Whenever you need to fill out 1601e, you don't have to download and install any applications - just try using our online tool. Our editor is constantly developing to give the very best user experience possible, and that's thanks to our resolve for continual development and listening closely to customer comments. To begin your journey, go through these simple steps:

Step 1: Simply click the "Get Form Button" above on this page to access our pdf form editor. This way, you'll find everything that is needed to fill out your file.

Step 2: The tool allows you to modify PDF files in various ways. Transform it by including personalized text, correct what is originally in the file, and place in a signature - all close at hand!

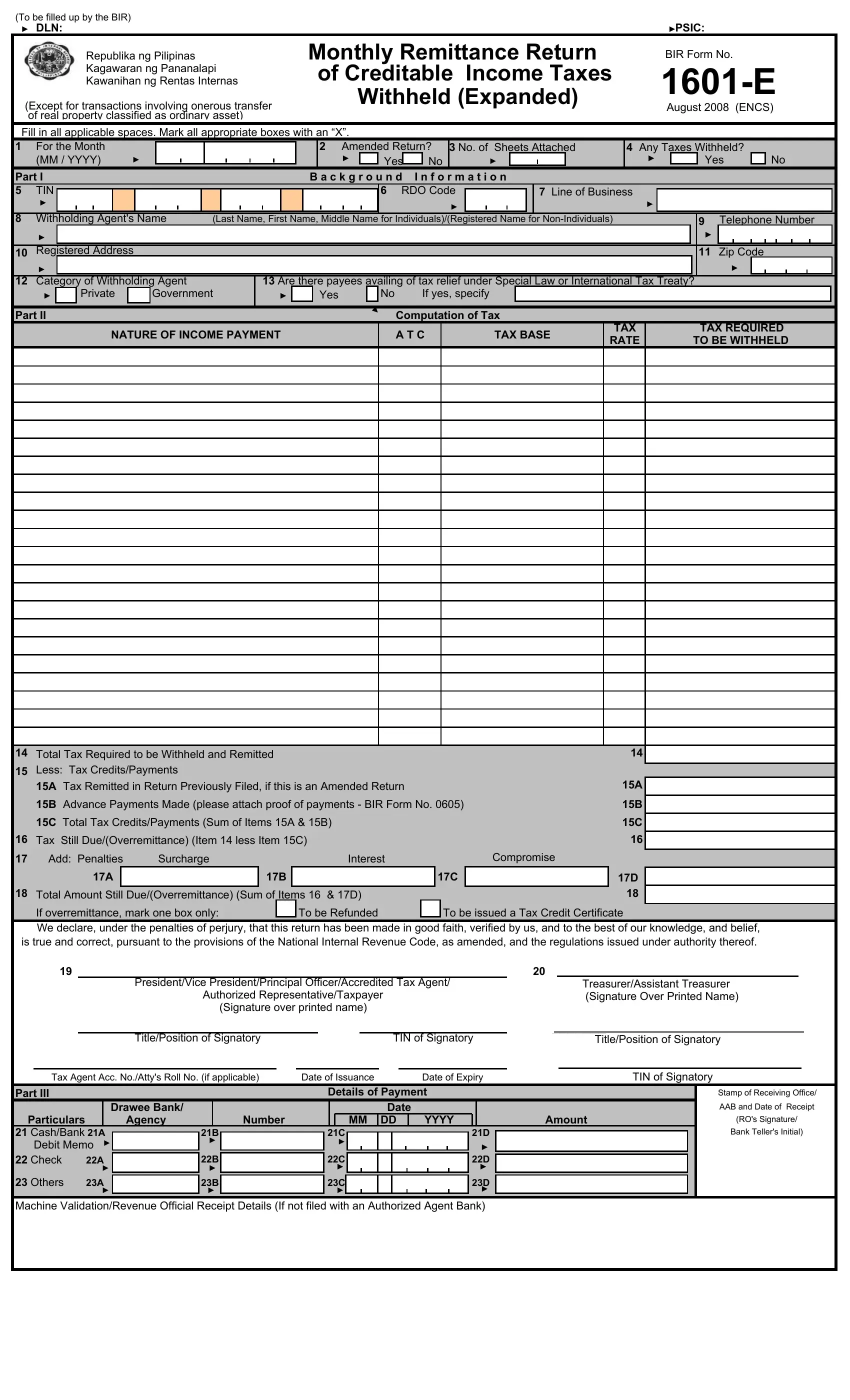

This PDF form will need particular info to be filled in, therefore be sure you take your time to type in precisely what is requested:

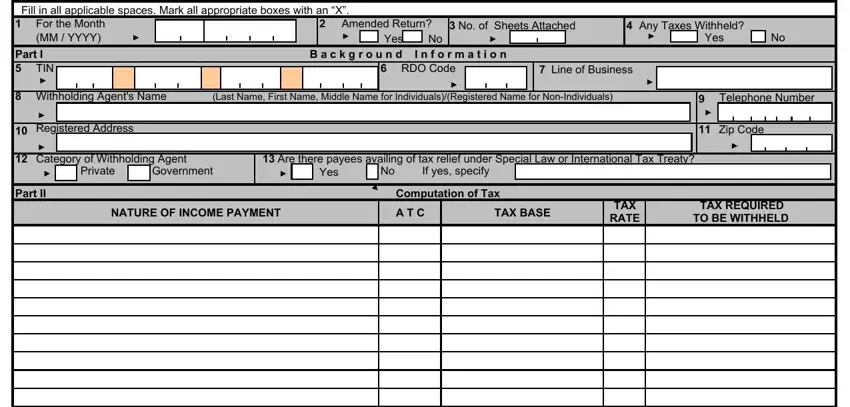

1. It's very important to fill out the 1601e accurately, hence be careful while filling out the parts comprising all these blanks:

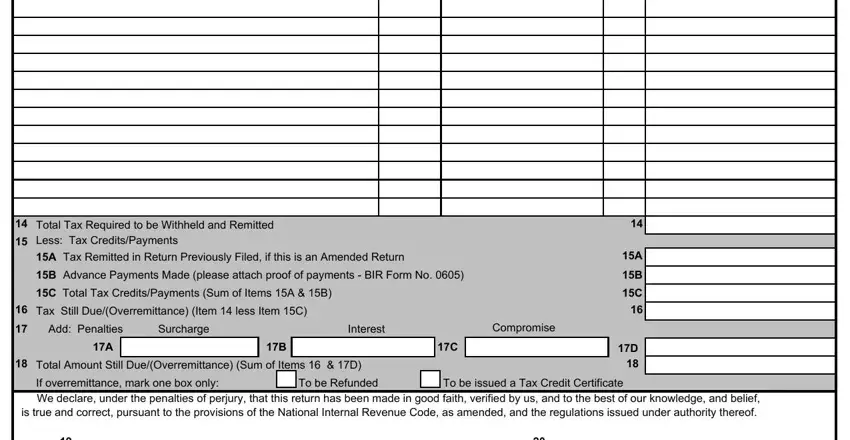

2. Once your current task is complete, take the next step – fill out all of these fields - Total Tax Required to be Withheld, A Tax Remitted in Return, B Advance Payments Made please, C Total Tax CreditsPayments Sum of, Tax Still DueOverremittance Item , Add Penalties, Surcharge, Interest, Compromise, Total Amount Still, If overremittance mark one box only, To be Refunded, To be issued a Tax Credit, We declare under the penalties of, and TreasurerAssistant Treasurer with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

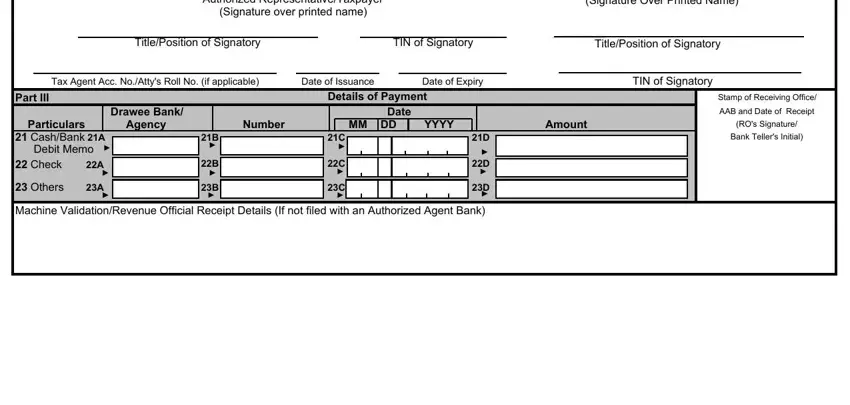

3. Completing Authorized RepresentativeTaxpayer, Signature over printed name, TitlePosition of Signatory, TIN of Signatory, TreasurerAssistant Treasurer, TitlePosition of Signatory, Tax Agent Acc NoAttys Roll No if, Date of Issuance, Date of Expiry, TIN of Signatory, Part III, Particulars, Drawee Bank Agency, CashBank A Debit Memo Check A, and Others A is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It is easy to make an error while filling in the Signature over printed name, hence make sure that you look again before you decide to submit it.

Step 3: Right after you've looked once more at the details in the file's blank fields, click "Done" to finalize your form at FormsPal. Make a 7-day free trial option with us and obtain direct access to 1601e - accessible inside your FormsPal cabinet. We do not sell or share the information that you type in whenever completing forms at our site.