BOE-91-B can be completed in no time. Just try FormsPal PDF tool to get the job done promptly. Our team is always working to expand the editor and ensure it is much better for clients with its cutting-edge features. Bring your experience to a higher level with constantly growing and interesting options we offer! Here's what you'd want to do to get started:

Step 1: Press the "Get Form" button above. It is going to open up our pdf tool so you could start filling in your form.

Step 2: With the help of this state-of-the-art PDF editing tool, it is possible to accomplish more than simply fill in blank fields. Express yourself and make your docs look faultless with customized textual content added, or tweak the file's original input to perfection - all supported by an ability to incorporate any kind of graphics and sign the document off.

It's straightforward to fill out the form using out helpful guide! Here's what you should do:

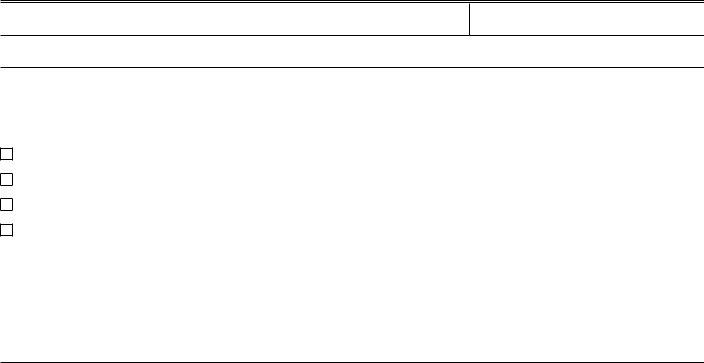

1. While submitting the BOE-91-B, be sure to complete all necessary blanks within its corresponding area. It will help to speed up the process, enabling your details to be handled swiftly and appropriately.

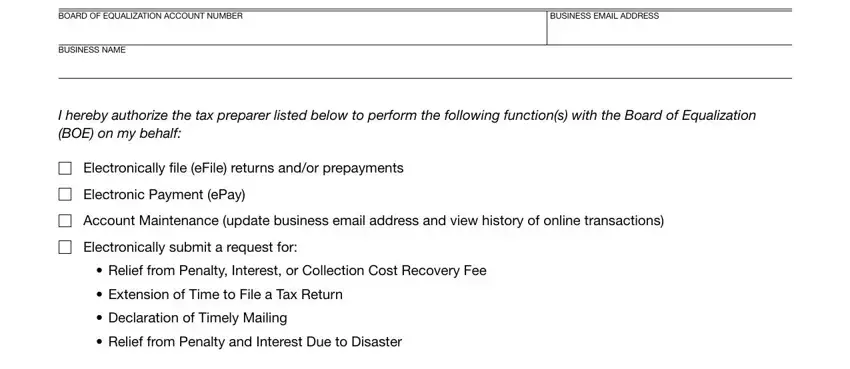

2. After filling in the last step, head on to the next stage and enter the necessary particulars in these fields - NAME OF TAXFEE PAYER please print, SIGNATURE OF TAXFEE PAYER, TITLE please print, NAME OF TAX PREPARER please print, ADDRESS street city state zip code, DATE, TELEPHONE NUMBER, TAX PREPARER INFORMATION, EMAIL ADDRESS, TELEPHONE NUMBER, A confirmation email will be sent, If you have any questions or need, Return this form to, State Board of Equalization, and Taxpayer Information Section MIC.

Always be extremely mindful while filling in TAX PREPARER INFORMATION and NAME OF TAX PREPARER please print, since this is the part in which many people make errors.

Step 3: Make certain the information is accurate and simply click "Done" to proceed further. Grab the BOE-91-B as soon as you sign up for a free trial. Easily get access to the pdf document from your FormsPal account, together with any edits and adjustments being all preserved! FormsPal is focused on the privacy of our users; we make sure all information put into our tool continues to be confidential.