Dealing with PDF documents online is definitely quite easy with this PDF editor. You can fill in texas form ap 228 here effortlessly. Our team is relentlessly working to enhance the editor and enable it to be much easier for people with its multiple functions. Take your experience one stage further with continually growing and exceptional possibilities we provide! Getting underway is effortless! All you have to do is take the next simple steps below:

Step 1: Just hit the "Get Form Button" in the top section of this webpage to start up our pdf form editing tool. This way, you'll find everything that is necessary to work with your file.

Step 2: The editor allows you to customize PDF files in many different ways. Transform it by writing personalized text, adjust existing content, and place in a signature - all within a few clicks!

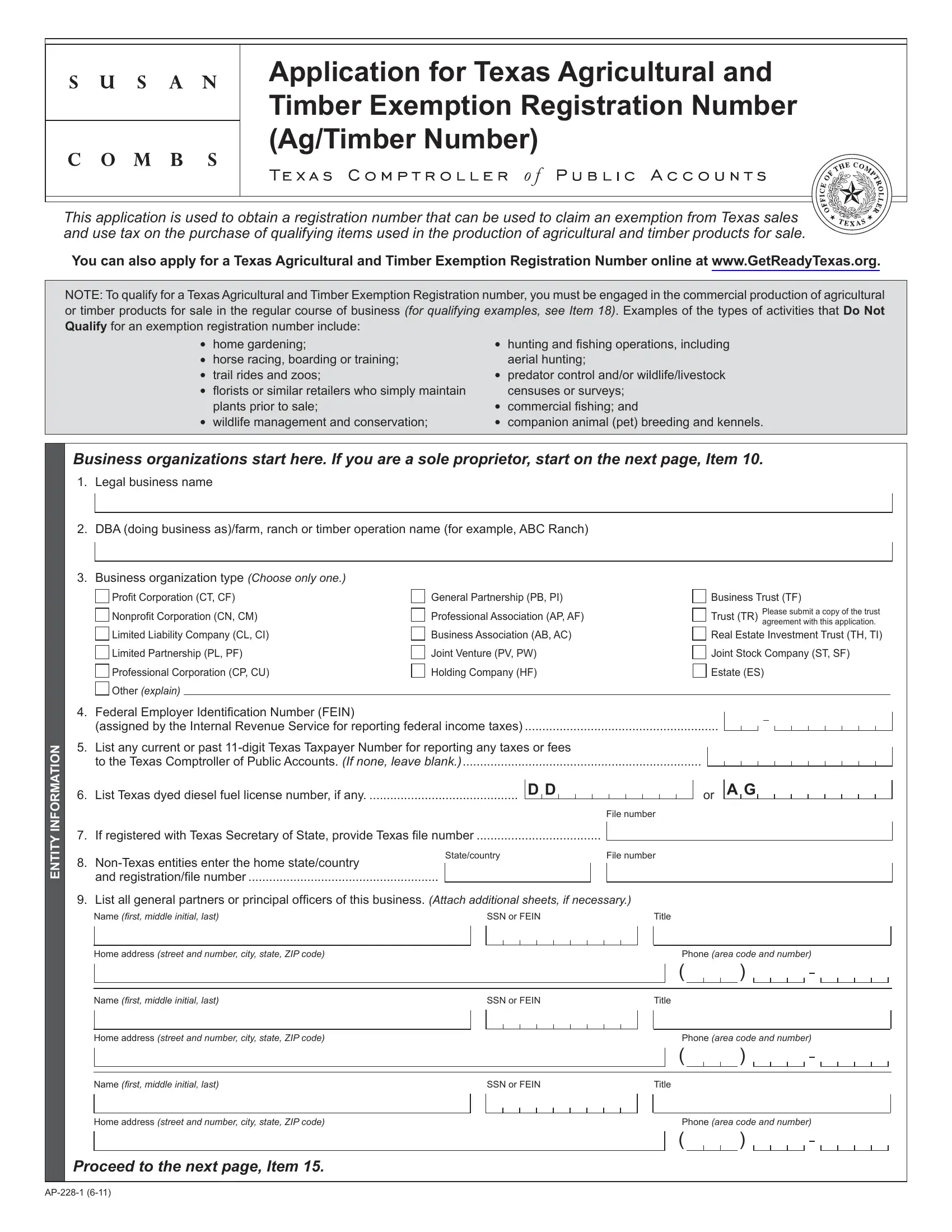

This PDF form requires specific information; to ensure accuracy, you need to take note of the next recommendations:

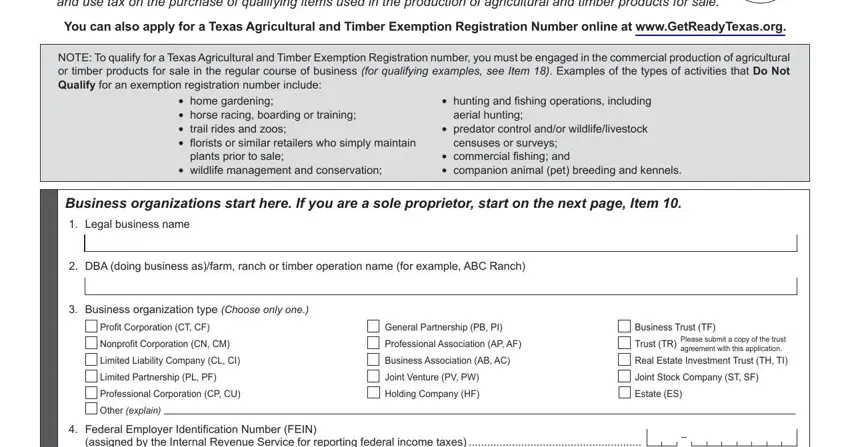

1. While submitting the texas form ap 228, make certain to complete all important blanks within its associated form section. It will help to facilitate the process, allowing for your information to be processed efficiently and correctly.

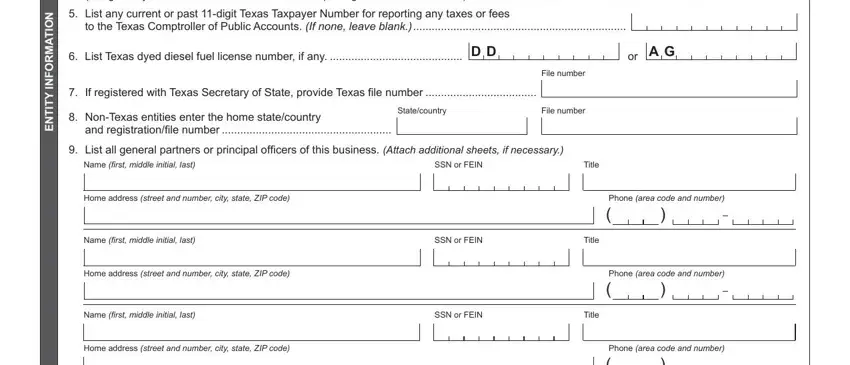

2. Just after this selection of blank fields is completed, go on to enter the relevant information in all these - Federal Employer Identifi cation, assigned by the Internal Revenue, List any current or past digit, to the Texas Comptroller of Public, List Texas dyed diesel fuel, D D, or A G, File number, N O T A M R O F N, Y T T N E, If registered with Texas, NonTexas entities enter the home, and registrationfi le number , Statecountry, and File number.

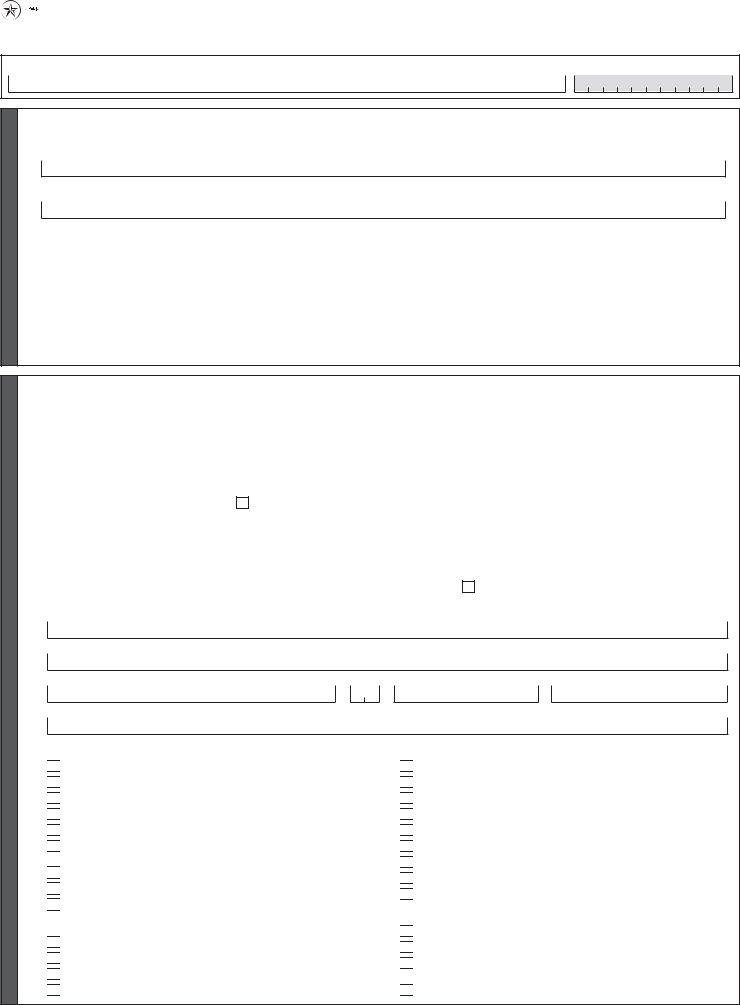

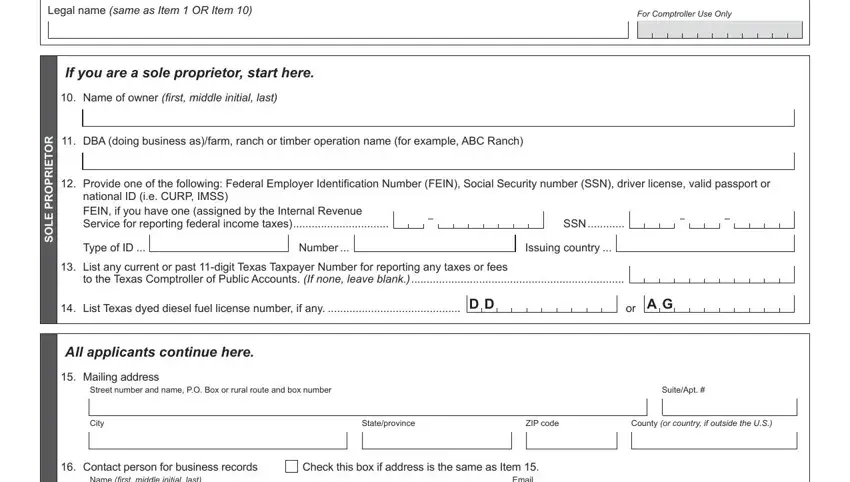

3. This next step is straightforward - fill in all the blanks in Legal name same as Item OR Item , For Comptroller Use Only, If you are a sole proprietor start, Name of owner fi rst middle, DBA doing business asfarm ranch, R O T E R P O R P E L O S, Provide one of the following, national ID ie CURP IMSS FEIN if, SSN , Type of ID , Number , Issuing country , List any current or past digit, to the Texas Comptroller of Public, and List Texas dyed diesel fuel to conclude this process.

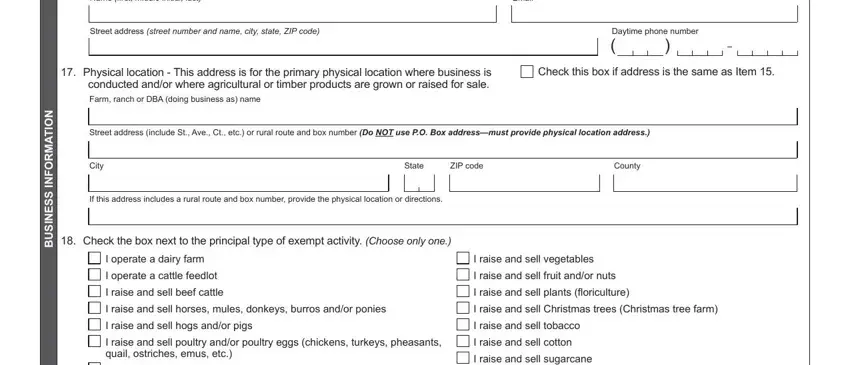

4. This next section requires some additional information. Ensure you complete all the necessary fields - Name fi rst middle initial last, Email, Street address street number and, Physical location This address, Daytime phone number , Check this box if address is the, N O T A M R O F N, S S E N S U B, Street address include St Ave Ct, City, State, ZIP code, County, If this address includes a rural, and Check the box next to the - to proceed further in your process!

Concerning S S E N S U B and Name fi rst middle initial last, ensure you get them right in this current part. The two of these could be the most significant ones in this form.

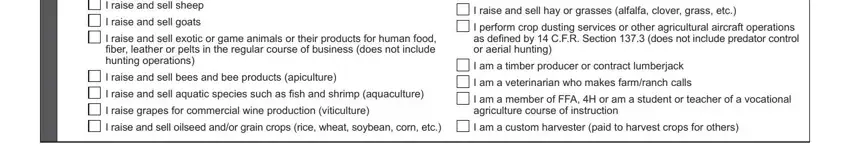

5. Finally, the following final portion is what you will have to wrap up prior to submitting the PDF. The fields at this point are the following: I raise and sell sugarcane, I raise and sell sheep, I raise and sell goats, I raise and sell exotic or game, I raise and sell bees and bee, I raise and sell aquatic species, I raise grapes for commercial wine, I raise and sell hay or grasses, I perform crop dusting services or, I am a timber producer or contract, I am a veterinarian who makes, I am a member of FFA H or am a, I raise and sell oilseed andor, and I am a custom harvester paid to.

Step 3: Before moving forward, you should make sure that all blanks have been filled in correctly. When you’re satisfied with it, click on “Done." Right after setting up afree trial account with us, it will be possible to download texas form ap 228 or email it directly. The PDF file will also be accessible in your personal cabinet with all your modifications. We don't share any information you type in while dealing with forms at our website.