Handling PDF documents online is always quite easy using our PDF tool. You can fill in form b255e here without trouble. To maintain our tool on the leading edge of convenience, we strive to integrate user-oriented capabilities and improvements on a regular basis. We're always glad to receive feedback - help us with reshaping how we work with PDF docs. Starting is effortless! All that you should do is take the next easy steps directly below:

Step 1: Click the "Get Form" button in the top area of this webpage to open our editor.

Step 2: Using our online PDF file editor, you could do more than merely fill in blank form fields. Try all the functions and make your forms seem high-quality with customized textual content put in, or modify the file's original input to excellence - all comes with an ability to insert stunning photos and sign the file off.

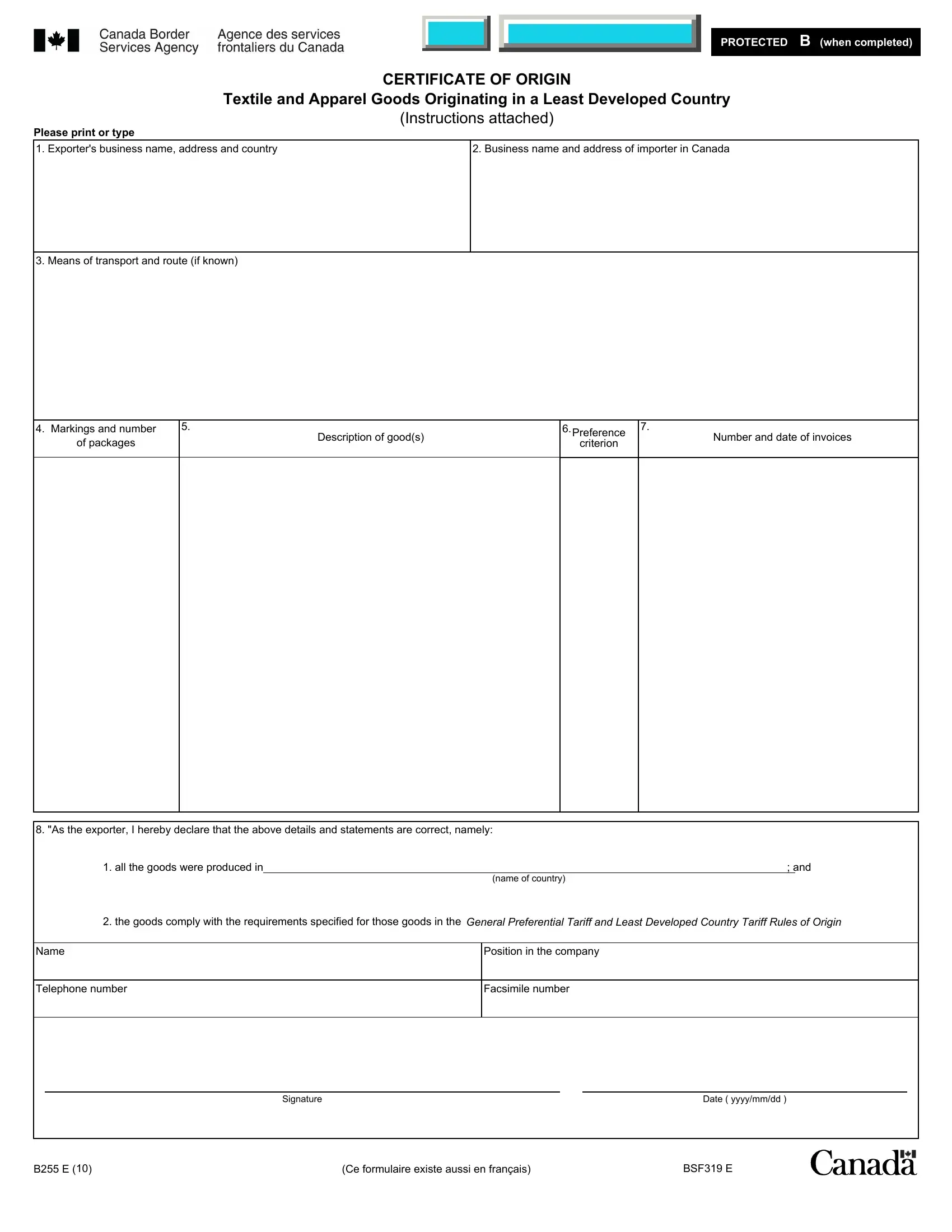

This PDF will need specific info to be filled out, so make sure to take the time to fill in what's asked:

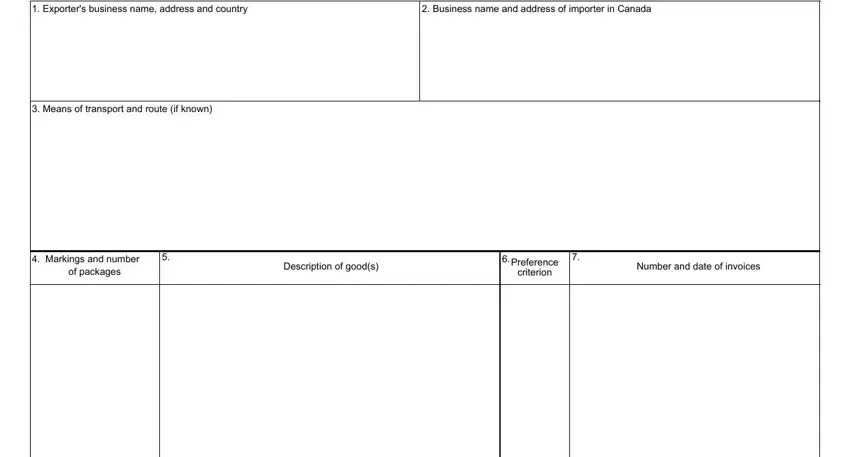

1. It's vital to fill out the form b255e properly, therefore be attentive when filling in the parts containing these particular blank fields:

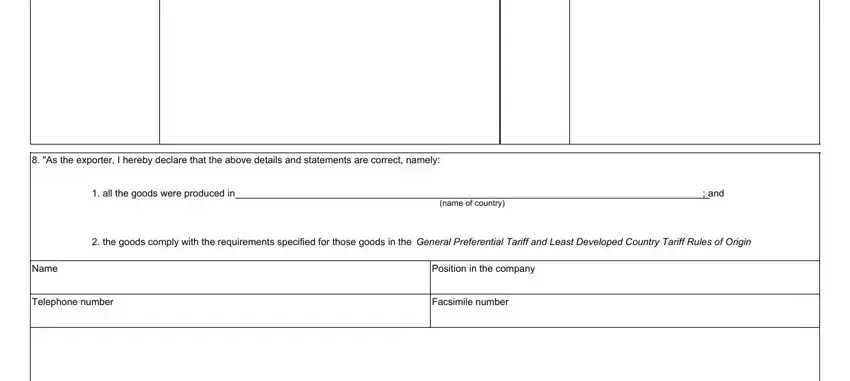

2. After the previous section is finished, you have to add the necessary particulars in As the exporter I hereby declare, all the goods were produced in , name of country, the goods comply with the, Name, Telephone number, Position in the company, and Facsimile number so you can progress further.

Always be extremely attentive while filling in Position in the company and name of country, as this is the section in which many people make some mistakes.

Step 3: Check that your details are correct and then click on "Done" to continue further. Make a free trial account with us and get direct access to form b255e - download, email, or edit from your FormsPal account. With FormsPal, you'll be able to complete forms without stressing about data breaches or data entries being shared. Our secure platform helps to ensure that your personal information is stored safely.