Couple of things can be simpler than managing documentation using the PDF editor. There isn't much for you to do to manage the transamerica change of address form form - simply adopt these measures in the next order:

Step 1: Pick the button "Get Form Here".

Step 2: Now you will be within the file edit page. You can include, change, highlight, check, cross, include or remove areas or text.

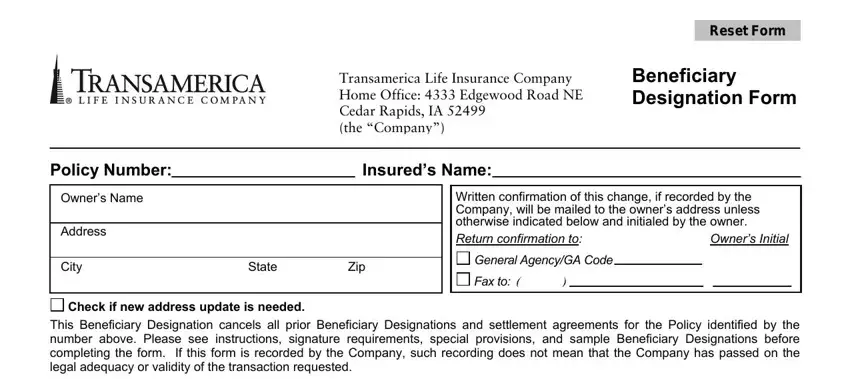

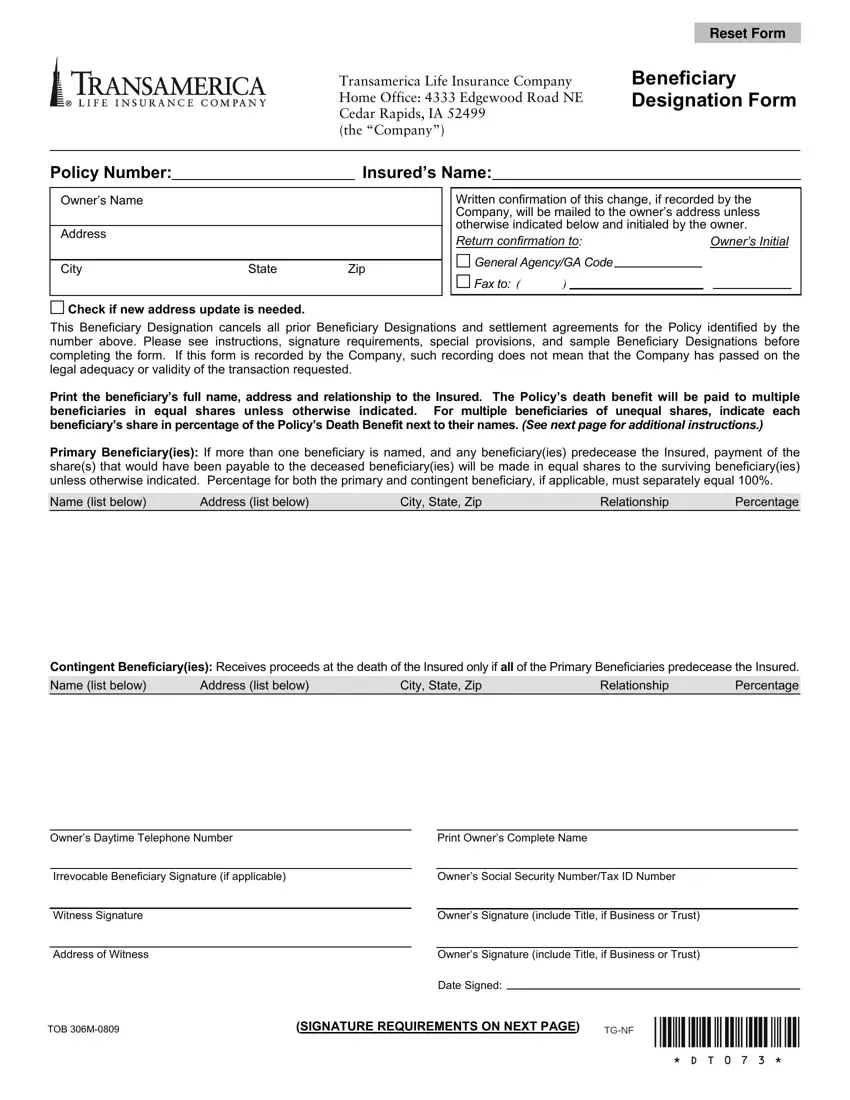

Type in the required information in each area to fill in the PDF transamerica change of address form

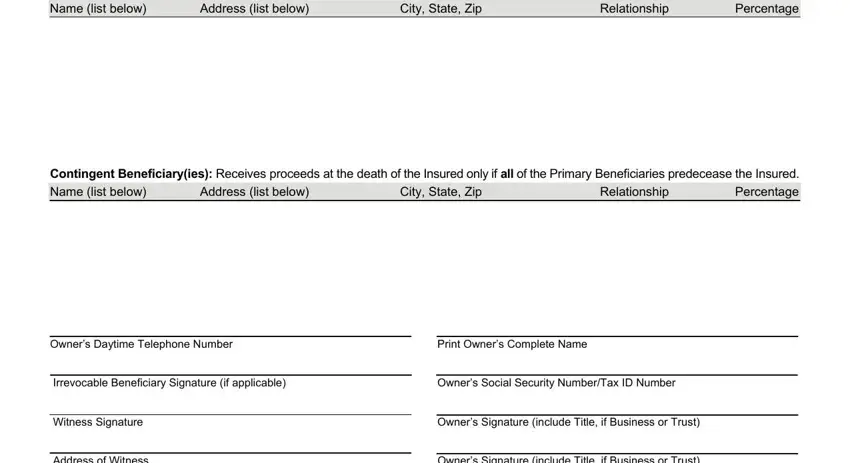

In the Name list below, Address list below, City State Zip, Relationship Percentage, Contingent Beneficiaryies Receives, Relationship Percentage, Address list below, City State Zip, Owners Daytime Telephone Number, Print Owners Complete Name, Irrevocable Beneficiary Signature, Owners Social Security NumberTax, Witness Signature, Address of Witness, and Owners Signature include Title if area, note down your details.

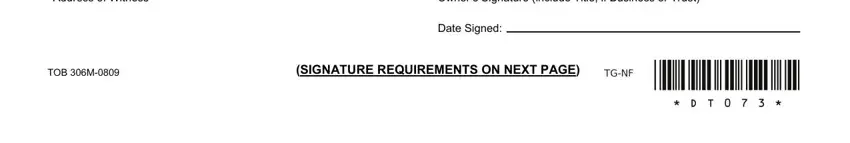

Focus on the main details about the Address of Witness, Owners Signature include Title if, Date Signed, TOB M, SIGNATURE REQUIREMENTS ON NEXT PAGE, and TGNF area.

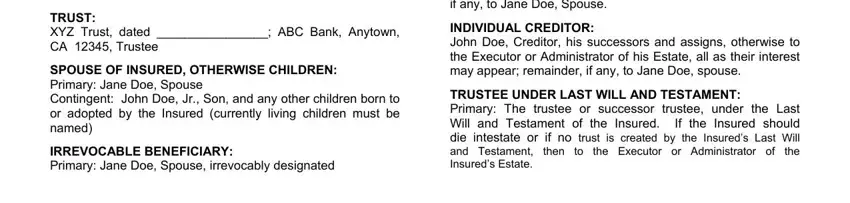

The INSUREDS ESTATE Estate of Insured, TRUST XYZ Trust dated ABC Bank, SPOUSE OF INSURED OTHERWISE, IRREVOCABLE BENEFICIARY Primary, CORPORATE CREDITOR Primary ABC Co, INDIVIDUAL CREDITOR John Doe, TRUSTEE UNDER LAST WILL AND, the Executor or Administrator of, and then space is the place where either side can describe their rights and responsibilities.

Step 3: Press the "Done" button. At that moment, you may transfer your PDF file - upload it to your device or send it through email.

Step 4: To prevent yourself from potential upcoming difficulties, you should always hold up to two copies of every file.

Check if new address update is needed.

Check if new address update is needed.