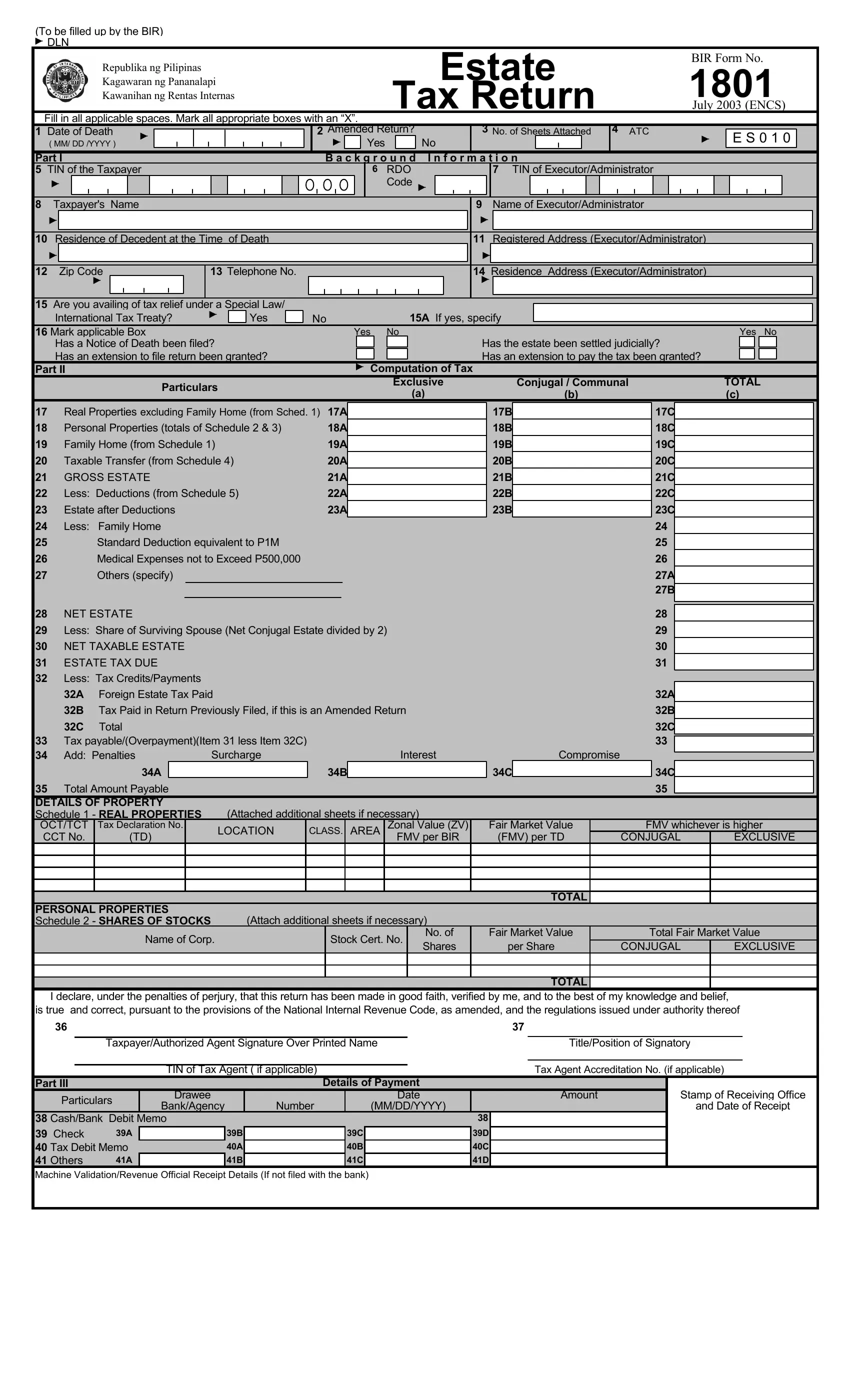

Who Shall File

This return shall be filed in triplicate by:

1.The executor, or administrator, or any of the legal heirs of the decedent, whether resident or non-resident of the Philippines, under any of the following situations:

a)In all cases of transfers subject to estate tax;

b)Where though exempt from estate tax, the gross value

of the estate exceeds |

two hundred thousand |

(P200,000) pesos; or |

|

c)Regardless of the gross value of the estate, where the said estate consists of registered or registrable property such as real property, motor vehicle, shares of stock or other similar property for which a clearance from the BIR is required as a condition precedent for the transfer of ownership thereof in the name of the transferee; or

2.If there is no executor or administrator appointed, qualified, and acting within the Philippines, then any person in actual or constructive possession of any property of the decedent.

When and Where to File

This return shall be filed within six (6) months from the decedent's death. In meritorious cases, the Commissioner shall have authority to grant a reasonable extension not exceeding thirty (30) days for filing the return.

A certified copy of the schedule of partition and the order of the court approving the same shall be furnished the Commissioner within thirty (30) days after the promulgation of such order.

The return shall be filed with any Authorized Agent Bank (AAB) of the Revenue District Office having jurisdiction over the place of domicile of the decedent at the time of his death. In places where there are no AABs, the return shall be filed with the Revenue Collection Officer or duly Authorized City/Municipal Treasurer of the Revenue District Office having jurisdiction over the place of domicile of the decedent at the time of his death. If the decedent has no legal residence in the Philippines, the return shall be filed with the Office of the Commissioner (Revenue District Office No. 39, South Quezon City).

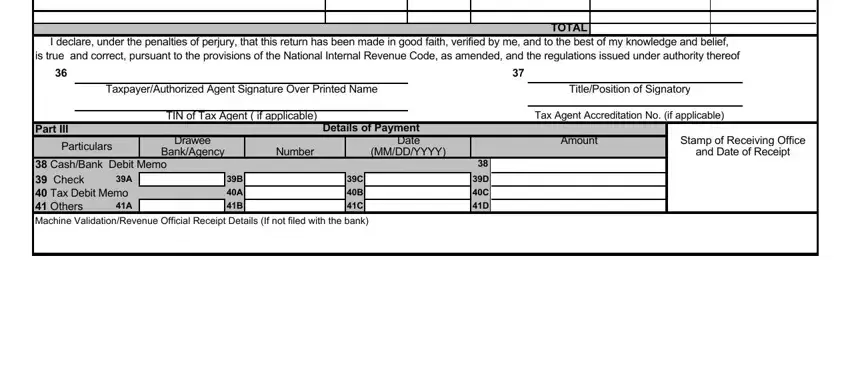

When and Where to Pay

Upon filing this return, the estate tax due shall be paid to the Authorized Agent Bank (AAB) where the return is filed. In places where there are no AABs, payment shall be made directly to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer who shall issue Revenue Official Receipt (BIR Form No. 2524) therefor.

Where the return is filed with an AAB, the lower portion of the return must be properly machine-validated and stamped by the Authorized Agent Bank to serve as the receipt of payment. The machine validation shall reflect the date of payment, amount paid and transaction code, and the stamp mark shall show the name of the bank, branch code, teller’s name and teller’s initial. The AAB shall also issue an official receipt or bank debit advice or credit document, whichever is applicable, as additional proof of payment.

When the Commissioner finds that the payment on the due date of the estate tax or of any part thereof would impose undue hardship upon the estate or any of the heirs, he may extend the time for payment of such tax or any part thereof not to exceed five (5) years, in case the estate is settled through the courts, or two (2) years in case the estate is settled extrajudicially. In such case, the amount in respect of which the extension is granted shall be paid on or before the date of the expiration of the period of the extension, and the running of the Statute of Limitations for assessment as provided in Section 203 of the National Internal Revenue Code shall be suspended for the period of any such extension.

Where the taxes are assessed by reason of negligence, intentional disregard of rules and regulations, or fraud on the part of the taxpayer, no extension will be granted by the Commissioner.

If an extension is granted, the Commissioner may require the executor, or administrator, or beneficiary, as the case may be, to furnish a bond in such amount, not exceeding double the amount of the tax and with such sureties as the Commissioner deems necessary, conditioned upon the payment of the said tax in accordance with the terms of the extension.

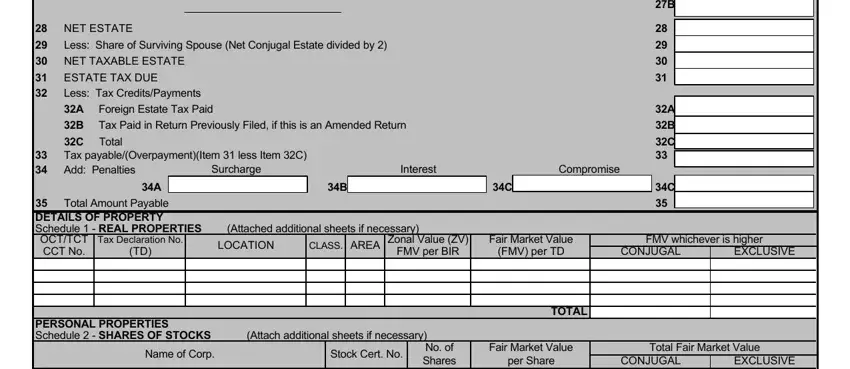

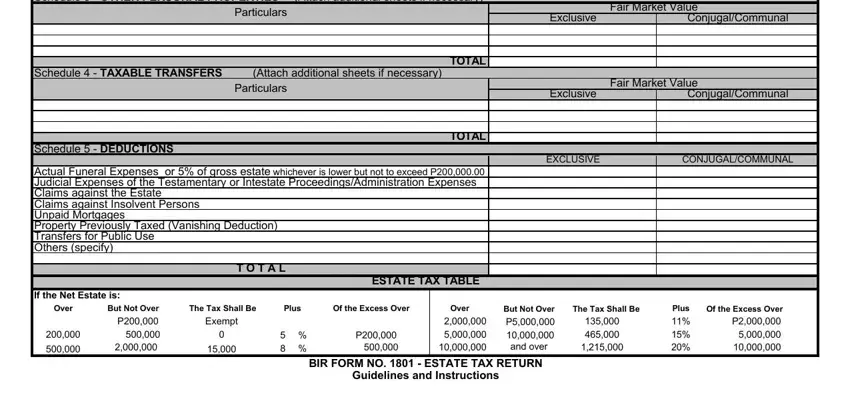

Tax Rates and Basis of Tax

There shall be imposed a schedular rate based on the value of the NET ESTATE determined as of the time of death of decedent composed of all property, real or personal, tangible or intangible less allowable deductions.

Valuation of Estate

In case of properties, the estate shall be appraised at its fair market value (FMV) as of the time of death. However, the appraised value of real property as of the time of death shall be whichever is higher of:

1.The Fair Market Value as determined by the Commissioner, or

2.The Fair Market Value as shown in the schedule of values fixed by the Provincial or City Assessors.

Gross Estate

Gross Estate for citizens and resident aliens shall include all the property of the decedent at the time of death, real or personal, tangible or intangible, wherever situated but excluding the exclusive properties of the surviving spouse. For Non-resident alien, it shall include the property situated in the Philippines.

As an additional information, properties located outside the Philippines, if any, of a non-resident alien decedent, although not taxable, shall still be presented in the return under the Schedule Section for information purposes and for purposes of computing the correct amount of allowable deductions.

This requirement should be dispensed with if the estate is not claiming

any deduction. If there is an allegation of absence of property outside the Philippines, a certification to this effect should be secured from the nearest Philippine Consular Office.

Penalties

There shall be imposed and collected as part of the tax:

1.A surcharge of twenty five percent (25%) for each of the following violations:

a.Failure to file any return and pay the amount of tax or installment due on or before the due date;

b.Unless otherwise authorized by the Commissioner, filing a return

with a person or office other than those with whom it is required to be filed;

c.Failure to pay the full or part of the amount of tax shown on the return, or the full amount of tax due for which no return is required to be filed on or before the due date;

d.Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment.

2.A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case any payment has been made on the basis of such return before the discovery of the falsity or fraud, for each of the following violations:

a.Willful neglect to file the return within the period prescribed by the Code or by rules and regulations; or

b.In case a false or fraudulent return is willfully made.

3.Interest at the rate of twenty percent (20%) per annum, or such higher rate as may be prescribed by rules and regulations, on any unpaid amount of tax, from the date prescribed for the payment until the amount is fully paid.

4.Compromise penalty.

Attachments

1.Certified true copy of the DEATH CERTIFICATE;

2.NOTICE OF DEATH duly received by the BIR, if gross taxable estate exceeds P20,000 for deaths occurring on or after Jan. 1, 1998; or if the gross taxable estate exceeds P3,000 for deaths occurring prior to Jan. 1, 1998;

3.Any of the following: a) Affidavit of Self Adjudication; b) Deed of Extra- Judicial Settlement of the Estate, if the estate had been settled extrajudicially; c) Court order if settled judicially; d) Sworn Declaration of all properties of the Estate;

4.A certified copy of the schedule of partition of the estate and the order of the court approving the same, if applicable;

5.Certified true copy/ies of the Transfer/Original/Condominium Certificate of Title/s of real property/ies (front and back pages), if applicable;

6.Certified true copy of the latest Tax Declaration of real properties at the time of death, if applicable;

7."Certificate of No Improvement" issued by the Assessor's Office where declared properties have no declared improvement;

8.Certificate of Deposit/Investment/Indebtedness owned by the decedent and the surviving spouse, if applicable;

9.Photo copy of Certificate of Registration of vehicles and other proofs showing the correct value of the same, if applicable;

10.Proof of valuation of shares of stocks at the time of death, if applicable; For listed stocks - newspapers clippings/certification from the

STOCK EXCHANGE

For unlisted stocks - latest audited Financial Statements of issuing corporation with computation of book value per share

11.Xerox copy of certificate of stocks, if applicable;

12.Proof of valuation of other types of personal property, if applicable;

13.Proof of Claimed Tax Credit, if applicable;

14.CPA Statement on the itemized assets of the decedent, itemized deductions from gross estate and the amount due if the gross value of the estate exceeds two million pesos (P2,000,000);

15.Certification of the Barangay Captain for the claimed Family Home;

16.Duly notarized Promissory Note for "Claims Against the Estate" arising from Contract of Loan;

17.Accounting of the proceeds of loan contracted within three (3) years prior to death of the decedent;

18.Proof of the claimed "Property Previously Taxed";

19.Proof of the claimed "Transfer for Public Use".

20.Copy of Tax Debit Memo used as payment, if applicable.

These requirements must be submitted upon field or office audit of the

tax case before the Tax Clearance Certificate/Certificate Authorizing Registration can be released to the taxpayer.

Additional requirements may be requested for presentation during the audit of the tax case depending upon existing audit procedures.

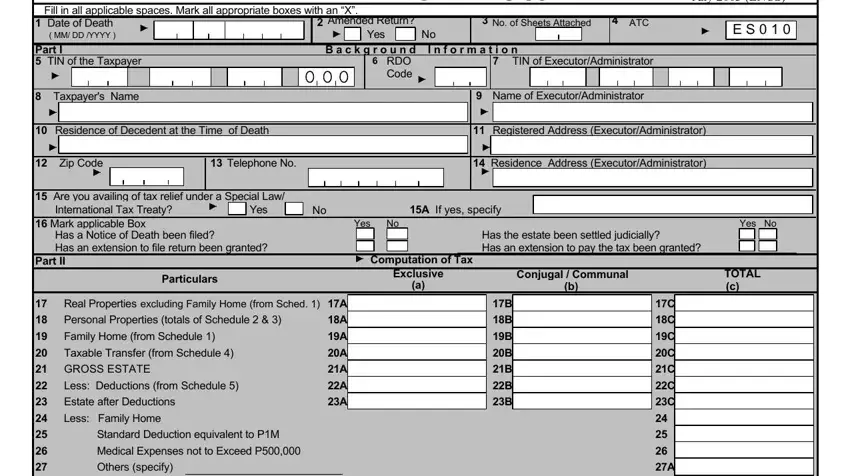

Note: All background information must be properly filled up.

§All returns filed by an accredited tax representative on behalf of a taxpayer shall bear the following information

A.For CPA’s and others (individual practitioners, members of GPPs); A.1 Taxpayer Identification Number (TIN); and

A.2 Certificate of Accreditation Number, Date of Issuance, and Date of Expiry.

B.For Members of the Philippine Bar (individual practitioners, members of GPPs);

B.1 Taxpayer Identification Number (TIN); and

B.2 Attorney’s Roll Number or Accreditation Number, if any

§TIN = Taxpayer Identification Number.

§The last 3 digits of the 12-digit TIN refers to the branch code.

ENCS