1904 bir form can be filled in online without difficulty. Just use FormsPal PDF editing tool to complete the job fast. To keep our editor on the forefront of convenience, we work to integrate user-driven features and improvements regularly. We are always looking for feedback - assist us with revolutionizing PDF editing. In case you are seeking to begin, this is what it will require:

Step 1: Just press the "Get Form Button" above on this site to get into our pdf editing tool. There you will find all that is necessary to fill out your document.

Step 2: The tool allows you to customize your PDF file in many different ways. Enhance it with your own text, correct what is already in the file, and place in a signature - all at your fingertips!

This document requires some specific details; in order to ensure consistency, be sure to pay attention to the subsequent steps:

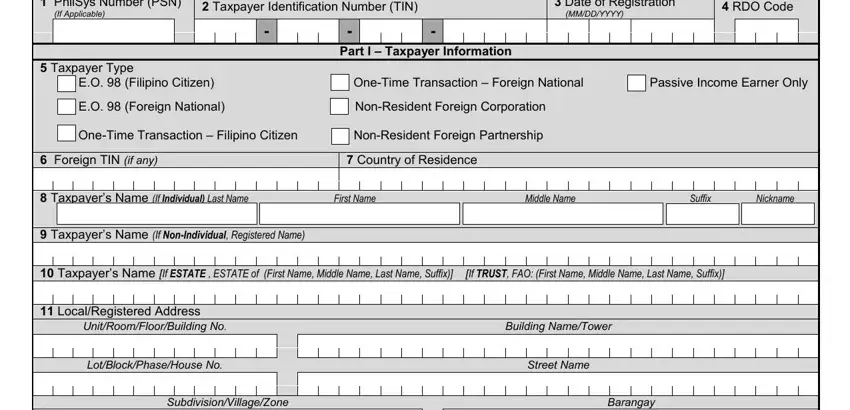

1. Begin completing your 1904 bir form with a number of major fields. Consider all the information you need and ensure nothing is omitted!

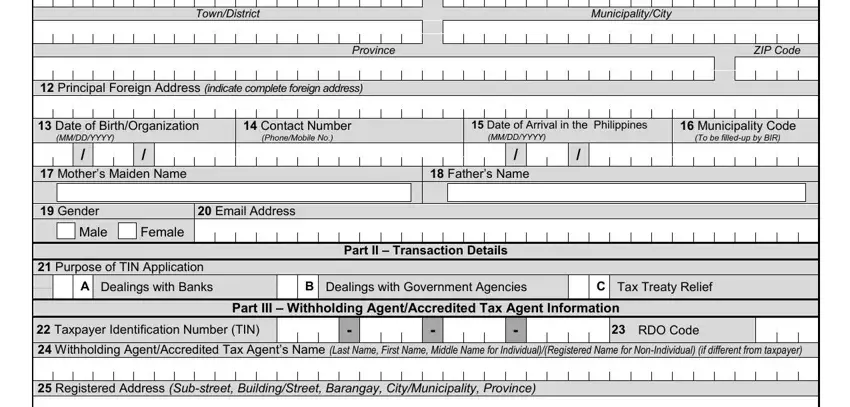

2. Soon after filling in the last step, head on to the next step and enter the necessary particulars in these blank fields - ZIP Code, MunicipalityCity, Date of Arrival in the, Fathers Name, Municipality Code To be filledup, SubdivisionVillageZone, TownDistrict, Province, Principal Foreign Address, Contact Number PhoneMobile No, Mothers Maiden Name, Gender, Email Address, Male Female, and Purpose of TIN Application.

As to Purpose of TIN Application and Fathers Name, make certain you don't make any errors in this current part. These two are the most important fields in the form.

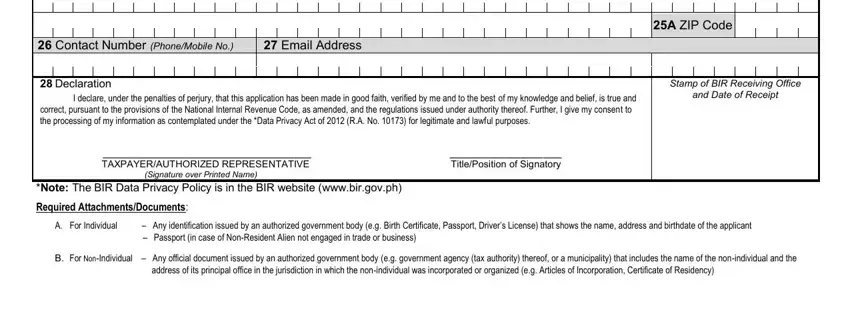

3. Completing Email Address, Registered Address Substreet, TAXPAYERAUTHORIZED REPRESENTATIVE, Signature over Printed Name Note, A ZIP Code, Stamp of BIR Receiving Office, and Date of Receipt, Required AttachmentsDocuments, A For Individual Any, Passport in case of NonResident, B For NonIndividual Any official, and address of its principal office in is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: Before submitting your file, ensure that form fields have been filled in the proper way. The moment you think it is all good, click on “Done." Join us right now and easily get 1904 bir form, ready for downloading. Every single change made is handily preserved , enabling you to change the file at a later time when necessary. FormsPal ensures your data confidentiality via a secure method that in no way records or distributes any sort of personal information involved in the process. Rest assured knowing your paperwork are kept confidential each time you work with our service!