Dealing with PDF files online is simple using our PDF tool. You can fill in Arizona Tax Return Form here effortlessly. We at FormsPal are aimed at providing you the ideal experience with our editor by constantly adding new features and enhancements. With these improvements, using our editor gets easier than ever before! Starting is easy! What you need to do is stick to the following simple steps directly below:

Step 1: Press the "Get Form" button in the top part of this page to get into our PDF editor.

Step 2: As soon as you access the tool, you will find the document made ready to be filled out. Aside from filling out various fields, you could also do various other actions with the form, including writing custom textual content, modifying the original textual content, inserting images, placing your signature to the document, and more.

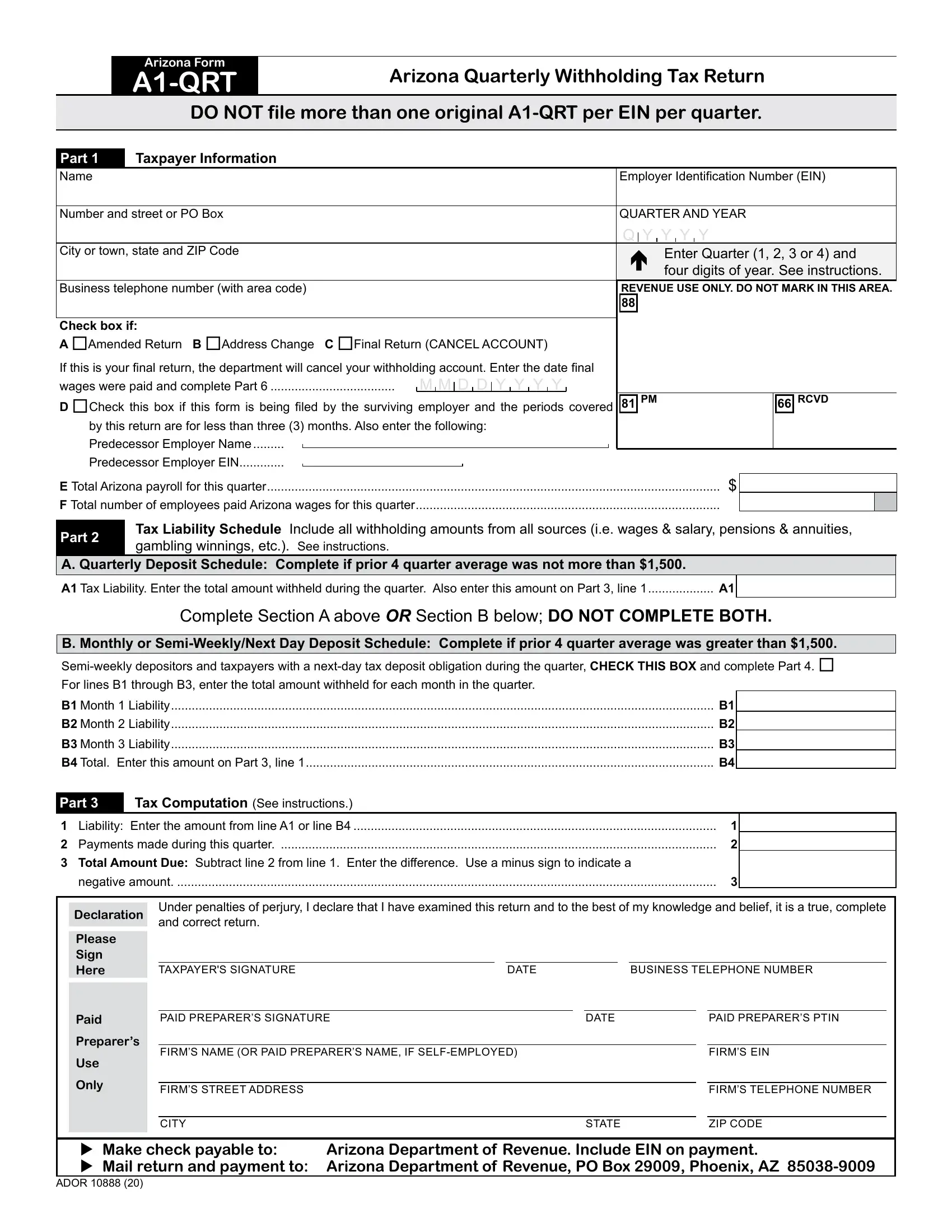

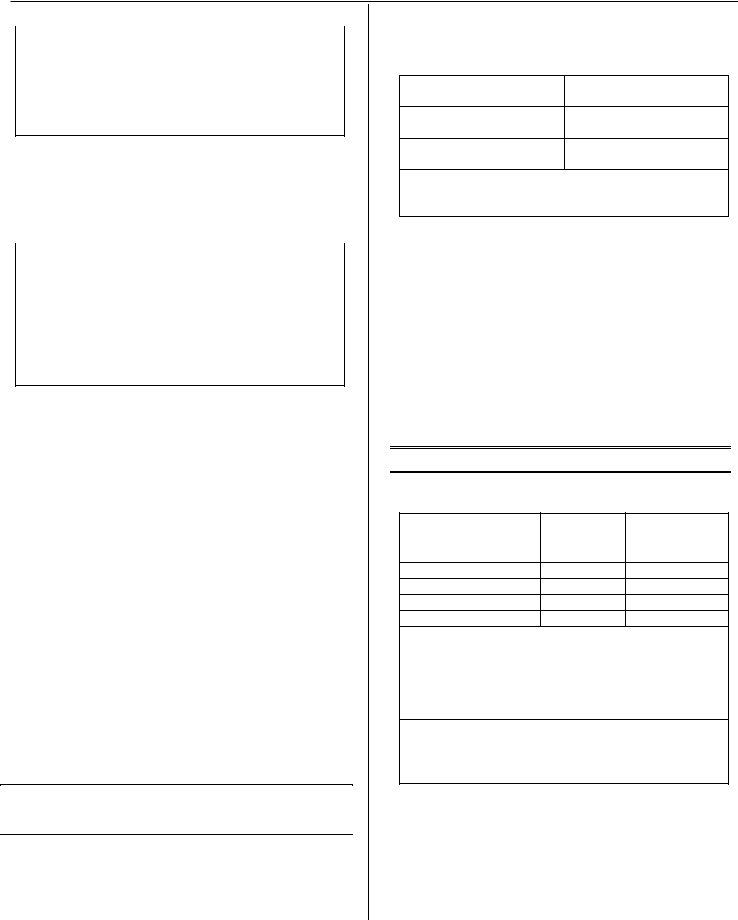

This PDF will need particular data to be entered, hence you must take whatever time to provide what is required:

1. For starters, while filling in the Arizona Tax Return Form, start in the page that features the following blank fields:

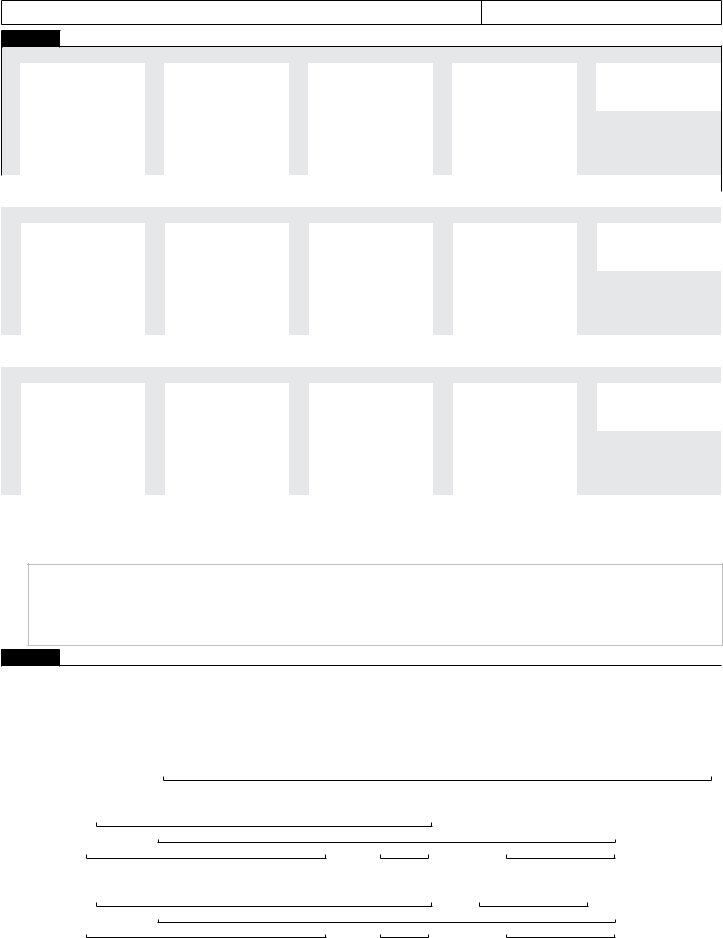

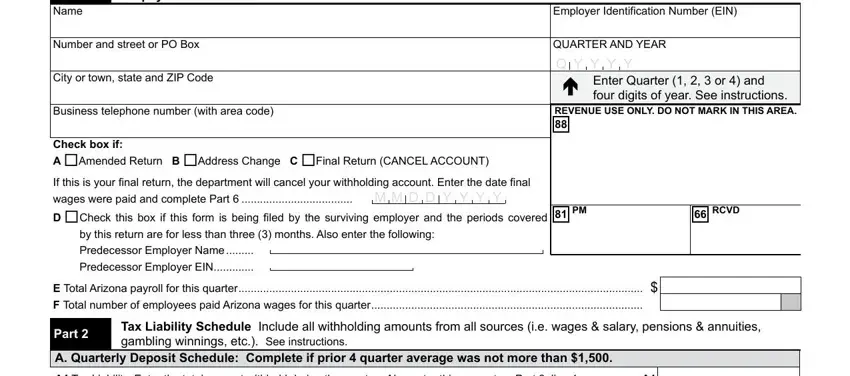

2. Now that the last section is completed, it is time to put in the required details in B Monthly or SemiWeeklyNext Day, B Month Liability B, B Month Liability B, B Month Liability B, B Total Enter this amount on Part , Part , Tax Computation See instructions, Liability Enter the amount from, Payments made during this quarter, negative amount , Declaration, Under penalties of perjury I, Please Sign Here, Paid, and TAXPAYERS SIGNATURE so you're able to move forward further.

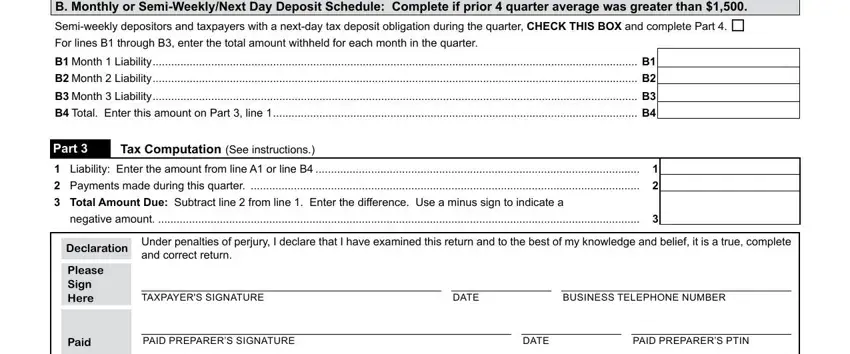

3. Your next part is generally straightforward - complete every one of the fields in Preparers, Use, Only, FIRMS NAME OR PAID PREPARERS NAME, FIRMS EIN, FIRMS STREET ADDRESS, FIRMS TELEPHONE NUMBER, CITY, STATE, ZIP CODE, Make check payable to Mail, Arizona Department of Revenue, and ADOR to conclude this part.

When it comes to FIRMS EIN and Preparers, be sure you review things in this current part. Both of these are the most important fields in this form.

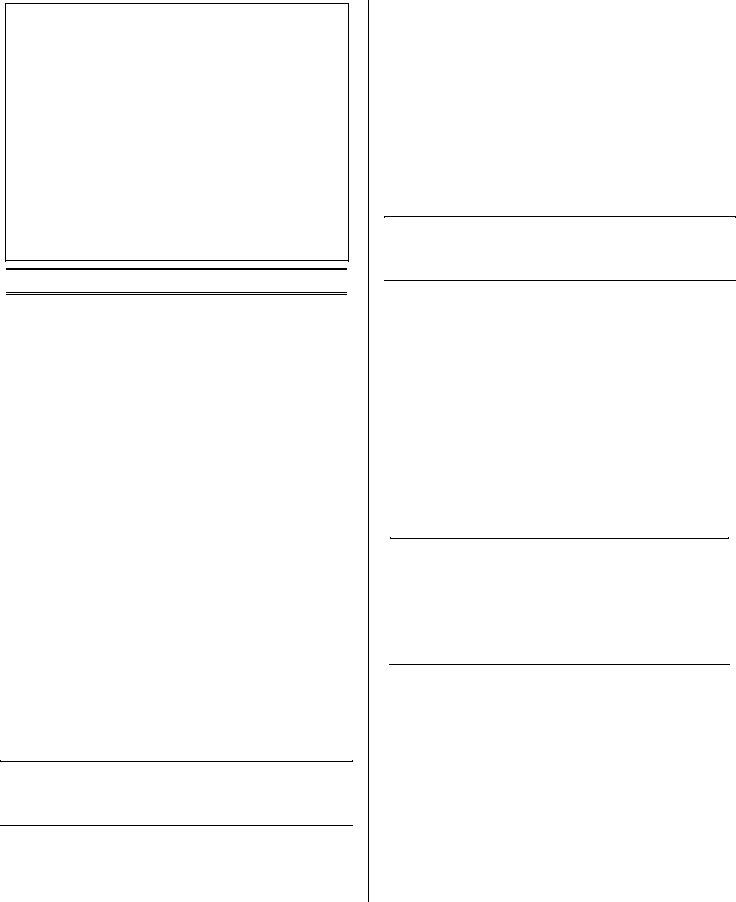

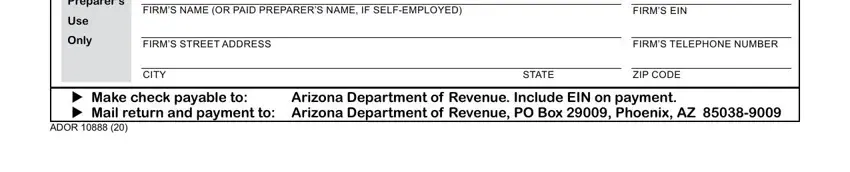

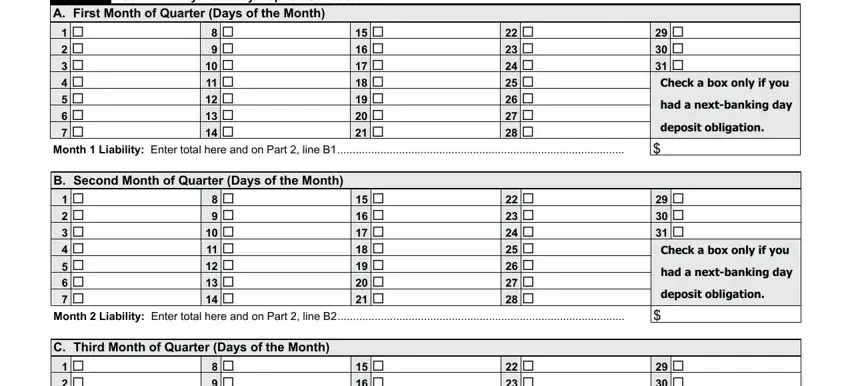

4. The fourth section comes with the following blanks to look at: Part A First Month of Quarter, SemiWeeklyNext Day Deposit Schedule, Check a box only if you, had a nextbanking day, deposit obligation, Month Liability Enter total here, B Second Month of Quarter Days of, Check a box only if you, had a nextbanking day, deposit obligation, Month Liability Enter total here, C Third Month of Quarter Days of, and Check a box only if you.

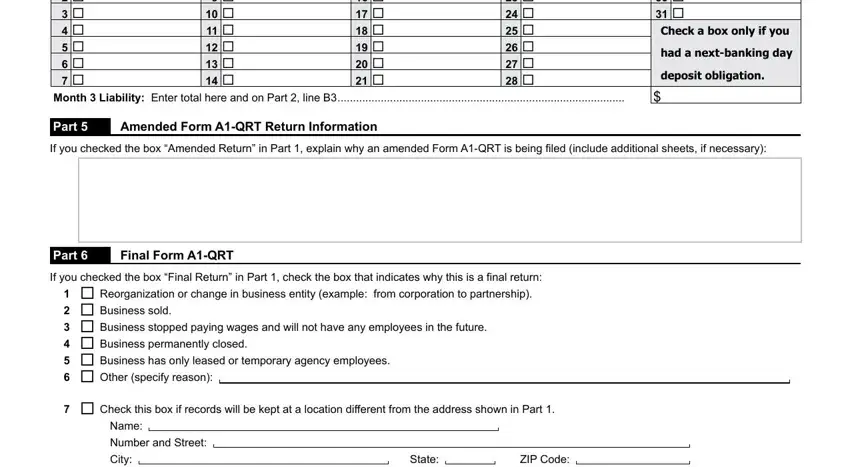

5. This final notch to submit this form is critical. Be sure to fill out the mandatory fields, which includes Check a box only if you, had a nextbanking day, deposit obligation, Month Liability Enter total here, Part , Amended Form AQRT Return, If you checked the box Amended, Part , Final Form AQRT, If you checked the box Final, Check this box if records will, Name, Number and Street, City, and State, prior to finalizing. In any other case, it might result in an unfinished and possibly unacceptable paper!

Step 3: Soon after looking through your form fields you've filled in, press "Done" and you are done and dusted! Right after registering afree trial account here, you'll be able to download Arizona Tax Return Form or send it via email at once. The PDF document will also be readily available from your personal account menu with your each modification. At FormsPal.com, we aim to make certain that your details are kept private.