You are able to complete lsu form arizona instantly by using our online PDF tool. In order to make our editor better and more convenient to utilize, we consistently come up with new features, taking into consideration feedback from our users. Getting underway is simple! All that you should do is stick to the following simple steps down below:

Step 1: Simply click the "Get Form Button" in the top section of this webpage to see our pdf file editing tool. There you'll find everything that is necessary to work with your document.

Step 2: This tool provides the opportunity to customize your PDF in many different ways. Modify it with any text, adjust existing content, and include a signature - all at your fingertips!

Be attentive when filling out this pdf. Make sure that every blank is done correctly.

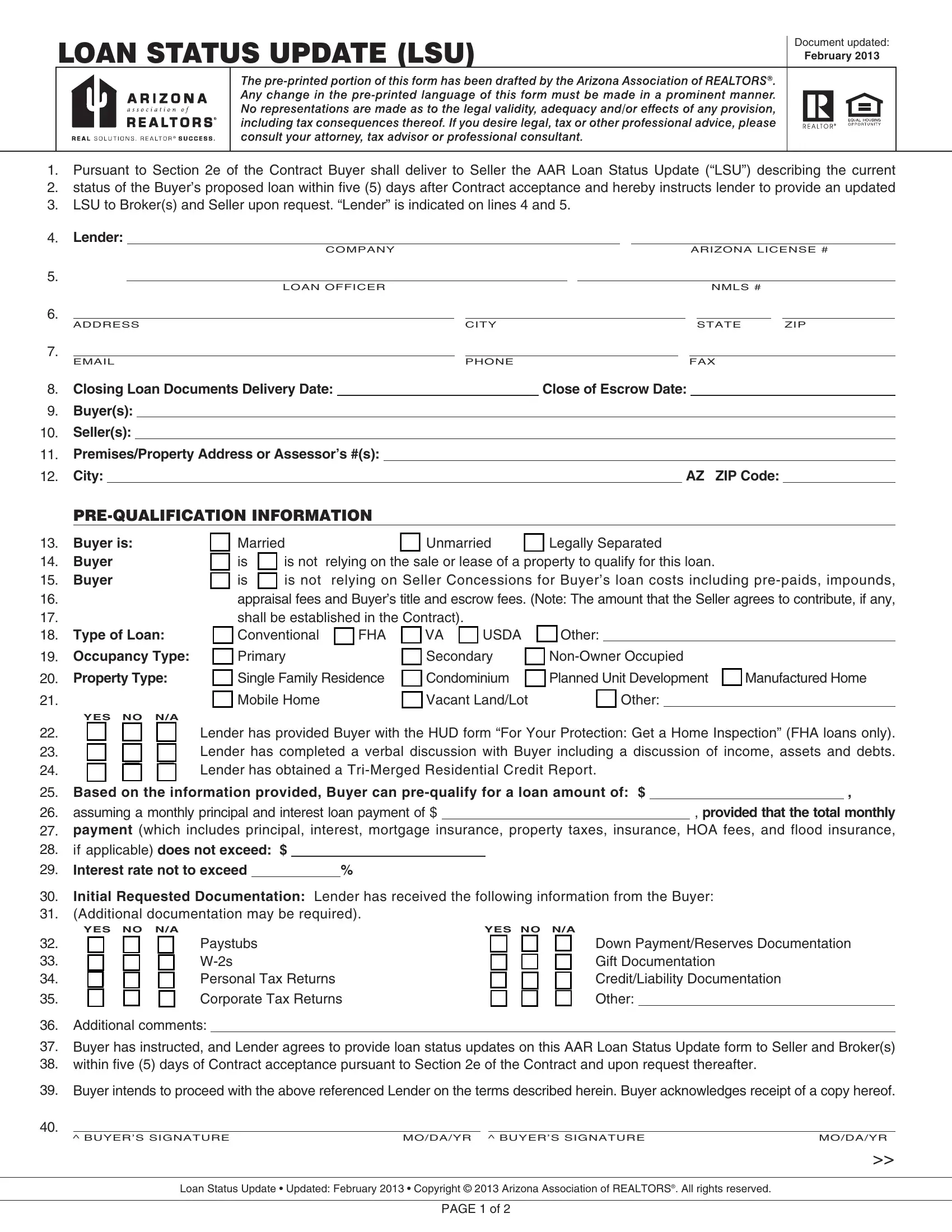

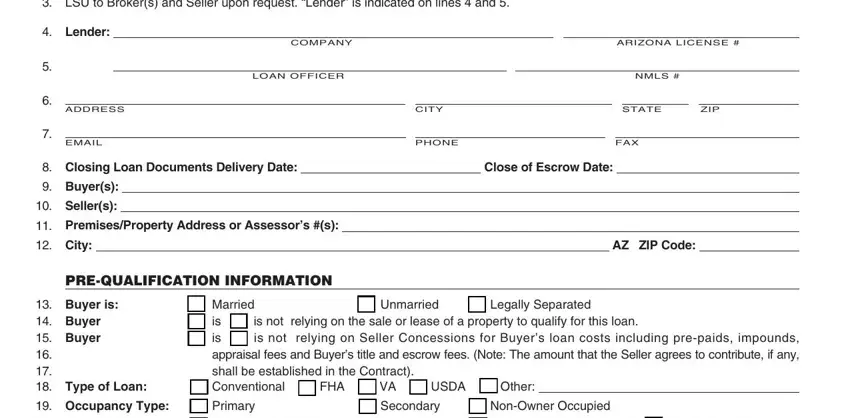

1. Complete the lsu form arizona with a selection of major fields. Get all the required information and be sure not a single thing missed!

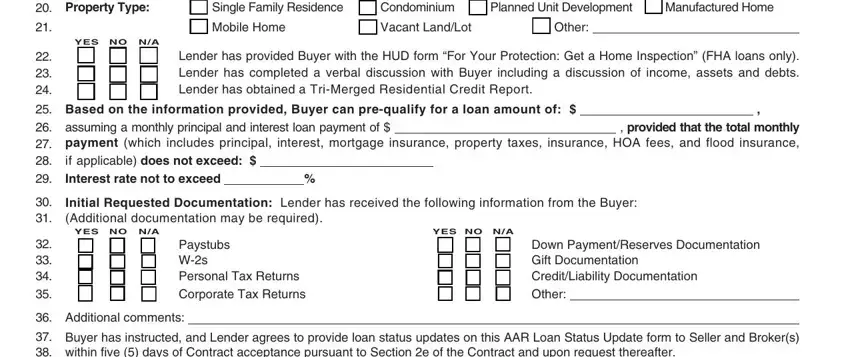

2. Now that the last part is done, you're ready insert the required particulars in Property Type, n Single Family Residence n, n Vacant LandLot n Other, YES NO NA n n n Lender has, Based on the information provided, Initial Requested Documentation, YES NO NA n n n Paystubs n n n Ws, YES NO NA n n n Down, Additional comments, and Buyer has instructed and Lender so you're able to move forward to the third step.

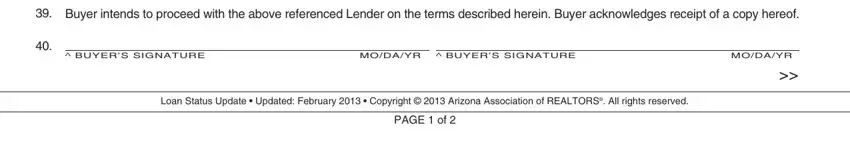

3. The following segment is relatively simple, Buyer intends to proceed with the, BUYERS SIGNATURE, MODAYR BUYERS SIGNATURE, MODAYR, Loan Status Update Updated, and PAGE of - every one of these empty fields must be completed here.

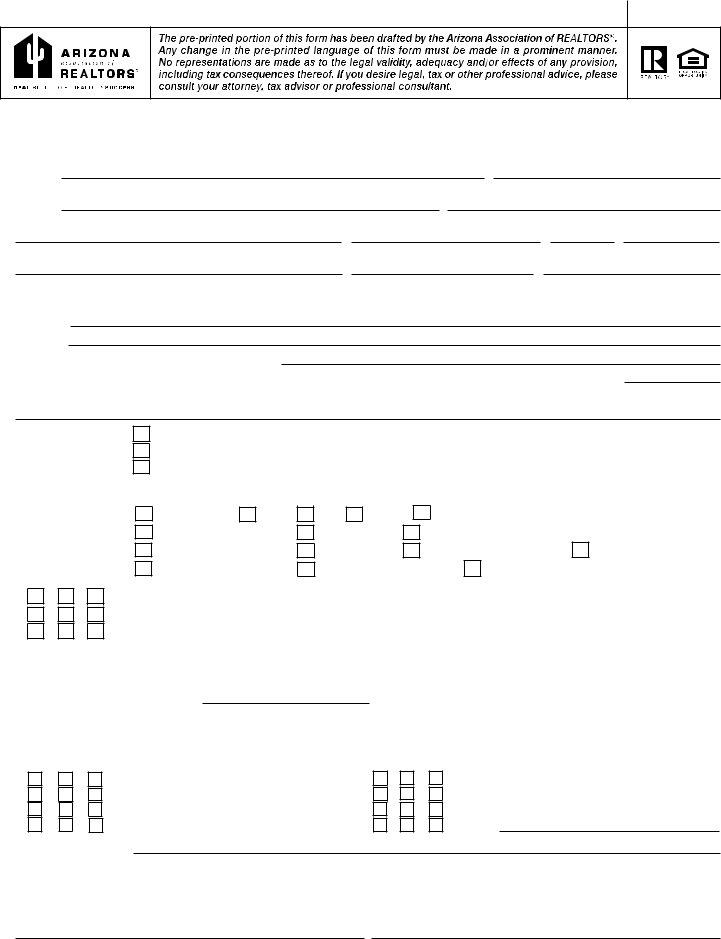

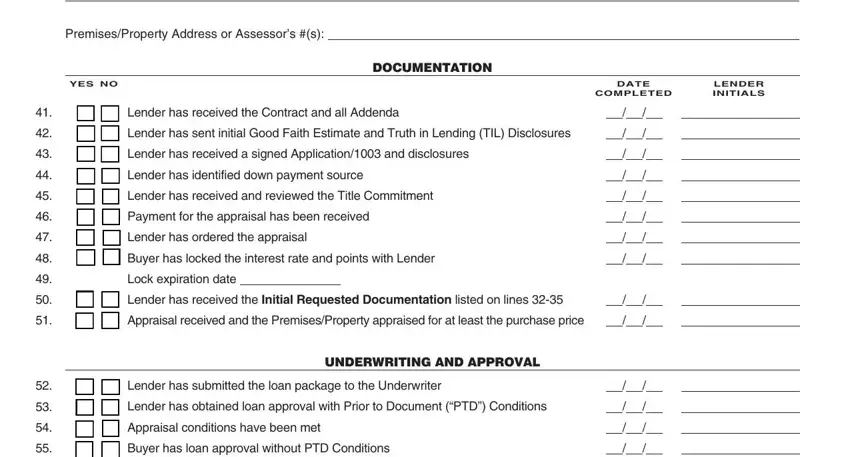

4. This fourth section arrives with the next few blanks to complete: Loan Status Update LSU , PremisesProperty Address or, YES NO, n n Lender has received the, DATE, COMPLETED, LENDER INITIALS, n n Lender has sent initial Good, DOCUMENTATION, n n Lender has received a signed, n n Lender has identified down, n n Lender has received and, n n Payment for the appraisal has, n n Lender has ordered the, and n n Buyer has locked the interest.

It is possible to make errors while filling out the n n Payment for the appraisal has, so be sure to reread it prior to deciding to send it in.

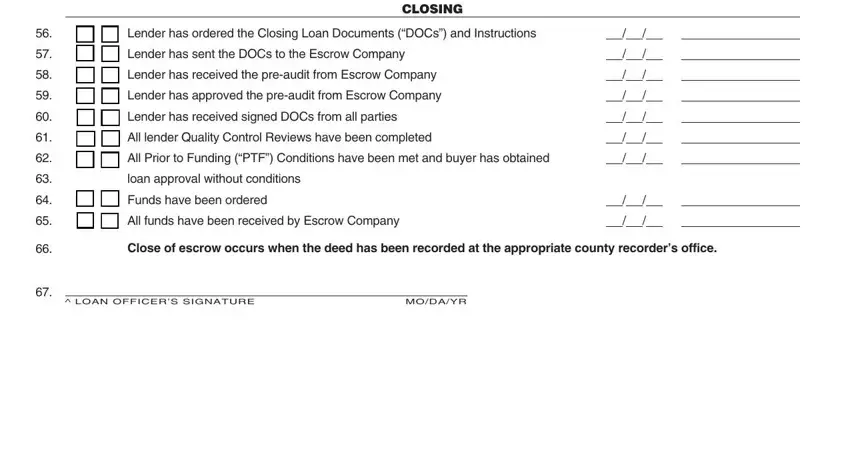

5. To finish your document, this last segment features a couple of additional blank fields. Completing n n Lender has ordered the Closing, CLOSING, n n Lender has sent the DOCs to, n n Lender has received the, n n Lender has approved the, n n Lender has received signed, n n All lender Quality Control, n n All Prior to Funding PTF, loan approval without conditions, n n Funds have been ordered, n n All funds have been received, Close of escrow occurs when the, LOAN OFFICERS SIGNATURE, and MODAYR should finalize the process and you will be done in a snap!

Step 3: Go through the information you have inserted in the blank fields and then press the "Done" button. After getting a7-day free trial account at FormsPal, you'll be able to download lsu form arizona or send it via email without delay. The document will also be available through your personal account with your every modification. If you use FormsPal, it is simple to complete forms without worrying about database incidents or records being distributed. Our secure platform ensures that your personal data is stored safely.