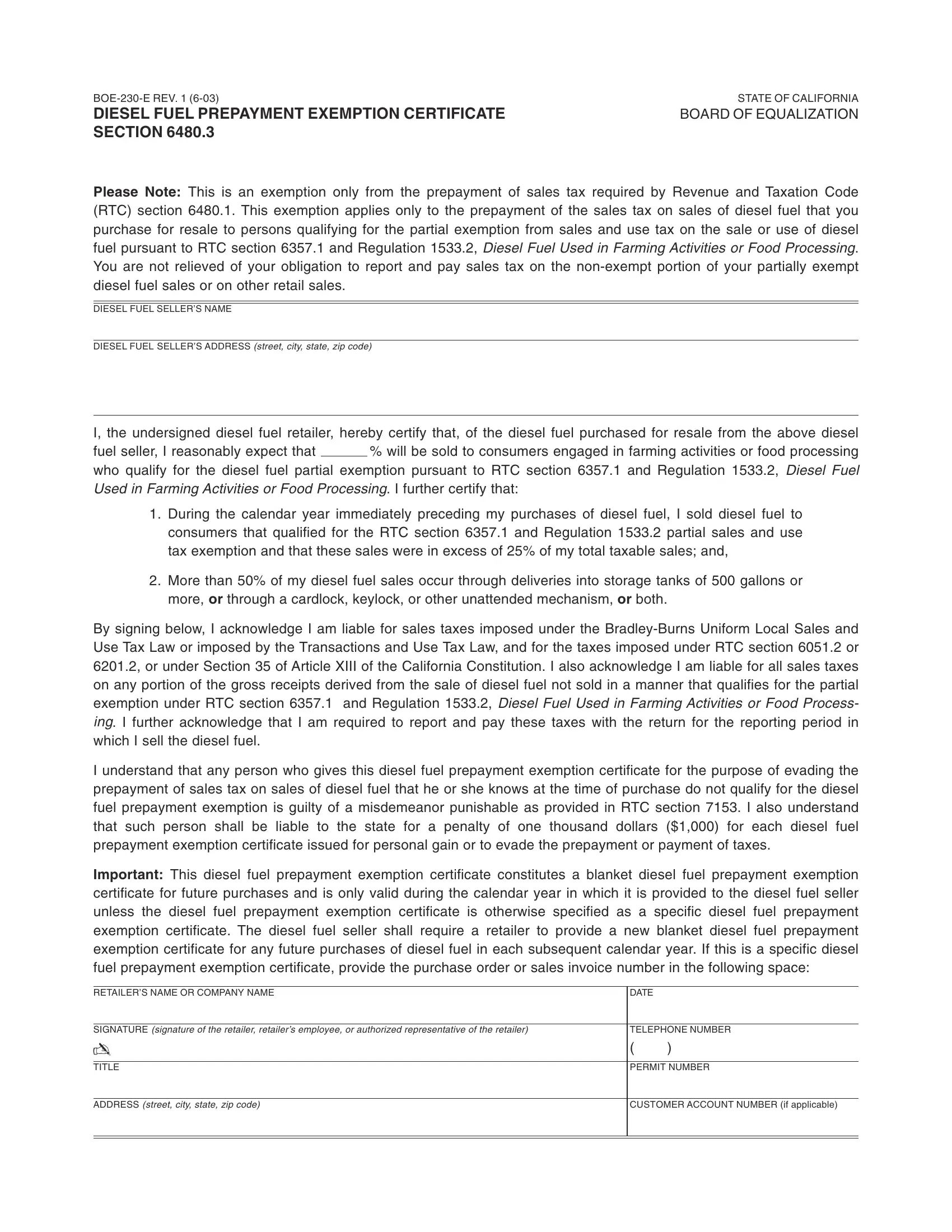

BOE-230-E REV. 1 (6-03) |

STATE OF CALIFORNIA |

DIESEL FUEL PREPAYMENT EXEMPTION CERTIFICATE |

BOARD OF EQUALIZATION |

SECTION 6480.3 |

|

Please Note: This is an exemption only from the prepayment of sales tax required by Revenue and Taxation Code (RTC) section 6480.1. This exemption applies only to the prepayment of the sales tax on sales of diesel fuel that you purchase for resale to persons qualifying for the partial exemption from sales and use tax on the sale or use of diesel fuel pursuant to RTC section 6357.1 and Regulation 1533.2, Diesel Fuel Used in Farming Activities or Food Processing. You are not relieved of your obligation to report and pay sales tax on the non-exempt portion of your partially exempt diesel fuel sales or on other retail sales.

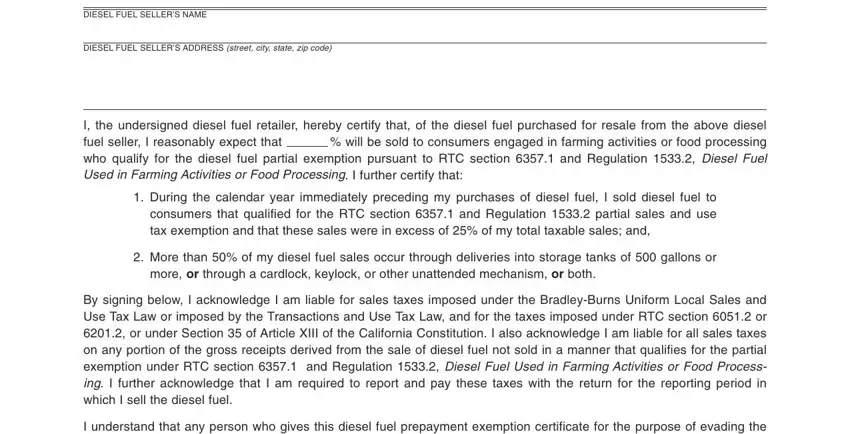

DIESEL FUEL SELLER’S NAME

DIESEL FUEL SELLER’S ADDRESS (street, city, state, zip code)

I, the undersigned diesel fuel retailer, hereby certify that, of the diesel fuel purchased for resale from the above diesel

fuel seller, I reasonably expect that% will be sold to consumers engaged in farming activities or food processing who qualify for the diesel fuel partial exemption pursuant to RTC section 6357.1 and Regulation 1533.2, Diesel Fuel Used in Farming Activities or Food Processing. I further certify that:

1.During the calendar year immediately preceding my purchases of diesel fuel, I sold diesel fuel to consumers that qualified for the RTC section 6357.1 and Regulation 1533.2 partial sales and use tax exemption and that these sales were in excess of 25% of my total taxable sales; and,

2.More than 50% of my diesel fuel sales occur through deliveries into storage tanks of 500 gallons or more, or through a cardlock, keylock, or other unattended mechanism, or both.

By signing below, I acknowledge I am liable for sales taxes imposed under the Bradley-Burns Uniform Local Sales and Use Tax Law or imposed by the Transactions and Use Tax Law, and for the taxes imposed under RTC section 6051.2 or 6201.2, or under Section 35 of Article XIII of the California Constitution. I also acknowledge I am liable for all sales taxes on any portion of the gross receipts derived from the sale of diesel fuel not sold in a manner that qualifies for the partial exemption under RTC section 6357.1 and Regulation 1533.2, Diesel Fuel Used in Farming Activities or Food Process- ing. I further acknowledge that I am required to report and pay these taxes with the return for the reporting period in which I sell the diesel fuel.

I understand that any person who gives this diesel fuel prepayment exemption certificate for the purpose of evading the prepayment of sales tax on sales of diesel fuel that he or she knows at the time of purchase do not qualify for the diesel fuel prepayment exemption is guilty of a misdemeanor punishable as provided in RTC section 7153. I also understand that such person shall be liable to the state for a penalty of one thousand dollars ($1,000) for each diesel fuel prepayment exemption certificate issued for personal gain or to evade the prepayment or payment of taxes.

Important: This diesel fuel prepayment exemption certificate constitutes a blanket diesel fuel prepayment exemption certificate for future purchases and is only valid during the calendar year in which it is provided to the diesel fuel seller unless the diesel fuel prepayment exemption certificate is otherwise specified as a specific diesel fuel prepayment exemption certificate. The diesel fuel seller shall require a retailer to provide a new blanket diesel fuel prepayment exemption certificate for any future purchases of diesel fuel in each subsequent calendar year. If this is a specific diesel fuel prepayment exemption certificate, provide the purchase order or sales invoice number in the following space:

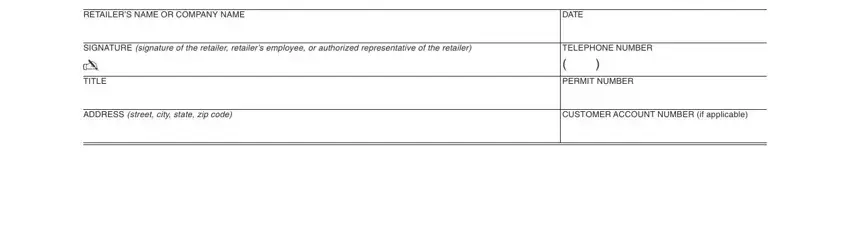

RETAILER’S NAME OR COMPANY NAME |

DATE |

SIGNATURE (signature of the retailer, retailer’s employee, or authorized representative of the retailer) |

TELEPHONE NUMBER |

✍ |

( |

) |

|

|

TITLE |

PERMIT NUMBER |

|

|

ADDRESS (street, city, state, zip code) |

CUSTOMER ACCOUNT NUMBER (if applicable) |

|

|

|