Working with PDF documents online is a breeze with this PDF editor. Anyone can fill out 1905 bir here in a matter of minutes. To make our editor better and easier to utilize, we continuously implement new features, with our users' suggestions in mind. Getting underway is easy! All you have to do is follow these simple steps down below:

Step 1: Hit the "Get Form" button in the top area of this page to open our editor.

Step 2: With our handy PDF file editor, it's possible to accomplish more than just fill out blank fields. Try all the functions and make your documents look high-quality with customized text incorporated, or tweak the original input to perfection - all that accompanied by an ability to incorporate stunning images and sign it off.

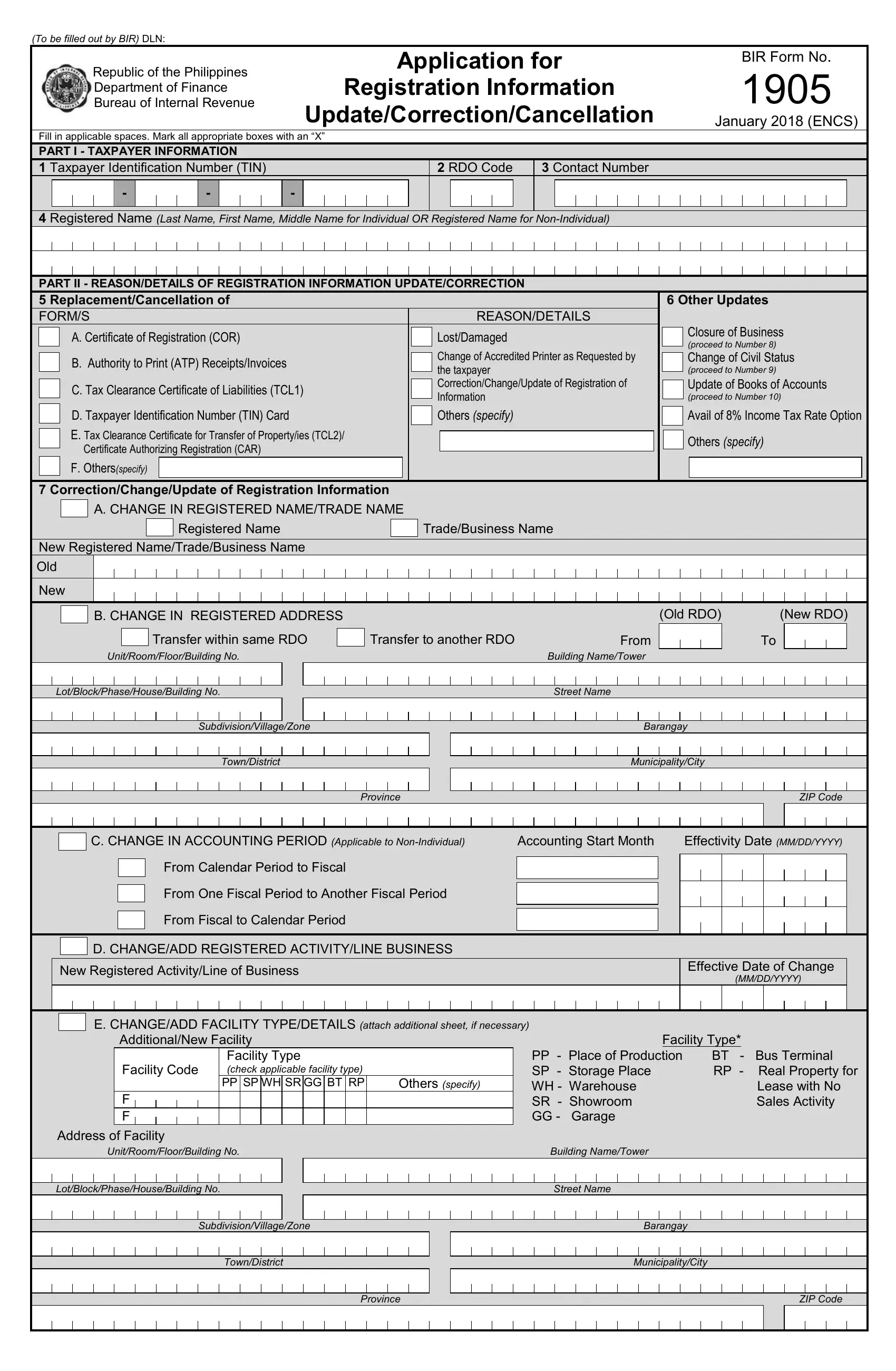

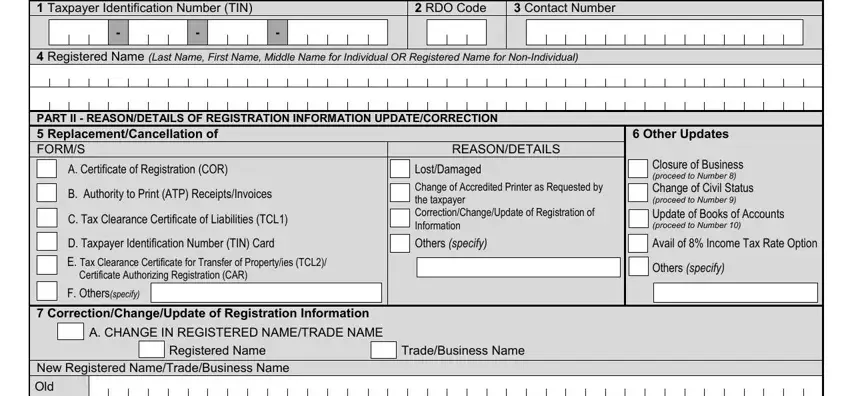

This document requires specific data to be filled in, hence be certain to take some time to type in precisely what is asked:

1. While filling in the 1905 bir, be sure to complete all of the necessary fields within its corresponding area. It will help expedite the process, making it possible for your information to be processed quickly and appropriately.

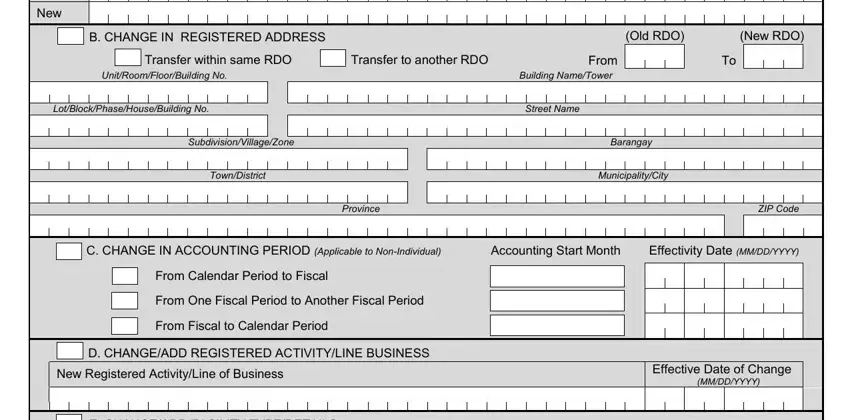

2. Given that this part is complete, it is time to add the needed details in New, B CHANGE IN REGISTERED ADDRESS, Old RDO New RDO, Transfer within same RDO Transfer, Effectivity Date MMDDYYYY, Accounting Start Month, C CHANGE IN ACCOUNTING PERIOD, From One Fiscal Period to Another, From Fiscal to Calendar Period, From Calendar Period to Fiscal, D CHANGEADD REGISTERED, New Registered ActivityLine of, Effective Date of Change, and MMDDYYYY so you're able to move forward to the next stage.

As to B CHANGE IN REGISTERED ADDRESS and From Calendar Period to Fiscal, make certain you take a second look in this section. Both of these are thought to be the key ones in this file.

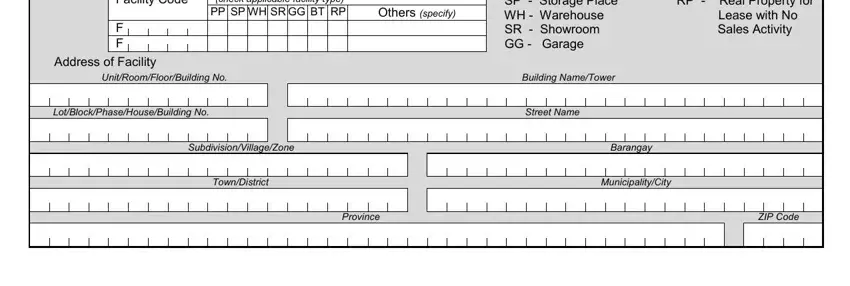

3. The following step is considered pretty simple, Facility Code, F F, Facility Type check applicable, Others specify, PP Place of Production BT Bus, and Address of Facility - each one of these form fields will need to be filled out here.

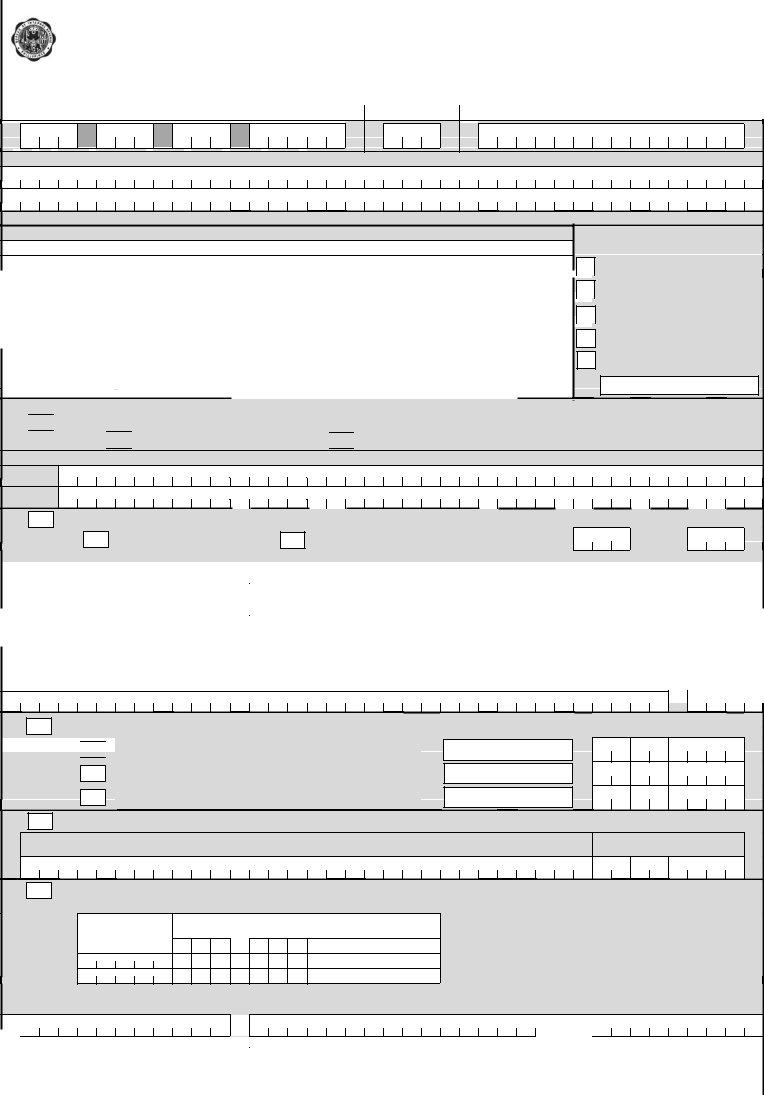

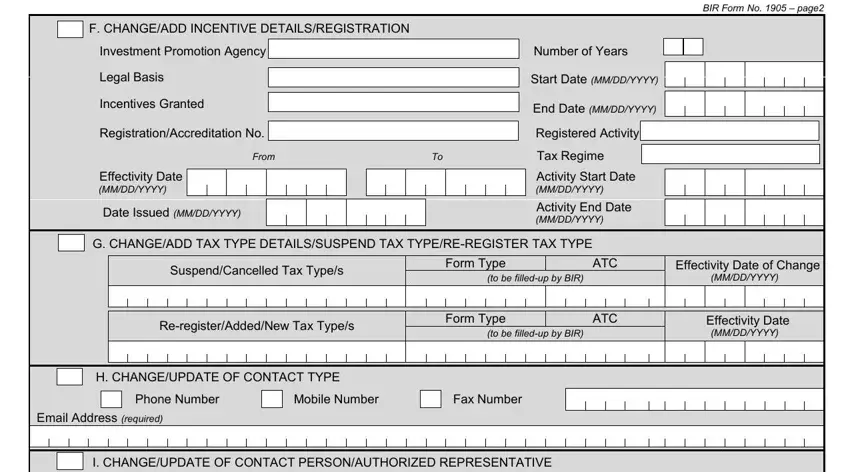

4. The form's fourth paragraph comes with all of the following blanks to complete: F CHANGEADD INCENTIVE, Investment Promotion Agency Number, Legal Basis, Incentives Granted, Start Date MMDDYYYY, End Date MMDDYYYY, RegistrationAccreditation No, From To Tax Regime, Effectivity Date MMDDYYYY, Date Issued MMDDYYYY, Activity Start Date MMDDYYYY, Activity End Date MMDDYYYY, G CHANGEADD TAX TYPE, SuspendCancelled Tax Types, and ReregisterAddedNew Tax Types.

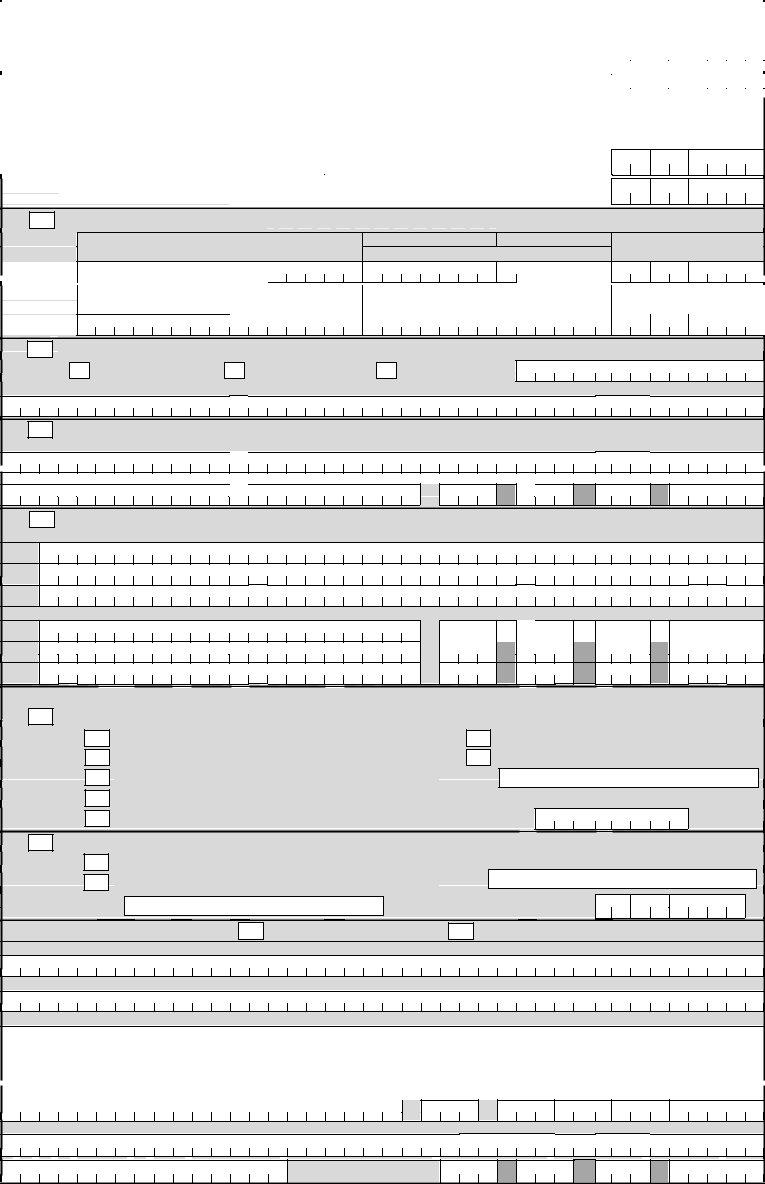

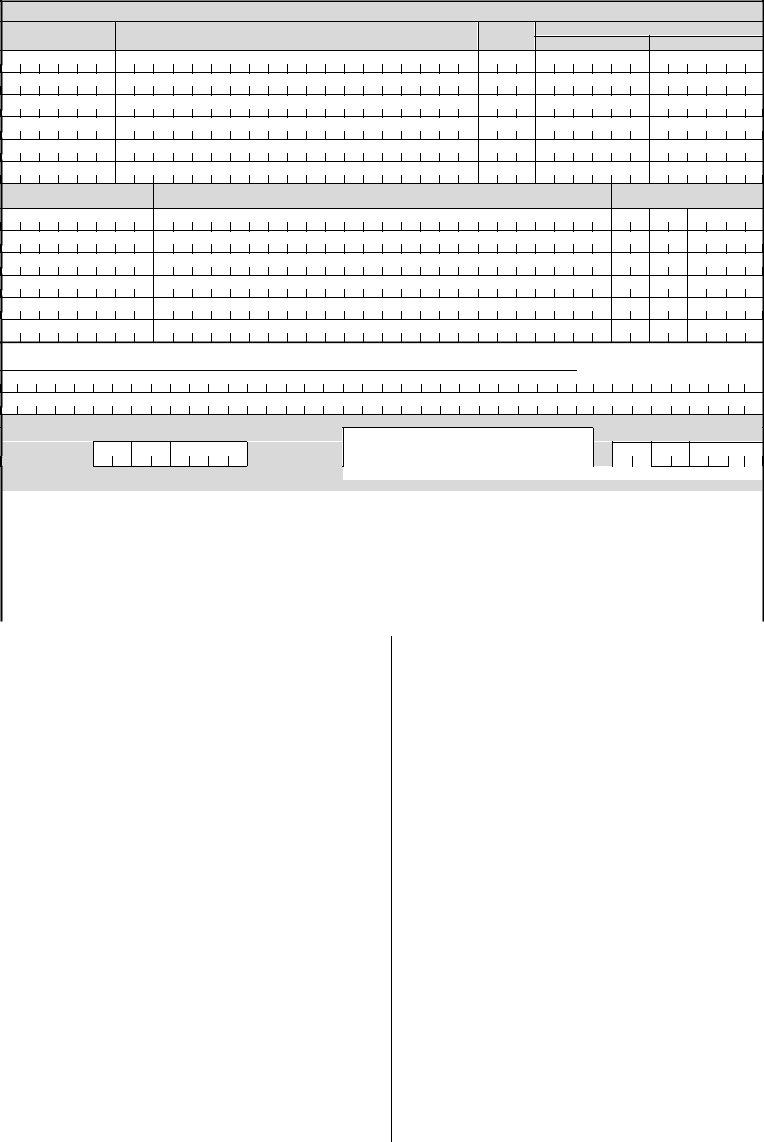

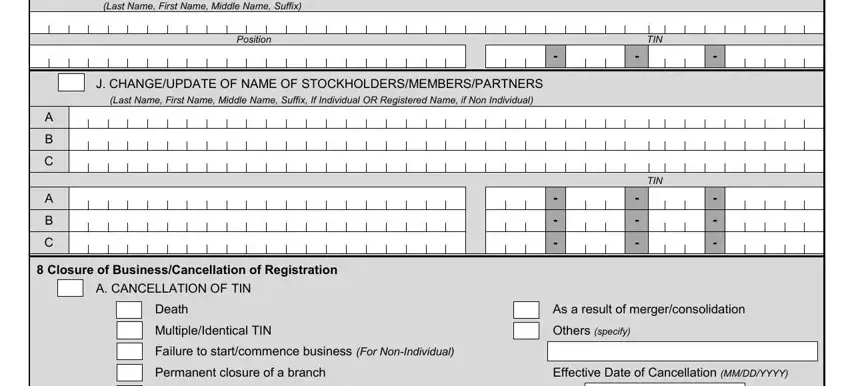

5. As a final point, the following final subsection is what you'll want to finish before closing the document. The blanks you're looking at are the following: I CHANGEUPDATE OF CONTACT, J CHANGEUPDATE OF NAME OF, Closure of BusinessCancellation, A CANCELLATION OF TIN, Death MultipleIdentical TIN, Permanent closure of a branch, Failure to startcommence business, TIN, As a result of mergerconsolidation, Effective Date of Cancellation, and Others specify.

Step 3: Make sure the details are right and then click on "Done" to conclude the project. Try a free trial account with us and obtain direct access to 1905 bir - with all transformations preserved and accessible from your personal account. When you use FormsPal, you can complete forms without being concerned about database leaks or records being shared. Our protected system ensures that your private information is kept safely.