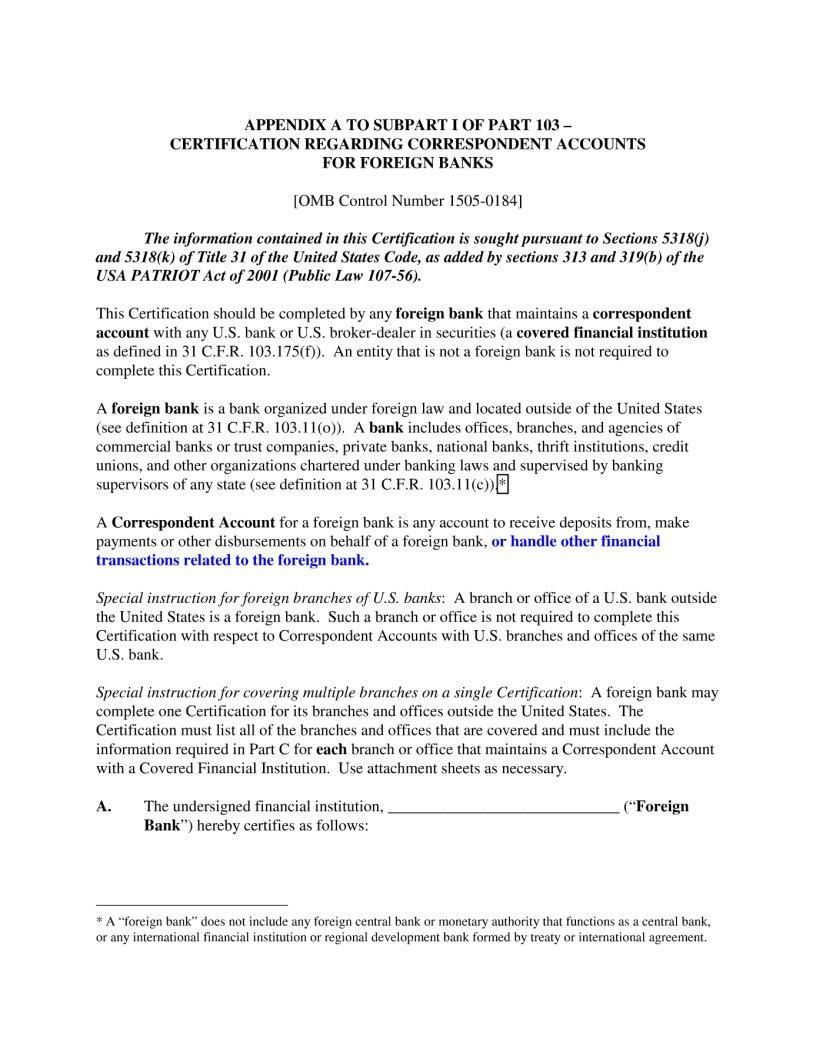

Navigating the world of finance can often feel like trying to decipher an ancient code. Within this complex realm, the Bank Certification form serves as a crucial tool, bridging the gap between individuals and their banking institutions. This document, essential for transactions and processes such as loan applications, account openings, and compliance with anti-money laundering regulations, is more than just a form; it's a testament to a person's financial standing and relationship with their bank. It verifies the authenticity of an account holder's information, ensuring that the details provided are accurate and up to date. By offering a comprehensive snapshot of an account holder's financial health, the Bank Certification form plays a pivotal role in financial transactions, embodying trust and credibility between parties. Understanding its purpose, the details required, and the situations in which it is necessary, can significantly streamline any financial process, making the form an indispensable asset for both individuals and financial institutions alike.

| Question | Answer |

|---|---|

| Form Name | Bank Certification Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | bank any certification, certification bank certificate sample, bank certification form sample, bank certification form |