“AS IS” Residential Contract For Sale And Purchase

THIS FORM HAS BEEN APPROVED BY THE FLORIDA REALTORS AND THE FLORIDA BAR

1* PARTIES: ______________________________________________________________________________ (“Seller),

2* and ___________________________________________________________________________________ (“Buyer”),

3agree that Seller shall sell and Buyer shall buy the following described Reel Property and Personal Property

4(collectively “Property”) pursuant to the terms and conditions of this AS IS Residential Contract For Sale And Purchase and

5 any riders and addenda (“Contract"):

6 1. PROPERTY DESCRIPTION:

7* |

(a) |

Street address, city, zip: _______________________________________________________________________ |

8* |

(b) |

Property is located in: _______________County, Florida. Real Property Tax ID No.: ________________________ |

9* |

(c) |

Real Property: The legal description is ____________________________________________________________ |

10___________________________________________________________________________________________

11___________________________________________________________________________________________

12together with all existing improvements and fixtures, including built-in appliances, built-in furnishings and attached

13wall-to-wall carpeting and flooring (“Real Property”) unless specifically excluded in Paragraph 1(e) or by other terms

15(d) Personal Property: Unless excluded in Paragraph 1(e) or by other terms of this Contract, the following items which

16are owned by Seller and existing on the Property as of the date of the initial offer are included in the purchase

17range(s)/(oven(s), refrigerator(s), dishwasher(s), disposal, ceiling fan(s), intercom, light fixture(s), drapery rods and

18draperies, blinds, window treatments, smoke detector(s), garage door opener(s), security gate and other access

19devices, and storm shutters/panels (“Personal Property”).

20* |

Other items included in this purchase are:__________________________________________________________ |

21___________________________________________________________________________________________

22Personal Property is included in the Purchase Price, has no contributory value, and shall be left for the Buyer.

23* |

(e) The following items are excluded from the purchase: _________________________________________________ |

24___________________________________________________________________________________________

25 |

|

PURCHASE PRICE AND CLOSING |

|

26* |

2. |

PURCHASE PRICE (U.S. currency): ……………………………….………………………………… |

$_______________ |

27* |

|

(a) Initial deposit to be held in escrow in the amount of (checks subject to COLLECTION) … |

$_______________ |

28The initial deposit made payable and delivered to "Escrow Agent”, named below

29* |

(CHECK ONE): (i) ! accompanies offer or (ii) ! is to be made within ________(if left blank, |

30then 3) days after Effective Date. IF NEITHER BOX IS CHECKED, THEN OPTION (ii)

31SHALL BE DEEMED SELECTED

32* |

Escrow Agent Information: Name: _________________________________________________ |

33* |

Address______________________________________________________________________ |

34* |

Phone: _______________E-mail: _______________________________Fax: ______________ |

35* |

(b) Additional deposit to be delivered to Escrow Agent within _______________ (if left blank, then 10) |

36* |

days after Effective Date……………………………………………………………………….…….. $_______________ |

37(All deposits paid or agreed to be paid, are collectively referred to as the “Deposit”)

38* |

(c) |

Financing: Express as a dollar amount or percentage ("Loan Amount") see Paragraph 8 …… _______________ |

39* |

(d) |

Other:_________________________________________________________________ |

$_______________ |

40(e) Balance to close (not Including Buyer’s closing costs. prepaids and prorations) by wire

41* |

transfer or COLLECTED funds……………………………………………………………………. $_______________ |

42NOTE: For the definition of “COLLECTION” OR “COLLECTED” see STANDRD S.

433. TIME FOR ACCEPTANCE OF OFFER AND COUNTER-OFFERS; EFFECTIVE DATE:

44* |

(a) If not signed by Buyer and Seller, and an executed copy delivered to all parties on or before _______________ |

45* |

___________________________, this offer shall be deemed withdrawn and the Deposit, if any, shall be returned to |

46Buyer. Unless otherwise stated, time for acceptance of any counter-offers shall be within 2 days after the day the

47counter-offer is delivered.

48(b) The effective date of this Contract shall be the date when the last one of the Buyer and Seller has signed or initialed

49and delivered this offer or final counter-offer (“Effective Date”).

504. CLOSING DATE: Unless modified by other provisions of this Contract, the closing of this transaction shall occur and

51the closing documents required to be furnished by each party pursuant to this Contract shall be delivered (“Closing")

52* |

on ____________________________________________ (“Closing Date”), at the time established by the Closing Agent. |

535. EXTENSION OF CLOSING DATE:

54(a) If Closing funds from Buyers lender(s) are not available al time of Closing due to Truth In Lending Act (TILA) notice

55requirements, Closing shall be extended for such period necessary to satisfy TILA notice requirements, not to

56exceed 7 days.

Buyer’s Initials __________ __________ |

Page 1 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

57(b) if extreme weather or other condition or event constituting “Force Majeure” (see STANDARD G) causes: (i)

58disruption of utilities or other services essential for Closing, or (ii) Hazard, Wind, Flood or Homeowners’ insurance,

59to become unavailable prior to Closing, Closing shall be extended a reasonable time up to 3 days after

60restoration of utilities and other services essential to Closing, and availability of applicable Hazard, Wind, Flood or

61Homeowners’ insurance. If restoration of such utilities or services and availability of insurance has not occurred

62* |

within __________(if left blank, then 14) days after Closing Date, than either party may terminate this Contract by |

63delivering written notice to the other party, and Buyer shall he refunded the Deposit, thereby releasing Buyer and

64Seller from all further obligations under this Contract.

656. OCCUPANCY AND POSSESSION:

66(a) Unless the box in Paragraph 6(b) is checked, Seller shall, at Closing, deliver occupancy and possession of the

67Property to Buyer free of tenants, occupants and future tenancies. Also, at Closing, Seller shall have removed all

68personal Items and trash from the Property and shall deliver all keys, garage door openers, access devices and

69codes, as applicable, to Buyer. If occupancy is to be delivered before Closing, Buyer assumes all risks of loss to the

70Property from date of occupancy, shall be responsible and liable for maintenance from that date, and shall be

71deemed to have accepted the Property in its existing condition as of time of taking occupancy.

72* (b) ! CHECK IF PROPERTY IS SUBJECT TO LEASE(S) OR OCCUPANCY AFTER CLOSING: lf Property is

73subject to a lease(s) after Closing or is intended to be rented or occupied by third parties beyond Closing, the facts

74and terms thereof shall be disclosed in writing by Seller to Buyer and copies of the written lease(s) shall be

75delivered to Buyer, all within 5 days after Effective Date. If Buyer determines, in Buyer’s sole discretion, that the

76lease(s) or terms of occupancy are not acceptable to Buyer, Buyer may terminate this Contract by delivery of

77written notice of such election to Seller within 5 days alter receipt of the above items from Seller, and Buyer shall be

78refunded the Deposit thereby releasing Buyer and Seller from alt further obligations under this Contract. Estoppel

79Letter(s) and Sellers affidavit shall be provided pursuant to STANDARD D. If Property is intended to be occupied

80by Seller after Closing, See Rider U. POST-CLOSING OCCUPANCY BY SELLER.

81* |

7. |

ASSIGNABILITY: (CHECK ONE): Buyer ! may assign and thereby be released from any further liability under this |

82* |

|

Contract; ! may assign but not he released from liability under this Contract; or ! may not assign this Contract. |

83 |

|

FINANCING |

84 |

8. |

FINANCING: |

85* |

|

! (a) Buyer will pay cash or may obtain a loan for the purchase of the Property. There is no financing contingency to |

86Buyer’s obligation to close.

87* ! (b) This Contract is contingent upon Buyer obtaining a written loan commitment for a ! conventional ! FHA ! VA

88* or ! other __________________(describe) loan on the following terms within _______ (if left blank, than 30) days after

89* Effective Date (“Loan Commitment Date") for (CHECK ONE): ! fixed, ! adjustable, ! fixed or adjustable rate loan in

90* the Loan Amount (See Paragraph 2(c)), at an initial interest rate not to exceed ________% (if left blank, then prevailing

91* rate based upon Buyer’s creditworthiness), and for a term of ________ (if left blank, then 30) years (“Financing”).

92* Buyer shall make mortgage loan application for the Financing within ________(if left blank, then 5) days after Effective

93Date and use good faith and diligent effort to obtain a written loan commitment for the Financing (“Loan Commitment”)

94and thereafter to close this Contract. Buyer shall keep Seller and Broker fully informed about the status of mortgage

95loan application and Loan Commitment and authorizes Buyer’s mortgage broker and Buyer’s lender to disclose such

96status and progress to Seller and Broker.

97 |

|

|

98 |

Upon Buyer’s receipt of Loan Commitment, Buyer shall provide written notice of same to Seller. If Buyer does not |

99 |

receive Loan Commitment by Loan Commitment Date, then thereafter either party may cancel this Contract up to the |

100 |

earlier of: |

|

101 |

i. |

Buyer’s delivery of written notice to Seller that Buyer has either received Loan Commitment or elected to |

102 |

|

waive the financing contingency of this Contract; or |

103 |

ii. |

7 days prior to Closing Date |

104 |

If either party timely cancels this Contract pursuant to this Paragraph 8 and Buyer is not In default under the terms of |

105 |

this Contract, Buyer shall he refunded the Deposit thereby releasing Buyer and Seller from all further obligations under |

106 |

this Contract. If neither party has timely canceled this Contract pursuant to this Paragraph 8, then this financing |

107 |

contingency shall he deemed waived by Buyer. |

108 |

If Buyer delivers written notice of receipt of Loan Commitment to Seller and this Contract docs not thereafter close, the |

109 |

Deposit shall he paid to Seller unless failure to close is due to: (1) Seller’s default; (2) Properly related conditions of the |

110 |

Loan Commitment have not been met (except when such conditions are waived by other provisions of this Contract); (3) |

111 |

appraisal of the Property obtained by Buyer's lender is insufficient to meet terms of the Loan Commitment; or (4) the |

112 |

loan is not funded due to financial failure of Buyer’s lender, in which event(s) the Deposit shall be returned to Buyer, |

113 |

thereby releasing Buyer and Seller from all further obligations under this Contract. |

Buyer’s Initials __________ __________ |

Page 2 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

114* ! (c) Assumption of existing mortgage (see rider for terms).

115* ! (d) Purchase money note and mortgage to Seller (see riders; addenda; or special clauses for terms).

116 |

CLOSING COSTS, FEES AND CHARGES |

1179. CLOSING COSTS; TITLE INSURANCE; SURVEY; HOME WARRANTY; SPECIAL ASSESSMENTS:

118(a) COSTS TO BE PAID BY SELLER:

119 |

" Documentary stamp taxes and surtax on deed, if any |

" HOA/Condominium Association estoppel fees |

120 |

" Owner’s Policy and charges (if Paragraph 9(c)(i) is checked) |

" Recording and other fees needed to cure title |

121 |

" Title search charges (if Paragraph 9(c)(iii) is checked) |

" Seller’s attorneys’ fees |

122* |

" Other: _________________________________________________________________________________________ |

123If, prior to Closing, Seller is unable to meet the AS IS Maintenance Requirement as required by Paragraph 11 a

124sum equal to 125% of estimated costs to meet the AS IS Maintenance Requirement shall be escrowed at Closing. If

125actual costs to meet the AS IS Maintenance Requirement exceed escrowed amount, Seller shall pay such actual

126costs. Any unused portion of escrowed amount(s) shall be returned to Seller.

127(b) COSTS TO BE PAID BY BUYER:

128 |

" Taxes and recording fees on notes and mortgages |

" Loan Expenses |

129 |

" Recording fees for deed and financing statements |

" Appraisal Fees |

130 |

" Owner's Policy and Charges (if Paragraph 9(c)(ii) is checked) |

" Buyer’s Inspections |

131 |

" Survey (and elevation certification, if required) |

" Buyer’s attorneys' fees |

132 |

" Lender’s title policy and endorsements |

" All property related insurance |

133 |

" HOA/Condominium Association application/transfer fees |

" Owners Policy Premium (if Paragraph |

134 |

|

9 (c) (iii) is checked.) |

135* |

" Other:______________________________________________________________________________________ |

136* |

(c) TITLE EVIDENCE AND INSURANCE: At least ________ (if left blank, then 5) days prior to Closing Date, a title |

137insurance commitment issued by a Florida licensed title insurer, with legible copies of instruments listed as

138exceptions attached thereto ("Title Commitment") and, after Closing, an owner's policy of title insurance (see

139STANDARD A for terms) shall be obtained and delivered to Buyer. If Seller has an owner’s policy of title insurance

140covering the Real Property, a copy shall he furnished to Buyer and Closing Agent within 5 days after Effective Date.

141The owner's title policy premium, title search, municipal lien search and closing services (collectively, “Owner’s

142Policy and Charges”) shall he paid, as set forth below

143(CHECK ONE):

144* |

! (i) Seller shall designate Closing Agent and pay for Owner’s Policy and Charges (but not including charges for |

145closing services related to Buyer‘s lender‘s policy and endorsements and loan closing, which amounts shall be paid

146by Buyer to Closing Agent or such other provider(s) as Buyer may select); or

147* |

! (ii) Buyer shall designate Closing Agent and pay for Owner’s Policy and Charges and charges for closing |

148services related to Buyer’s lender’s policy, endorsements, and loan closing; or

149* |

! (iii) [MIAMI-DADE/BROWARD REGIONAL PROVISION]: Seller shall furnish a copy of a prior owner’s policy of |

150title insurance or other evidence of title and pay fees for: (A) a continuation or update of such title evidence, which

151is acceptable to Buyer’s title Insurance underwriter for reissue of coverage; (B) tax search: and (C) municipal lien

152search. Buyer shall obtain and pay for post-Closing continuation and premium for Buyer‘s owner's policy, and If

153* |

applicable, Buyer’s lender‘s policy. Seller shall not be obligated to pay more than $________________ (if left blank, |

154then $200.00) for abstract continuation or title search ordered or performed by Closing Agent.

155(d) SURVEY: At least 5 days prior to Closing, Buyer may, at Buyer‘s expense, have the Real Property surveyed and

156certified by a registered Florida surveyor (“Survey"). If Seller has a survey covering the Real Property, a copy shall

157be furnished to Buyer and Closing Agent within 5 days after Effective Date

158* |

(e) HOME WARRANTY: At Closing, ! Buyer ! Seller ! N/A shall pay for a home warranty plan issued by |

159* |

____________________________________________ at a cost not to exceed $_______________. A home |

160warranty plan provides for repair or replacement of many of a home’s mechanical systems and major built-in

161appliances in the event of breakdown due to normal wear and tear during the agreements warranty period.

162(f) SPECIAL ASSESSMENTS: At Closing, Seller shall pay: (i) the full amount of liens imposed by a public body

163(“public body” does not include a Condominium or Homeowner’s Association) that are certified, confirmed and

164ratified before Closing; and (ii) the amount of the public body’s most recent estimate or assessment for an

165improvement which is substantially complete as of Effective Date, but that has not resulted in a lien being imposed

166on the Property before Closing. Buyer shall pay all other assessments. If special assessments may be paid in

167installments (CHECK ONE):

168! (a) Seller shall pay installments due prior to Closing and Buyer shall pay installments due alter Closing.

169installments prepaid or due for the year of Closing shall be prorated.

170* |

! (b) Seller shall pay the assessment(s) in full prior to or at the time of Closing. |

171IF NEITHER BOX IS CHECKED, THEN OPTION (a) SHALL BE DEEMED SELECTED.

Buyer’s Initials __________ __________ |

Page 3 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

172This Paragraph 9(f) shall not apply to a special benefit tax lien imposed by a community development district (CDD)

173pursuant to Chapter 190. F.S., which lien shall he prorated pursuant to STANDARD K.

17510. DISCLOSURES:

176(a) RADON GAS: Radon is a naturally occurring radioactive gas that, when it is accumulated in a building in sufficient

177quantities, may present health risks to persons who are exposed to it over time. Levels of radon that exceed federal

178and state guidelines have been found in buildings in Florida. Additional information regarding radon and radon

179testing may be obtained from your county health department.

180(b) PERMITS DISCLOSURE: Except as may have been disclosed by Seller to Buyer in a written disclosure, Seller

181does not know of any improvements made to the Property which were made without required permits or made

182pursuant to permits which have not been properly closed.

183(c) MOLD: Mold is naturally occurring and may cause health risks or damage to property. If Buyer is concerned or

184desires additional information regarding mold, Buyer should contact an appropriate professional

185(d) FLOOD ZONE; ELEVATION CERTIFICATION: Buyer is advised to verify by elevation certificate which flood zone

186the Property is in, whether flood insurance is required by Buyer's lender, and what restrictions apply to improving

187the Property and rebuilding in the event of casualty. If Property is in a "Special Flood Hazard Area” or “Coastal

188Barrier Resources Act" designated area or otherwise protected area identified by the U.S. Fish and Wildlife Service

189under the Coastal Barrier Resources Act and the lowest floor elevation for the building(s) and /or flood insurance

190rating purposes is below minimum flood elevation or is ineligible for flood insurance through the National Flood

191* |

Insurance Program, Buyer may terminate this Contract by delivering written notice to seller within ________(if left |

192blank, then 20) days after Effective Date, and Buyer shall be refunded the Deposit thereby releasing Buyer and

193Seller from all further obligations under this Contract, falling which Buyer accepts existing elevation of buildings and

194flood zone designation of Property. The National Flood Insurance Reform Act of 2012 (referred to as Biggert-

195Waters 2012) may phase in actuarial rating of pre-Flood Insurance Rate Map (pre-FIRM) non-primary structures

196(residential structures in which the insured or spouse does not reside for at least 80% of the year) and an elevation

197certificate may be required for actuarial rating.

198(e) ENERGY BROCHURE: Buyer acknowledges receipt of Florida Energy-Efficiency Rating Information Brochure

199required by Section 553.996, F.S.

200(f) LEAD-BASED PAINT: If Property includes pre-1978 residential housing, a lead-based paint disclosure is

201mandatory.

202(g) HOMEOWNERS' ASSOCIATION/COMMUNITY DISCLOSURE: BUYER SHOULD NOT EXECUTE THIS

203CONTRACT UNTIL BUYER HAS RECEIVED AND READ THE HOMEOWNERS’ ASSOCIATION/COMMUNITY

204DISCLOSURE, IF APPLICABLE.

205(h) PROPERTY TAX DISCLOSURE SUMMARY: BUYER SHOULD NOT RELY ON THE SELLER’S CURRENT

206PROPERTY TAXES AS THE AMOUNT OF PROPERTY TAXES THAT THE BUYER MAY BE OBILIGATED TO

207PAY IN THE YEAR SUBSEQUENT TO PURCHASE. A CHANGE OF OWNERSHIP OR PROPERTY

208IMPROVEMENTS TRIGGERS REASSESSMENTS OF THE PROPERTY THAT COULD RESULT IN HIGHER

209PROPERTY TAXES. IF YOU HAVE ANY QUESTIONS CONCERNING VALUATION, CONTACT THE COUNTY

210PROPERTY APPRAISER’S OFFICE FOR INFORMATION.

211(i) FIRPTA TAX WITHHOLDING: Seller shall inform Buyer in writing if Seller is a “foreign person” as defined by the

212Foreign Investment in Real Property Tax Act (“FIRPTA“), Buyer and Seller shall comply with FIRPTA, which may

213require Seller to provide additional cash at Closing. If Seller is not a “foreign person", Seller can provide Buyer, at or

214prior to Closing, a certification of non-foreign status, under penalties of perjury, to inform Buyer and Closing Agent

215that no withholding is required. See STANDARD V for further information pertaining to FIRPTA. Buyer and Seller

216are advised to seek legal counsel and tax advice regarding their respective rights, obligations, reporting and

217withholding requirements pursuant to FIRPTA.

218(j) SELLER DISCLOSURE: Seller knows of no facts materially affecting the value of the Real Property which are not

219readily observable and which have not been disclosed to Buyer. Except as provided for in the preceding sentence,

220Seller extends and intends no warranty and makes no representation of any type, either express or implied, as to

221the physical condition or history of the Property. Except as otherwise disclosed in writing Seller has received no

222written or verbal notice from any governmental entity or agency as to a currently uncorrected building,

223environmental, or safety code violation.

224 |

PROPERTY MAINTENANCE, CONDITION, INSPECTIONS AND EXAMINATIONS |

22511. PROPERTY MAINTENANCE: Except for ordinary wear and tear and Casualty Loss, Seller shall maintain the Property,

226including, but not limited to. lawn, shrubbery, and pool, in the condition existing as of Effective Date (“AS IS

227Maintenance Requirement").

Buyer’s Initials __________ __________ |

Page 4 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

22812. PROPERTY INSPECTION; RIGHT TO CANCEL:

229* (a) PROPERTY INSPECTION AND RIGHT TO CANCEL: Buyer shall have _________ (if left blank. than 15) days

230after Effective Date (“Inspection Period”) within which to have such inspections of the Property performed

231as Buyer shall desire during the Inspection Period. If Buyer determines, in Buyer's sole discretion, that the

232Property is not acceptable to Buyer, Buyer may terminate this Contract by delivering written notice or such

232election to Seller prior to expiration of Inspection Period. If Buyer timely terminates this Contract, the

233Deposit paid shall be returned to Buyer, thereupon, Buyer and Seller shall be released of all further

234obligations under this Contract; however, Buyer shall be responsible for prompt payment for such

235inspections, for repair of damage to, and restoration of, the Property resulting from such inspections, and

237shall provide Seller with paid receipts for all work done on the Property (the preceding provision shall

238survive termination or this Contract). Unless Buyer exercises the right to terminate granted herein, Buyer

239accepts the physical condition of the Property and any violation of governmental, building, environmental,

240and safety codes, restrictions, or requirements, but subject to Seller's continuing AS IS Maintenance

241Requirement, and Buyer shall be responsible for any and all repairs and improvements required by Buyer’s

242lender.

243(b) WALK-THROUGH INSPECTION/RE-INSPECTION: On the day prior to Closing Date, or on Closing Date prior to

244time of Closing, as specified by Buyer, Buyer or Buyer’s representative may perform a walk-through (and follow-up

245walk-through, if necessary) inspection of the Property solely to confirm that all items of Personal Property are on the

246Property and to verify that Seller has maintained the Property as required by the AS IS Maintenance Requirement

247and has met all other contractual obligations

248(c) SELLER ASSISTANCE AND COOPERATION IN CLOSE-OUT OF BUILDING PERMITS: If Buyer’s inspection of

249the Property identifies open or needed building permits, then Seller shall promptly deliver to Buyer all plans, written

250documentation or other information in Seller’s possession, knowledge, or control relating to improvements to the

251Property which are the subject of such open or needed Permits, and shall promptly cooperate in good faith with

252Buyer’s efforts to obtain estimates of repairs or other work necessary to resolve such Permit issues. Seller’s

253obligation to cooperate shall include Seller’s execution of necessary authorizations, consents, or other documents

254necessary for Buyer to conduct inspections and have estimates of such repairs or work prepared, but in fulfilling

255such obligation, Seller shall not he required to expend, or become obligated to expend, any money.

256(d) ASSIGNMENT OF REPAIR AND TREATMENT CONTRACTS AND WARRANTIES: At Buyer's option and cost,

257Seller will, at Closing. assign all assignable repair, treatment and maintenance contracts and warranties to Buyer.

258 |

ESCROW AGENT AND BROKER |

25913. ESCROW AGENT: Any Closing Agent or Escrow Agent (collectively “Agent”) receiving the Deposit, other funds and

260other items is authorized, and agrees by acceptance of them, to deposit them promptly, hold same in escrow within the

261State of Florida and, subject to COLLECTION, disburse them in accordance with terms and conditions of this Contract.

262Failure of funds to become COLLECTED shall not excuse Buyer’s performance. When conflicting demands for the

263Deposit are received, or Agent has a good faith doubt as to entitlement to the Deposit, Agent may take such actions

264permitted by this Paragraph 13, as Agent deems advisable. If in doubt as to Agent’s duties or liabilities under this

265Contract, Agent may, at Agent’s option, continue to hold the subject matter of the escrow until the parties agree to its

266disbursement or until a final judgment of a court of competent jurisdiction shall determine the rights of the parties, or

267Agent may deposit same with the clerk of the circuit court having jurisdiction of the dispute. An attorney who represents

268a party and also acts as Agent may represent such party in such action. Upon notifying all parties concerned of such

269action, all liability on the part of Agent shall fully terminate, except to the extent of accounting for any items previously

270delivered out of escrow. If a licensed real estate broker, Agent will comply with provisions of Chapter 475, F.S., as

271amended and FREC rules to timely resolve escrow disputes through mediation, arbitration, interpleader or an escrow

272disbursement order.

273Any proceeding between Buyer and Seller wherein Agent is made a party because of acting as Agent hereunder, or in

274any proceeding where Agent interpleads the subject matter of escrow, Agent shall recover reasonable attorney’s

275fees and costs incurred, to he paid pursuant to court order out of the escrowed funds or equivalent. Agent shall not he

276liable to any party or person for mis-delivery of any escrowed items, unless such mis-delivery is due to Agents willful

277breach of this Contract or Agent’s gross negligence. This Paragraph 13 shall survive Closing or termination of this

278Contract.

27914. PROFESSIONAL ADVICE; BROKER LIABILITY: Broker advises Buyer and Seller to verily Property condition. square

280footage, and all other facts and representations made pursuant to this Contract and to consult appropriate professionals

281for legal, tax, environmental, and other specialized advice concerning matters affecting the Properly and the transaction

282contemplated by this Contract. Broker represents to Buyer that Broker does not reside on the Property and that all

283representations (oral, written or otherwise) by Broker are based on Seller representations or public records. BUYER

284AGREES TO RELY SOLELY ON SELLER, PROFESSIONAL INSPECTORS AND GOVERNNENTAL AGENCIES

285FOR VERIFICATION OF PROPERTY CONDITION, SQUARE FOOTAGE AND FACTS THAT MATERIALLY AFFECT

286PROPERTY VALUE AND NOT ON THE REPRESENTATIONS (ORAL, WRITTEN OR OTHERWISE) OF BROKER.

Buyer’s Initials __________ __________ |

Page 5 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

287Buyer and Seller (individually, the “indemnifying Party") each individually indemnifies, holds harmless, and releases

288Broker and Broker’s officers, directors, agents and employees from all liability for loss or damage, including all costs

289and expenses, and reasonable attorney’s fees at all levels, suffered or incurred by Broker and Broker’s officers,

290directors, agents and employees in connection with or arising from claims, demands or causes of action instituted by

291Buyer or Seller based on: (i) inaccuracy of information provided by the Indemnifying Party or from public records; (ii)

292Indemnifying Party’s misstatement(s) or failure to perform contractual obligations; (iii) Broker’s performance, at

293Indemnifying Party’s request, of any task beyond the scope of services regulated by Chapter 475, F.S., as amended,

294including Broker’s referral, recommendation or retention of any vendor for, or on behalf of Indemnifying Party; (iv)

295products or services provided by any such vendor for, or on behalf of, Indemnifying Party; and (v) expenses incurred by

296any such vendor. Buyer and Seller each assumes full responsibility for selecting and compensating their respective

297vendors and paying their other costs under this Contract whether or not this transaction closes. This Paragraph 14 will

298not relieve Broker of statutory obligations under Chapter 475, F.S., as amended. For purposes of this Paragraph 14,

299Broker will he treated as a party to this Contract. This Paragraph 14 shall survive Closing or termination of this Contract.

300 |

DEFAULT AND DIBPUTE RESOLUTION |

30115. DEFAULT:

302(a) BUYER DEFAULT: If Buyer fails, neglects or refuses to perform Buyer’s obligations under this Contract, including

303payment of the Deposit, within the time(s) specified, Seller may elect to recover and retain the Deposit for the

304account of Seller as agreed upon liquidated damages, consideration for execution of this Contract, and in full

305settlement of any claims, whereupon Buyer and Seller shall be relieved from all further obligations under this

306Contract, or Seller, at Seller’s option, may, pursuant to Paragraph 16, proceed in equity to enforce Seller’s rights

307under this Contract. The portion of the Deposit, if any, paid to Listing Broker upon default by Buyer, shall be split

308equally between Listing Broker and Cooperating Broker; provided however, Cooperating Broker’s share shall not be

309greater than the commission amount Listing Broker had agreed to pay to Cooperating Broker.

310(b) SELLER DEFAULT: If for any reason other than failure of Seller to make Seller’s title marketable after reasonable

311diligent effort, Seller fails, neglects or refuses to perform Seller’s obligations under this Contract, Buyer may elect to

312receive return of Buyer’s Deposit without thereby waiving any action for damages resulting from Seller’s breach,

313and, pursuant to Paragraph 16, may seek to recover such damages or seek specific performance.

314This Paragraph 15 shall survive Closing or termination of this Contract

31516. DISPUTE RESOLUTION: Unresolved controversies. claims and other matters in question between Buyer and Seller

316arising out of, or relating to, this Contract or its breach, enforcement or interpretation (“Dispute”) will he settled as

317follows:

318(a) Buyer and Seller will have 10 days after the date conflicting demands for the Deposit are made to attempt to

319resolve such Dispute, failing which, Buyer and Seller shall submit such Dispute to mediation under Paragraph

32016(b).

321(b) Buyer and Seller shall attempt to settle Disputes in an amicable manner through mediation pursuant to Florida

322Rules for Certified and Court-Appointed Mediators and Chapter 44, F.S., as amended (the “Mediation Rules”). The

323mediator must be certified or must have experience in the real estate industry. Injunctive relief may he sought

324without first complying with this Paragraph 16(b). Disputes not settled pursuant to this Paragraph 16 may be

325resolved by instituting action in the appropriate court having jurisdiction of the matter. This Paragraph 16 shall

326survive Closing or termination of this Contract.

32717. ATTORNEY’S FEES; COSTS: The parties will split equally any mediation fee incurred in any mediation permitted by

328this Contract, and each party will pay their own costs, expenses and fees, including attorney’s fees, incurred in

329conducting the mediation. In any litigation permitted by this Contract, the prevailing party shall he entitled to recover

330from the non-prevailing party costs and fees, including reasonable attorney’s fees, incurred in conducting the litigation.

331This Paragraph 17 shall survive Closing or termination of this Contract.

332 |

STANDARDS FOR REAL ESTATE TRANSACTIONS (“STANDARDS”) |

33318. STANDARDS:

334A. TITLE:

335(i) TITLE EVIDENCE; RESTRICTIONS; EASEMENTS; LIMITATIONS: Within the time period provided in Paragraph

3369(c), the Title Commitment, with legible copies of instruments listed as exceptions attached thereto, shall be issued and

337delivered to Buyer. The Title Commitment shall set forth those matters to he discharged by Seller at or before Closing

338and shall provide that, upon recording of the deed to Buyer, an owner’s policy of title insurance In the amount of the

339Purchase Price, shall he issued to Buyer insuring Buyer’s marketable title to the Real Property, subject only to the

340following matters: (a) comprehensive land use plans, zoning, and other land use restrictions, prohibitions and

341requirements imposed by governmental authority; (b) restrictions and matters appearing on the Plat or otherwise

342common to the subdivision; (c) outstanding oil, gas and mineral rights of record without right of entry; (d) unplatted

343public utility easements of record (located contiguous to real property lines and not more than 10 feet in width as to rear

344or front lines and 7 1/2 feet in width as to side lines); (e) taxes for year of Closing and subsequent years; and (f)

Buyer’s Initials __________ __________ |

Page 6 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

STANDARDS FOR REAL ESTATE TRANSACTIONS (“STANDARDS”) CONTINUED

345assumed mortgages and purchase money mortgages, if any (if additional items, attach addendum); provided, that,

346none prevent use of Property for RESIDENTIAL PURPOSES. If there exists at Closing any violation of terms Identified

347in (b) – (f) above, then the same shall be deemed a title defect. Marketable title shall be determined according to

348applicable Title Standards adopted by authority of The Florida Bar and in accordance with law.

349(ii) TITLE EXAMINATION: Buyer shall have 5 days after receipt of Title Commitment to examine it and notify Seller in

350writing specifying defect(s), if any, that render title unmarketable. If Seller provides Title Commitment and it is delivered

351to Buyer less than 5 days prior to Closing Date, Buyer may extend Closing for up to 5 days after date of receipt to

352examine same in accordance with this STANDARD A. Seller shall have 30 days ("Cure Period") after receipt of Buyer’s

353notice to take reasonable diligent efforts to remove defects. If Buyer fails to so notify Seller, Buyer shall be deemed to

354have accepted title as it then is. If Seller cures defects within Cure Period, Seller will deliver written notice to Buyer (with

355proof of cure acceptable to Buyer and Buyer’s attorney) and the parties will close this Contact on Closing Date (or If

356Closing Date has passed, within 10 days after Buyer’s receipt of Seller’s notice). If Seller is unable to cure defects

357within Cure Period, then Buyer may, within 5 days after expiration of Cure Period, deliver written notice to Seller: (a)

358extending Cure Period for a specified period not to exceed 120 days within which Seller shall continue to use

359reasonable diligent effort to remove or cure the defects (“Extended Cure Period”); or (b) electing to accept title with

360existing defects and close this Contract on Closing Date (or If Closing Date has passed, within the earlier of 10 days

361after end of Extended Cure Period or Buyer’s receipt of Seller’s notice), or (c) electing to terminate this Contract and

362receive a refund of the Deposit, thereby releasing Buyer and Seller from all further obligations under this Contract. If

363after reasonable diligent effort, Seller is unable to timely cure defects, and Buyer does not waive the defects, this

364Contract shall terminate, and Buyer shall receive a refund of the Deposit, thereby releasing Buyer and Seller from all

365further obligations under this Contract.

366B. SURVEY: If Survey discloses encroachments on the Real Property or that Improvements located thereon encroach

367on setback lines, easements, or lands of others, or violate any restrictions, covenants, applicable governmental

368regulations described in STANDARD A (i)(a), (b) or (d) above, Buyer shall deliver written notice of such matters,

369together with a copy of Survey, to Seller within 5 days after Buyer’s receipt of Survey, but no later than Closing. If Buyer

370timely delivers such notice and Survey to Seller, such matters identified in the notice and Survey shall constitute a title

371defect, subject to cure obligations of STANDARD A above. If Seller has delivered a prior survey, Seller shall, at Buyer’s

372request, execute an affidavit of “no change” to the Real Property since the preparation of such prior survey, to the

373extent the affirmations therein are true and correct

374C. INGRESS AND EGRESS: Seller represents that there is ingress and egress to the Real Property and title to the

375Real Property is insurable in accordance with STANDARD A without exception for lack of legal right of access.

376D. LEASE INFORMATION: Seller shall, at least 10 days prior to Closing, furnish to Buyer estoppel letters from

377tenant(s)/occupant(s) specifying nature and duration of occupancy, rental rates, advanced rent and security deposits

378paid by tenant(s) or occupant(s) (“Estoppel Letter(s)”). lf Seller is unable to obtain such Estoppel Letter(s), the same

379information shall be furnished by Seller to Buyer within that time period in the form of a Seller's affidavit, and Buyer may

380thereafter contact tenant(s) or occupant(s) to confirm such information. If Estoppel Letter(s) or Sellers affidavit, if any,

381differ materially from Seller’s representations and lease(s) provided pursuant to Paragraph 6, or if tenant(s)/occupant(s),

382fail or refuse to confirm Seller’s affidavit, Buyer may deliver written notice to Seller within 5 days after receipt of such

383information, but no later than 5 days prior to Closing Date, terminating this Contract and receive a refund of the Deposit,

384thereby releasing Buyer and Seller from all further obligations under this Contract. Seller shall, at Closing, deliver and

385assign all leases to Buyer who shall assume Seller’s obligations thereunder.

386E. LIENS: Seller shall furnish to Buyer at Closing an affidavit attesting (i) to the absence of any financing statement,

387claims of lien or potential lienors known to Seller, and (ii) that there have been no improvements or repairs to the Real

388Property for 90 days immediately preceding Closing Data. lf the Real Properly has been Improved or repaired within

389that time, Seller shall deliver releases or waivers of construction liens executed by all general contractors,

390subcontractors, suppliers and materialmen in addition to Seller's lien affidavit setting forth names of all such general

391contractors, subcontractors, suppliers and materialmen, further affirming that all charges for improvements or repairs

392which could serve as a basis for construction lien or a claim for damages have been paid or will be paid at Closing.

393F. TIME: Calendar days shall be used in computing time periods. Time is of the essence in this Contract.

394Other than time for acceptance and Effective Date as set forth in Paragraph 3, any time periods provided for or dates

395specified in this Contract, whether preprinted, handwritten, typewritten or inserted herein, which shall end or occur on a

396Saturday, Sunday, or a national legal holiday (see 5 U.S.C. 6103) shall extend to 5.00 p.m. (where the Property is

397located) of the next business day.

398G. FORCE MAJEURE: Buyer or Seller shall not be required to perform any obligation under this Contract or be liable

399to each other for damages so long as performance or non-performance of the obligation is delayed, caused or

400prevented by Force Majeure. “Force Majeure” means: hurricanes, earthquakes, floods, fire, acts of God, unusual

401transportation delays, wars, insurrections, acts of terrorism, and any other cause not reasonably within control of Buyer

402or Seller, and which, by: exercise of reasonable diligent effort, the non-performing party is unable in whole or in part to

403prevent or overcome. All time periods, including Closing Date, will he extended for the period that the Force Majeure

404prevents performance under this contract, provided, however, if such Force Majeure continues to prevent performance

Buyer’s Initials __________ __________ |

Page 7 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

STANDARDS FOR REAL ESTATE TRANSACTIONS (“STANDARDS”) CONTINUED

405under this Contract more than 14 days beyond Closing Date, then either party may terminate this Contract by delivering

406written notice to the other and the Deposit shall be refunded to Buyer, thereby releasing Buyer and Seller from all

407further obligations under this Contract.

408H. CONVEYANCE: Seller shall convey marketable title to the Real Property by statutory warranty, trustee’s, personal

409representative’s, or guardian’s deed, as appropriate to the status of Seller, subject only to matters described in

410STANDARD A and those accepted by Buyer. Persona! Property shall, at request of Buyer, be transferred by absolute

411bill of sale with warranty of title, subject only to such matters as may be provided for in this Contract.

412I. CLOSING LOCATION; DOCUMENTS; AND PROCEDURE:

413(i) LOCATION: Closing will lake place in the county where the Real Property is located at the office of the attorney or

414other closing agent (“Closing Agent”) designated by the party paying for the owner’s policy of title insurance, or, if no

415title Insurance, designated by Seller. Closing may be conducted by mail or electronic means.

416(ii) CLOSING DOCUMENTS: Seller shall, at or prior to Closing, execute and deliver, as applicable, deed, bill of sale,

417certificate(s) of title or other documents necessary to transfer title to the Property, construction lien affidavit(s), owner’s

418possession and no lien affidavit(s), and assignment(s) of leases. Seller shall provide Buyer with paid receipts for all work

419done on the Property pursuant to this Contract. Buyer shall furnish and pay for, as applicable the survey, flood

420elevation certification, and documents required by Buyer’s lender.

421(iii) PROCEDURE: The deed shall be recorded upon COLLECTION of all closing funds. If the Title Commitment

422provides insurance against adverse matters pursuant to Section 627.7841, F.S., as amended, the escrow closing

423procedure required by STANDARD J shall be waived, and Closing Agent shall, subject to COLLECTION of all closing

424funds, disburse at Closing the brokerage fees to Broker and the net sale proceeds to Seller.

425J. ESCROW CLOSING PROCEDURE: If Title Commitment issued pursuant to Paragraph 9(c) does not provide for

426insurance against adverse matters as permitted under section 627.7841, F.S., as amended, the following escrow and

427closing procedures shall apply: (1) all Closing proceeds shall be held in escrow by the Closing Agent tor a period of not

428more than 10 days after Closing; (2) if Seller’s title is rendered unmarketable, through no fault of Buyer, Buyer shall,

429within the 10 day period, notify Seller in writing of the defect and Seller shall have 30 days from date of receipt of such

430notification to cure the defect; (3) if Seller falls to timely cure the defect, the Deposit and all Closing funds paid by Buyer

431shall, within 5 days after written demand by Buyer, be refunded to Buyer and, simultaneously with such repayment.

432Buyer shall return the Personal Property, vacate the Real Property and re-convey the Property to Seller by special

433warranty deed and bill of sale; and (4) if Buyer fails to make timely demand for refund of the Deposit, Buyer shall take

434title as is, waiving all rights against Seller as to any intervening defect except as may he available to Buyer by virtue of

435warranties contained in the deed or bill of sale.

436K. PRORATIONS; CREDITS: The following recurring items will be made current (if applicable) and prorated as of the

437day prior to Closing Date, or date of occupancy if occupancy occurs before Closing Date: real estate taxes (including

438special benefit tax assessments imposed by a CDD), interest, bonds, association fees. insurance, rents and other

439expenses of Property. Buyer shall have option of taking over existing policies of insurance, if assumable, in which event

440premiums shall he prorated. Cash at Closing shall he increased or decreased as may be required by prorations to be

441made through day prior to Closing. Advance rent and security deposits, if any, will be credited to Buyer. Escrow

442deposits held by Seller’s mortgagee will be paid to Seller. Taxes shall be prorated based on current year's tax with due

443allowance made for maximum allowable discount, homestead and other exemptions. If Closing occurs on a date when

444current year’s millage is not fixed but current year’s assessment is available, taxes will be prorated based upon such

445assessment and prior years millage. If current year’s assessment is not available, then taxes will he prorated on prior

446year’s tax. If there are completed improvements on the Real Property by January 1st of year of Closing, which

447improvements were not in existence on January 1st of prior year, than taxes shall be prorated based upon prior year’s

448millage and at an equitable assessment to be agreed upon between the parties, failing which, request shall be made to

449the County Property Appraiser for an informal assessment taking into account available exemptions. A tax proration

450based on an estimate shall, at either party’s request, be readjusted upon receipt of current years tax bill. This

451STANDARD K shall survive Closing.

452L. ACCESS TO PROPERTY TO CONDUCT APPRAISALS, INSPECTIONS, AND WALK-THROUGH: Seller shall,

453upon reasonable notice, provide utilities service and access to Property for appraisals and inspections, including a walk-

454through (or follow-up walk-through it necessary) prior to Closing.

455M. RISK OF LOSS: lf, after Effective Date, but before Closing, Property is damaged by firm or other casualty

456(“Casualty Loss”) and cost of restoration (which shall Include cost of pruning or removing damaged trees) does not

457exceed 1.5% of Purchase Price, cost of restoration shall be an obligation of Seller and Closing shall proceed pursuant

458to terms of this Contract. If restoration is not completed as of Closing, a sum equal to 125% or estimated cost to

459complete restoration (not to exceed 1.5% of Purchase Price), will be escrowed at Closing. If actual cost of restoration

460exceeds escrowed amount, Seller shall pay such actual costs (but, not in excess of 1.5% of Purchase Price). Any

461unused portion of escrowed amount shall be returned to Seller. If Cost of restoration exceeds 1.5% of Purchase Price,

462Buyer shall elect to either take Property "as is" together with the 1.5%, or receive a refund of the Deposit, thereby

463releasing Buyer and Seller from all further obligations under this Contract. Seller‘s sole obligation with respect to tree

464damage by casualty or other natural occurrence shall be cost of pruning or removal.

Buyer’s Initials __________ __________ |

Page 8 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

STANDARDS FOR REAL ESTATE TRANSACTIONS (“STANDARDS”) CONTINUED

465N. 1031 EXCHANGE: If either Seller or Buyer wish to enter into a like-kind exchange (either simultaneously with

466Closing or deferred) under Section 1031 of the Internal Revenue Code (“Exchange"), the other party shall cooperate in

467all reasonable respects to effectuate the Exchange, including execution of documents; provided, however, cooperating

468party shall incur no liability or expense related to the Exchange, and Closing shall not be contingent upon, nor extended

469or delayed by, such Exchange..

470O. CONTRACT NOT RECORDABLE; PERSONS BOUND; NOTICE; DELIVERY; COPIES; CONTRACT

471EXECUTION: Neither this Contract nor any notice of it shall be recorded in any public records. This Contract shall be

472binding on, and inure to the benefit of, the parties and their respective heirs or successors in interest. Whenever the

473Context permits, singular shall include plural and one gender shall include all. Notice and delivery given by or to the

474attorney or broker (including such Broker's real estate licensee) representing any party shall be as effective as if given

475by or to that party. All notices must be in writing and may be made by mail, personal delivery or electronic (including

476“pdf”) media. A facsimile or electronic (including “pdf") copy of this Contract and any signatures hereon shall be

477considered for all purposes as an original. This Contract may be executed by use of electronic signatures, as

478determined by Florida’s Electronic Signature Act and other applicable laws.

479P. INTEGRATION; MODIFICATION: This Contract contains the full and complete understanding and agreement of

480Buyer and Seller with respect to the transaction contemplated by this Contract and no prior agreements or

481representations shall be binding upon Buyer or Seller unless included in this Contract. No modification to or change in

482this Contract shall be valid or binding upon Buyer or Seller unless in writing and executed by the parties intended to be

483bound by it.

484Q. WAIVER: Failure of Buyer or Seller to insist on compliance with, or strict performance of, any provision of this

485Contract, or to take advantage of any right under this Contract, shall not constitute a waiver of other provisions or rights.

486R. RIDERS; ADDENDA; TYPEWRITTEN OR HANDWRITTEN PROVISIONS: Riders, addenda, and typewritten or

487handwritten provisions shall control all printed provisions of this Contract in conflict with them.

488S. COLLECTION or COLLECTED: "COLLECTION" or “COLLECTED” means any checks tendered or received,

489including Deposits, have become actually and finally collected and deposited in the account of Escrow Agent

490or Closing Agent. Closing and disbursement of funds and delivery of closing documents may be delayed by

491Closing Agent until such amounts have been COLLECTED In Closing Agent’s accounts.

492T. LOAN COMMITMENT: "Loan Commitment” means a statement by the lender setting forth the terms and conditions

493upon which the lender is willing to make a particular mortgage loan to a particular borrower. Neither a pre-approval

494letter nor a prequalification letter shall be deemed a Loan Commitment for purposes of this Contract.

495U. APPLICABLE LAW AND VENUE: This Contract shall be construed in accordance with the laws of the State of

496Florida and venue for resolution of all disputes, whether by mediation, arbitration or litigation, shall lie in the county

497where the Real Property is located.

498V. FOREIGN INVESTMENT IN REAL PROPERTY TAX ACT ("FIRPTA"): If a Seller of U.S. real property is a "foreign

499person” as defined by FIRPTA, Section 1445 of the Internal Revenue Code requires the buyer of the real property to

500withhold 10% of the amount realized by the seller on the transfer and remit the withheld amount to the internal Revenue

501Service (IRS) unless an exemption to the required withholding applies or the seller has obtained a Withholding

502Certificate from the IRS authorizing a reduced amount of withholding. Due to the complexity and potential risks of

503FIRPTA, Buyer and Seller should seek legal and tax advice regarding compliance, particularly if an "exemption” is

504claimed on the sale of residential property for $300,000 or less.

505(i) No withholding is required under Section 1445 if the Seller is not a “foreign person”, provided Buyer accepts proof

506of same from Seller, which may include Buyer’s receipt of certification of non-foreign status from Seller, signed under

507penalties of perjury, stating that Seller is not a foreign person and containing Seller’s name, U.S. taxpayer identification

508number and home address (or office address, in the case of an entity), as provided for in 26 CFR 1.1445-2(b).

509Otherwise, Buyer shall withhold 10% of the amount realized by Seller on the transfer and timely remit said funds to the

510IRS.

511(ii) If Seller has received a Withholding Certificate from the IRS which provides for reduced or eliminated withholding in

512this transaction and provides same to Buyer by Closing, then Buyer shall withhold the reduced sum, if any required, and

513timely remit said funds to the IRS.

514(iii) If prior to Closing Seller has submitted a completed application to the IRS for a Withholding Certificate and has

515provided to Buyer the notice required by 25 CFR 1.1445-1(c) (2)(i)(B) but no Withholding Certificate has been received

516as of Closing, Buyer shall, at Closing, withhold 10% of the amount realized by Seller on the transfer and, at Buyer’s

517option, either (a) timely remit the withheld funds to the IRS or (b) place the funds in escrow, at Seller’s expense, with an

518escrow agent selected by Buyer and pursuant to terms negotiated by the parties, to be subsequently disbursed in

519accordance with the Withholding Certificate issued by the IRS or remitted directly to the IRS if the Seller’s application is

520rejected or upon terms set forth in the escrow agreement.

521(iv) In the event the net proceeds due Seller are not sufficient to meet the withholding requirement(s) in this transaction,

522Seller shall deliver to Buyer, at Closing, the additional COLLECTED funds necessary to satisfy the applicable

523requirement and thereafter Buyer shall timely remit said funds to the IRS or escrow the funds for disbursement in

524accordance with the final determination of the IRS, as applicable

Buyer’s Initials __________ __________ |

Page 9 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

ADDENDA AND ADDITIONAL TERMS

STANDARDS FOR REAL ESTATE TRANSACTIONS (“STANDARDS”) CONTINUED

525(v) Upon remitting funds to the IRS pursuant to this STANDARD, Buyer shall provide Seller copies of IRS Forms 8288

526and 8288-A, as filed.

527W. RESERVED

528X. BUYER WAIVER OF CLAIMS: To the extent permitted by law, Buyer waives any claims against Seller and

529against any real estate licensee involved in the negotiation of this Contract, for any damage or defects

530pertaining to the physical condition of the Property that may exist at Closing of this Contract and be

531subsequently discovered by the Buyer or anyone claiming by, through, under or against the Buyer. This

532provision does not relieve Seller’s obligation to comply with Paragraph 10(j). This Standard X shall survive

533Closing.

534

53519. ADDENDA: The following additional terms are included in the attached addenda or riders and incorporated into this

536* Contract (Check If applicable):

! A. Condominium Rider |

! M. |

Defective Drywall |

! X. Kick-out Clause |

! B. Homeowners' Assn. |

! N. |

Coastal Construction Control Line |

! Y. Sellers Attorney Approval |

! C. Seller Financing |

! O. |

Insulation Disclosure |

! Z. Buyer’s Attorney Approval |

! D. Mortgage Assumption |

! P. |

Lead Based Paint Disclosure |

! AA.Licensee-Personal Interest in |

! E. FHA/VA Financing |

|

(Pre 1978 Housing) |

Property |

! F. Appraisal Contingency |

! Q. |

Housing for Older Persons |

! BB. Binding Arbitration |

! G. Short Sale |

! R. |

Rezoning |

! Other _____________________ |

! H. Homeowners’/Flood Ins. |

! S. |

Lease Purchaser/Lease Option |

____________________________ |

! I. RESERVED |

! T. |

Pre-Closing Occupancy by Buyer |

____________________________ |

! J. Interest-Bearing Acct. |

! U. |

Post-Closing Occupancy by Seller |

____________________________ |

! K. RESERVED |

! V. |

Sale of Buyer's Property |

____________________________ |

! L. RESERVED |

! W. |

Back-up Contract |

|

537* 20. ADDITIONAL TERMS: ADMINISTRATION FEE: Buyer/Seller agrees to pay Realty3000, Inc. an_____________

538Administration fee in the amount of $195.00 at the closing of this Contract.________________________________

539___________________________________________________________________________________________

540___________________________________________________________________________________________

541___________________________________________________________________________________________

542___________________________________________________________________________________________

543___________________________________________________________________________________________

544___________________________________________________________________________________________

545___________________________________________________________________________________________

546___________________________________________________________________________________________

547___________________________________________________________________________________________

548___________________________________________________________________________________________

549___________________________________________________________________________________________

550___________________________________________________________________________________________

551___________________________________________________________________________________________

552___________________________________________________________________________________________

553___________________________________________________________________________________________

554 |

COUNTER-OFFER/REJECTION |

555* ! Seller counters Buyer‘s offer (to accept the counter-offer, Buyer must sign or initial the counter-offered terms and deliver

556a copy of the acceptance to Seller).

557* ! Seller rejects Buyer’s offer.

558THIS IS INTENDED T0 BE A LEGALLY BINDING CONTRACT. IF NOT FULLY UNDERSTOOD, SEEK THE ADVICE OF

559AN ATTORNEY PRIOR TO SIGNING.

560THIS FORM HAS BEEN APPROVED BY THE FLORIDA REALTORS AND THE FLORIDA BAR.

561Approval of this form by the Florida Realtors and The Florida Bar does not constitute an opinion that any of the terms and

562conditions in this Contract should be accepted by the parties in a particular transaction. Terms and conditions should be

563negotiated based upon the respective interests, objectives and bargaining positions of all interested persons.

Buyer’s Initials __________ __________ |

Page 10 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

564AN ASTERISK (*) FOLLOWING A LINE NUMBER IN THE MARGIN INDICATES THE LINE CONTAINS A BLANK TO BE

565COMPLETED.

566 |

|

|

|

567 |

|

|

|

668* Buyer: ________________________________________________________________ |

Date: _________________ |

569 |

|

|

|

570 |

|

|

|

571 |

|

|

|

572 |

|

|

|

573* Buyer: ________________________________________________________________ |

Date: _________________ |

574 |

|

|

|

575 |

|

|

|

576 |

|

|

|

577 |

|

|

|

578* Seller: ________________________________________________________________ |

Date: _________________ |

579 |

|

|

|

580 |

|

|

|

581 |

|

|

|

582 |

|

|

|

583* Seller: ________________________________________________________________ |

Date: _________________ |

584 |

|

|

|

585 |

Buyer's address for purposes of notice |

Seller’s address for purposes of notice |

586* ______________________________________ |

______________________________________ |

587* ______________________________________ |

______________________________________ |

588* ______________________________________ |

______________________________________ |

589 |

|

|

|

590BROKER: Listing and Cooperating Brokers, if any, named below (collectively, “Broker”), are the only Brokers entitled to

591compensation in connection with this Contract. Instruction to Closing Agent: Seller and Buyer direct Closing Agent to

592disburse at Closing the full amount of the brokerage fees as specified in separate brokerage agreements with the parties

593and cooperative agreements between the Brokers, except to the extent Broker has retained such fees from the escrowed

594funds. This Contract shall not modify any MLS or other offer of compensation made by Seller or Listing Broker to

595Cooperating Brokers.

596 |

|

|

597* |

______________________________________ |

______________________________________ |

598 |

Cooperating Sales Associate, If Any |

Listing Sales Associate |

599 |

|

|

600* |

______________________________________ |

______________________________________ |

601 |

Cooperating Broker, If Any |

Listing Broker |

Buyer’s Initials __________ __________ |

Page 11 of 11 |

Seller’s Initials __________ __________ |

FloridaRealtors/FloridaBar-ASIS- 2 Rev.8/13 © 2013 Florida Realtors® and The Florida Bar. All rights reserved

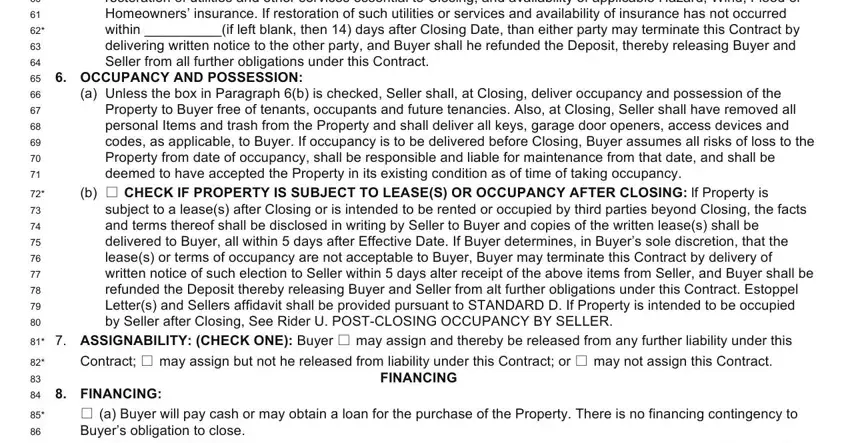

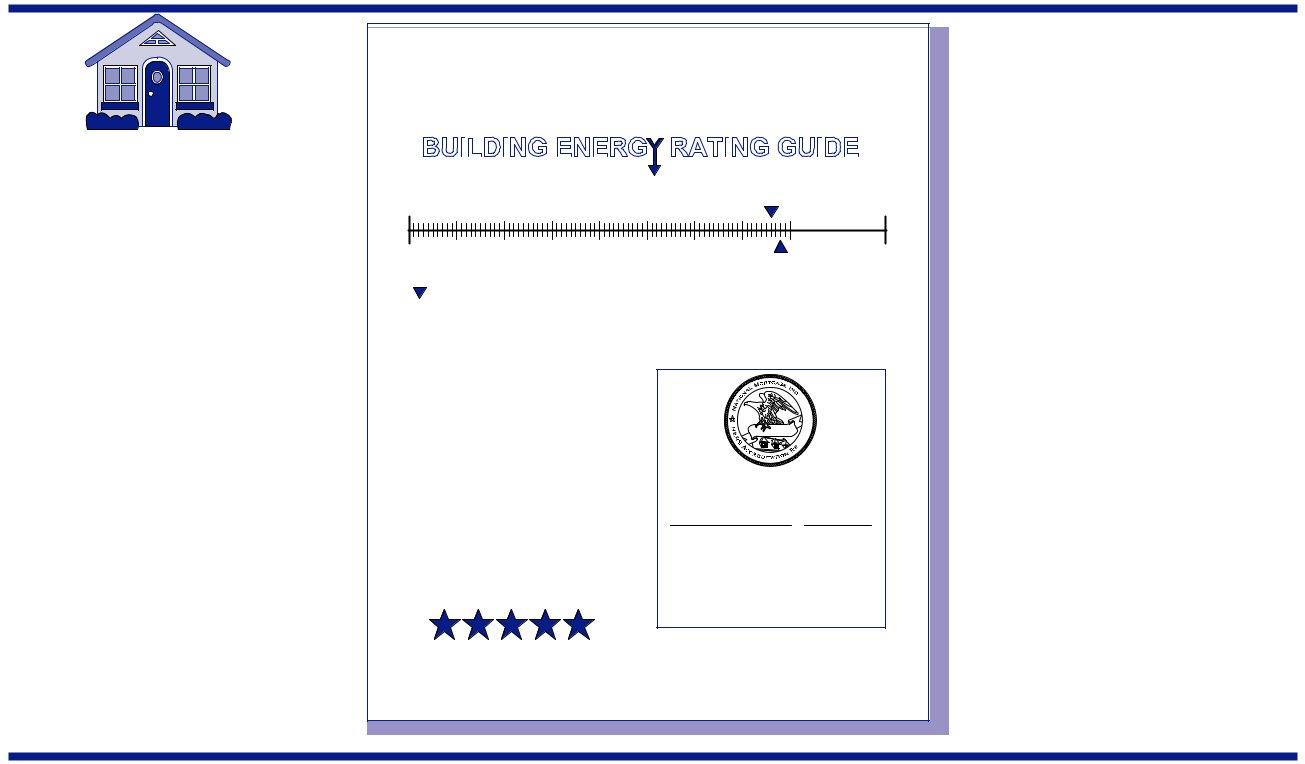

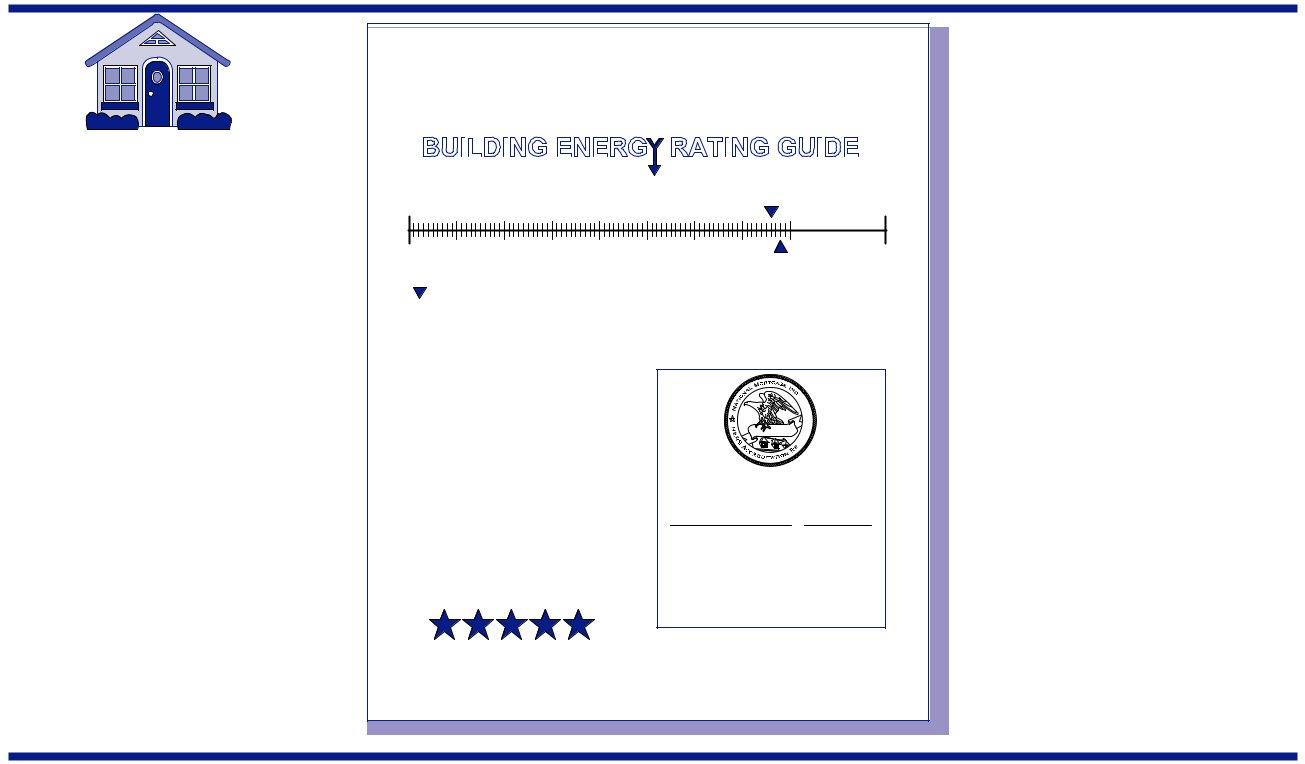

Here's how the Florida EnergyGauge

program works.

After the rating, you’ll get an easy-to-read form like the one on the inside page. The Rating Guide has a scale that allows you to compare the specific home you’re looking at with the most efficient and the least efficient homes of the same size with the same num- ber of bedrooms available in your part of the state today. In addition to this overall estimate of energy use and comparisons, you get a detailed breakdown on the energy costs of the home’s air conditioning, space heating, water heating, refrigerator, clothes dryer, cooking costs, lighting, pool pumping and other mis- cellaneous equipment.

One of the keys to the success of this program is the uniformity of ratings, made possible by the use of the EnergyGauge® soft- ware developed by the Florida Solar Energy Center. It has been specially designed to let Raters input the key data on the home and obtain accurate information for comparison purposes. A unique optimization feature even lets Raters determine what energy-efficiency features can be added to the home to maxi- mize cost-savings and comfort-improvement.

So how can a home energy rating help you reduce your energy use and save money?

That’s easy. While the design and construction of your home and the efficiency of its appli- ances and equipment control the most significant portion of its energy use, occupant lifestyle will still have a big effect on exactly how much energy gets used. Your comfort preferences and personal habits - the level at which you set the thermostat, whether or not you turn off lights and fans when leaving a room, how much natural ventilation you use, and other factors - will all affect your home’s actual monthly energy use.

Florida’s program parallels national activities.

The Residential Energy Services Network (RESNET) sets the national standards for Home Energy Rating Systems (HERS), and Florida’s sys- tem meets these standards. The Florida Building Energy Rating Guide provides a HERS Index for the home. This national score enables homes to qualify for national mortgage financing options requiring a HERS Index. This index is computed in accordance with national guidelines, consider- ing the heating, cooling, water heating, lighting, appliance, and photovoltaic energy uses. HERS awards stars to the rating.

Tell your Realtor or builder that you want to get the home rated before you buy it.

They can give you the names of Raters in your area. Additional information on the pro- gram is available from the Energy Gauge Program Office at 321-638-1715, or visit our Web site at www.floridaenergycenter.org.

Who does Energy Ratings?

It is important to note that only Florida State Certified Raters are allowed to perform ratings. These Raters have undergone rigorous training programs and have passed the RESNET National Core exam and the required challenge exams. They are also required to undergo continuing education classes and additional exams to keep their certifications current. An on-going quality control program also watches over their Ratings and their work. All their Ratings are submitted to a central registry that checks them for accuracy and compiles generic building data.

Energy Ratings in Florida

The Florida Building Energy-Efficiency Rating Act (Florida Statute 553.990) was passed by the State Legislature in 1993 and amended in 1994. It established a voluntary statewide energy- efficiency rating system for homes. The Rating System has been adopted by DCA Rule 9B-60.

The Florida Energy Gauge Program

Florida's Building Energy Rating System

1679 Clearlake Road

Cocoa, Florida 32922-5703

321-638-1715

Fax: 321-638-1010

E-Mail: info@energygauge.com

Web site: www.floridaenergycenter.org

Thinking About Buying a Home?

Get An

EnergyGauge®Rating!

Consider the Benefits:

sMore Home for Less Money

sImproved Mortgage Options

sEnhanced Indoor Comfort

sSuperior Energy Efficiency

sMore Environmental Sustainability

sTested Quality Construction

sGreater Resale Value

Congratulations on your decision

to purchase a home.

As you know, there are a lot of factors to consider before signing on the dotted line. By now, you’ve probably checked out the location of the home you like the best. You know how much the seller wants, how many bedrooms there are, wheth- er your dining room table will fit, where you’ll park your car and lots of other important things.

But wait, there’s still one more important

thing you really ought to do.

You wouldn’t buy a car without asking how

FORM FRBER-2006Effective Date:

Projected Rating Based on Plans

Field Confirmation Required

Energy Gauge |

|

|

Anyplace |

|

Design: Orlando, FL |

Miami, FL |

Title: Miami_TaxCredit |

TMY: ORLANDO_INTL_ARPT, FL |

|

CZ1 - New home tax credit qualification example |

BUILDING ENERG RATING GUIDE |

|

$941 |

Reference |

$0 |

$1237 |

|

0 MBtu |

43.4 MBtu |

|

56 MBtu |

|

Proposed Home |

Cost Basis: |

|

|

|

|

EnergyGauge Default |

Electric Rate: $0.083 |

/kWh |

|

|

|

|

EnergyGauge Default |

Gas Rate: |

$0.682 |

/Therm |

|

Savings = $296 |

Statewide Prices |

Oil: $1.50/gal |

LP Gas: $1.75/gal |

This Home may Qualify for EPA's Energy Star Label 1

This Home Qualifies for an Energy Efficient Mortgage (EEM)

sMaybe most important of all, the national

Home Energy Rating System (HERS) Index on the energy rating can qualify you for a number of special mortgage programs that offer lower interest rates, lower closing costs, and other benefits. More and more lenders are coming into Florida with money- saving packages for buyers of energy-efficient homes.

Before buying your next home, hire a Certified Energy Rater to do a rating.

Your builder or Realtor can help you find a Certified Rater in your area. After the rating, you’ll get an easy-to-understand Energy Guide that estimates how much it will cost to pay for energy used in that home; it will allow you to look at a number of separate areas of energy use throughout the house.

For many years, buyers have had home inspectors look over a home before making their

many miles-per-gallon it gets, would you? So why would you even think of buying a house without knowing how much the power bills will be? That’s why now is the perfect time to get an Energy- Gauge® rating on the house.

Since 1994, there has been a voluntary statewide energy-efficiency rating system for homes in Florida, and prospective homeowners just like you all around the state are getting their homes rated before they make their purchase. There are several very important reasons why:

s Energy ratings give homebuyers a market- |

place yardstick that measures the benefits |

of energy-efficiency improvements. You get |

detailed estimates of how much your energy |

use will cost. |

s Energy ratings give you clear and specific |

Cooling |

|

|

|

|

|

|

|

|

$146 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating |

|

|

|

|

$44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hot Water |

|

|

|

|

|

|

|

$199 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ceil. Fan |

|

|

$23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dishwash |

|

$9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dryer |

|

|

|

$74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lighting |

|

|

|

$102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Misc. |

|

|

|

|

$253 |

Pumps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Range |

|

$37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Refrig. |

|

$54 |

|

|

|

|

|

|

|

PV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HERS Index2: 68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|