The Arizona Joint Tax Application form stands as a comprehensive document for businesses to register for various tax responsibilities in the state of Arizona, including Transaction Privilege Tax (TPT), Withholding/Unemployment Tax, and Use Tax. This form serves as a conduit for businesses to establish their legal tax duties with the Department of Revenue and the Department of Economic Security, ensuring that all tax-related matters are properly handled from the start of a business operation. Besides the basic business information, ownership type, and an outline of the tax registration process, the form also delves into specifics such as employment information for withholding and unemployment tax purposes, indispensable for employers. Fees associated with the TPT are clearly laid out, distinguishing between state and city obligations, with an emphasis on compliance and correct fee calculation to avoid processing delays. Moreover, the form outlines the procedure for businesses acquiring existing businesses or applying for changes in ownership, highlighting the state's concern for maintaining up-to-date business records and the seamless continuation of tax responsibilities. The document underscores the importance of accuracy and completeness, as any omission or incorrect information can result in the return of the application, thereby delaying business operations. This meticulous approach demonstrates Arizona’s commitment to a structured and transparent tax administration system, facilitating businesses in their compliance endeavors.

| Question | Answer |

|---|---|

| Form Name | Arizona Joint Tax Application Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | az joint tax application fillable, DBA, joint tax application, arizona joint tax application online |

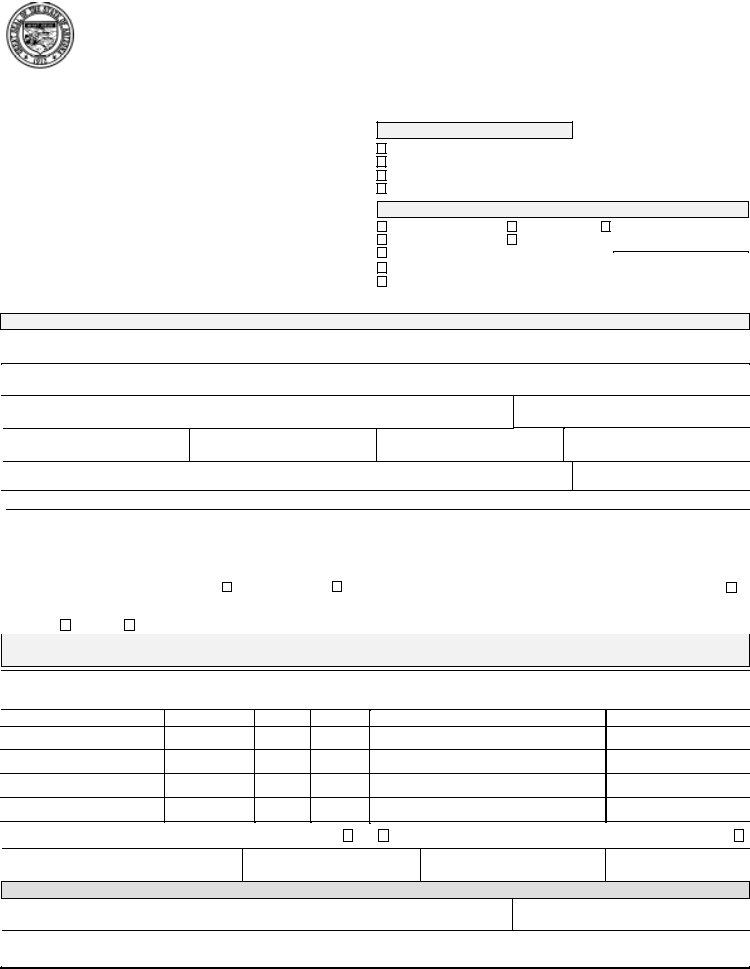

ARIZONA JOINT TAX APPLICATION

DEPT. OF REVENUE |

DEPT. OF ECONOMIC SECURITY |

|

PO BOX |

29069 |

PO BOX 6028 |

PHOENIX AZ |

PHOENIX AZ |

|

IMPORTANT: See attached instructions before completing this application. You must complete each section below or your application will be returned. For licensing questions on Transaction Privilege, Withholding or Use call (602)

I. LICENSE TYPE

Transaction Privilege Tax ( TPT )

Withholding/Unemployment Tax (if hiring employees)

Use Tax

TPT For Cities ONLY

II. TYPE OF OWNERSHIP OR EMPLOYING UNIT

Individual |

Association |

Partnership |

Trust |

Limited Liability Company

Other (Please Explain)

Corporation State of Inc._______ Date of Inc.____________

Sub Chapter S

* Tax exempt organizations must attach a copy of the Internal Revenue Service letter of determination.

III. BUSINESS INFORMATION

LEGAL BUSINESS

BUSINESS OR DBA NAME

MAILING ADDRESS (Street, Route No., or P.O. Box)

IN CARE OF

CITY

STATE

ZIP CODE

BUSINESS PHONE (Include Area Code)

PRIMARY LOCATION OF BUSINESS (Must be Physical Address) STREET, CITY, STATE, ZIP CODE

ARIZONA COUNTY

For additional locations, complete supplement form on reverse of instructions.

DESCRIPTION OF BUSINESS (INCLUDE TYPE OF MERCHANDISE SOLD OR TAXABLE ACTIVITY OR TYPE OF EMPLOYMENT)

|

|

|

|

|

|

|

DATE BUSINESS STARTED IN ARIZONA |

DATE SALES BEGAN |

|

DATE EMPLOYEES FIRST HIRED |

AVERAGE NO. OF EMPLOYEES |

||

|

|

|

|

|

|

|

TPT FILING METHOD: |

CASH RECEIPTS |

ACCRUAL |

DO YOU SELL NEW MOTOR VEHICLE TIRES OR VEHICLES? IF YES, CHECK HERE |

|||

|

|

|

|

|||

ARE YOU LIABLE FOR FEDERAL UNEMPLOYMENT TAX |

|

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FOR EMPLOYERS AND |

||||

|

|

|

|

|

CORPORATIONS) |

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

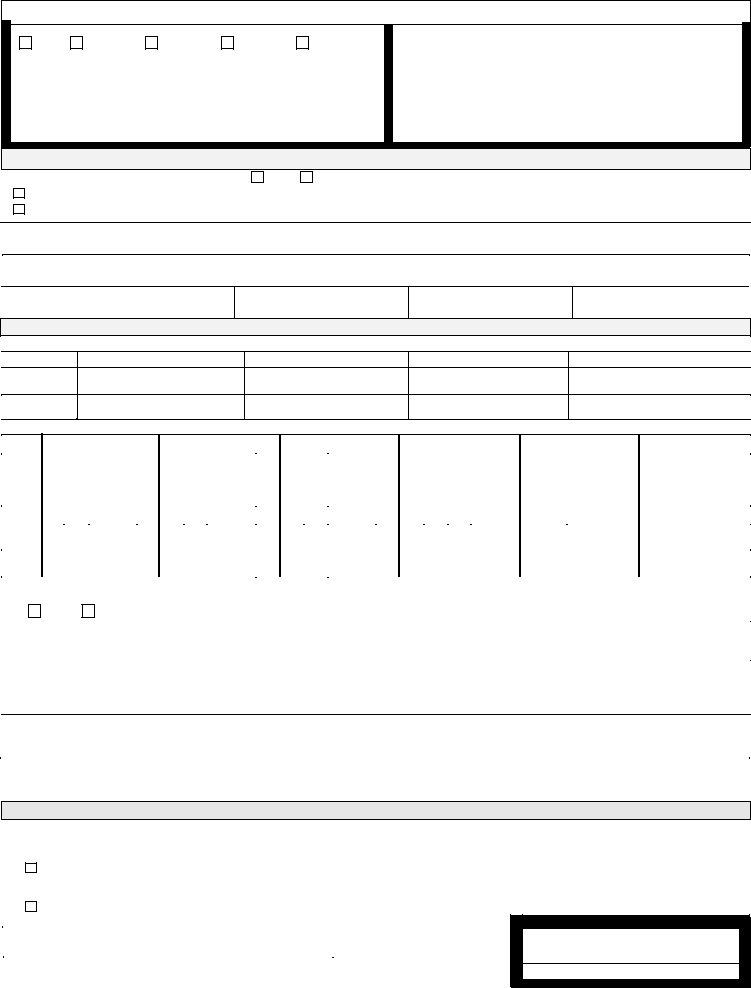

IV. IDENTIFICATION OF OWNER (AND SPOUSE IF MARRIED) PARTNERS, CORPORATE OFFICERS, OR OFFICIALS OF THIS EMPLOYING UNIT

The authority for mandatory requirement for Social Security Numbers is provided in A.A.C.

NAME |

SOC. SEC. NO. |

TITLE |

% OWNED |

COMPLETE RESIDENCE ADDRESS |

PHONE NUMBER |

(Area Code)

(Area Code)

(Area Code)

(Area Code)

Do you have or have you previously had an Arizona State Tax Number? Yes

No

If yes, fill in below and check here if you want to cancel the existing number

ENTER BUSINESS NAME

UNEMPLOYMENT NO.

WITHHOLDING NO.

TPT NO.

V. LOCATION OF TAX RECORDS (by whom and where your records are kept)

NAME OF COMPANY OR PERSON TO CONTACT

PHONE NUMBER (Include Area Code)

STREET NO., STREET NAME (Not P.O. Box or Route No.) CITY, STATE, ZIP CODE

THIS APPLICATION MUST BE COMPLETED, SIGNED, AND RETURNED AS PROVIDED BY ARS §

ADOR

DES |

THIS BOX FOR AGENCY USE ONLY |

DOR |

|

|

|

NEW |

CHANGE |

REVISE |

REOPEN |

SIC __________ |

ACCT NO ______________ CTY CD __________ LIAB __________ TLAPSE________ |

||||

START ___________________________ LIAB EST _______________________________ |

||||

REPORTS |

|

S/E DATE |

KP |

|

TPT _______________________________________________________________

W H _______________________________________________________________

CITIES ____________ ___________ ___________ ___________ ___________

VI. PREVIOUS OWNERS (complete if you are acquiring an existing business)

Did you acquire all or part of an existing business? No |

Yes |

If yes, indicate date ________________________________ and whether you acquired: |

ALL business operations and locations in Arizona. |

You will receive the unemployment tax rate of the business you acquired. |

|

PART of the business.To apply for a portion of the prior owner's unemployment tax rate call to obtain form

NAME OF PREVIOUS OWNER

PREVIOUS OWNER'S PRESENT ADDRESS

PREVIOUS OWNER'S CURRENT PHONE NO.

UNEMPLOYMENT NO.

WITHHOLDING NO.

TPT NO.

VII. EMPLOYMENT INFORMATION (complete only if applying for withholding/unemployment tax license)

Record of Arizona wages paid by calendar quarters for current and preceding calendar years.

YEAR

19

19

1ST QUARTER

2ND QUARTER

3RD QUARTER

4TH QUARTER

Weekly record of number of persons performing services in Arizona for current & preceding calendar year.

YEAR |

JANUARY |

FEBRUARY |

MARCH |

APRIL |

MAY |

JUNE |

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

JULY |

AUGUST |

SEPTEMBER |

OCTOBER |

NOVEMBER |

DECEMBER |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VIII. ARE INDIVIDUALS PERFORMING SERVICES THAT ARE EXCLUDED FROM WITHHOLDING OR UNEMPLOYMENT TAX? |

||||||||||||||||||||||||||

No |

Yes |

|

|

If yes, explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

IX. FEES FOR TRANSACTION PRIVILEGE TAX (no fee for withholding, use or unemployment) |

|

|

|

|

|

|

|

|

||||||||||||||||||

State Fees (# loc. x $12.00): |

City Fees (Total from Table): |

Total Fees: |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

X. SIGNATURE(S) required |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This application must be signed by either a sole owner, two partners, two corporate officers, the trustee, receiver or personal representative of an estate.

UNDER PENALTY OF PERJURY I (WE) DECLARE THAT THE INFORMATION ON THIS DOCUMENT IS TRUE AND CORRECT.

TYPE OR PRINT NAME |

TITLE |

SIGNATURE |

DATE |

|

|

|

|

TYPE OR PRINT NAME |

TITLE |

SIGNATURE |

DATE |

XI. VOLUNTARY ELECTION OF UNEMPLOYMENT TAX COVERAGE

The undersigned, on behalf of the employing unit, voluntarily elects beginning January 1 of the current calendar year or the date employment started if later, and continuing for not less than two full calendar years to:

A. Become an employer subject to Title 23, Chapter 4, Arizona Revised Statutes, to the same extent as all other employers and extend unemployment tax coverage to my employees although not mandatory.

B. Extend coverage to all employees performing services excluded from coverage as shown in Section IX above.

SIGNATURE/TITLE |

DATE |

|

|

ADOR |

UC - 001 |

AGENCY USE ONLY

APPROVED/DATE

INSTRUCTIONS FOR JOINT TAX APPLICATION

IMPORTANT: You must complete each of the following sections or your application will be returned

USE THIS APPLICATION TO:

· |

License New Business: |

A new business |

|

with no previous owners. |

|

· |

Change Ownership: |

If purchasing an |

|

existing business or changing business |

|

|

entity (sole owner to corporation, etc.). |

|

|

If you need to update a license, add a |

|

|

business location, or make other |

|

|

changes: Request an update card or |

|

|

provide a written notification of the change |

|

|

(a form is not necessary). Please include |

|

Many of the larger cities in Arizona |

IV. IDENTIFICATION OF OWNER(S) |

|||

administer and collect their own privilege |

Enter as many as applicable; attach a |

|||

taxes. Please contact those cities directly to |

separate sheet if additional space is needed. |

|||

obtain |

information |

about licensing |

V. LOCATION OF TAX RECORDS |

|

requirements. |

|

|||

II. TYPE OF OWNERSHIP OR |

Complete as indicated. |

|||

VI. PREVIOUS OWNERS |

||||

EMPLOYMENT UNIT |

|

|||

Check |

as applicable. |

Corporation must |

Complete this section if you acquired an |

|

provide the state and date of incorporation. |

existing business. |

|||

fees of $12 per location plus applicable city |

fee(s). |

I.LICENSE TYPE

Transaction Privilege Tax (TPT): Anyone involved in an activity taxable under the TPT statutes must apply for a TPT License before engaging in business.

·For TPT, you are required to obtain a separate license for each business or rental location. This may be accomplished in one of the following ways:

·Each location may be licensed as a separate business with a separate license number for purpose of reporting sales and use taxes individually. Therefore a separate application is needed for each location.

Multiple locations may be licensed under a consolidated license number, provided the ownership is the same, to allow filing of a single tax return. If applying for a new license, list the various business locations as instructed below. If already licensed and you are adding locations, do not use this application to consolidate an existing license. Request on update form.

Please Note: Applicants in the construction contracting business may be required to submit bonds for TPT tax before a transaction privilege license is issued. The amount of bond required is based on the type of construction performed. Please see the Department of Revenue Taxpayer Bonds brochure for more information.

In addition, bonds are required for new license holders for construction contracts over $50,000, before building permits can be issued. TPT license holders who are delinquent in payment of tax or returns are also subject to bonding.

Withholding & Unemployment Taxes: Employers paying wages or salaries to employees for services performed in the State must apply for a Withholding number & Unemployment number.

Use Tax:

TPT for cities only: This type of license is needed if your business activity is subject to city TPT that is collected by the state, but the activity is not taxed at the state level.

III.BUSINESS INFORMATION

·Enter the Legal Business Name of the Owner or Employing Unit (Name of corporation as listed in its articles of incorporation, or individual & spouse, or partners, or organization owning or controlling the business).

·Enter the name of the Business/DBA (doing business as) name, if same as above, enter "same."

·Enter mailing address where all correspondence is to be sent. You may use

your home address, corporate headquarters, or accounting firm's address, etc. If mailing addresses differ for licenses (for instance withholding and unemployment insurance), please use cover letter to explain.

·If you wish correspondence to be sent to a name other than the owner, enter the name of the department or accountancy firm in the "In care of" box to ensure delivery by the postal service.

·Enter the street address for the primary location(s) of the business. For additional

business location(s) complete the supplemental form on the reverse side of the instructions.

·Describe the major business activity:

principal product you manufacture, commodity sold, or services performed. Your description of the business is very important because it determines your transaction privilege tax rate and provides a basis for state economic forecasting.

·Enter the date the business started in Arizona.

·Enter the date sales began in Arizona.

·Enter the date employees were first hired in Arizona and the average number of employees.

·Cash/Accrual Methods: Cash method requires the payment of tax based on sales receipts actually received during the period covered on the tax return. When filing under the accrual method, the tax is calculated on the sales billed rather than receipts.

·Sellers of new motor vehicles and motor vehicle tires in the state, for

·Indicate whether you are liable for FUTA

and enter your Federal Employer Identification number.

·Taxpayers are required to provide their taxpayer identification number (TIN) on all returns and documents. A TIN is defined as the federal employer identification number (EIN), or social security number (SSN) depending upon how income tax is reported. Employers must provide their federal EIN. A penalty of $5 will be assessed for each document filed without a TIN.

VII. EMPLOYMENT INFORMATION

Enter total gross wages paid for each quarter the business has operated. Enter the number of persons performing services each week the business operated.

VIII. COMPLETE AS APPLICABLE

IX. FEES

There are no fees for Withholding, Unemployment, or Use Tax registrations. To calculate the fees for TPT ($12) licenses, calculate the State fees by multiplying the number of locations in the state by $12. To calculate the city(ies) fee, use the table on the reverse of instructions. First, indicate the number of businesses or physical locations for each of the cities for which the Department of Revenue licenses and collects. Then multiply by the city fee for each city in which you will do business. Add the columns to determine the total city fees. Fill in the totals for state fees and city fees on the application form and total to determine the amount due. Make checks payable to the Arizona Department of

Revenue. Be sure to return the instruction/fees sheet with your application.

To obtain licensing for cities not listed on the form, please contact the city directly.

X.SIGNATURES

The application must be signed only by individuals legally responsible for the business, not agents or representatives.

XI. VOLUNTARY ELECTION OF UN- EMPLOYMENT TAX COVERAGE

Complete and sign this portion of the application ONLY if you wish to provide unemployment coverage to your employees, and you believe you are not REQUIRED to provide coverage. Refer to "A Guide to Arizona Employment Tax Requirements" or "Employers' Handbook" for requirements.

ADOR

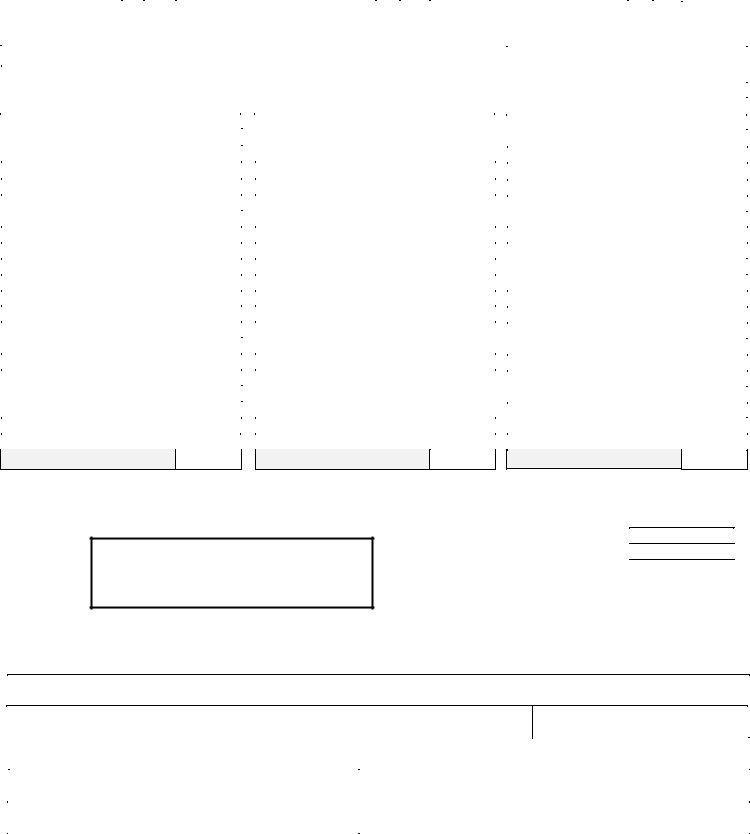

CITIES OR TOWNS LICENSED BY THE STATE

|

C |

F |

TOTAL |

|

|

C |

F |

TOTAL |

|

|

C |

F |

TOTAL |

|

O |

|

|

O |

|

|

O |

||||||

CITY/TOWN |

E |

FEES |

|

CITY/TOWN |

E |

FEES |

|

CITY/TOWN |

E |

||||

D |

|

D |

|

D |

FEES |

||||||||

|

E |

|

|

|

E |

|

|

|

E |

||||

|

E |

|

|

|

E |

|

|

|

E |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

APACHE JUNCTION |

AJ |

2.00 |

|

|

GLOBE |

GL |

2.00 |

|

|

SAFFORD |

SF |

2.00 |

|

BENSON |

BS |

5.00 |

|

|

GOODYEAR |

GY |

5.00 |

|

|

SAHUARITA |

SA |

5.00 |

|

BISBEE |

BB |

1.00 |

|

|

GUADALUPE |

GU |

2.00 |

|

|

SAN LUIS |

SU |

2.00 |

|

BUCKEYE |

BE |

2.00 |

|

|

HAYDEN |

HY |

5.00 |

|

|

SEDONA |

SE |

2.00 |

|

BULLHEAD CITY |

BH |

2.00 |

|

|

HOLBROOK |

HB |

1.00 |

|

|

SHOW LOW |

SL |

2.00 |

|

CAMP VERDE |

CE |

2.00 |

|

|

HUACHUCA CITY |

HC |

2.00 |

|

|

SIERRA VISTA |

SR |

1.00 |

|

CAREFREE |

CA |

10.00 |

|

|

JEROME |

JO |

2.00 |

|

|

SNOWFLAKE |

SN |

2.00 |

|

CASA GRANDE |

CG |

2.00 |

|

|

KEARNY |

KN |

2.00 |

|

|

SOMERTON |

SO |

2.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAVE CREEK |

CK |

20.00 |

|

|

KINGMAN |

KM |

2.00 |

|

|

SOUTH TUCSON |

ST |

2.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHINO VALLEY |

CV |

2.00 |

|

|

LAKE HAVASU |

LH |

5.00 |

|

|

SPRINGERVILLE |

SV |

5.00 |

|

CLARKDALE |

CD |

2.00 |

|

|

LITCHFIELD PARK |

LP |

2.00 |

|

|

ST. JOHNS |

SJ |

2.00 |

|

CLIFTON |

CF |

2.00 |

|

|

MAMMOTH |

MH |

2.00 |

|

|

SUPERIOR |

SI |

2.00 |

|

COLORADO CITY |

CC |

2.00 |

|

|

MARANA |

MA |

5.00 |

|

|

SURPRISE |

SP |

10.00 |

|

COOLIDGE |

CL |

2.00 |

|

|

MIAMI |

MM |

2.00 |

|

|

TAYLOR |

TL |

2.00 |

|

COTTONWOOD |

CW |

2.00 |

|

|

ORO VALLEY |

OR |

12.00 |

|

|

THATCHER |

TC |

2.00 |

|

DOUGLAS |

DL |

5.00 |

|

|

PAGE |

PG |

2.00 |

|

|

TOLLESON |

TN |

2.00 |

|

DUNCAN |

DC |

2.00 |

|

|

PARADISE VALLEY |

PV |

2.00 |

|

|

TOMBSTONE |

TS |

1.00 |

|

EAGAR |

EG |

10.00 |

|

|

PARKER |

PK |

2.00 |

|

|

WELLTON |

WT |

2.00 |

|

EL MIRAGE |

EM |

2.00 |

|

|

PAYSON |

PS |

2.00 |

|

|

WICKENBURG |

WB |

2.00 |

|

ELOY |

EL |

10.00 |

|

|

PIMA |

PM |

2.00 |

|

|

WILLCOX |

WC |

1.00 |

|

FLORENCE |

FL |

2.00 |

|

|

PINETOP/LAKESIDE |

PP |

2.00 |

|

|

WILLIAMS |

WL |

2.00 |

|

FOUNTAIN HILLS |

FH |

2.00 |

|

|

PRESCOTT VALLEY |

PL |

2.00 |

|

|

WINKELMAN |

WM |

2.00 |

|

FREDONIA |

FD |

10.00 |

|

|

QUARTZSITE |

QZ |

2.00 |

|

|

WINSLOW |

WS |

10.00 |

|

GILA BEND |

GI |

2.00 |

|

|

QUEEN CREEK |

QC |

2.00 |

|

|

YOUNGTOWN |

YT |

10.00 |

|

GILBERT |

GB |

2.00 |

|

|

|

|

|

|

|

YUMA |

YM |

2.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

TOTAL

TOTAL

FOR CITIES NOT LISTED, PLEASE CONTACT THE CITY DIRECTLY

PLEASE NOTE:

City fees are subject to change occasionally.

You will be billed for the difference.

Total of City Fees: State Fees $12.00 x No. Loc.:

TOTAL FEES:

FOR ADDITIONAL LOCATIONS, COMPLETE THE FOLLOWING:

Name Doing Business As at this Location

Physical Location (not P.O. Box or Rte. No.)

Telephone No.

|

City |

County |

State |

ZIP Code |

|

Avg. No. of Employees |

|

|

|

|

|

|

|

|

|

|

Name Doing Business As at this Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Physical Location (not P.O. Box or Rte. No.) |

|

|

|

Telephone No. |

|

||

|

|

|

|

|

|

|

|

|

City |

County |

State |

ZIP Code |

|

Avg. No. of Employees |

|

|

|

|

|

|

|

|

|

If more space is needed, please attach additional sheet.

ADOR