When it comes to navigating the complexities of filing federal income tax returns, the Appendix Problem Solution form serves as a practical roadmap for taxpayers seeking clarity and direction. This form intricately outlines real-life scenarios, guiding individuals through the process of completing their tax returns with accuracy and confidence. Whether it's the case of Keith and Jennifer Hamilton, a couple grappling with typical financial situations like employment income, interest from savings, and unexpected life events, or Rhonda Hill, a single office manager supporting a retired relative, each scenario provides a detailed portrait of the taxpayers' financial year. The form not only navigates through wages, interest income, dividends, and inheritances but also addresses less common financial occasions such as the sale of property, work-related accidents, and receiving gifts. Moreover, it delves into specific deductions and benefits, like medical expenses and charitable contributions, highlighting the importance of understanding how different elements of one's financial life intersect with tax obligations. The Appendix Problem Solution form, found on the IRS website, is a valuable resource for those seeking to demystify the process of tax return preparation, encouraging the use of real, accessible data to ensure compliance and optimize financial outcomes.

| Question | Answer |

|---|---|

| Form Name | Appendix Problem Solution Form |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | tax return problem solutions, Utah, W-2, Keith |

Comprehensive Tax Return Problems

INDIVIDUAL TAX RETURN PROBLEM 1

Required:

•Use the following information to complete Keith and Jennifer Hamiltons 2011 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps.

•Form 1040, supporting schedules, and instructions to the forms and schedules can be found at the IRS Web site (www.irs.gov).

Facts:

1.Keith Hamilton is employed as an airline pilot for Flyby Airlines in Las Vegas, NV. Jennifer is employed as a teachers assistant at Small World Elementary School, in Henderson, NV. Keith and Jennifer live in a home they purchased this year. Keith and Jennifer have three children who lived with them all year, Joshua (17), Danielle (14), and Sara (10). Keith and Jennifer provided the following personal information:

•Keith and Jennifer do not want to contribute to the presidential election campaign.

•Keith and Jennifer do not claim itemized deductions.

•Keith and Jennifer live at 3678 Blue Sky Drive, Henderson, NV 89052.

•Keiths birthday is 10/12/1966 and his Social Security number is

•Jennifers birthday is 7/16/1969 and her Social Security number is

•Joshuas birthday is 6/30/1994 and his Social Security number is

•Danielles birthday is 8/12/1997 and her Social Security number is

•Saras birthday is 5/13/2001 and her Social Security number is

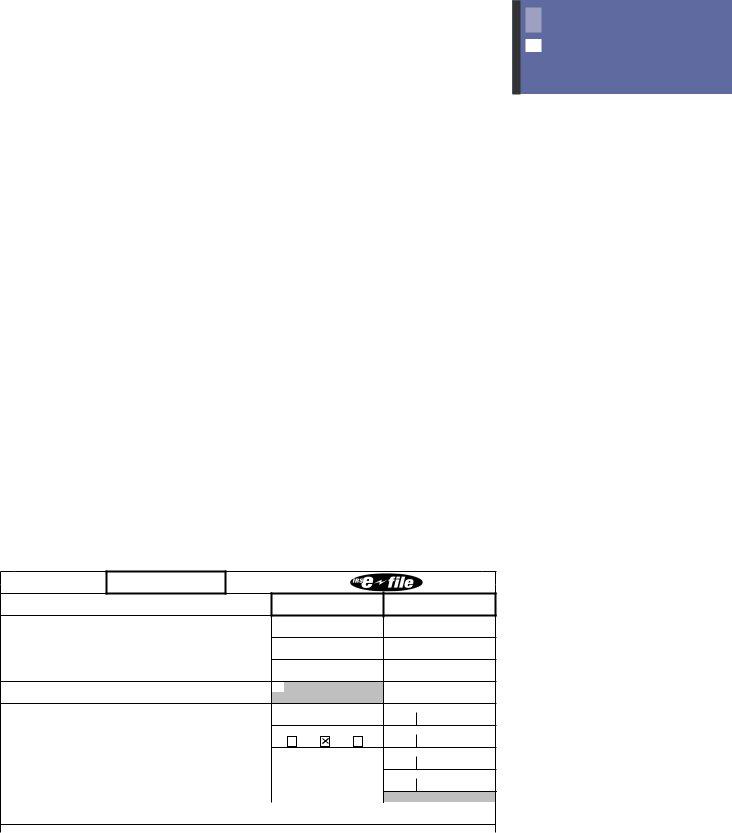

2.Keith received the following Form

a Employee’s social security number |

|

Safe, accurate, |

Visit the IRS website at |

OMB No. |

FAST! Use |

www.irs.gov/efile |

|

|

|

||

|

|

|

b Employer identification number (EIN) |

|

|

1 |

Wages, tips, other compensation |

2 Federal income tax withheld |

||||

|

|

|

193,645.00 |

|

|

38,500.00 |

|||

|

|

|

|

|

|

||||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

4 Social security tax withheld |

||||

Flyby Airlines |

|

|

|

106,800.00 |

|

|

4,485.60 |

||

375 West Flight Blvd. |

|

5 |

Medicare wages and tips |

6 |

Medicare tax withheld |

||||

Las Vegas, NV 89119 |

|

|

|

208,645.00 |

|

|

3,025.35 |

||

|

|

|

7 |

Social security tips |

|

8 |

Allocated tips |

||

d Control number |

|

|

9 |

|

|

|

10 |

Dependent care benefits |

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

12a See instructions for box 12 |

|||

|

|

|

|

|

|

|

C |

|

|

Keith Hamilton |

|

|

|

|

|

|

o |

D |

15,000 |

|

|

|

|

|

|

ed |

|||

3678 Blue Sky Drive |

|

|

13 |

Statutory |

Retirement |

12b |

|

|

|

|

|

|

employee |

plan |

sick pay |

C |

|

|

|

Henderson, NV 89052 |

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

14 Other |

|

|

12c |

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

e |

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

15 State |

Employer’s state ID number |

16 State wages, tips, etc. |

17 State income tax |

18 Local wages, tips, etc. |

19 Local income tax |

20 Locality name |

|

NV |

|

987654321 |

193,645.00 |

0.00 |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

Wage and Tax |

2011 |

Department of the |

||||

Statement |

|

|

|

||||

Copy

This information is being furnished to the Internal Revenue Service.

APPENDIX C

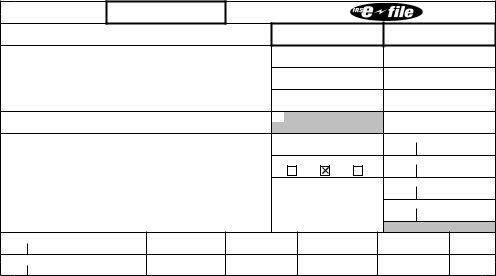

3.Jennifer received the following Form

a Employee’s social security number |

|

Safe, accurate, |

Visit the IRS website at |

OMB No. |

FAST! Use |

www.irs.gov/efile |

|

|

|

||

|

|

|

b Employer identification number (EIN) |

|

|

1 |

Wages, tips, other compensation |

2 Federal income tax withheld |

||||

|

|

|

|

36,825 |

|

|

|

5,524.00 |

|

|

|

|

|

|

|

|

|

||

c Employer’s name, address, and ZIP code |

|

3 |

Social security wages |

|

4 Social security tax withheld |

||||

Small World Elementary School |

|

|

|

39,825 |

|

|

|

1,672.65 |

|

333 Tiny Tot Lane |

|

|

5 |

Medicare wages and tips |

6 |

Medicare tax withheld |

|||

Henderson, NV 89053 |

|

|

|

|

39,825 |

|

|

|

577.46 |

|

|

|

7 |

Social security tips |

|

8 |

Allocated tips |

||

d Control number |

|

|

9 |

|

|

|

10 |

Dependent care benefits |

|

e Employee’s first name and initial |

Last name |

Suff. |

11 |

Nonqualified plans |

|

12a See instructions for box 12 |

|||

|

|

|

|

|

|

|

C |

|

|

Jennifer Hamilton |

|

|

|

|

|

|

o |

D |

3,000 |

|

|

|

|

|

|

ed |

|||

3678 Blue Sky Drive |

|

|

13 |

Statutory |

Retirement |

12b |

|

|

|

|

|

|

employee |

plan |

sick pay |

C |

|

|

|

Henderson, NV 89052 |

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

14 Other |

|

|

12c |

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

12d |

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

o |

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

e |

|

|

f Employee’s address and ZIP code |

|

|

|

|

|

|

|

|

|

15State

NV

Employer’s state ID number

123456789

16State wages, tips, etc.

36,825

17State income tax

0.00

18Local wages, tips, etc.

19Local income tax

20Locality name

Form |

Wage and Tax |

2011 |

Department of the |

Statement |

|

Copy

This information is being furnished to the Internal Revenue Service.

4.During 2011, Keith and Jennifer received $550 in interest from Las Vegas city bonds, $1,070 interest from U.S. Treasury bonds, and $65 from their savings account at SCD Credit Union. Keith and Jennifer are joint owners of the Las Vegas city bonds and the U.S. Treasury bonds. They have a joint savings account at SCD Credit Union.

5.On January 21, 2011, Jennifer was involved in a car accident. Because the other driver was at fault, the other drivers insurance company paid Jennifer $1,350 for medical expenses and $300 for emotional distress. She received payment on March 15, 2011.

6.Keiths father died on November 15, 2010. Keith received a $100,000 death benefit from his fathers life insurance policy on February 8, 2011.

7.On February 15, 2011, Keith hurt his arm on a family skiing trip in Utah and was unable to fly for two weeks. He received $4,000 for disability pay from his disability insurance policy. He received the check on March 2, 2011. The disability insurance policy premiums are paid for by Flyby Airlines as a fully taxable fringe benefit to Keith (the premiums paid on his behalf are included in Keiths compensation amount on his

8.Jennifers grandmother died on March 10, 2011, leaving Jennifer with an inheritance of $30,000. (She received the inheritance on May 12, 2011.) Flyby Airlines had space available on its Long Island, NY, flight and provided Keith, Jennifer, and their three children with free flights so they could attend the funeral. The value of the airfare was $5,284.

9.On April 1, 2011, Jennifer slipped in the Small World Elementary lunchroom, and injured her back. Jennifer received $1,200 in workers compensation bene- fits because her

She also received a $2,645 reimbursement for medical expenses from the health insurance company. Small World Elementary pays the premiums for Jennifers health insurance policy as a nontaxable fringe benefit.

Appendix C |

10.On May 17, 2011, Keith and Jennifer received a federal income tax refund of $975 from their 2010 federal income tax return.

11.On June 5, 2011, Keith and Jennifer sold their home in Henderson, NV, for $510,000 (net of commissions). Keith and Jennifer purchased the home eleven years ago for $470,000. On July 12, 2011, they bought a new home for $675,000.

12.On July 25, 2011, Keiths aunt Beatrice gave Keith $18,000 because she wanted to let everyone know that Keith is her favorite nephew.

13.On September 29, 2011, Jennifer won an iPad valued at $500 in a raffle at the annual fair held at Joshuas high school.

INDIVIDUAL TAX RETURN PROBLEM 3

Required:

•Use the following information to complete Rhonda Hills 2011 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps.

•The forms, schedules, and instructions can be found at the IRS

Web site (www.irs.gov). The instructions can be helpful in completing the forms.

Appendix C |

Facts:

1.Rhonda Hill (unmarried) is employed as an office manager at the main office of Carter and Associates CPA firm. Rhonda lives in a home she purchased

20 years ago. Rhondas older cousin Mabel Wright lives with Rhonda in the home. Mabel is retired and receives $2,400 of Social Security payments each year. Mabel is able to save this money because Rhonda provides all of Mabels support. Rhonda also provided the following information:

•Rhonda does not want to contribute to the presidential election campaign.

•Rhonda lives at 1234 Blue Ridge Way, Tulsa, OK 74101.

•Rhondas birthday is 12/18/1957 and her Social Security number is

•Mabels birthday is 11/2/1944 and her Social Security number is

•Rhonda does not have any foreign bank accounts or trusts.

2.Rhonda received a Form

• |

Line 1 Wages, tips, other compensation: |

$72,000 |

||

• Line 2 Federal income tax withheld: |

9,300 |

|||

• |

Line 3 |

Social Security wages: |

72,000 |

|

• |

Line 4 |

Social Security tax withheld: |

3,024 |

|

• Line 5 |

Medicare wages and tips: |

72,000 |

||

• Line 6 |

Medicare tax withheld: |

1,044 |

||

• |

Line 16 |

State wages, tips, etc.: |

72,000 |

|

• Line 17 |

State income tax: |

2,700 |

||

•Carter and Associates address is 1234 CPA Way Tulsa, OK 74101; its FEIN is 91:0001002; and its State ID number is 123456678

3.Rhonda received $250 in interest from Tulsa City bonds, $120 interest from IBM bonds, and $15 from her savings account at UCU Credit Union. She also received a $460 dividend from Huggies Company and $500 from Bicker Corpo- ration. Both dividends are qualified dividends.

4.Rhonda sold 200 shares of DM stock for $18 a share on June 15, 2011. She purchased the stock on December 12, 2006, for $10 a share. She also sold

50 shares of RSA stock for $15 a share on October 2, 2011. She purchased the stock for $65 a share on February 2, 2011. Stock basis amounts have been reported to the IRS.

5.The following is a record of the medical expense that Rhonda paid for herself during the year. The amounts reported are amounts she paid in excess of insur- ance reimbursements.

Insurance premiums |

$900 |

Prescription medications |

100 |

250 |

|

Doctor and dentist visits |

485 |

Eyeglasses |

300 |

Physical therapy |

200 |

6.Rhonda paid $2,800 in mortgage interest during the year to UCU credit union. She also paid $1,200 in real property taxes during the year.

7.Rhonda contributed $2,350 to Heavenly Church during the year. Heavenly Churchs address is 1342 Religion Way, Tulsa, OK 74101.