Using PDF files online is definitely a breeze using our PDF editor. You can fill in il incorporation here painlessly. To have our tool on the cutting edge of efficiency, we work to put into operation user-oriented capabilities and improvements regularly. We're routinely looking for suggestions - assist us with remolding PDF editing. By taking a few easy steps, it is possible to start your PDF editing:

Step 1: Click on the "Get Form" button above. It'll open our editor so that you could start completing your form.

Step 2: The editor will give you the ability to work with the majority of PDF files in various ways. Modify it by including your own text, correct what is already in the document, and include a signature - all when you need it!

Filling out this PDF calls for thoroughness. Ensure all required blanks are filled out properly.

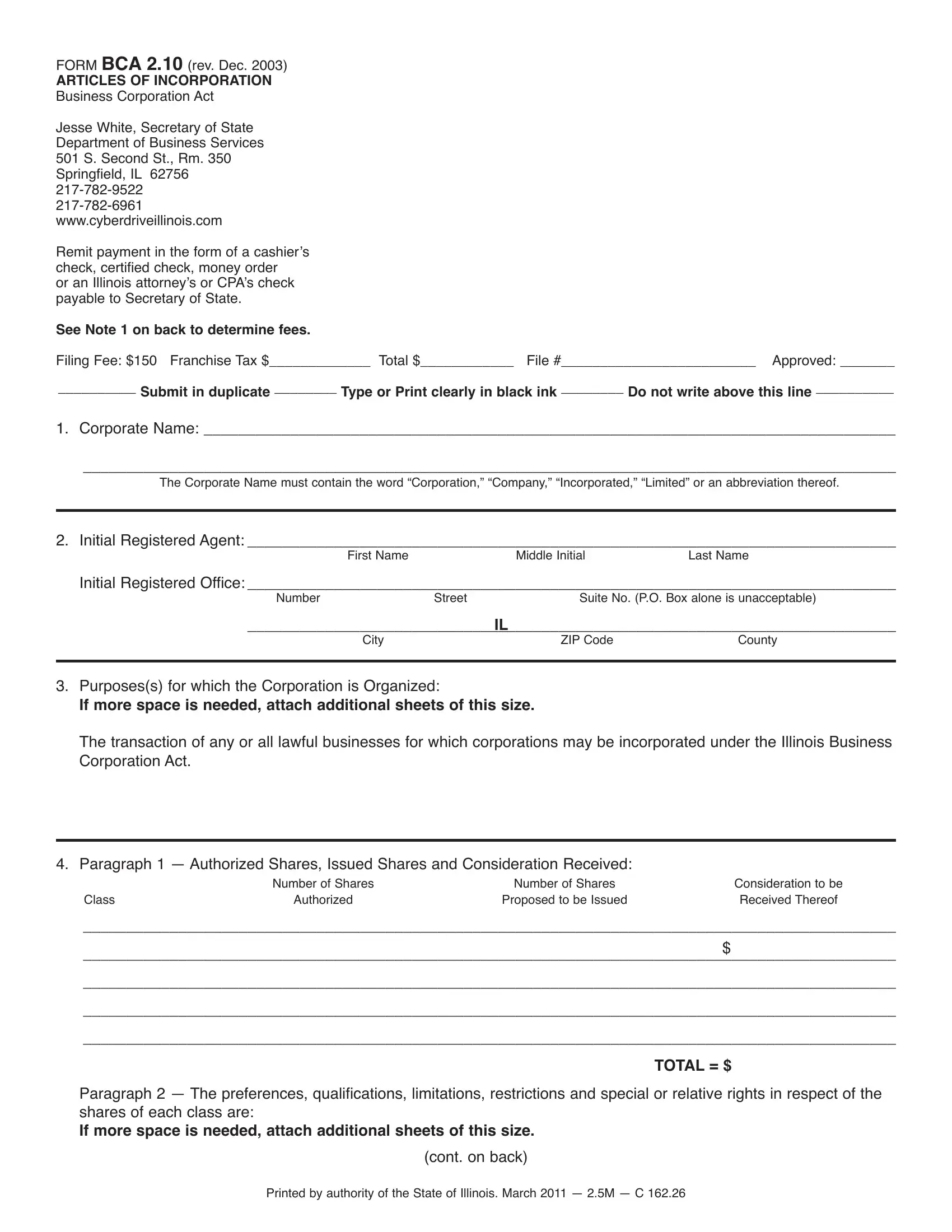

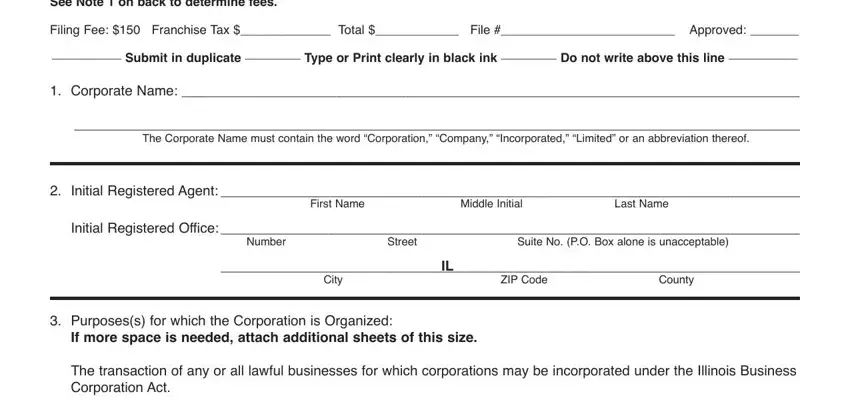

1. Firstly, when filling out the il incorporation, beging with the part that features the subsequent blank fields:

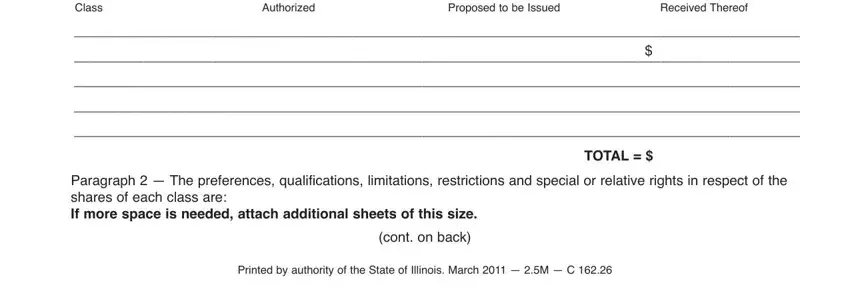

2. When this selection of blanks is completed, go on to enter the applicable details in all these: Class, Number of Shares, Authorized, Number of Shares, Proposed to be Issued, Consideration to be Received, TOTAL , Paragraph The preferences, cont on back, and Printed by authority of the State.

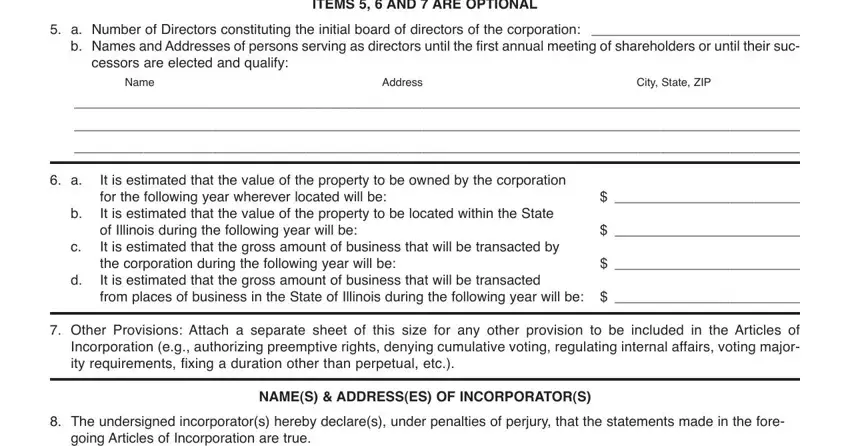

3. In this step, have a look at ITEMS AND ARE OPTIONAL, a Number of Directors, cessors are elected and qualify, Name, Address, City State ZIP, It is estimated that the value of, Other Provisions Attach a, The undersigned incorporators, NAMES ADDRESSES OF INCORPORATORS, and going Articles of Incorporation. Each of these have to be completed with utmost attention to detail.

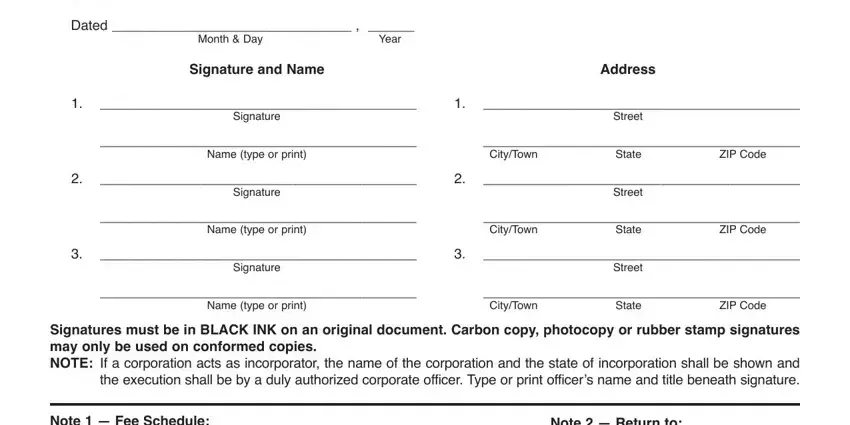

4. This fourth part comes next with these particular empty form fields to complete: going Articles of Incorporation, Dated , Month Day, Year, Signature and Name, Address, Signature, Street, Name type or print, CityTown State ZIP Code, Signature, Street, Name type or print, CityTown State ZIP Code, and Signature.

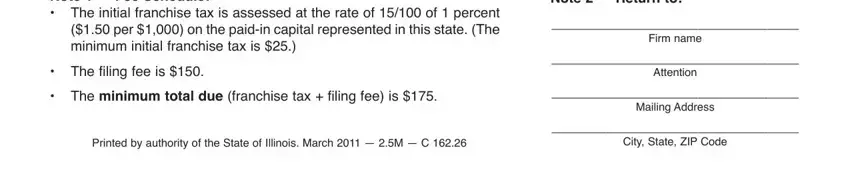

5. To conclude your document, the last area incorporates a few extra fields. Typing in Note Fee Schedule The initial, The filing fee is , The minimum total due franchise, Printed by authority of the State, Note Return to, Firm name, Attention, Mailing Address, and City State ZIP Code will wrap up the process and you're going to be done before you know it!

It's very easy to make errors when completing the Note Return to, therefore be sure you take a second look before you finalize the form.

Step 3: After going through your form fields you have filled out, click "Done" and you are all set! Right after setting up afree trial account with us, you'll be able to download il incorporation or send it through email without delay. The document will also be accessible through your personal account menu with your edits. We don't share the information you type in whenever dealing with forms at FormsPal.