Using PDF files online is quite easy with this PDF editor. You can fill in state pension form here and try out several other options available. To make our tool better and easier to utilize, we constantly develop new features, with our users' suggestions in mind. Here's what you'd want to do to start:

Step 1: First, open the tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: Using this advanced PDF editing tool, you'll be able to accomplish more than just fill in forms. Edit away and make your docs seem great with customized text added, or tweak the original input to perfection - all that accompanied by an ability to insert just about any pictures and sign the document off.

This PDF doc will need specific information; to ensure correctness, you need to pay attention to the suggestions further down:

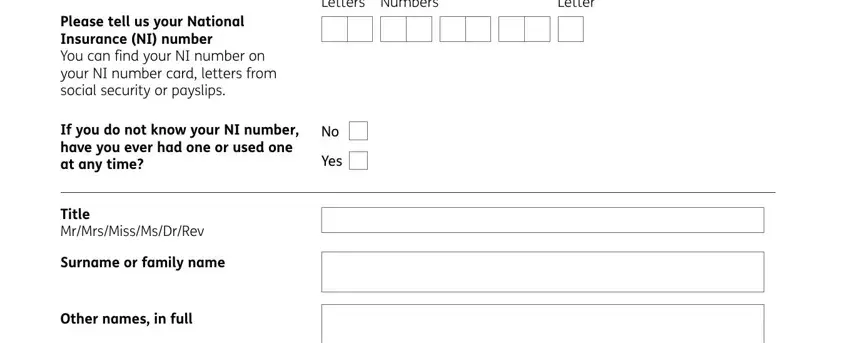

1. Whenever filling in the state pension form, ensure to include all essential blanks within the relevant form section. This will help speed up the work, which allows your information to be handled promptly and accurately.

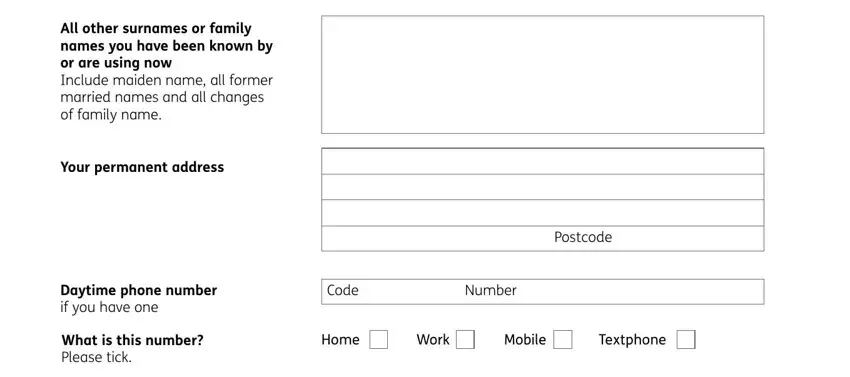

2. When the previous section is done, you should insert the necessary particulars in Your permanent address, Postcode, Daytime phone number if you have, What is this number Please tick, Code, Number, Home, Work, Mobile, Textphone, and Date of birth so you're able to progress further.

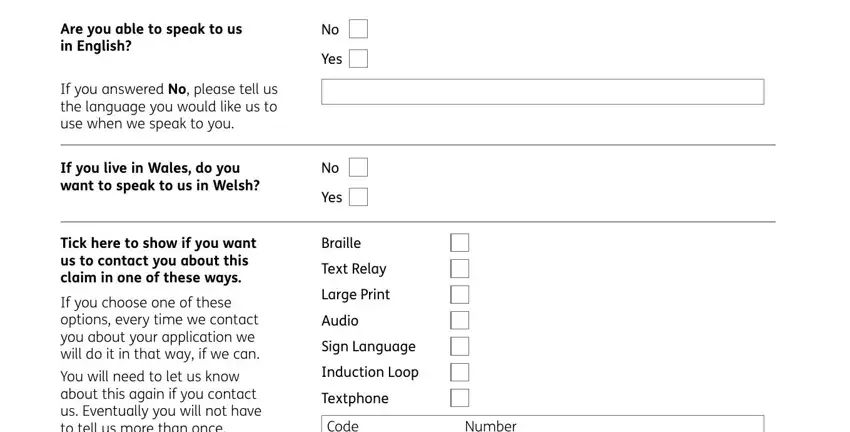

3. This next section will be focused on Are you able to speak to us in, If you answered No please tell us, If you live in Wales do you want, Yes, Yes, Tick here to show if you want us, If you choose one of these options, You will need to let us know about, Braille, Text Relay, Large Print, Audio, Sign Language, Induction Loop, and Textphone - complete all these blanks.

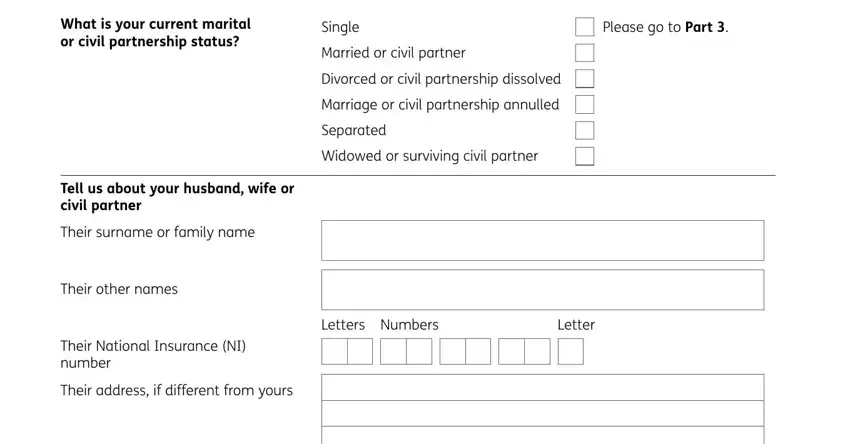

4. This next section requires some additional information. Ensure you complete all the necessary fields - What is your current marital or, Single, Married or civil partner, Please go to Part , Divorced or civil partnership, Marriage or civil partnership, Separated, Widowed or surviving civil partner, Letters Numbers, Letter, Tell us about your husband wife or, Their surname or family name, Their other names, Their National Insurance NI number, and Their address if different from - to proceed further in your process!

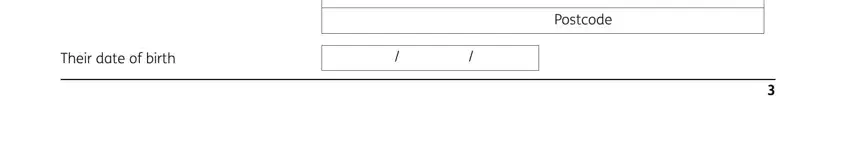

5. This form must be finished by dealing with this part. Here one can find a full list of blank fields that require accurate details for your document usage to be faultless: Their date of birth, and Postcode.

People who use this PDF generally make mistakes when completing Postcode in this area. You should definitely read twice everything you enter right here.

Step 3: Just after going through the form fields you have filled out, click "Done" and you're done and dusted! Obtain your state pension form as soon as you subscribe to a free trial. Quickly view the form in your FormsPal account page, with any edits and adjustments being all preserved! We do not share the information that you enter while dealing with forms at our website.