It is possible to fill out cigna life benificary forms effectively with the help of our online PDF tool. To retain our tool on the leading edge of efficiency, we aim to put into action user-oriented capabilities and improvements on a regular basis. We are routinely pleased to get suggestions - join us in remolding the way you work with PDF forms. Getting underway is effortless! All you need to do is adhere to these easy steps below:

Step 1: Click on the orange "Get Form" button above. It is going to open up our tool so that you can begin filling out your form.

Step 2: With our handy PDF editor, it is easy to do more than simply complete blank form fields. Express yourself and make your docs look sublime with customized textual content incorporated, or modify the original input to perfection - all that accompanied by the capability to insert any images and sign the PDF off.

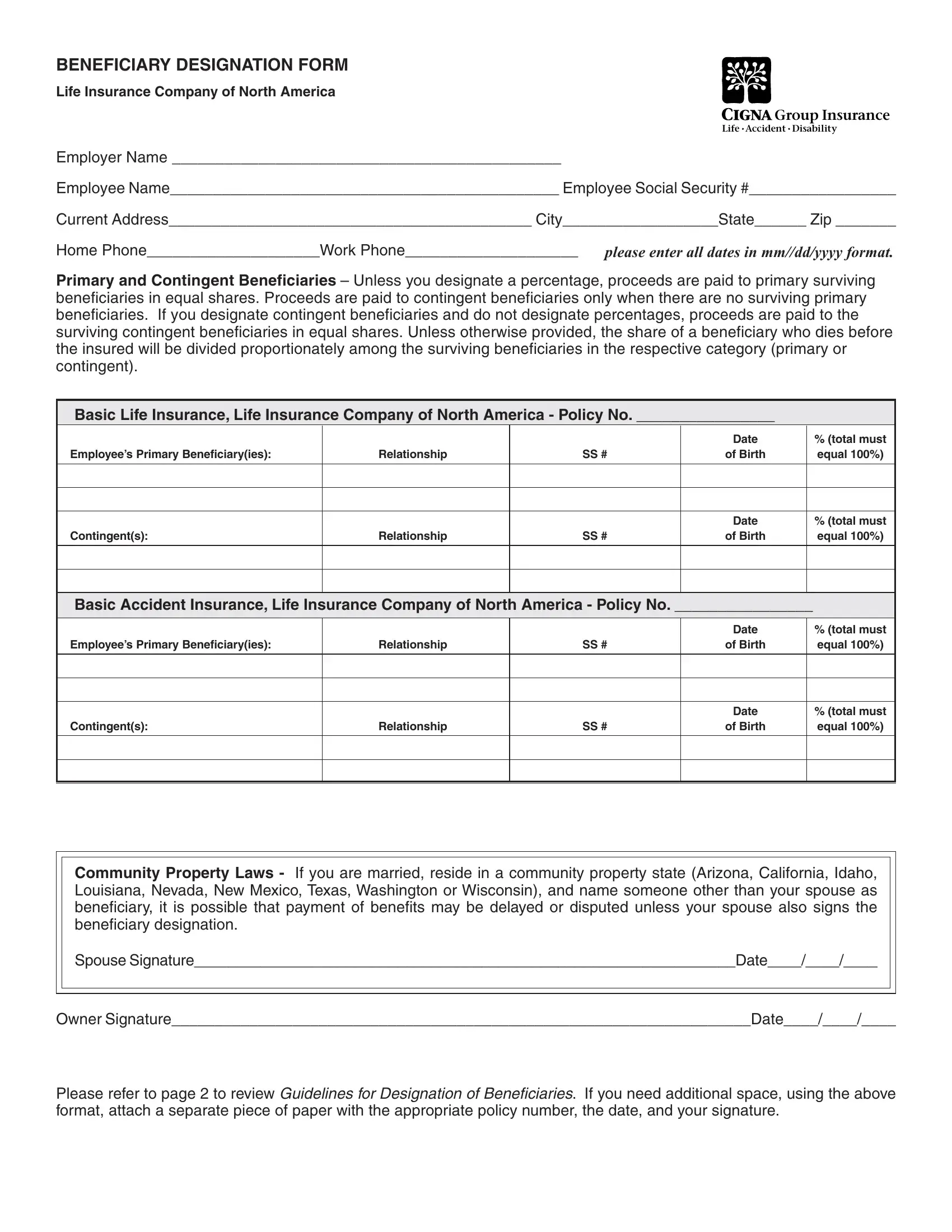

This form will need particular info to be entered, therefore ensure you take whatever time to provide precisely what is requested:

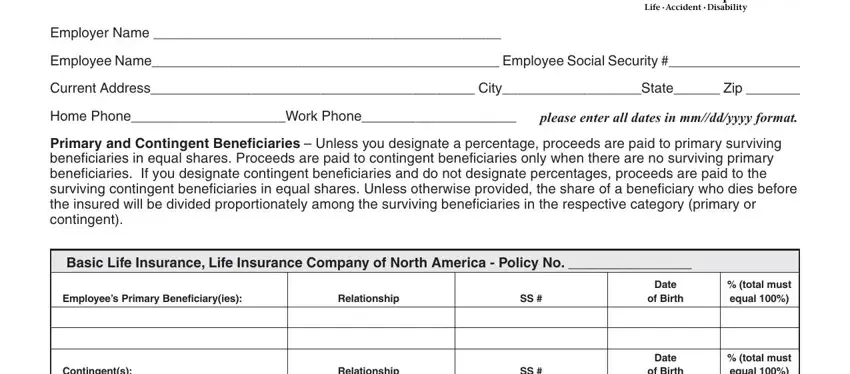

1. Begin completing the cigna life benificary forms with a selection of necessary fields. Note all of the important information and be sure nothing is forgotten!

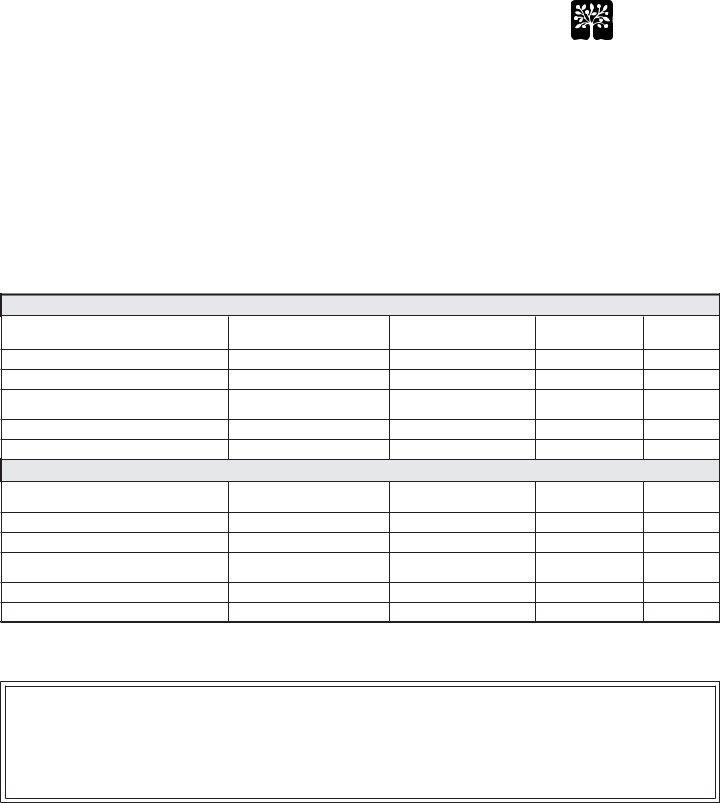

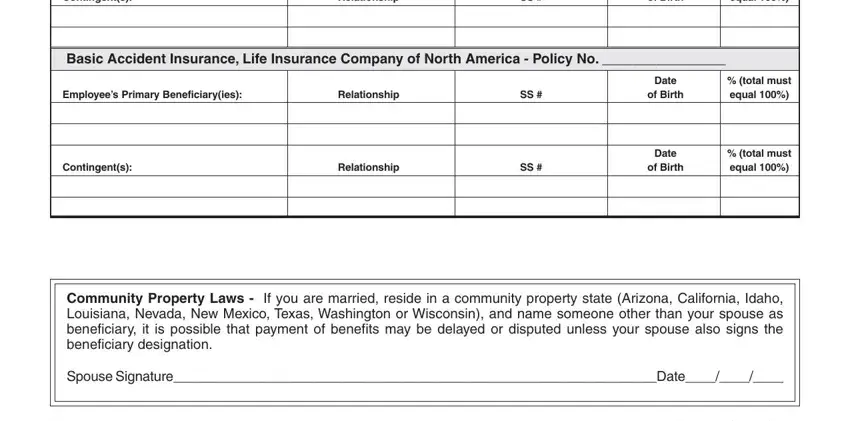

2. The next stage would be to submit all of the following fields: Contingents, Relationship, SS , of Birth, total must equal , Basic Accident Insurance Life, Employees Primary Beneficiaryies, Relationship, SS , Contingents, Relationship, SS , Date, of Birth, and total must equal .

Be really mindful while completing Relationship and of Birth, as this is where many people make errors.

Step 3: Right after you have glanced through the information in the blanks, simply click "Done" to conclude your document creation. Sign up with us today and immediately gain access to cigna life benificary forms, all set for downloading. All modifications made by you are saved , so that you can edit the file later when required. We don't share or sell the information that you use while filling out documents at our website.