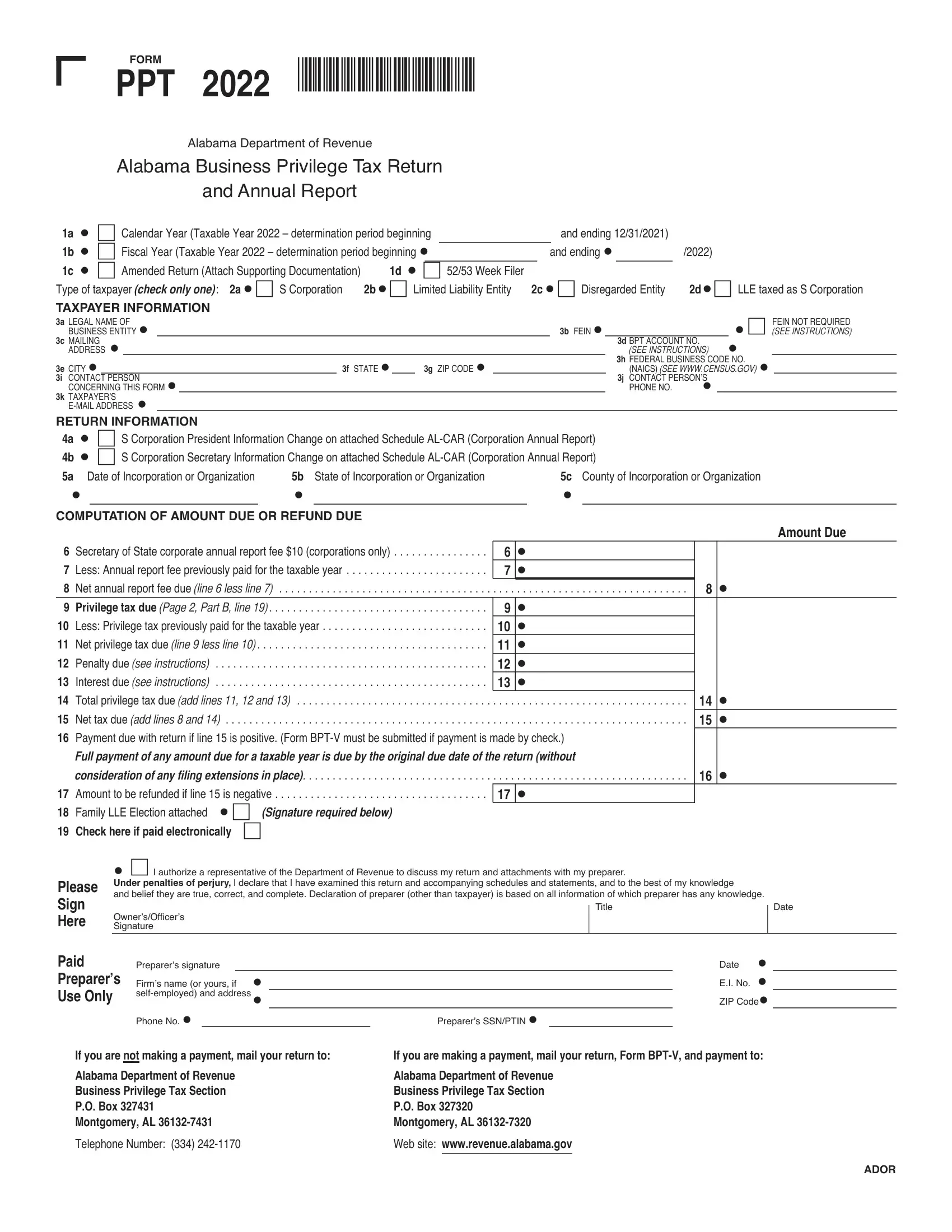

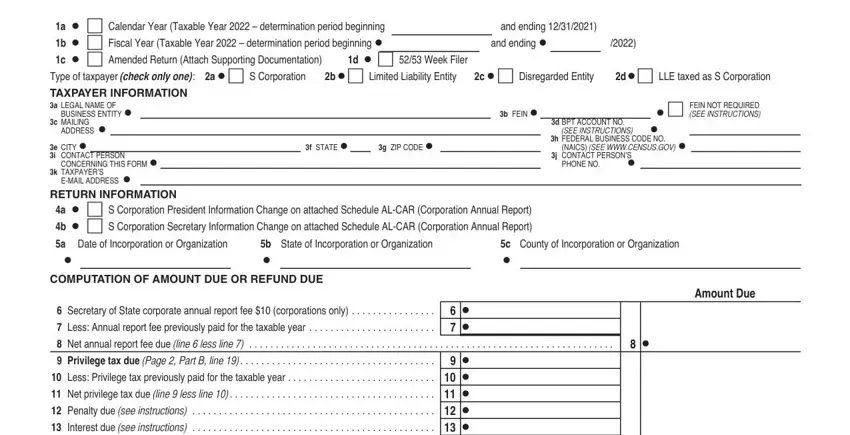

1. While completing the alabama 2020 form printable, make sure to incorporate all necessary fields within the relevant form section. It will help to expedite the work, allowing your information to be handled promptly and appropriately.

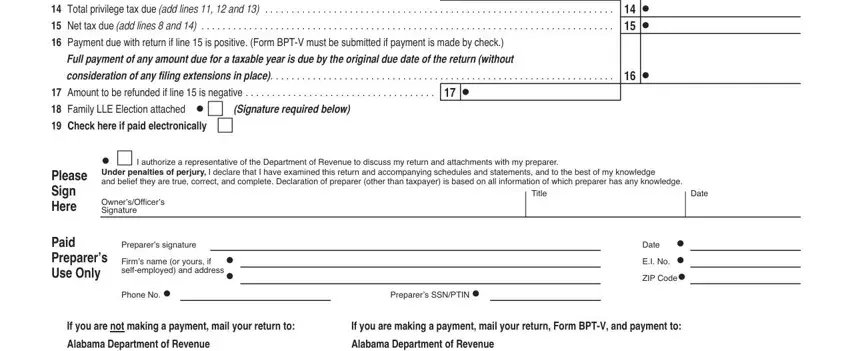

2. Soon after completing the last section, head on to the subsequent step and complete all required details in all these blanks - Total privilege tax due add lines, Net tax due add lines and , Payment due with return if line , Full payment of any amount due for, consideration of any filing, Amount to be refunded if line is, I authorize a representative of, Under penalties of perjury I, OwnersOfficers Signature, Title, Date, Please Sign Here, Paid Preparers Use Only, Preparers signature Firms name or, and Phone No .

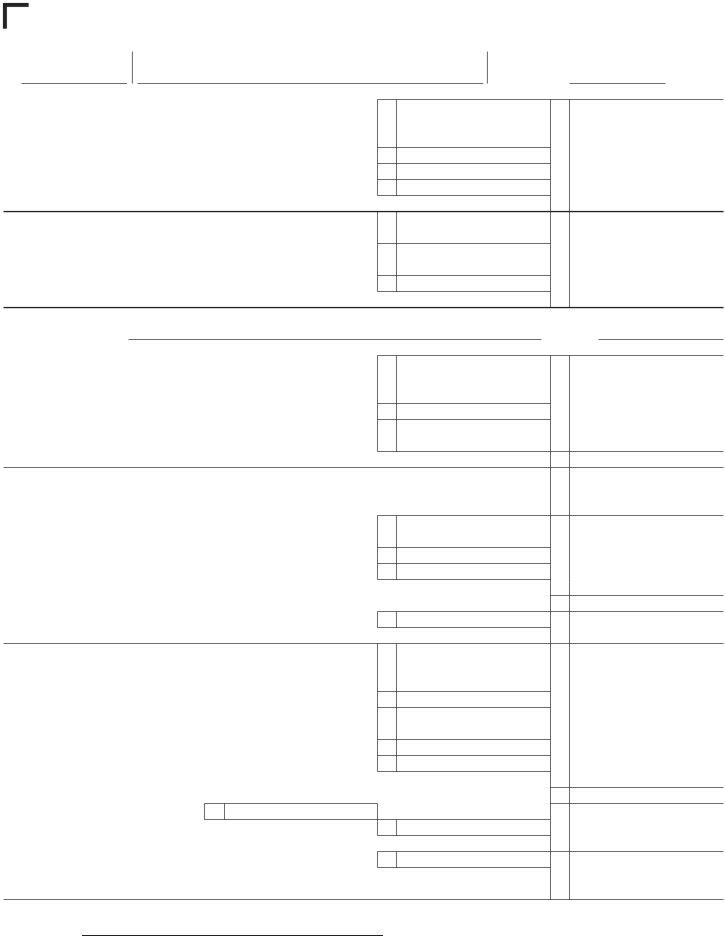

3. The next part is going to be easy - complete every one of the fields in a FEIN V PART A NET WORTH, b LEGAL NAME OF BUSINESS ENTITY, I SCorporations, Issued capital stock and, but not less than zero , Retained earnings but not less, Gross amount of related party, All payments for compensation, c DETERMINATION PERIOD END DATE, MMDDYYYY, Total net worth add lines Go to, II Limited Liability Entities LLEs, Sum of the partnersmembers, All compensation distributions or, and excess of to finish this segment.

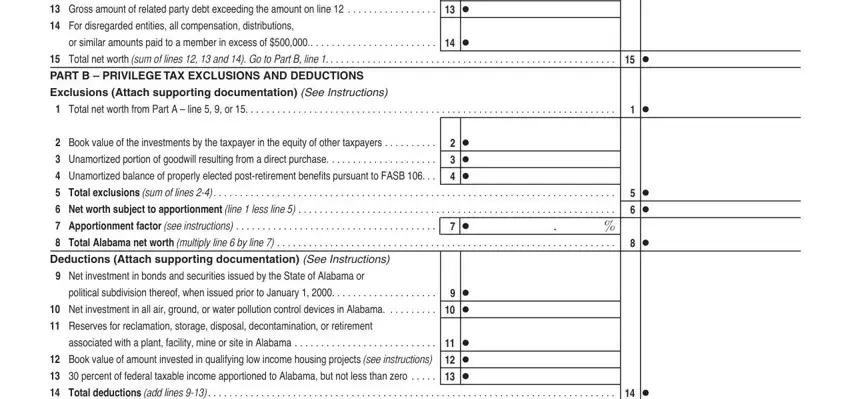

4. To go onward, this fourth form section requires filling in several blank fields. Included in these are Gross amount of related party, For disregarded entities all, or similar amounts paid to a, Total net worth sum of lines , PART B PRIVILEGE TAX EXCLUSIONS, Exclusions Attach supporting, Total net worth from Part A line, Book value of the investments by, Unamortized portion of goodwill, Unamortized balance of properly, Total exclusions sum of lines , Net worth subject to, Apportionment factor see, Deductions Attach supporting, and Net investment in bonds and, which you'll find key to continuing with this particular form.

Always be very careful when filling in Total net worth from Part A line and Exclusions Attach supporting, as this is the part where a lot of people make some mistakes.

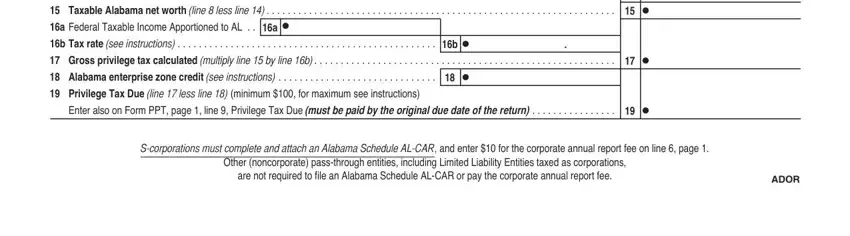

5. The document must be concluded by filling in this area. Below there's a comprehensive set of fields that require accurate information for your document submission to be complete: Total deductions add lines , Taxable Alabama net worth line , a Federal Taxable Income, b Tax rate see instructions , Gross privilege tax calculated, Alabama enterprise zone credit, Privilege Tax Due line less line, Enter also on Form PPT page line , Scorporations must complete and, Other noncorporate passthrough, are not required to file an, and ADOR.

Step 3: After taking one more look at your fields and details, press "Done" and you are done and dusted! Right after registering a7-day free trial account at FormsPal, you'll be able to download alabama 2020 form printable or email it immediately. The PDF document will also be readily accessible from your personal account page with all of your changes. We don't share or sell any information that you type in while working with forms at our site.