BOE-502-A (P1) REV. 13 (06-17)

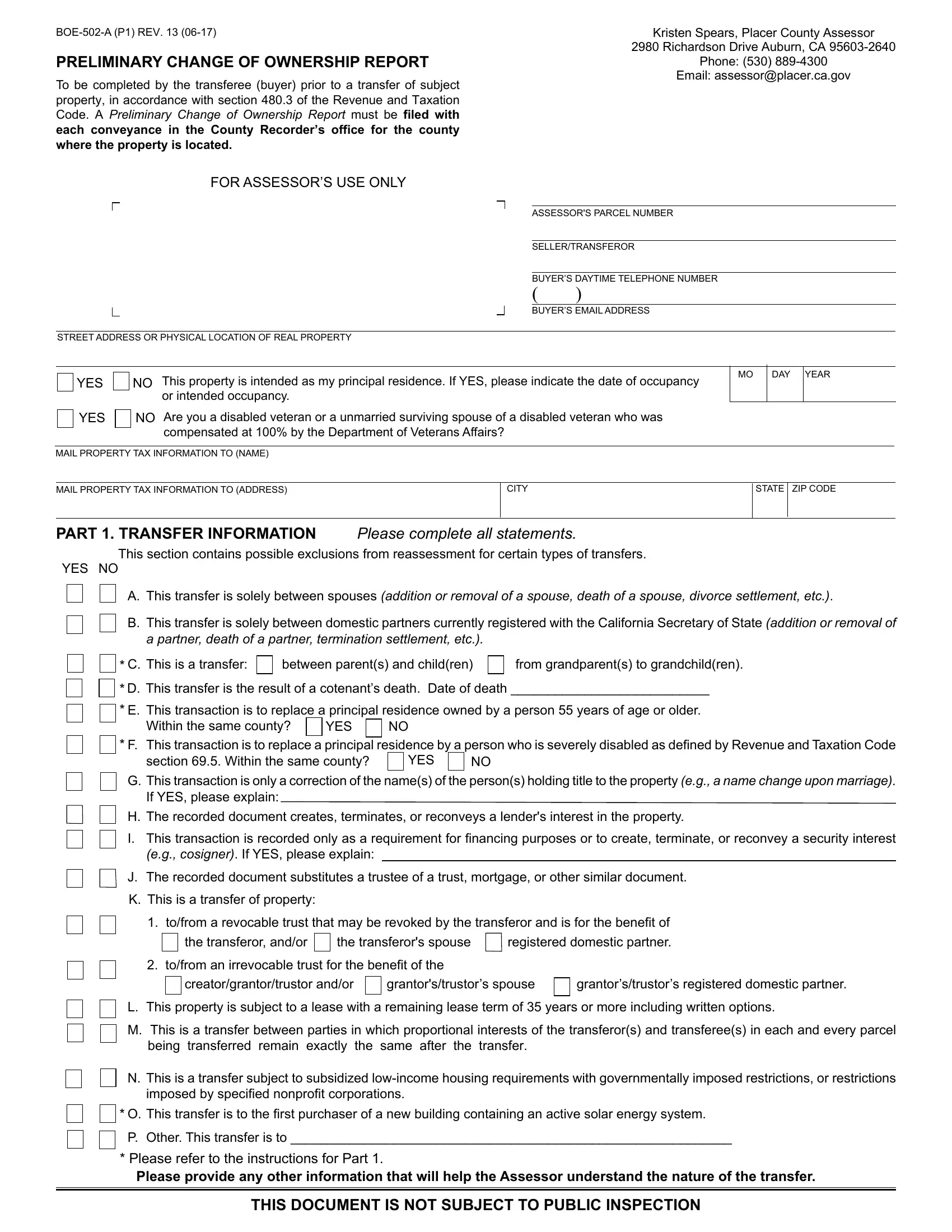

PRELIMINARY CHANGE OF OWNERSHIP REPORT

To be completed by the transferee (buyer) prior to a transfer of subject property, in accordance with section 480.3 of the Revenue and Taxation

Code. A Preliminary Change of Ownership Report must be filed with each conveyance in the County Recorder’s office for the county where the property is located.

Kristen Spears, Placer County Assessor

2980 Richardson Drive Auburn, CA 95603-2640

Phone: (530) 889-4300

Email: assessor@placer.ca.gov

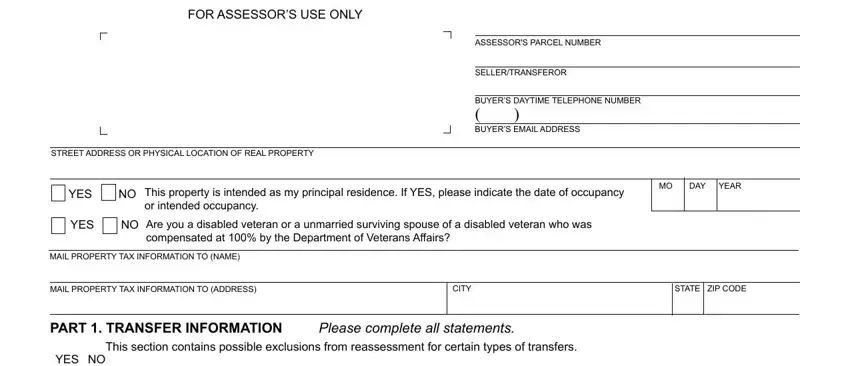

FOR ASSESSOR’S USE ONLY

ASSESSOR'S PARCEL NUMBER

SELLER/TRANSFEROR

BUYER’S DAYTIME TELEPHONE NUMBER

( )

BUYER’S EMAIL ADDRESS

STREET ADDRESS OR PHYSICAL LOCATION OF REAL PROPERTY

This property is intended as my principal residence. If YES, please indicate the date of occupancy or intended occupancy.

Are you a disabled veteran or a unmarried surviving spouse of a disabled veteran who was compensated at 100% by the Department of Veterans Affairs?

MAIL PROPERTY TAX INFORMATION TO (NAME)

MAIL PROPERTY TAX INFORMATION TO (ADDRESS)

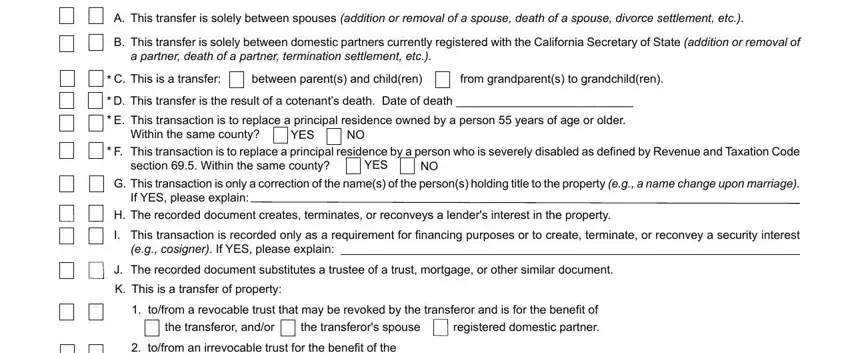

PART 1. TRANSFER INFORMATION |

Please complete all statements. |

This section contains possible exclusions from reassessment for certain types of transfers.

YES NO

A. This transfer is solely between spouses (addition or removal of a spouse, death of a spouse, divorce settlement, etc.).

B. This transfer is solely between domestic partners currently registered with the California Secretary of State (addition or removal of a partner, death of a partner, termination settlement, etc.).

* C. This is a transfer: |

|

between parent(s) and child(ren) |

|

from grandparent(s) to grandchild(ren). |

* D. This transfer is the result of a cotenant’s death. Date of death ___________________________

*E. This transaction is to replace a principal residence owned by a person 55 years of age or older.

Within the same county? |

YES |

NO |

|

* F. This transaction is to replace a principal residence by a person who is severely disabled as deined by Revenue and Taxation Code |

section 69.5. Within the same county? |

YES |

NO |

G.This transaction is only a correction of the name(s) of the person(s) holding title to the property (e.g., a name change upon marriage).

If YES, please explain:

H. The recorded document creates, terminates, or reconveys a lender's interest in the property.

I.This transaction is recorded only as a requirement for inancing purposes or to create, terminate, or reconvey a security interest (e.g., cosigner). If YES, please explain:

J. The recorded document substitutes a trustee of a trust, mortgage, or other similar document.

K. This is a transfer of property:

1. |

|

to/from a revocable trust that may be revoked by the transferor and is for the beneit of |

|

|

|

|

the transferor, and/or |

|

the transferor's spouse |

registered domestic partner. |

|

|

|

|

|

2. |

|

to/from an irrevocable trust for the beneit of the |

|

|

|

|

|

|

|

creator/grantor/trustor and/or |

|

grantor's/trustor’s spouse |

|

grantor’s/trustor’s registered domestic partner. |

|

|

|

|

|

|

|

|

|

|

|

|

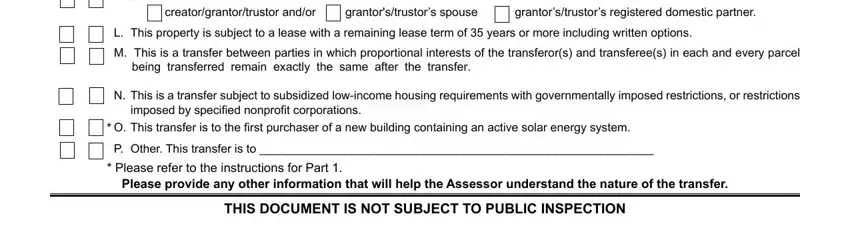

L. This property is subject to a lease with a remaining lease term of 35 years or more including written options.

M.This is a transfer between parties in which proportional interests of the transferor(s) and transferee(s) in each and every parcel being transferred remain exactly the same after the transfer.

N.This is a transfer subject to subsidized low-income housing requirements with governmentally imposed restrictions, or restrictions imposed by specified nonprofit corporations.

* O. This transfer is to the irst purchaser of a new building containing an active solar energy system.

P. Other. This transfer is to ____________________________________________________________

* Please refer to the instructions for Part 1.

Please provide any other information that will help the Assessor understand the nature of the transfer.

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION

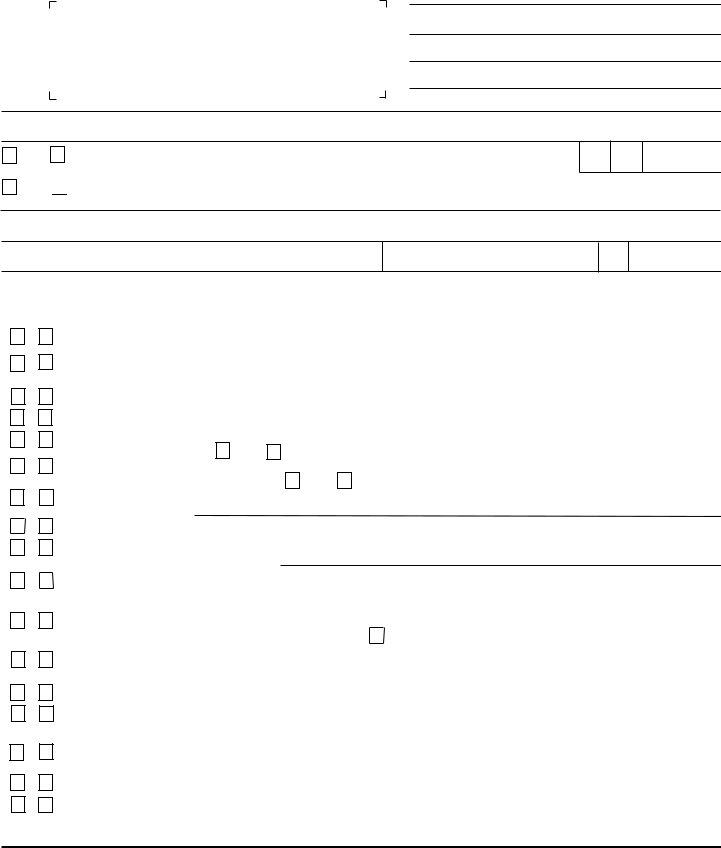

BOE-502-A (P2) REV. 13 (06-17)

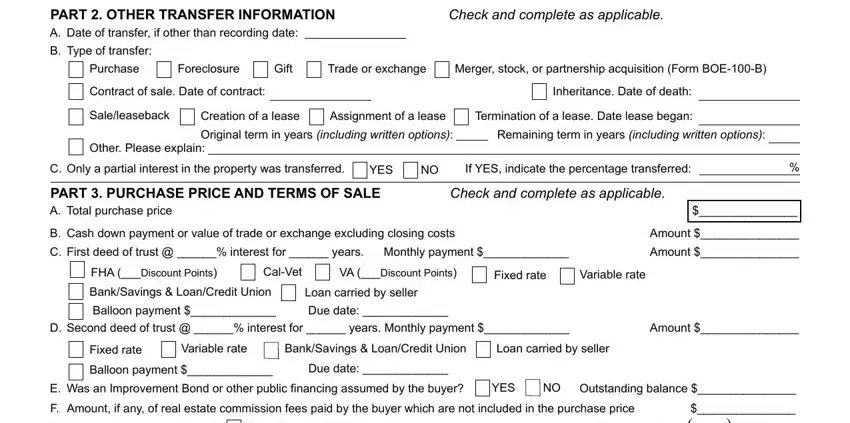

PART 2. OTHER TRANSFER INFORMATION |

Check and complete as applicable. |

A.Date of transfer, if other than recording date:

B.Type of transfer:

Purchase Foreclosure Gift

Contract of sale. Date of contract:

Trade or exchange |

|

Merger, stock, or partnership acquisition (Form BOE-100-B) |

|

|

|

|

Inheritance. Date of death: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sale/leaseback |

|

Creation of a lease |

|

Assignment of a lease |

|

Termination of a lease. Date lease began: |

|

|

|

Original term in years (including written options): |

|

|

Remaining term in years (including written options): |

Other. Please explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Only a partial interest in the property was transferred.

NO |

If YES, indicate the percentage transferred: |

% |

PART 3. PURCHASE PRICE AND TERMS OF SALE |

Check and complete as applicable. |

|

|

A. Total purchase price |

|

|

|

|

|

|

|

|

|

|

$_______________ |

|

|

|

|

|

|

B. Cash down payment or value of trade or exchange excluding closing costs |

|

|

|

Amount $_______________ |

C. First deed of trust @ ______% interest for ______ years. |

Monthly payment $_____________ |

|

Amount $_______________ |

FHA (___Discount Points) |

Cal-Vet |

VA (___Discount Points) |

Fixed rate |

Variable rate |

|

|

Bank/Savings & Loan/Credit Union |

|

Loan carried by seller |

|

|

|

|

|

|

Balloon payment $_____________ |

|

Due date: _____________ |

|

|

|

|

|

|

D. Second deed of trust @ ______% interest for ______ years. Monthly payment $_____________ |

|

Amount $_______________ |

Fixed rate |

Variable rate |

Bank/Savings & Loan/Credit Union |

Loan carried by seller |

|

|

Balloon payment $_____________ |

|

Due date: _____________ |

|

|

|

|

|

|

E. Was an Improvement Bond or other public inancing assumed by the buyer? |

YES |

NO |

Outstanding balance $_______________ |

F. Amount, if any, of real estate commission fees paid by the buyer which are not included in the purchase price |

$_______________ |

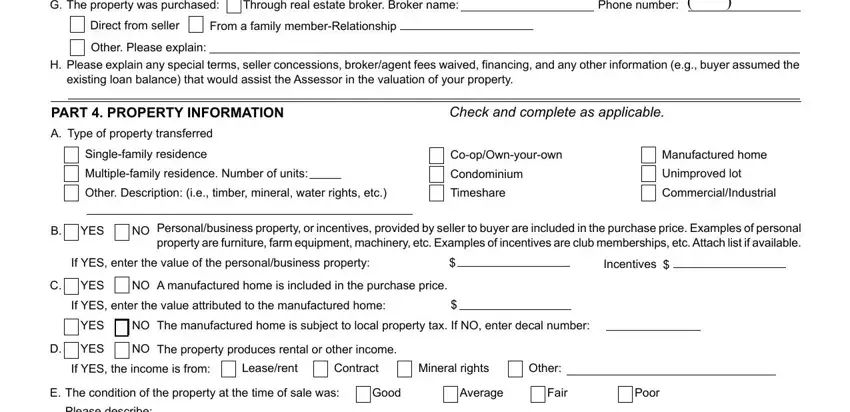

G. The property was purchased: |

Through real estate broker. Broker name: |

|

|

|

|

Phone number: |

( |

) |

From a family member-Relationship

Other. Please explain:

H.Please explain any special terms, seller concessions, broker/agent fees waived, inancing, and any other information (e.g., buyer assumed the existing loan balance) that would assist the Assessor in the valuation of your property.

PART 4. PROPERTY INFORMATION

A. Type of property transferred

Single-family residence

Multiple-family residence. Number of units:

Other. Description: (i.e., timber, mineral, water rights, etc.)

Check and complete as applicable.

Co-op/Own-your-own |

Manufactured home |

Condominium |

Unimproved lot |

Timeshare |

Commercial/Industrial |

|

YES |

|

|

NO |

Personal/business property, or incentives, provided by seller to buyer are included in the purchase price. Examples of personal |

|

|

|

|

|

|

|

|

property are furniture, farm equipment, machinery, etc. Examples of incentives are club memberships, etc. Attach list if available. |

|

|

|

|

|

If YES, enter the value of the personal/business property: |

|

|

$ |

|

|

|

|

|

|

|

|

Incentives $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

|

|

NO |

A manufactured home is included in the purchase price. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If YES, enter the value attributed to the manufactured home: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO |

The manufactured home is subject to local property tax. If NO, enter decal number: |

|

|

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

|

|

YES |

|

|

NO |

The property produces rental or other income. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If YES, the income is from: |

|

Lease/rent |

|

Contract |

|

Mineral rights |

|

Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The condition of the property at the time of sale was: |

|

Good |

|

|

Average |

|

|

|

Fair |

|

|

|

Poor |

|

|

|

|

|

|

|

|

|

Please describe: __________________________________________________________________________________________________

CERTIFICATION

I certify (or declare) that the foregoing and all information hereon, including any accompanying statements or documents, is true and correct to the best of my knowledge and belief.

SIGNATURE OF BUYER/TRANSFEREE OR CORPORATE OFFICER |

DATE |

t |

|

NAME OF BUYER/TRANSFEREE/PERSONAL REPRESENTATIVE/CORPORATE OFFICER (PLEASE PRINT) TITLE

TELEPHONE

()

EMAIL ADDRESS

The Assessor’s ofice may contact you for additional information regarding this transaction.

BOE-502-A (P3) REV. 13 (06-17)

ADDITIONAL INFORMATION

Please answer all questions in each section, and sign and complete the certiication before iling. This form may be used in all 58 California counties. If a document evidencing a change in ownership is presented to the Recorder for recordation without the concurrent iling of a Preliminary Change of Ownership Report, the Recorder may charge an additional recording fee of twenty dollars ($20).

NOTICE: The property which you acquired may be subject to a supplemental assessment in an amount to be determined by the County Assessor. Supplemental assessments are not paid by the title or escrow company at close of escrow, and are not included in lender impound accounts. You may be responsible for the current or upcoming property taxes even if you do not receive the tax bill.

NAME AND MAILING ADDRESS OF BUYER: Please make necessary corrections to the printed name and mailing address. Enter Assessor’s Parcel Number, name of seller, buyer’s daytime telephone number, buyer’s email address, and street address or physical

location of the real property.

NOTE: Your telephone number and/or email address is very important. If there is a question or a problem, the Assessor needs to be able to contact you.

MAIL PROPERTY TAX INFORMATION TO: Enter the name, address, city, state, and zip code where property tax information should be mailed. This must be a valid mailing address.

PRINCIPAL RESIDENCE: To help you determine your principal residence, consider (1) where you are registered to vote, (2) the home address on your automobile registration, and (3) where you normally return after work. If after considering these criteria you are still uncertain, choose the place at which you have spent the major portion of your time this year. Check YES if the property is intended as your principal residence, and indicate the date of occupancy or intended occupancy.

DISABLED VETERAN: If you checked YES, you may qualify for a property tax exemption. A claim form must be iled and all

requirements met in order to obtain the exemption. Please contact the Assessor for a claim form.

PART 1: TRANSFER INFORMATION

If you check YES to any of these statements, the Assessor may ask for supporting documentation.

C, D, E, F: If you checked YES to any of these statements, you may qualify for a property tax reassessment exclusion, which may allow you to maintain your property’s previous tax base. A claim form must be iled and all requirements met in order to obtain any of these exclusions. Contact the Assessor for claim forms. NOTE: If you give someone money or property during your life, you may be subject to federal gift tax. You make a gift if you give property (including money), the use of property, or the right to receive income from property without expecting to receive something of at least equal value in return. The transferor (donor) may be required to ile Form 709, Federal Gift Tax Return, with the Internal Revenue Service if they make gifts in excess of the annual exclusion amount.

G:Check YES if the reason for recording is to correct a name already on title [e.g., Mary Jones, who acquired title as Mary J. Smith, is granting to Mary Jones]. This is not for use when a name is being removed from title.

H:Check YES if the change involves a lender, who holds title for security purposes on a loan, and who has no other beneficial interest in the property.

"Beneicial interest" is the right to enjoy all the beneits of property ownership. Those beneits include the right to use, sell, mortgage, or lease the property to another. A beneicial interest can be held by the beneiciary of a trust, while legal control of the trust is held by the trustee.

I:A "cosigner" is a third party to a mortgage/loan who provides a guarantee that a loan will be repaid. The cosigner signs an agreement with the lender stating that if the borrower fails to repay the loan, the cosigner will assume legal liability for it.

M:This is primarily for use when the transfer is into, out of, or between legal entities such as partnerships, corporations, or limited liability companies. Check YES only if the interest held in each and every parcel being transferred remains exactly the same.

N:Check YES only if this property is subject to a government or nonprofit affordable housing program that imposes restrictions. Property may qualify for a restricted valuation method (i.e., may result in lower taxes).

O:If you checked YES, you may qualify for a new construction property tax exclusion. A claim form must be iled and all requirements met in order to obtain the exclusion. Contact the Assessor for a claim form.

PART 2: OTHER TRANSFER INFORMATION

A:The date of recording is rebuttably presumed to be the date of transfer. If you believe the date of transfer was a different date (e.g., the transfer was by an unrecorded contract, or a lease identiies a speciic start date), put the date you believe is the correct transfer date. If it is not the date of recording, the Assessor may ask you for supporting documentation.

B:Check the box that corresponds to the type of transfer. If OTHER is checked, please provide a detailed description. Attach a separate sheet if necessary.

C.If this transfer was the result of an inhertiance following the death of the property owner, please complete a Change in Ownership Statement, Death of Real Property Owner, form BOE-502-D, if not already iled with the Assessor’s ofice.

BOE-502-A (P4) REV. 13 (06-17)

PART 3: PURCHASE PRICE AND TERMS OF SALE

It is important to complete this section completely and accurately. The reported purchase price and terms of sale are important factors in determining the assessed value of the property, which is used to calculate your property tax bill. Your failure to provide any required or requested information may result in an inaccurate assessment of the property and in an overpayment or underpayment of taxes.

A.Enter the total purchase price, not including closing costs or mortgage insurance.

“Mortgage insurance” is insurance protecting a lender against loss from a mortgagor’s default, issued by the FHA or a private mortgage insurer.

B.Enter the amount of the down payment, whether paid in cash or by an exchange. If through an exchange, exclude the closing costs.

“Closing costs” are fees and expenses, over and above the price of the property, incurred by the buyer and/or seller, which include title searches, lawyer’s fees, survey charges, and document recording fees.

C.Enter the amount of the First Deed of Trust, if any. Check all the applicable boxes, and complete the information requested.

A “balloon payment” is the inal installment of a loan to be paid in an amount that is disproportionately larger than the regular installment.

D.Enter the amount of the Second Deed of Trust, if any. Check all the applicable boxes, and complete the information requested.

E.If there was an assumption of an improvement bond or other public inancing with a remaining balance, enter the outstanding balance, and mark the applicable box.

An “improvement bond or other public inancing” is a lien against real property due to property-speciic improvement inancing, such as green or solar construction inancing, assessment district bonds, Mello-Roos (a form of inancing that can be used by cities, counties and special districts to inance major improvements and services within the particular district) or general improvement bonds, etc. Amounts for repayment of contractual assessments are included with the annual property tax bill.

F.Enter the amount of any real estate commission fees paid by the buyer which are not included in the purchase price.

G.If the property was purchased through a real estate broker, check that box and enter the broker’s name and phone number. If the property was purchased directly from the seller (who is not a family member of one of the parties purchasing the property), check the “Direct from seller” box. If the property was purchased directly from a member of your family, or a family member of one of the parties who is purchasing the property, check the “From a family member” box and indicate the relationship of the family member (e.g., father, aunt, cousin, etc.). If the property was purchased by some other means (e.g., over the Internet, at auction, etc.), check the “OTHER” box and provide a detailed description (attach a separate sheet if necessary).

H.Describe any special terms (e.g., seller retains an unrecorded life estate in a portion of the property, etc.), seller concessions (e.g., seller agrees to replace roof, seller agrees to certain interior inish work, etc.), broker/agent fees waived (e.g., fees waived by the broker/agent for either the buyer or seller), inancing, buyer paid commissions, and any other information that will assist the Assessor in determining the value of the property.

PART 4: PROPERTY INFORMATION

A.Indicate the property type or property right transferred. Property rights may include water, timber, mineral rights, etc.

B.Check YES if personal, business property or incentives are included in the purchase price in Part 3. Examples of personal or business property are furniture, farm equipment, machinery, etc. Examples of incentives are club memberships (golf, health, etc.), ski lift tickets, homeowners’ dues, etc. Attach a list of items and their purchase price allocation. An adjustment will not be made if a detailed list is not provided.

C.Check YES if a manufactured home or homes are included in the purchase price. Indicate the purchase price directly attributable to each of the manufactured homes. If the manufactured home is registered through the Department of Motor Vehicles in lieu of being subject to property taxes, check NO and enter the decal number.

D.Check YES if the property was purchased or acquired with the intent to rent or lease it out to generate income, and indicate the source of that anticipated income. Check NO if the property will not generate income, or was purchased with the intent of being owner-occupied.

E.Provide your opinion of the condition of the property at the time of purchase. If the property is in “fair” or “poor” condition, include a brief description of repair needed.