This PDF editor was developed to be as easy as possible. As soon as you stick to these actions, the process of filling out the ERMIT file is going to be easy.

Step 1: You can choose the orange "Get Form Now" button at the top of the following page.

Step 2: Now you can manage the ERMIT. You need to use our multifunctional toolbar to include, erase, and alter the content material of the document.

Type in the essential material in each section to complete the PDF ERMIT

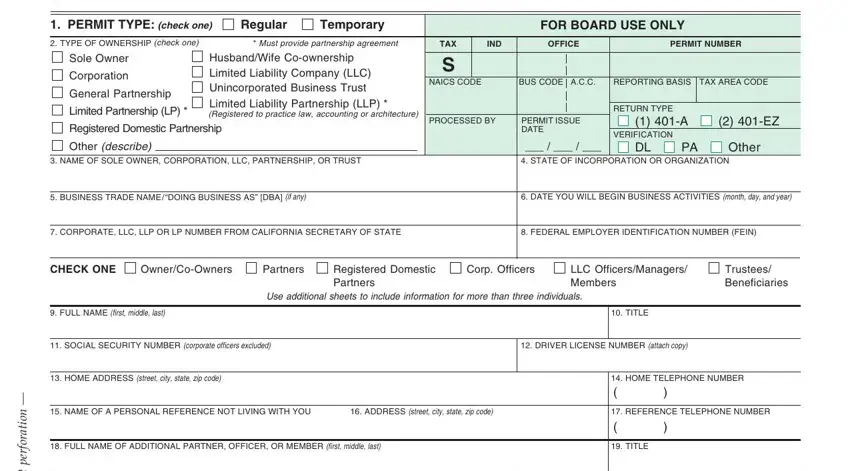

Provide the necessary information in the field PERMIT TYPE check one TYPE OF, Regular, Temporary, Must provide partnership agreement, Sole Owner, Corporation, General Partnership, Limited Partnership LP, HusbandWife Coownership Limited, Registered Domestic Partnership, Other describe, NAME OF SOLE OWNER CORPORATION, FOR BOARD USE ONLY, IND, and OFFICE.

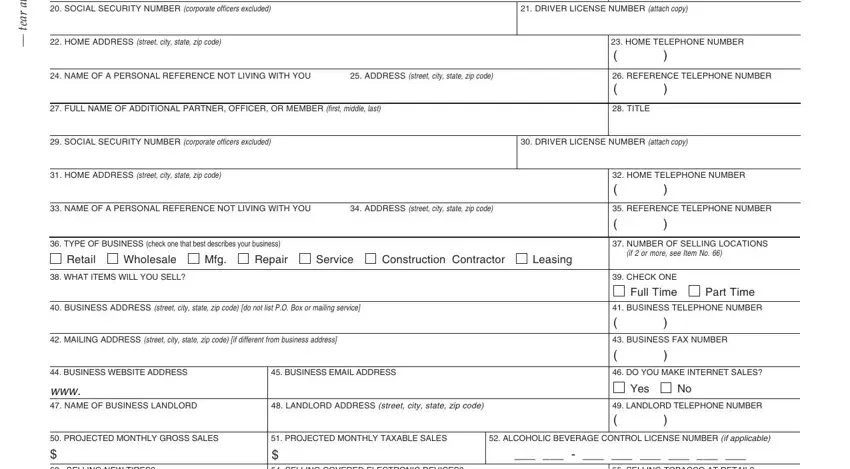

The system will ask for more details as a way to easily fill in the part t a, r a e t, SOCIAL SECURITY NUMBER corporate, DRIVER LICENSE NUMBER attach copy, HOME ADDRESS street city state, NAME OF A PERSONAL REFERENCE NOT, ADDRESS street city state zip code, HOME TELEPHONE NUMBER, REFERENCE TELEPHONE NUMBER, FULL NAME OF ADDITIONAL PARTNER, TITLE, SOCIAL SECURITY NUMBER corporate, DRIVER LICENSE NUMBER attach copy, HOME ADDRESS street city state, and NAME OF A PERSONAL REFERENCE NOT.

Describe the rights and responsibilities of the parties within the part PROJECTED MONTHLY GROSS SALES, PROJECTED MONTHLY TAXABLE SALES, Yes, Yes, SELLING TOBACCO AT RETAIL, Yes, and continued on reverse.

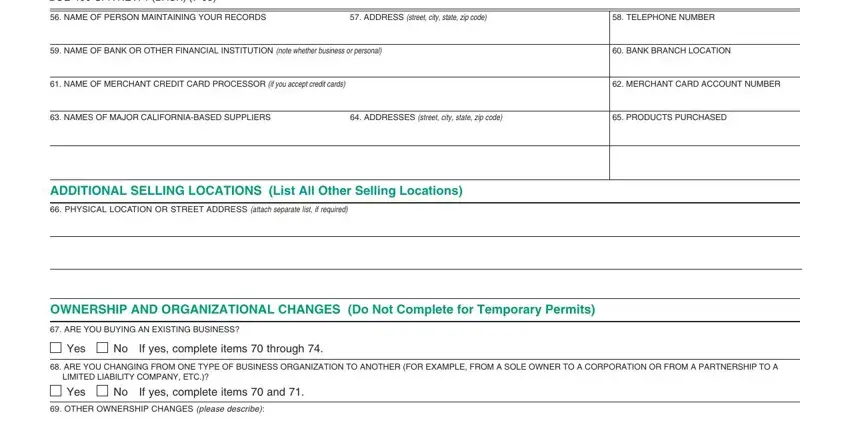

Finalize by analyzing the following fields and completing them as needed: BOESPA REV BACK, NAME OF PERSON MAINTAINING YOUR, ADDRESS street city state zip code, TELEPHONE NUMBER, NAME OF BANK OR OTHER FINANCIAL, BANK BRANCH LOCATION, NAME OF MERCHANT CREDIT CARD, MERCHANT CARD ACCOUNT NUMBER, NAMES OF MAJOR CALIFORNIABASED, ADDRESSES street city state zip, PRODUCTS PURCHASED, ADDITIONAL SELLING LOCATIONS List, PHYSICAL LOCATION OR STREET, OWNERSHIP AND ORGANIZATIONAL, and ARE YOU BUYING AN EXISTING.

Step 3: Select "Done". You can now upload your PDF form.

Step 4: In order to avoid probable upcoming troubles, you should always obtain up to a few copies of every single form.

No

No