At the heart of local tax compliance for employers in Pennsylvania lies the Berkheimer form, officially known as the Employer Quarterly Return of Local Earned Income Tax Withholding. This crucial document, paving the way for accurate tax reporting and withholding, requires meticulous attention to detail, underscoring the necessity for employers to understand its components and obligations thoroughly. Mailed to the designated post office box in Lehigh Valley, PA, or submitted electronically, the form serves as a conduit between businesses and the municipal taxing authority, ensuring that earned income taxes are correctly withheld from employees and duly reported each quarter. The form outlines a series of sections including total earned income tax withheld, adjustments, and the net tax due, alongside details such as penalties and interests for late submissions. Moreover, it emphasizes the employer's critical role in maintaining accurate records, such as changes in ownership or employee details, underlining the broader responsibility towards local tax compliance. As regulations stipulate filing on a quarterly basis, businesses are urged to stay vigilant on deadlines to avoid unnecessary penalties, a task facilitated by the form's clear guidelines and Berkheimer's additional support services for queries or appeals. This article delves into the Berkheimer form's facets, aiming to demystify the process and underscore the significance of this administrative duty in upholding the financial integrity of both the business and the local community it serves.

| Question | Answer |

|---|---|

| Form Name | Berkheimer Online Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | berkheimer local tax, how to fill out berkheimer local tax form, berkheimer lehigh valley, berkheimer tax forms |

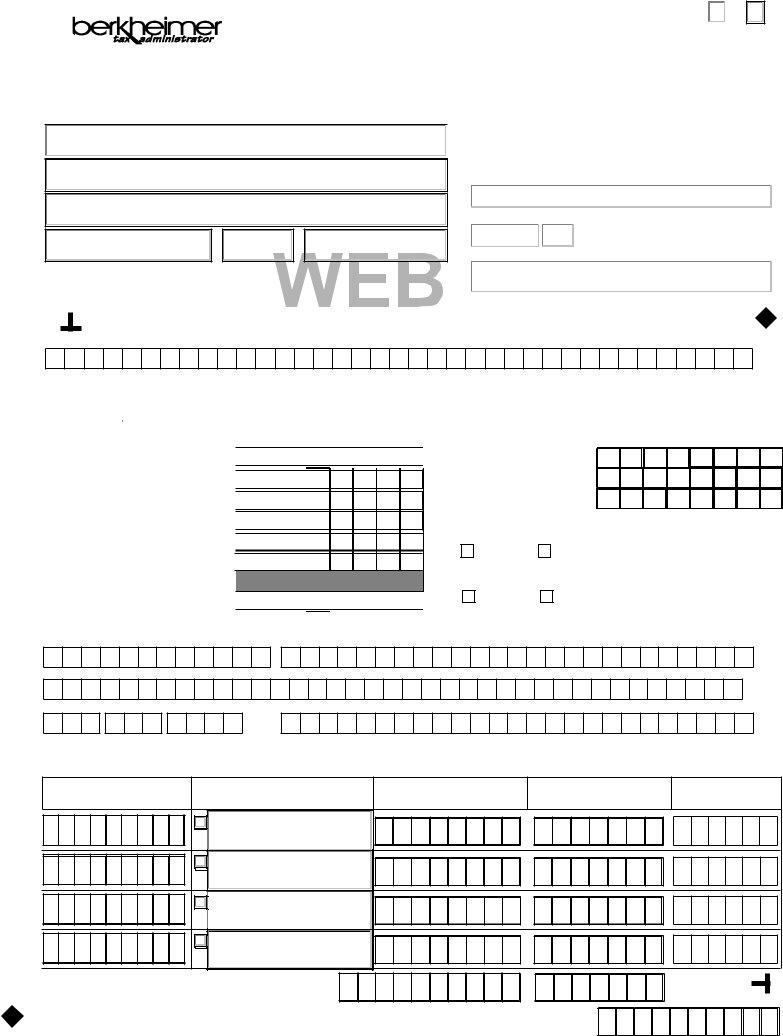

EMPLOYER QUARTERLY RETURN

Local Earned Income Tax Withholding

PO Box 25132

Lehigh valley, PA

PAgE |

|

Of |

|

|

|

DCEDE11

Mailing Address:

You are entitled to receive a written explanation of your rights with regard to the audit, appeal, enforcement, refund and collection of local taxes by calling Berkheimer at

Berkheimer is not the appointed tax hearing officer for your taxing district and will not accept any petitions for appeal. Petitions for appeal must be filed with the appropriate appeals board for your County. Berkheimer can provide you with the proper procedures and forms necessary to file an appeal with the appeals board for your Tax Collection District.

Location of Business

|

|

|

||

Year / Quarter |

||||

web |

||||

|

|

|

||

|

|

|

060612 |

|

Account # |

||||

|

||||

|

|

|

|

|

MUNICIPAL TAXINg AUTHORITY (City, Borough, or Township) IN WHICH fACILITY OR BUSINESS IS LOCATED (Attach listing of multiple locations within PA if applicable)

COUNTY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS PHONE NUMBER |

|

|

|

|

|

|

|

BUSINESS fAX NUMBER |

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER PSD CODE |

fEDERAL EIN OR SOCIAL SECURITY # |

|

ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

YEAR |

|

|

|

|

QUARTER |

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

TOTAL EARNED INCOME TAX WITHHELD |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|||

2. CREDIT OR ADJUSTMENT (attach explanation) |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

, |

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

TOTAL Of EARNED INCOME TAX DUE |

|

|

|

|

|

|

|

|

|

|

, |

|

|

(line 1 minus line2) |

|

|

|

|

|

|

|

|

|

|

||

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

TOTAL PAYMENTS MADE THIS QUARTER |

|

|

|

|

|

|

|

|

|

|

, |

||

|

(Schedule B) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

5. |

ADJUSTED TOTAL Of EIT DUE |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

||||

|

(line 3 minus line 4) |

|

|

|

|

|

|

|

|

|

|

||

6. PENALTY AND INTEREST |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

(1.00246% per month after due date x line 5) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

||||||

7. BALANCE DUE WITH RETURN |

.....(add lines 5 and 6) |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|||

.

..

.

..

.

M M D D Y Y Y |

Y |

8.DATE PERIOD ENDED (MM/DD/YYYY).....

9.TOTAL PAgES Of THIS RETURN .............

10.TOTAL NUMBER Of EMPLOYEES LISTED ...

If THERE HAS BEEN A CHANgE Of OWNERSHIP OR OTHER TRANSfER Of BUSINESS DURINg THE QUARTER, ATTACH EXPLANATION AND gIvE NAME Of PRESENT OWNER AND DATE THE CHANgE TOOK PLACE.

CHANgE |

NO CHANgE |

DO YOU EXPECT TO PAY TAXABLE WAgES NEXT QUARTER?

YES |

NO |

Under penalties of perjury, I (we) declare that I (we) have examined this information, including all accompanying schedules and statements and to the best of my (our) belief, they

are true, correct and complete

PRIMARY CONTACT INDIvIDUAL (fIRST NAME, LAST NAME)

TITLE

PRIMARY CONTACT PHONE NUMBERPRIMARY CONTACT EMAIL ADDRESS

SIgNATURE Of PRIMARY CONTACT INDIvIDUAL |

|

DATE (MM/DD/YYYY) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

(11)EMPLOYEE'S SOCIAL SECURITY NUMBER

(12)EMPLOYEE'S NAME/ADDRESS

Check if making any corrections to EMPLOYEE’S

Name/Address, SSN or Resident PSD

(13)GROSS COMPENSATION PAID THIS QUARTER

(14)AMOUNT OF EIT WITHHELD THIS QUARTER

(15) RESIDENT

PSD CODE

|

|

, |

. |

, |

. |

|

|

|

|

, |

. |

, |

. |

|

|

|

|

, |

. |

, |

. |

|

|

|

|

, |

. |

, |

. |

|

|

(16) FIRST PAGE TOTAL |

, |

, |

. |

, |

. |

|

|

Make Checks payable to: |

|

|

|||||

|

|

|

|

|

|

|

|

There will be an additional cost assessed for returned payments. |

|

|

TOTAL Amount Enclosed |

..... $ |

, |

, |

. |

|

|

|

There will be an additional cost assessed if no payment is enclosed for tax due at time of filing.

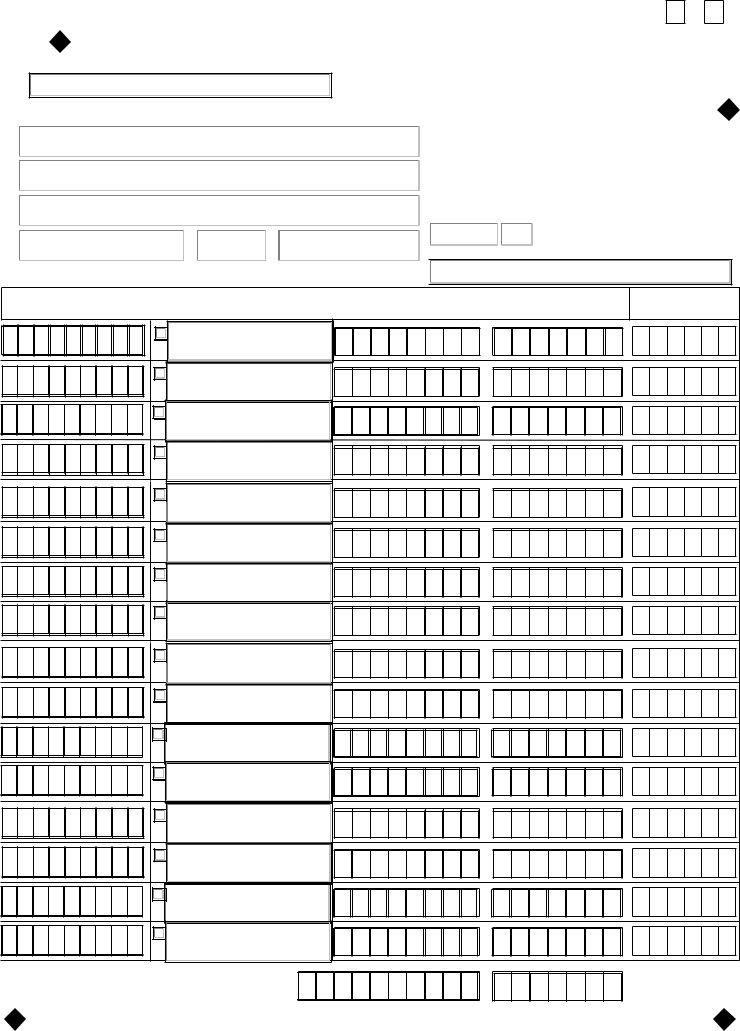

EMPLOYER QUARTERLY RETURN for Local Earned Income Tax Withholding

Employer Business Location:

Mailing Address:

|

|

|

|

|

|

|

|

|

|

|

|

|

Year / Quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(12) EMPLOYEE'S NAME/ADDRESS |

|

|

|

|

|

|

|

(14) AMOUNT OF EIT |

||||||

|

(11) EMPLOYEE'S |

|

|

(13) GROSS COMPENSATION |

|

|

|||||||||||

|

|

|

|

|

|||||||||||||

|

|

Check if making any corrections to EMPLOYEE’S |

|

|

|

||||||||||||

SOCIAL SECURITY NUMBER |

|

|

PAID THIS QUARTER |

|

WITHHELD THIS QUARTER |

||||||||||||

|

Name/Address, SSN or Resident PSD |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE OF

DCEDE12

(15)RESIDENT PSD CODE

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

|

|

, |

. |

, |

. |

(16 THIS PAGE TOTAL |

, |

, |

. |

, |

. |

|

WHO MUST FILE: |

INSTRUCTIONS |

|

If |

you have employed |

one |

or more individuals, other than |

domestic |

servants, |

for |

a |

salary, wage, |

commission, |

or |

other compensation, |

you |

must file a return for the first |

quarter |

in which |

you |

are |

required to |

withhold the |

Earned Income Tax from earnings, and each quarter thereafter. |

|

|

|

|

|

|

|||

If you have no employees for a tax period, a return must be filed indicating "no employees" for that quarter. All Pennsylvania based employers are required to withhold the tax based on the higher rate of either the employee’s resident tax rate or employer’s

QUARTERLY RETURNS AND DUE DATES: A return must be filed for each quarter of the calendar year on the dates listed below unless the date falls on a Saturday or Sunday then the due date becomes the next business day.

1st quarter: January, February, March |

Due on or Before |

April 30 |

2nd quarter: April, May, June |

Due on or Before |

July 31 |

3rd quarter: July, August, September |

Due on or Before |

October 31 |

4th quarter: October, November, December |

Due on or Before |

January 31 |

NOTE: Delinquent cost may be assessed for failure to file a required Employer Quarterly Earned Income Tax return.

WHERE TO FILE:

To file your quarterly

If you choose not to use an online filing option, you can mail your return and payment to the address noted at the bottom of this form.

ITEM 1:

ITEM 2:

ITEM 3:

ITEM 4:

ITEM 5: ITEM 6:

FORM

Total Earned Income Tax withheld from all employees' wages during the quarter.

Credit or Adjustment (attach explanation). Line is for the correction of tax withheld for the preceding quarter(s) of the same calendar year. Explanation should include details showing year/quarter, social security number (s) and the revised amount for each individual.

Total of Earned Income Tax Due (Line 1 minus Line 2)

Total Payments made this quarter.

Adjusted total of EIT Due (line 3 minus line 4).

Penalty and interest must be calculated at 1.00246% per month after due date. Multiply rate by line 5.

ITEM 7:

Balance due with return (add lines 5 and 6).

ITEM 8 THRU 12: These items are

ITEM 13: Gross Compensation Paid This Quarter - List Gross Wages Paid to each employee this quarter.

With the passage of Pennsylvania Act 48 of 1994, it is no longer possible for us to remit to the City of Philadelphia any monies which you have collected for employees. If you need to set up an account with the City of Philadelphia you may call them at

ITEM 14:

ITEM 15:

ITEM 16:

Amount of Tax Withheld This Quarter- List amount of Earned Income Tax Withheld by you for each employee this quarter. Enter “0” if no Tax withheld this quarter for employee listed.

PSD Code - Please list for each employee the 6 digit PSD Code of the CITY, BOROUGH, or TOWNSHIP in which the employee resides so the Earned Income Tax Administrator may distribute the tax to the proper taxing jurisdiction.

Include Total Taxable Gross Wages and Earned Income Tax Withheld.

ADDITIONAL FILING INSTRUCTIONS

Form

§CHECK THE BOX to the left of each employee if any changes or additions are made to that line. Address changes submitted must be actual street address of the employee. PO Boxes are not acceptable addresses for filing purposes.

REMIT TO:

BERKHEIMER TAX ADMINISTRATOR

PO BOX 25132

LEHIGH VALLEY, PA