When working in the online editor for PDFs by FormsPal, you are able to fill in or change form 201 pdf here and now. We at FormsPal are focused on providing you with the ideal experience with our editor by continuously presenting new functions and improvements. Our editor is now a lot more helpful as the result of the latest updates! At this point, filling out PDF files is easier and faster than ever. To get the ball rolling, go through these simple steps:

Step 1: Open the PDF inside our editor by clicking the "Get Form Button" above on this webpage.

Step 2: This tool helps you modify the majority of PDF files in various ways. Change it by including your own text, correct what's already in the document, and include a signature - all readily available!

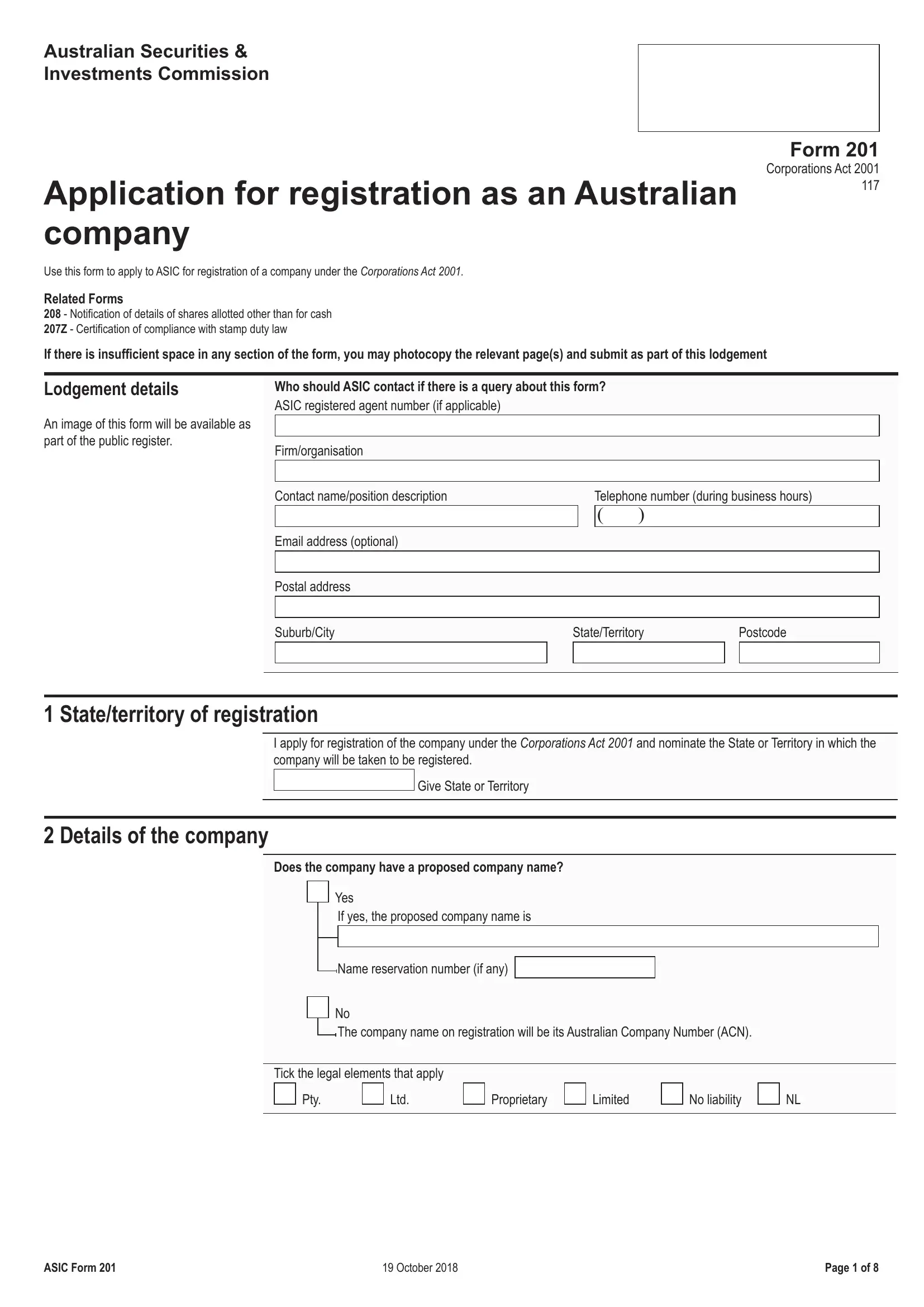

If you want to fill out this PDF form, be sure to enter the right details in each blank:

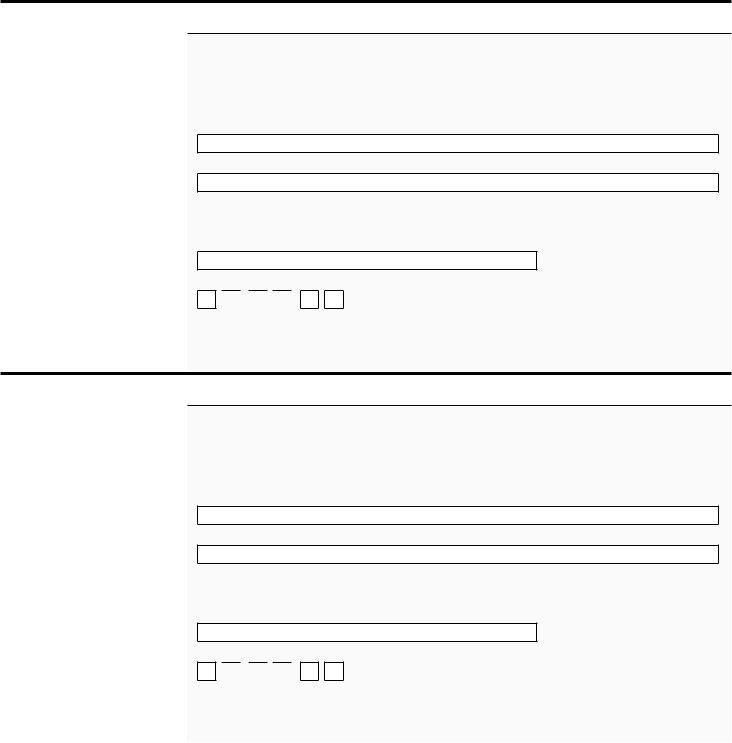

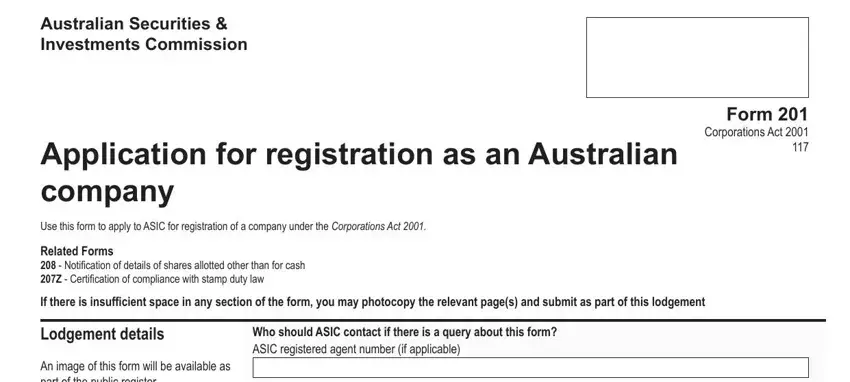

1. To begin with, once filling out the form 201 pdf, start out with the section that includes the next fields:

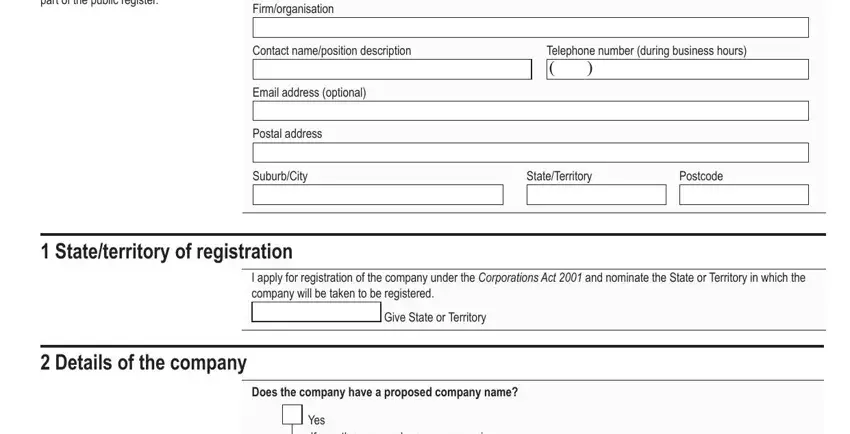

2. The third step is to submit all of the following blanks: An image of this form will be, Firmorganisation, Contact nameposition description, Email address optional, Postal address, SuburbCity, Telephone number during business, StateTerritory, Postcode, Stateterritory of registration, I apply for registration of the, Give State or Territory, Details of the company, Does the company have a proposed, and Yes.

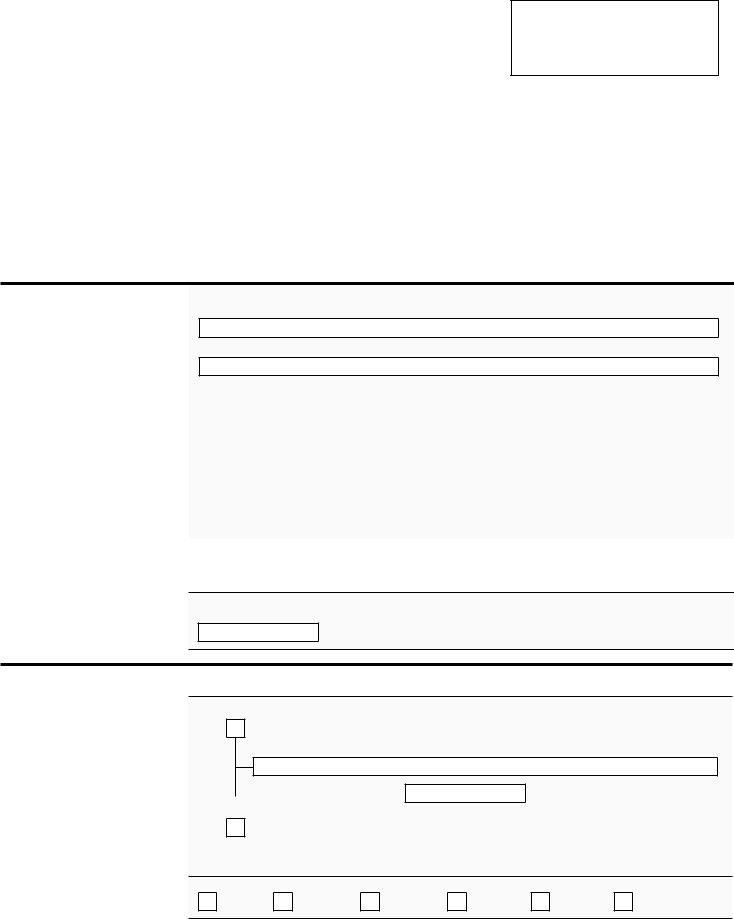

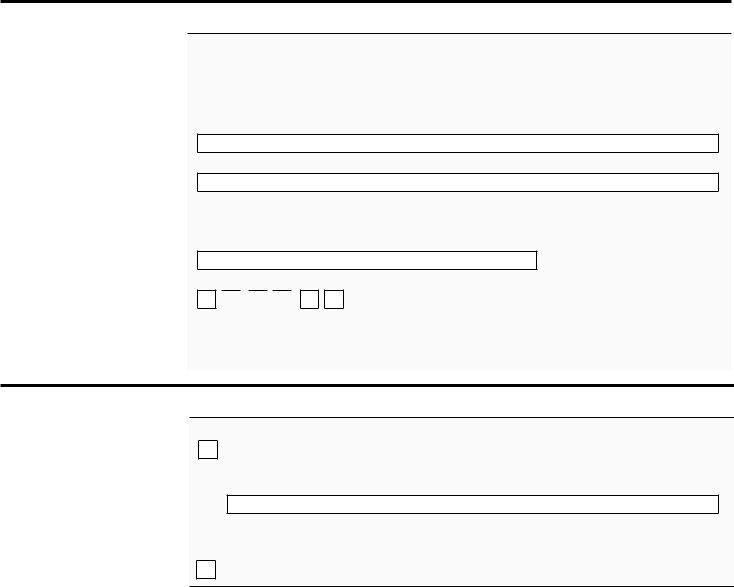

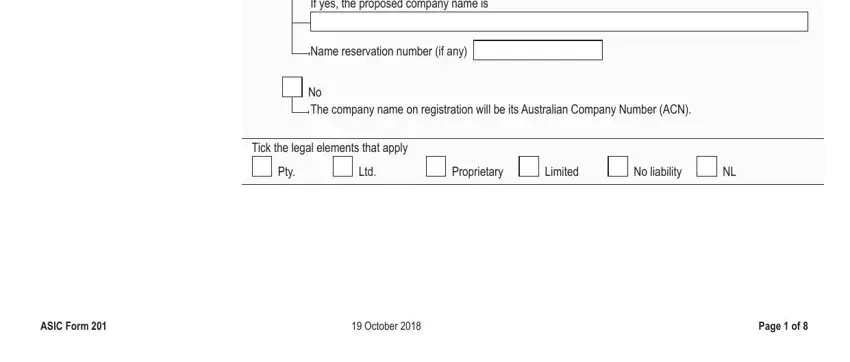

3. This next part is generally straightforward - fill out all the empty fields in If yes the proposed company name is, Name reservation number if any, The company name on registration, Tick the legal elements that apply, Pty, Ltd, Proprietary, Limited, No liability, ASIC Form , October , and Page of in order to finish this segment.

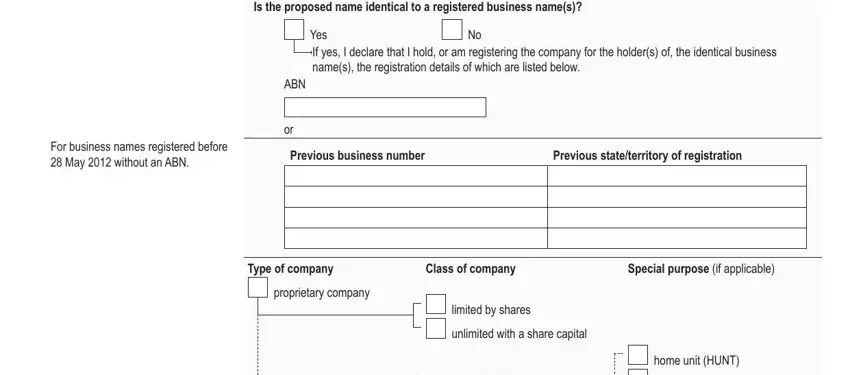

4. The next paragraph comes with these fields to consider: Is the proposed name identical to, Yes, If yes I declare that I hold or am, ABN, For business names registered, Previous business number, Previous stateterritory of, Type of company, Class of company, Special purpose if applicable, proprietary company, limited by shares, unlimited with a share capital, and home unit HUNT.

Be very mindful when filling out limited by shares and If yes I declare that I hold or am, because this is the part in which many people make a few mistakes.

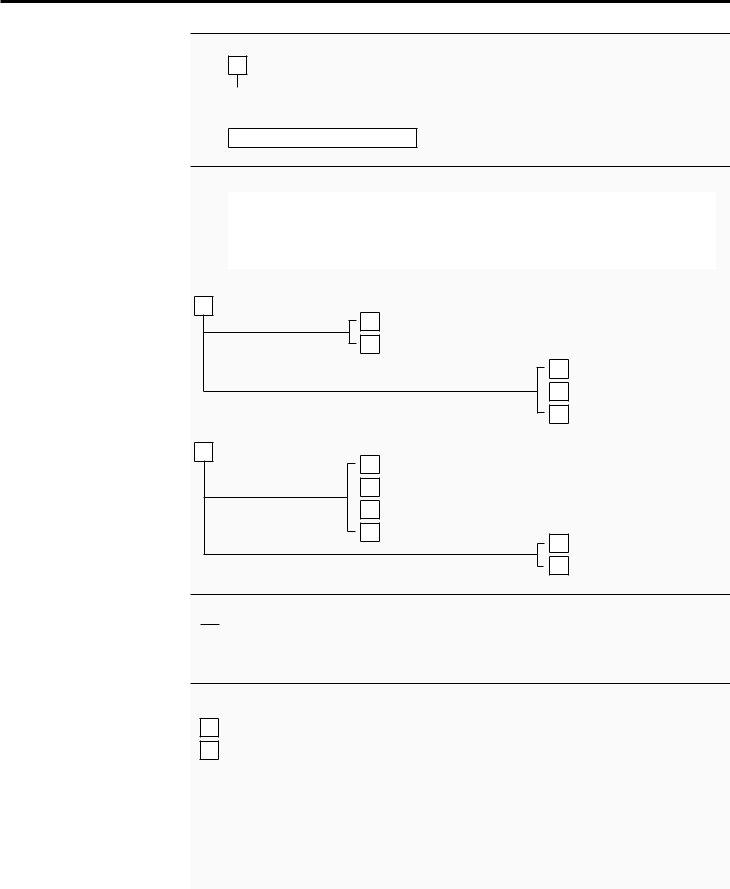

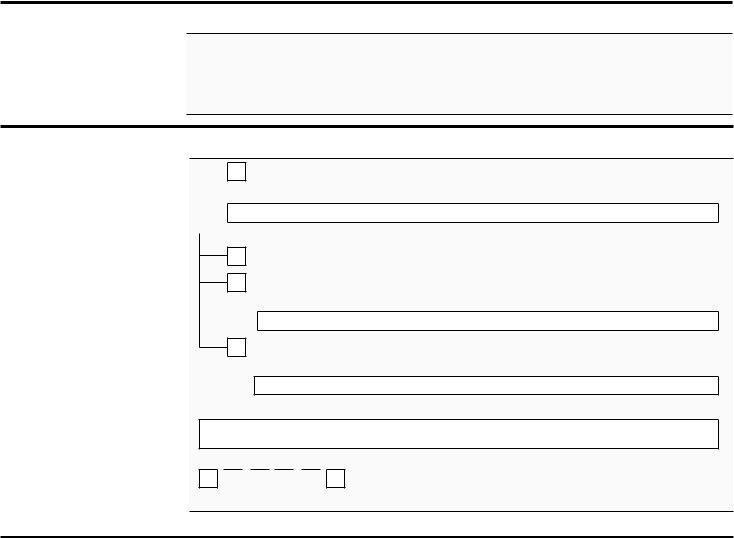

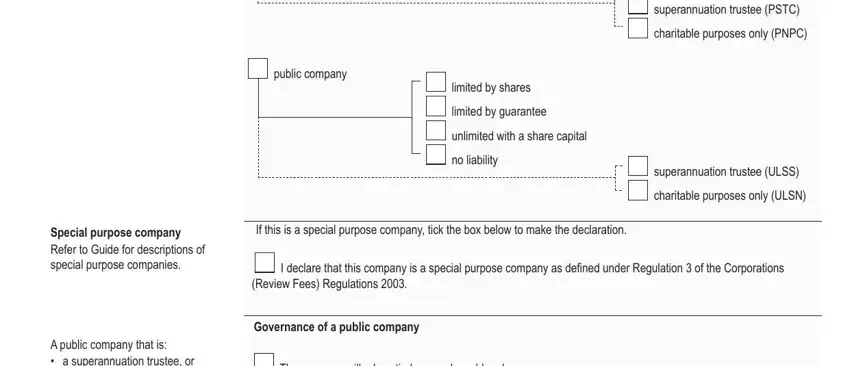

5. The pdf needs to be finished by going through this part. Further you have an extensive listing of form fields that require correct details to allow your document submission to be complete: public company, limited by shares, limited by guarantee, unlimited with a share capital, no liability, superannuation trustee PSTC, charitable purposes only PNPC, superannuation trustee ULSS, charitable purposes only ULSN, Special purpose company Refer to, If this is a special purpose, I declare that this company is a, Review Fees Regulations , A public company that is a, and Governance of a public company.

Step 3: Check the information you've inserted in the form fields and click the "Done" button. Join us right now and instantly use form 201 pdf, ready for download. Each and every modification you make is conveniently preserved , enabling you to modify the pdf later on if needed. At FormsPal.com, we strive to make sure that your information is kept protected.