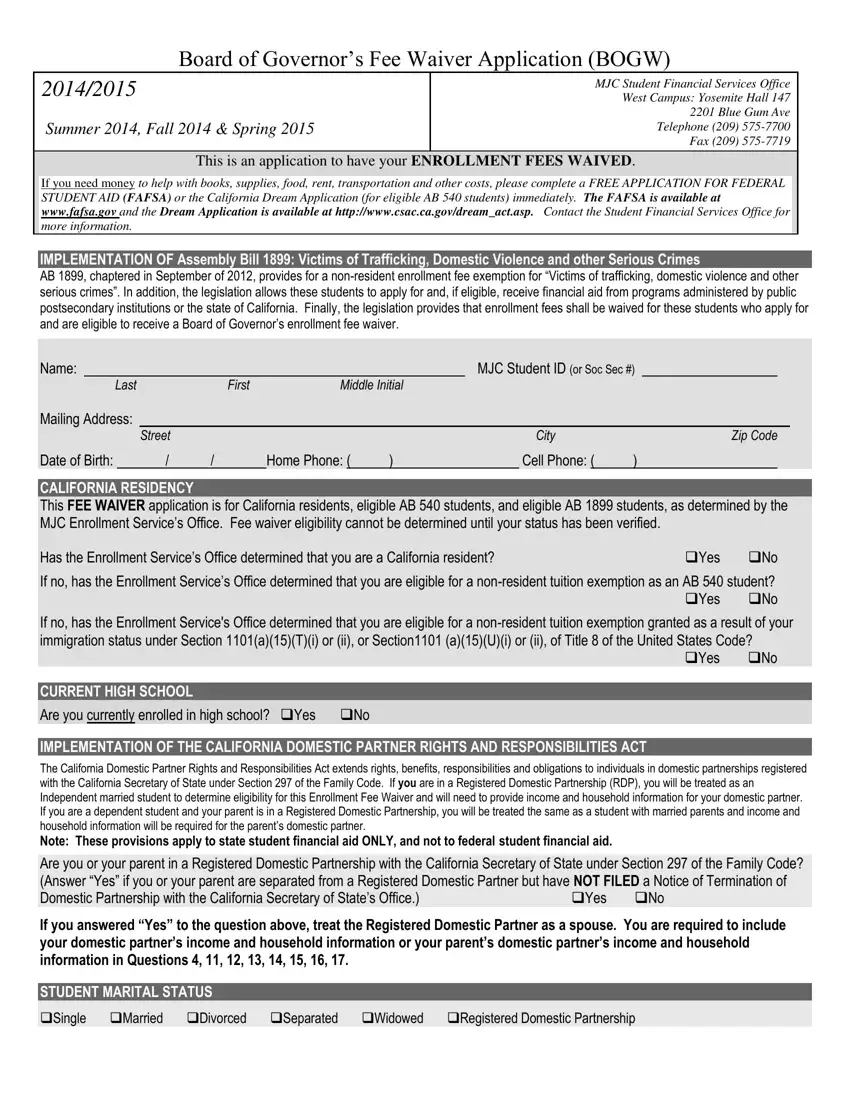

Board of Governor’s Fee Waiver Application (BOGW)

2014/2015

Summer 2014, Fall 2014 & Spring 2015

MJC Student Financial Services Office

West Campus: Yosemite Hall 147

2201 Blue Gum Ave

Telephone (209) 575-7700

Fax (209) 575-7719

This is an application to have your ENROLLMENT FEES WAIVED.

If you need money to help with books, supplies, food, rent, transportation and other costs, please complete a FREE APPLICATION FOR FEDERAL STUDENT AID (FAFSA) or the California Dream Application (for eligible AB 540 students) immediately. The FAFSA is available at www.fafsa.gov and the Dream Application is available at http://www.csac.ca.gov/dream_act.asp. Contact the Student Financial Services Office for more information.

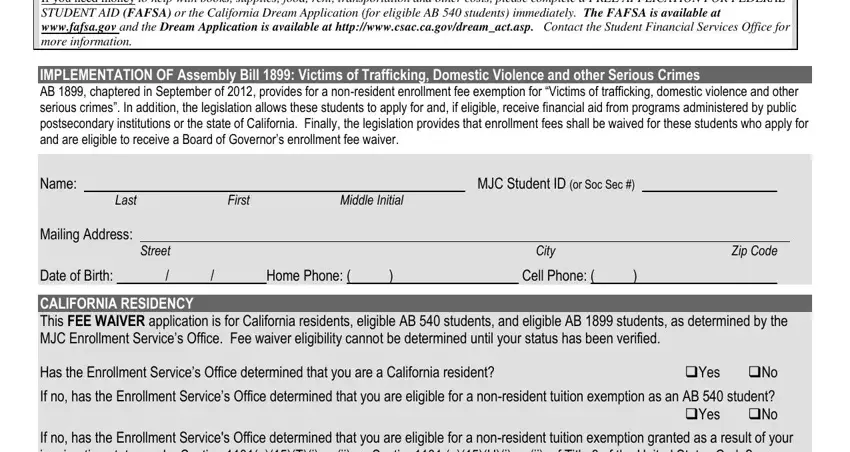

IMPLEMENTATION OF Assembly Bill 1899: Victims of Trafficking, Domestic Violence and other Serious Crimes

AB 1899, chaptered in September of 2012, provides for a non-resident enrollment fee exemption for “Victims of trafficking, domestic violence and other serious crimes”. In addition, the legislation allows these students to apply for and, if eligible, receive financial aid from programs administered by public

postsecondary institutions or the state of California. Finally, the legislation provides that enrollment fees shall be waived for these students who apply for and are eligible to receive a Board of Governor’s enrollment fee waiver.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

MJC Student ID (or Soc Sec #) |

|

Last |

|

First |

Middle Initial |

|

|

|

|

|

|

|

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street |

|

|

|

|

|

City |

|

Zip Code |

Date of Birth: |

|

/ |

/ |

Home Phone: ( |

) |

|

Cell Phone: ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALIFORNIA RESIDENCY

This FEE WAIVER application is for California residents, eligible AB 540 students, and eligible AB 1899 students, as determined by the MJC Enrollment Service’s Office. Fee waiver eligibility cannot be determined until your status has been verified.

Has the Enrollment Service’s Office determined that you are a California resident?Yes No If no, has the Enrollment Service’s Office determined that you are eligible for a non-resident tuition exemption as an AB 540 student?

Yes No

If no, has the Enrollment Service's Office determined that you are eligible for a non-resident tuition exemption granted as a result of your immigration status under Section 1101(a)(15)(T)(i) or (ii), or Section1101 (a)(15)(U)(i) or (ii), of Title 8 of the United States Code?

Yes |

No |

|

|

CURRENT HIGH SCHOOL |

|

Are you currently enrolled in high school? Yes No |

|

IMPLEMENTATION OF THE CALIFORNIA DOMESTIC PARTNER RIGHTS AND RESPONSIBILITIES ACT

The California Domestic Partner Rights and Responsibilities Act extends rights, benefits, responsibilities and obligations to individuals in domestic partnerships registered with the California Secretary of State under Section 297 of the Family Code. If you are in a Registered Domestic Partnership (RDP), you will be treated as an Independent married student to determine eligibility for this Enrollment Fee Waiver and will need to provide income and household information for your domestic partner.

If you are a dependent student and your parent is in a Registered Domestic Partnership, you will be treated the same as a student with married parents and income and household information will be required for the parent’s domestic partner.

Note: These provisions apply to state student financial aid ONLY, and not to federal student financial aid.

Are you or your parent in a Registered Domestic Partnership with the California Secretary of State under Section 297 of the Family Code? (Answer “Yes” if you or your parent are separated from a Registered Domestic Partner but have NOT FILED a Notice of Termination of

Domestic Partnership with the California Secretary of State’s Office.) |

Yes |

No |

If you answered “Yes” to the question above, treat the Registered Domestic Partner as a spouse. You are required to include your domestic partner’s income and household information or your parent’s domestic partner’s income and household

information in Questions 4, 11, 12, 13, 14, 15, 16, 17.

STUDENT MARITAL STATUS

Single Married Divorced Separated Widowed Registered Domestic Partnership

skip to question 13)

question 13)

DEPENDENCY STATUS

The questions below will determine whether you are considered a Dependent student or Independent student for fee waiver eligibility and whether parental information is needed. If you answer “Yes” to ANY of the questions 1-10 below, you will be considered an

INDEPENDENT student. If you answer “No” to all questions, you will be considered a Dependent student thereby reporting parental information and should continue with Question 11.

1. |

Were you born before January 1, 1991? (If “yes”, skip to question 13) |

Yes |

No |

2. |

As of today, are you married or in a Registered Domestic Partnership (RDP)? (Answer "Yes" if you are separated but not divorced |

|

or have not filed a termination notice to dissolve partnership. (If “yes”, skip to question 13) |

Yes |

No |

3. Are you a veteran of the U.S. Armed Forces or currently serving on active duty for purposes other than training? (If “yes”, skip to Yes No

4.Do you have children who will receive more than half of their support from you between July 1, 2014 - June 30, 2015, or other dependents who live with you (other than your children or spouse/RDP) who receive more than half of their support from you,

now and through June 30, 2015? (If “yes”, skip to question 13)Yes No

5. At any time since you turned age 13, were both your parents deceased, were you in foster care, or were you a dependent or

ward of the court? (If “yes”, skip to question 13) |

Yes |

No |

6.Are you or were you an emancipated minor as determined by a court in your state of legal residence? (If “yes”, skip to question 13) Yes No

7.Are you or were you in legal guardianship as determined by a court in your state of legal residence? (If “yes”, skip to question 13) Yes No

8.At any time on or after July 1, 2013, did your high school or school district homeless liaison determine that you were an

unaccompanied youth who was homeless? (If “yes”, skip to question 13) |

Yes |

No |

9.At any time on or after July 1, 2013, did the director of an emergency shelter or transitional housing program funded by the U.S. Department of Housing and Urban Development determine that you were an unaccompanied youth who was homeless? (If “yes”,

Yes No

10.At any time on or after July 1, 2013, did the director of a runaway or homeless youth basic center or transitional living program determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless? (If

“yes”, skip to question 13) |

Yes |

No |

If you answered "Yes" to any of the questions 1 - 10, you are considered an INDEPENDENT student for enrollment fee waiver purposes and must provide income and household information about yourself (and your spouse or RDP if applicable). Skip to Question #13.

If you answered "No" to all questions 1 - 10, complete the following questions:

11. |

If your parent(s) or his/her RDP filed or will file a 2013 U.S. Income Tax Return, were you, or will you be claimed on their tax return |

|

as an exemption by either or both of your parents? |

Will Not FileYes |

No |

12. |

Do you live with one or both of your parent(s) and/or his/her RDP? |

Yes |

No |

If you answered "No" to questions 1 - 10 and "Yes" to either question 11 or 12, you must provide income and household information about your PARENT(S)/RDP. Please answer questions for a DEPENDENT student in the sections that follow.

If you answered "No" or "Parent(s) will not file" to question 11, and "No" to question 12, you are a dependent student for all student aid except this enrollment fee waiver. You may answer questions as an INDEPENDENT student on the rest of this

application, but please try to get your PARENT information and file a FAFSA so you may be considered for other student aid. You cannot get other student aid without your parent(s’) information.

|

METHOD A ENROLLMENT FEE WAIVER |

|

|

|

|

13. |

Are you (the student ONLY) currently receiving monthly cash assistance for yourself or any dependents from: |

|

|

|

|

TANF/CalWORKs? |

Yes |

No |

|

|

|

SSI/SSP (Supplemental Security Income/State Supplemental Program)? |

Yes |

No |

|

|

|

General Assistance? |

Yes |

No |

|

|

|

|

|

|

14. |

If you are a dependent student, are your parent(s)/RDP receiving monthly cash assistance from TANF/CalWORKs or SSI/SSP |

|

|

|

as a primary source of income? |

Yes |

No |

|

If you answered "Yes" to question 13 or 14 you are eligible for an ENROLLMENT FEE WAIVER. YOU MUST bring this BOGW application into the Student Financial Services Office and fill out an “Agency Consent for Release of Information” form so we

can verify your current benefits. Continue to Method B below.

METHOD B ENROLLMENT FEE WAIVER

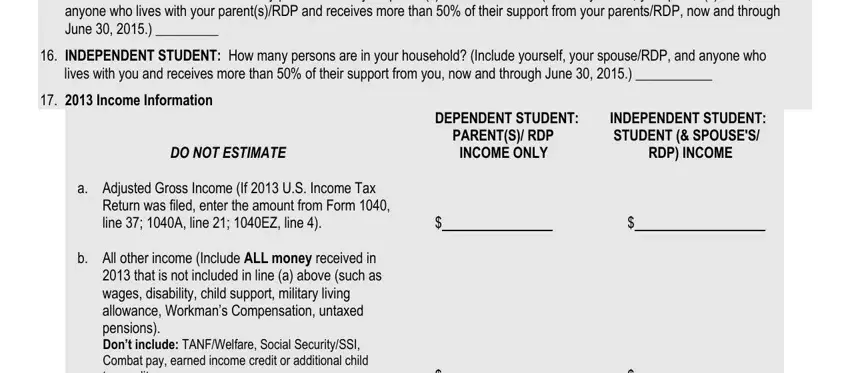

15.DEPENDENT STUDENT: How many persons are in your parent(s)/RDP household? (Include yourself, your parent(s)/RDP, and anyone who lives with your parent(s)/RDP and receives more than 50% of their support from your parents/RDP, now and through June 30, 2015.) _________

16.INDEPENDENT STUDENT: How many persons are in your household? (Include yourself, your spouse/RDP, and anyone who lives with you and receives more than 50% of their support from you, now and through June 30, 2015.) ___________

17.2013 Income Information

|

|

|

DEPENDENT STUDENT: |

INDEPENDENT STUDENT: |

|

|

|

|

PARENT(S)/ RDP |

STUDENT (& SPOUSE'S/ |

|

DO NOT ESTIMATE |

|

INCOME ONLY |

|

RDP) INCOME |

|

|

|

|

|

|

|

|

|

|

a. Adjusted Gross Income (If 2013 U.S. Income Tax |

|

|

|

|

|

|

|

|

Return was filed, enter the amount from Form 1040, |

|

|

|

|

|

|

|

|

line 37; 1040A, line 21; 1040EZ, line 4). |

|

$ |

|

|

$ |

|

|

|

b. All other income (Include ALL money received in |

|

|

|

|

|

|

|

|

2013 that is not included in line (a) above (such as |

|

|

|

|

|

|

|

|

wages, disability, child support, military living |

|

|

|

|

|

|

|

|

allowance, Workman’s Compensation, untaxed |

|

|

|

|

|

|

|

|

pensions). |

|

|

|

|

|

|

|

|

Don’t include: TANF/Welfare, Social Security/SSI, |

|

|

|

|

|

|

|

|

Combat pay, earned income credit or additional child |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

tax credit. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

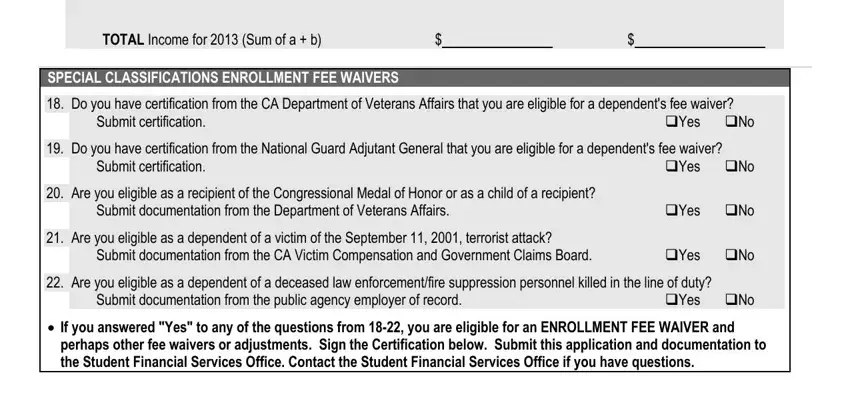

TOTAL Income for 2013 (Sum of a + b) |

|

$ |

|

|

$ |

|

|

|

SPECIAL CLASSIFICATIONS ENROLLMENT FEE WAIVERS |

|

|

|

|

|

|

|

|

18. |

Do you have certification from the CA Department of Veterans Affairs that you are eligible for a dependent's fee waiver? |

|

|

|

Submit certification. |

Yes |

No |

|

|

|

|

|

|

|

19. |

Do you have certification from the National Guard Adjutant General that you are eligible for a dependent's fee waiver? |

|

|

|

|

Submit certification. |

Yes |

No |

|

|

|

|

|

|

|

20. |

Are you eligible as a recipient of the Congressional Medal of Honor or as a child of a recipient? |

|

|

|

|

|

Submit documentation from the Department of Veterans Affairs. |

Yes |

No |

|

|

|

|

|

|

|

21. |

Are you eligible as a dependent of a victim of the September 11, 2001, terrorist attack? |

|

|

|

|

|

Submit documentation from the CA Victim Compensation and Government Claims Board. |

Yes |

No |

|

|

|

|

|

|

22. |

Are you eligible as a dependent of a deceased law enforcement/fire suppression personnel killed in the line of duty? |

|

|

|

|

Submit documentation from the public agency employer of record. |

Yes |

No |

|

If you answered "Yes" to any of the questions from 18-22, you are eligible for an ENROLLMENT FEE WAIVER and perhaps other fee waivers or adjustments. Sign the Certification below. Submit this application and documentation to the Student Financial Services Office. Contact the Student Financial Services Office if you have questions.

CERTIFICATION FOR ALL APPLICANTS: READ THIS STATEMENT AND SIGN BELOW

I hereby swear or affirm, under penalty of perjury, that all information on this form is true and complete to the best of my knowledge. If

asked by an authorized official, I agree to provide proof of this information, which may include a copy of my and my spouse/registered domestic partner and/or my parent's/registered domestic partner’s 2013 U.S. Income Tax Return(s). I also

realize that any false statement or failure to give proof when asked may be cause for the denial, reduction, withdrawal, and/or repayment of my waiver. I authorize release of information regarding this application between the college, the college district, and the Chancellor's Office of the California Community Colleges.

By signing below, I acknowledge that I understand the following information:

Federal and state financial aid programs are available to help with college costs (including enrollment fees, books & supplies, transportation and room and board expenses). By completing the FAFSA or the California Dream Application, additional financial assistance may be available in the form of Cal Grants, Pell and other grants, work study and other aid.

I may apply for and receive financial assistance if I am enrolled, either full time or part time, in an eligible program of study (certificate, associate degree or transfer).

Financial aid program information and application assistance is available in the college financial aid office.

Incomplete applications will be returned to the student which will delay processing.

TO EXPEDITE PROCESSING: Submit IN-PERSON to the Student Financial Services Office, West Campus Yosemite Hall 147

Other Options: FAX: 209-575-7719 MAIL: Modesto Junior College, Student Financial Services Office, 435 College Ave, Modesto CA 95350

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

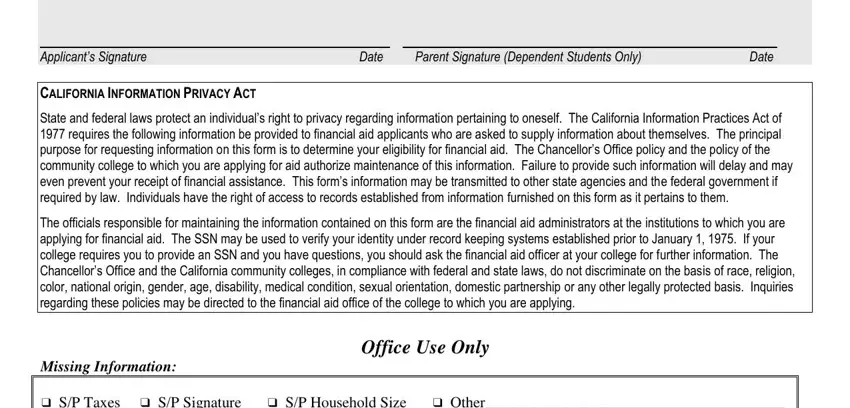

Applicant’s Signature |

Date |

|

Parent Signature (Dependent Students Only) |

Date |

CALIFORNIA INFORMATION PRIVACY ACT

State and federal laws protect an individual’s right to privacy regarding information pertaining to oneself. The California Information Practices Act of

1977 requires the following information be provided to financial aid applicants who are asked to supply information about themselves. The principal purpose for requesting information on this form is to determine your eligibility for financial aid. The Chancellor’s Office policy and the policy of the

community college to which you are applying for aid authorize maintenance of this information. Failure to provide such information will delay and may even prevent your receipt of financial assistance. This form’s information may be transmitted to other state agencies and the federal government if

required by law. Individuals have the right of access to records established from information furnished on this form as it pertains to them.

The officials responsible for maintaining the information contained on this form are the financial aid administrators at the institutions to which you are applying for financial aid. The SSN may be used to verify your identity under record keeping systems established prior to January 1, 1975. If your

college requires you to provide an SSN and you have questions, you should ask the financial aid officer at your college for further information. The Chancellor’s Office and the California community colleges, in compliance with federal and state laws, do not discriminate on the basis of race, religion,

color, national origin, gender, age, disability, medical condition, sexual orientation, domestic partnership or any other legally protected basis. Inquiries regarding these policies may be directed to the financial aid office of the college to which you are applying.

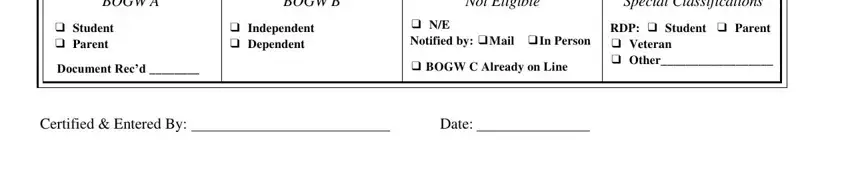

Office Use Only

Missing Information:

|

❑ S/P Taxes ❑ S/P Signature ❑ S/P Household Size |

❑ Other________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOGW A |

BOGW B |

|

Not Eligible |

Special Classifications |

|

|

|

|

❑ Student |

❑ Independent |

|

❑ N/E |

RDP: ❑ Student ❑ Parent |

|

|

|

|

❑ Parent |

❑ Dependent |

|

Notified by: ❑Mail ❑In Person |

❑ Veteran |

|

|

|

|

Document Rec’d ________ |

|

|

|

❑ BOGW C Already on Line |

❑ Other__________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certified & Entered By: |

|

|

|

|

Date: |

|

|

|

|

|