You'll find nothing complicated concerning preparing the boe 392 form when you use our editor. Following these basic steps, you will have the prepared PDF file in the minimum period possible.

Step 1: Click the button "Get form here" to access it.

Step 2: When you've accessed the boe 392 form editing page you can see the different actions you can carry out relating to your file in the top menu.

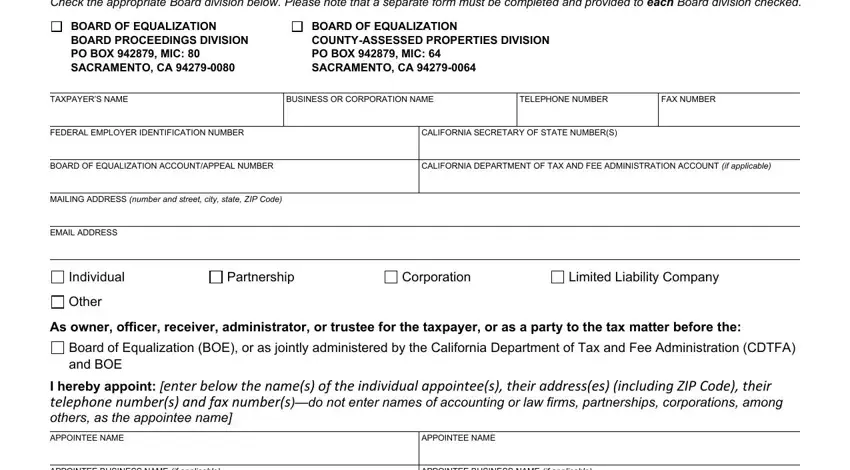

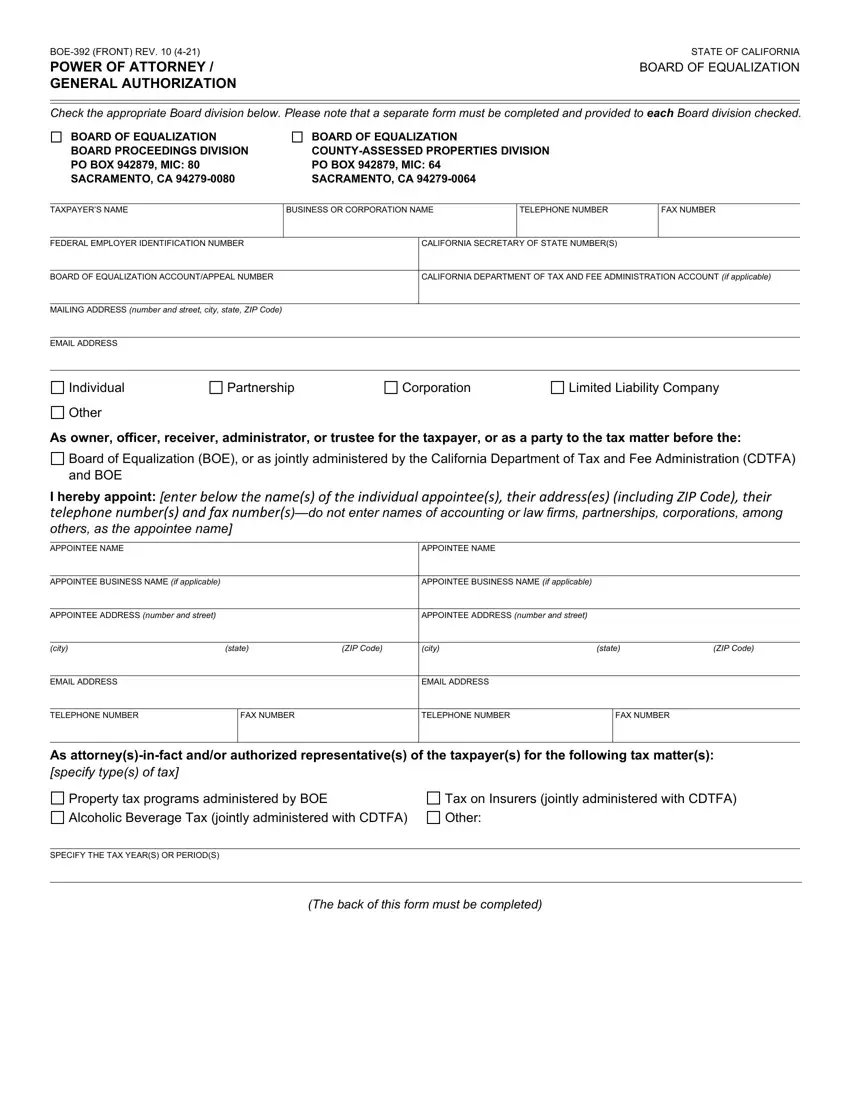

Fill out the boe 392 form PDF and enter the material for every single section:

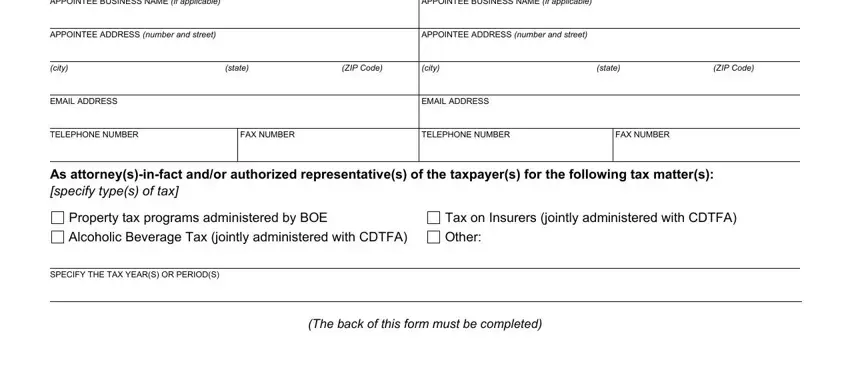

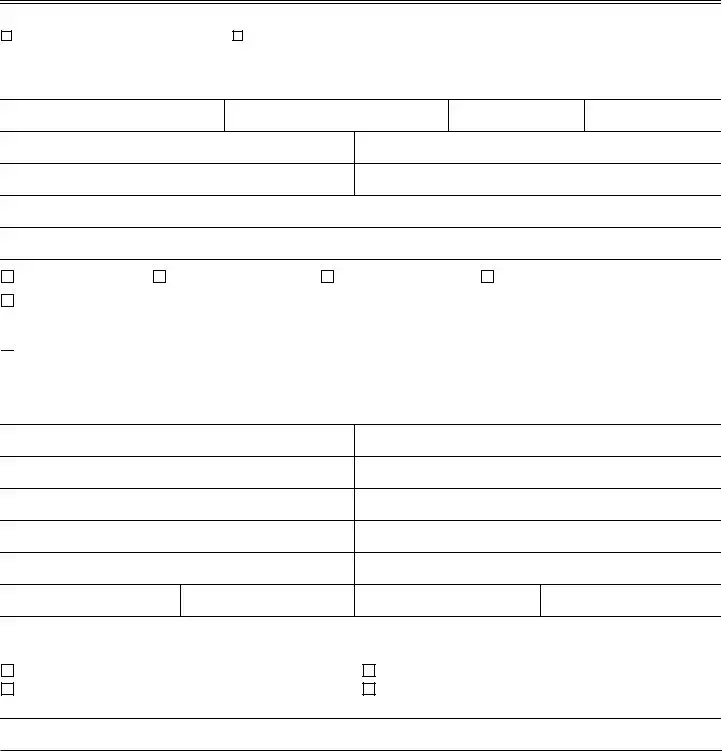

Remember to prepare the APPOINTEE BUSINESS NAME if, APPOINTEE BUSINESS NAME if, APPOINTEE ADDRESS number and street, APPOINTEE ADDRESS number and street, city, state, ZIP Code, city, state, ZIP Code, EMAIL ADDRESS, EMAIL ADDRESS, TELEPHONE NUMBER, FAX NUMBER, and TELEPHONE NUMBER field with the appropriate details.

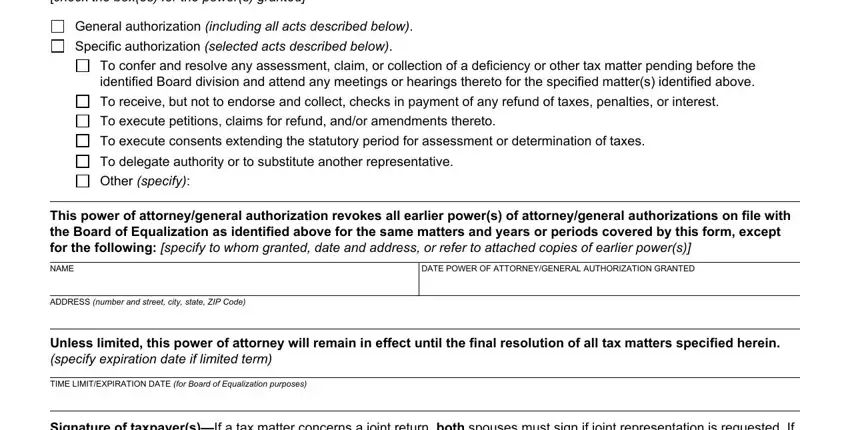

Write the demanded data when you're within the check the boxes for the powers, General authorization including, To confer and resolve any, To receive but not to endorse and, To execute consents extending the, To delegate authority or to, This power of attorneygeneral, NAME, DATE POWER OF ATTORNEYGENERAL, ADDRESS number and street city, Unless limited this power of, TIME LIMITEXPIRATION DATE for, and Signature of taxpayersIf a tax area.

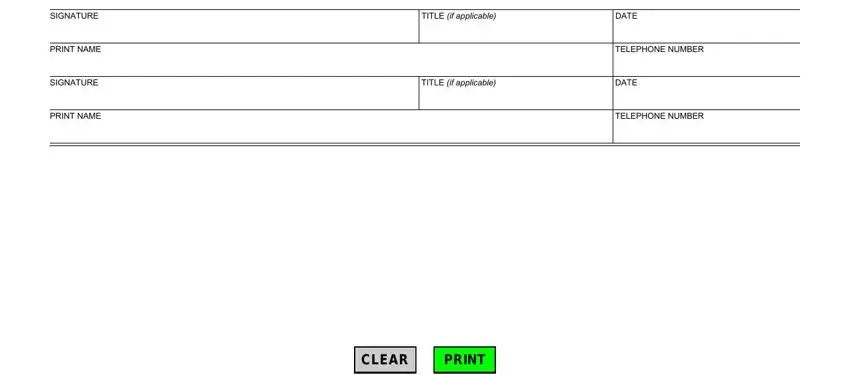

You need to identify the rights and responsibilities of each party in box IF THIS POWER OF ATTORNEYGENERAL, SIGNATURE, PRINT NAME, SIGNATURE, PRINT NAME, TITLE if applicable, DATE, TELEPHONE NUMBER, TITLE if applicable, DATE, and TELEPHONE NUMBER.

Step 3: Select "Done". It's now possible to upload your PDF file.

Step 4: To prevent yourself from any type of complications in the future, you will need to prepare no less than several copies of the file.

Board of Equalization (BOE), or as jointly administered by the California Department of Tax and Fee Administration (CDTFA) and BOE

Board of Equalization (BOE), or as jointly administered by the California Department of Tax and Fee Administration (CDTFA) and BOE