With the online PDF editor by FormsPal, you're able to fill in or modify Texas Form Ap 169 here and now. To make our tool better and less complicated to use, we constantly design new features, considering suggestions from our users. This is what you'd want to do to get started:

Step 1: Open the PDF inside our tool by hitting the "Get Form Button" in the top part of this webpage.

Step 2: When you launch the PDF editor, you will see the form all set to be filled out. Besides filling out different fields, you may also do other things with the form, such as putting on your own textual content, editing the initial textual content, inserting graphics, placing your signature to the form, and a lot more.

It is easy to finish the pdf following our detailed guide! Here's what you need to do:

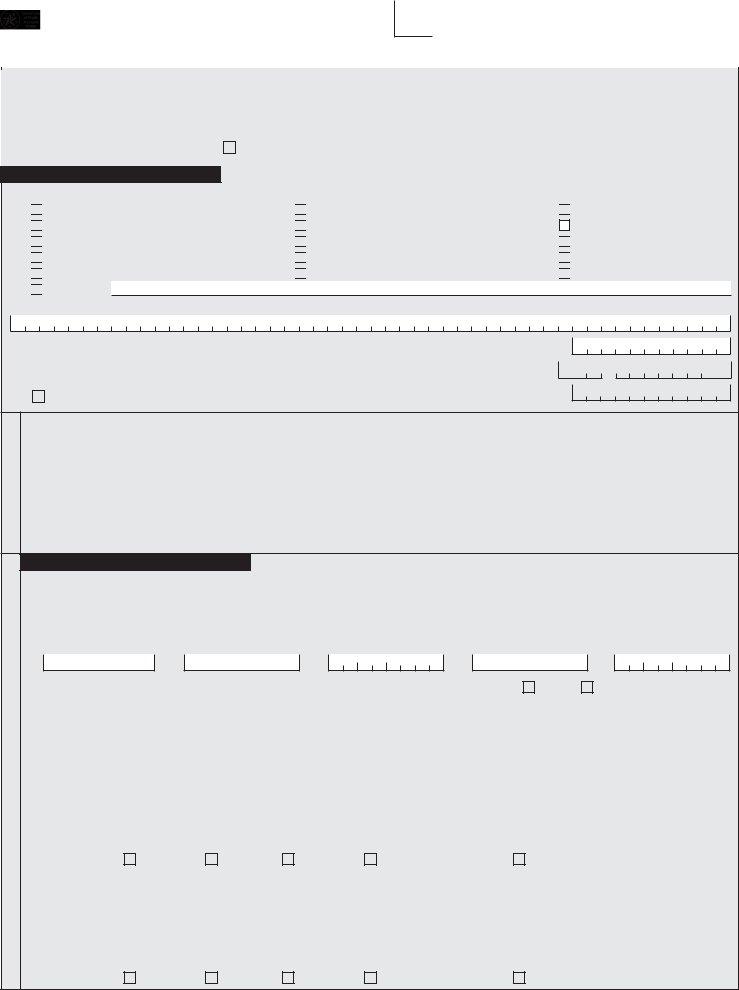

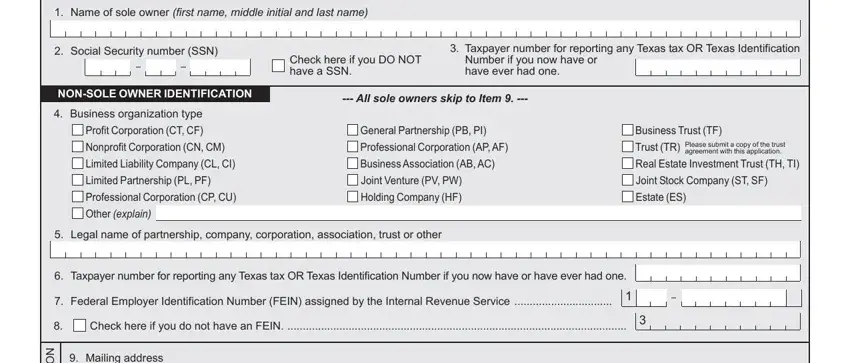

1. It is critical to fill out the Texas Form Ap 169 correctly, hence be careful when filling out the areas including all of these blanks:

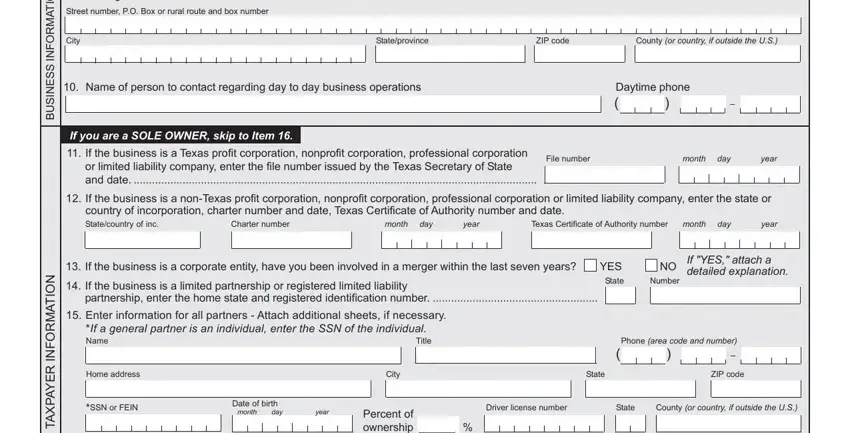

2. Once your current task is complete, take the next step – fill out all of these fields - N O T A M R O F N, S S E N S U B, Mailing address, Street number PO Box or rural, City, Stateprovince, ZIP code, County or country if outside the US, Name of person to contact, Daytime phone, If you are a SOLE OWNER skip to, If the business is a Texas profit, or limited liability company enter, File number, and month with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be very careful when completing ZIP code and File number, since this is the part in which many people make a few mistakes.

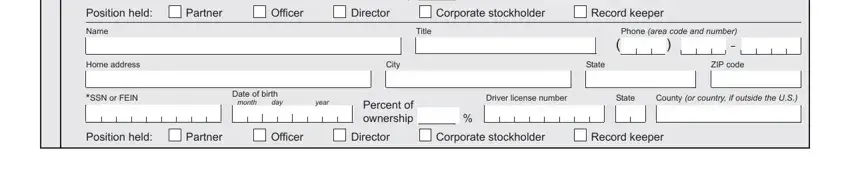

3. Completing Percent of ownership, Position held, Partner, Officer, Director, Corporate stockholder, Record keeper, Name, Home address, SSN or FEIN, Title, Phone area code and number, City, State, and ZIP code is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

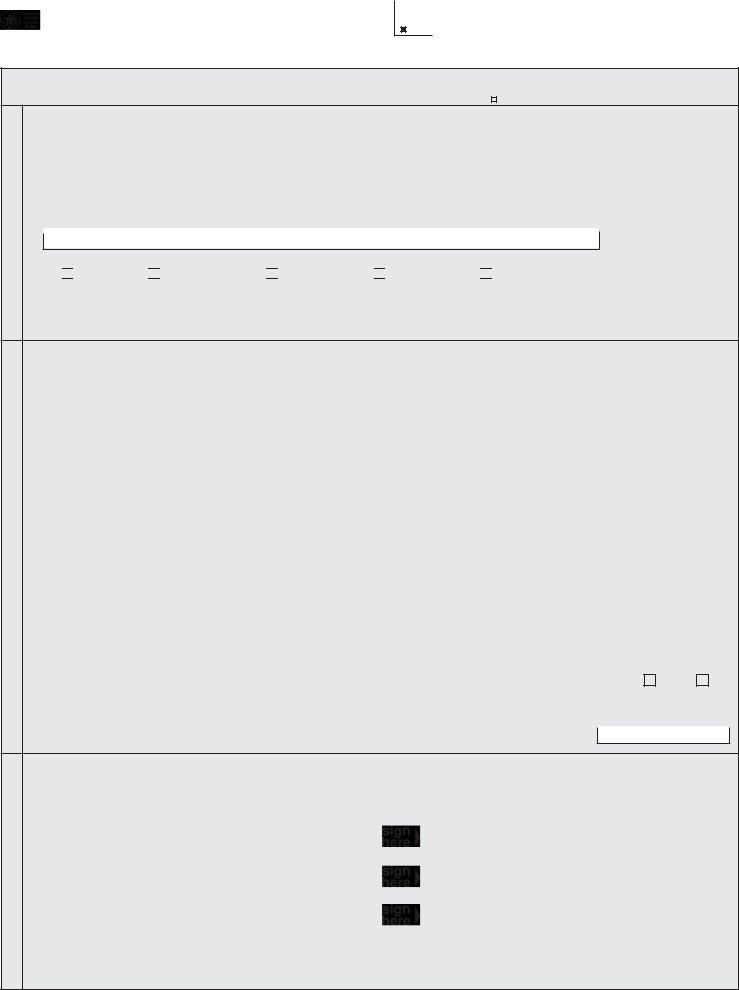

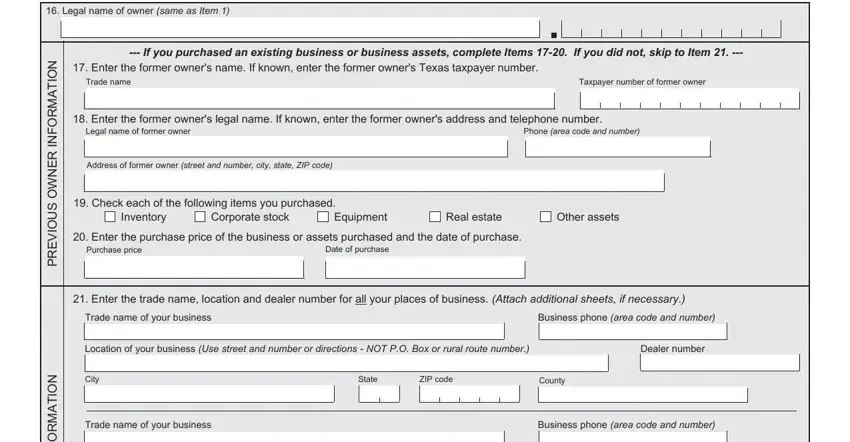

4. Filling in Legal name of owner same as Item, If you purchased an existing, Enter the former owners name If, Trade name, Taxpayer number of former owner, Enter the former owners legal, Legal name of former owner, Phone area code and number, Address of former owner street and, Check each of the following items, Inventory, Corporate stock, Equipment, Real estate, and Other assets is key in the fourth form section - make sure to devote some time and be mindful with each and every field!

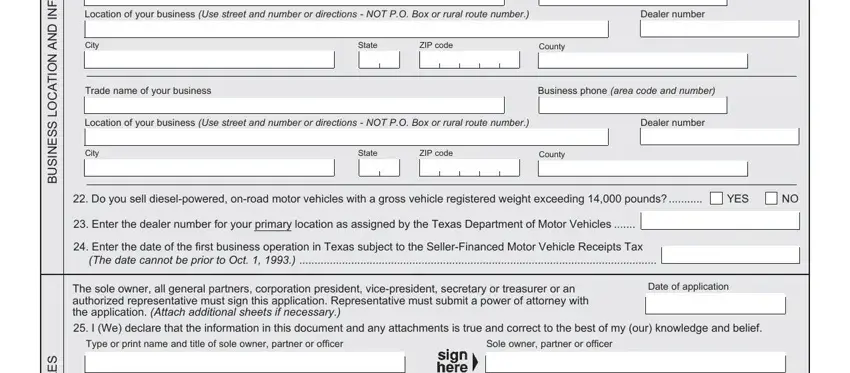

5. Because you come close to the completion of your file, there are a couple more points to undertake. Mainly, Location of your business Use, Dealer number, City, State, ZIP code, County, Trade name of your business, Business phone area code and number, Location of your business Use, Dealer number, City, State, ZIP code, County, and N O T A M R O F N must all be done.

Step 3: Glance through all the information you've typed into the form fields and press the "Done" button. Get the Texas Form Ap 169 as soon as you subscribe to a free trial. Conveniently get access to the pdf in your personal account page, with any edits and changes being all kept! FormsPal ensures your data privacy via a protected method that never saves or shares any personal information involved in the process. Feel safe knowing your paperwork are kept safe every time you work with our services!