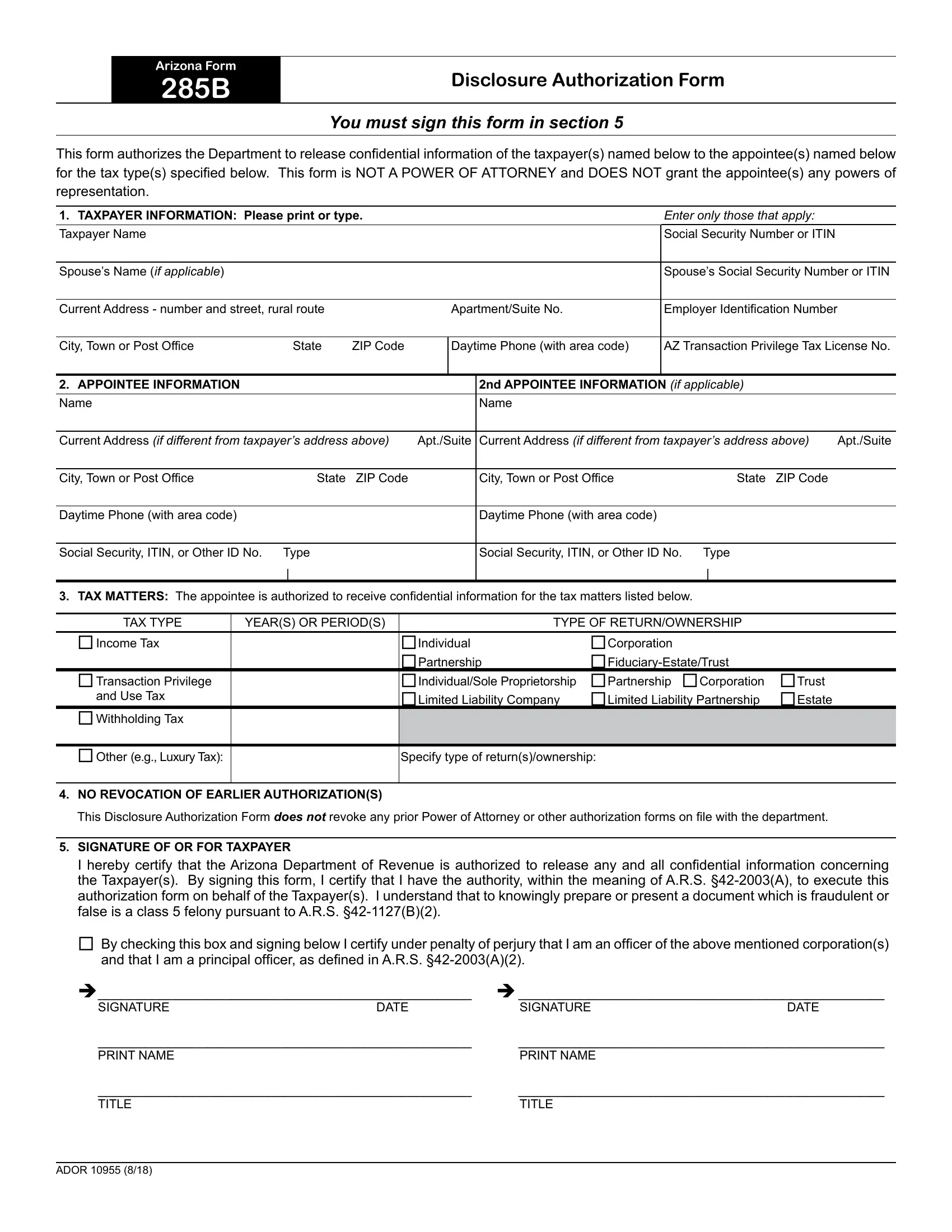

Through the online PDF editor by FormsPal, you'll be able to fill in or modify arizona form 285 pdf right here and now. To make our tool better and simpler to utilize, we continuously develop new features, with our users' feedback in mind. To get the ball rolling, consider these basic steps:

Step 1: Access the form inside our editor by clicking on the "Get Form Button" above on this page.

Step 2: As soon as you access the PDF editor, you'll see the form all set to be filled out. Other than filling in various blanks, you may also perform other sorts of actions with the PDF, such as putting on your own words, changing the initial text, inserting images, affixing your signature to the PDF, and a lot more.

Completing this PDF needs attention to detail. Make sure every single blank field is filled in correctly.

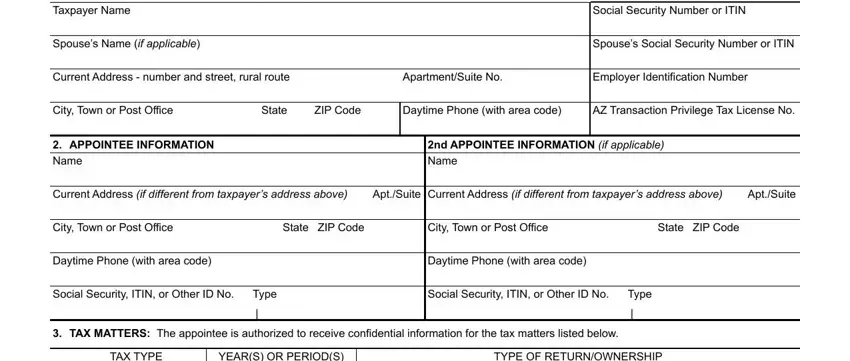

1. Begin filling out your arizona form 285 pdf with a group of essential blank fields. Get all the necessary information and be sure absolutely nothing is missed!

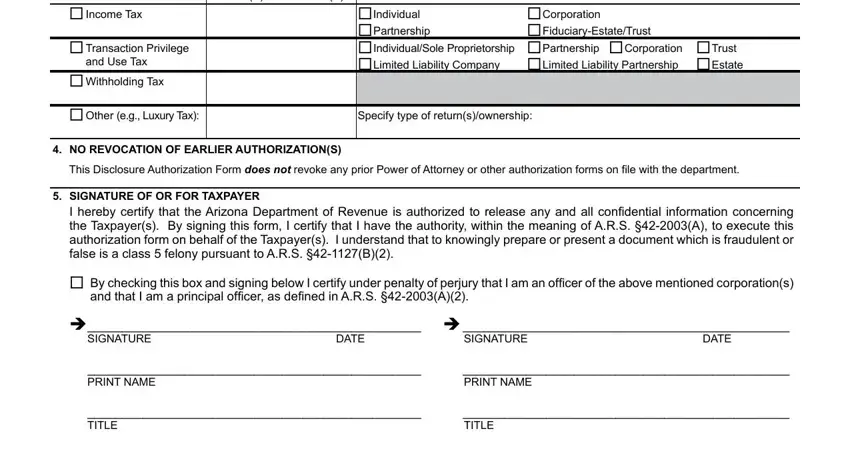

2. The subsequent step would be to fill in all of the following blank fields: TAX TYPE, YEARS OR PERIODS, TYPE OF RETURNOWNERSHIP, Income Tax, Transaction Privilege, and Use Tax, Withholding Tax, Other eg Luxury Tax, Individual Partnership , Corporation FiduciaryEstateTrust, Trust Estate, Specify type of returnsownership, NO REVOCATION OF EARLIER, This Disclosure Authorization Form, and SIGNATURE OF OR FOR TAXPAYER.

It is easy to make a mistake when completing your Specify type of returnsownership, hence be sure to take a second look before you'll finalize the form.

Step 3: Once you've looked over the information you filled in, click on "Done" to finalize your document creation. Acquire the arizona form 285 pdf after you sign up at FormsPal for a free trial. Instantly access the form from your personal cabinet, along with any edits and changes automatically kept! At FormsPal.com, we aim to ensure that all of your information is stored private.