Through the online PDF editor by FormsPal, you may complete or alter kentucky revenue tax forms 765 gp here and now. Our team is aimed at providing you with the perfect experience with our editor by continuously adding new capabilities and improvements. Our editor is now even more useful thanks to the newest updates! Now, filling out PDF forms is easier and faster than ever. This is what you would need to do to get going:

Step 1: Click on the "Get Form" button in the top section of this page to open our editor.

Step 2: After you open the tool, you'll see the document made ready to be completed. Besides filling out different blanks, you can also do other sorts of actions with the PDF, that is putting on custom words, changing the original text, inserting graphics, putting your signature on the document, and much more.

It really is easy to complete the form adhering to this practical tutorial! Here's what you have to do:

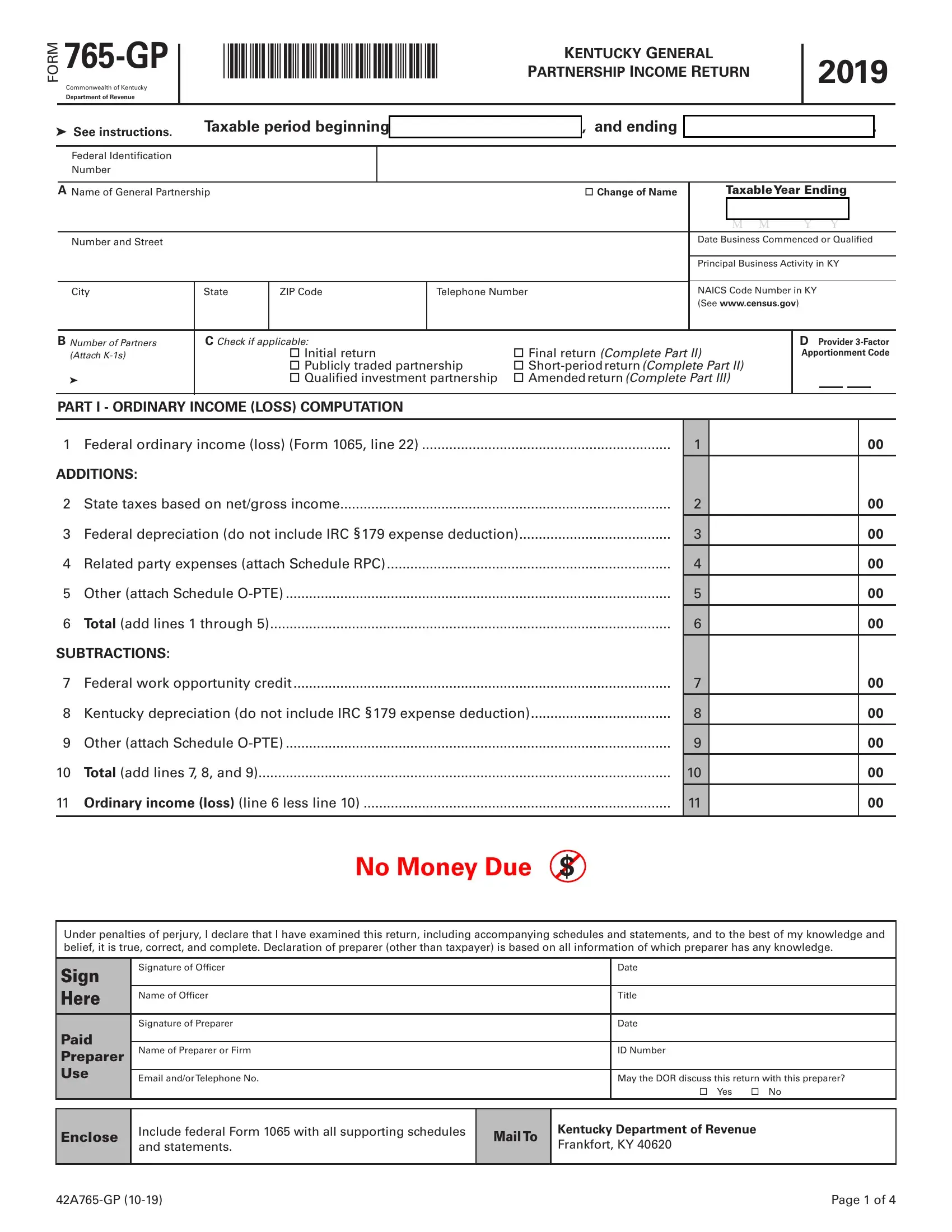

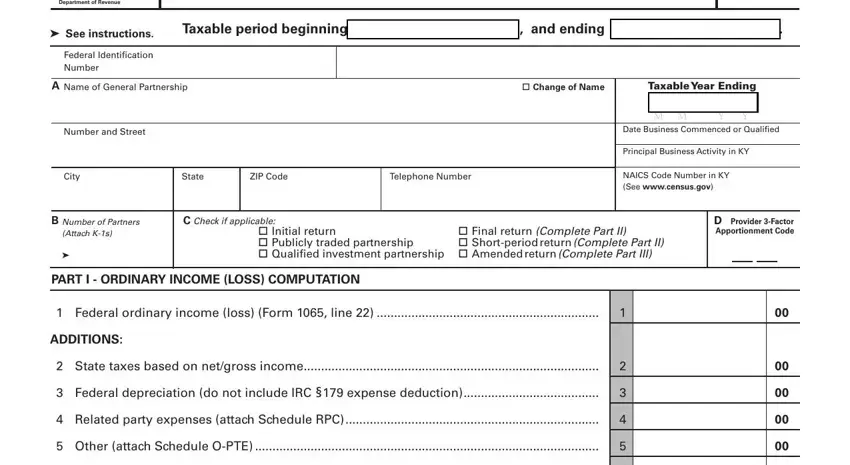

1. For starters, when filling in the kentucky revenue tax forms 765 gp, start with the area that includes the following blanks:

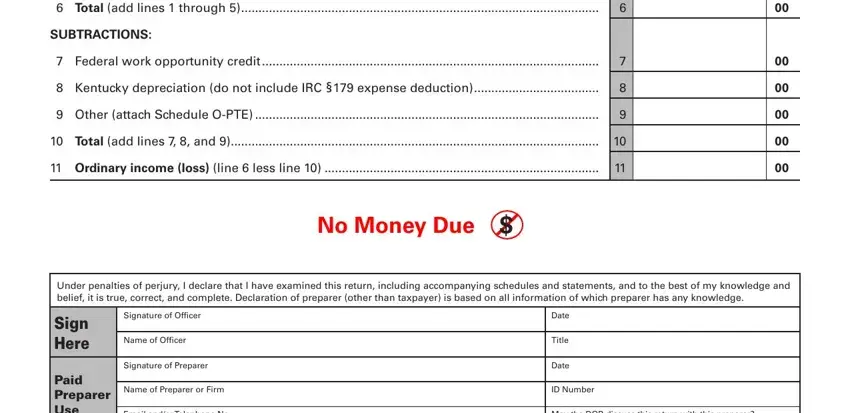

2. The next stage is to fill in these particular blank fields: Total add lines through, SUBTRACTIONS, Federal work opportunity credit, Kentucky depreciation do not, Other attach Schedule OPTE, Total add lines and, Ordinary income loss line less, No Money Due, Under penalties of perjury I, Sign Here, Paid Preparer Use, Signature of Officer, Name of Officer, Signature of Preparer, and Name of Preparer or Firm.

3. This 3rd part is considered rather straightforward, Paid Preparer Use, Email andor Telephone No, May the DOR discuss this return, Yes No, Enclose, Include federal Form with all, Mail To, Kentucky Department of Revenue, AGP, and Page of - all these form fields must be filled out here.

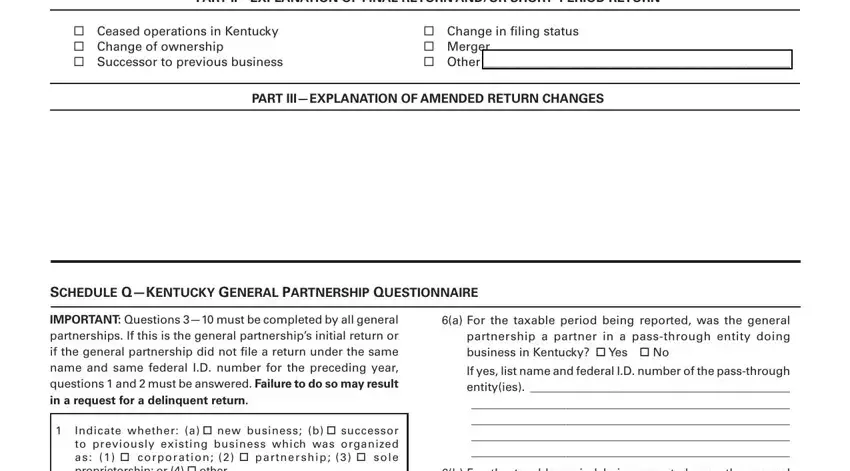

4. Completing PART IIEXPLANATION OF FINAL RETURN, Ceased operations in Kentucky, Change in filing status Merger, PART IIIEXPLANATION OF AMENDED, SCHEDULE QKENTUCKY GENERAL, IMPORTANT Questions must be, Indicate whether a new business b, a For the taxable period being, If yes list name and federal ID, and b For the taxable period being is vital in this part - make sure you take the time and fill in every single blank area!

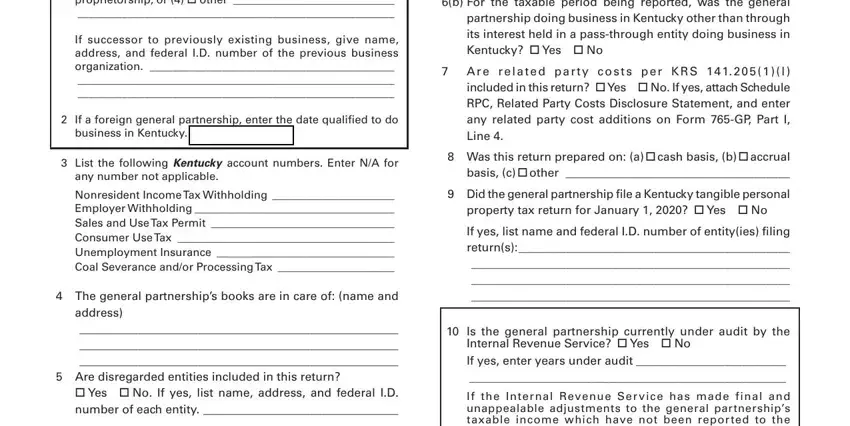

5. To finish your document, this last section requires a couple of additional blank fields. Typing in Indicate whether a new business b, If successor to previously, If a foreign general partnership, business in Kentucky, List the following Kentucky, any number not applicable, Nonresident Income Tax Withholding, The general partnerships books, b For the taxable period being, A r e r e l a t e d p a rt y c o, Was this return prepared on a, Did the general partnership file a, property tax return for January, If yes list name and federal ID, and address is going to finalize everything and you're going to be done in the blink of an eye!

People often make errors when filling in Indicate whether a new business b in this part. Make sure you go over what you enter here.

Step 3: Make certain your details are accurate and then just click "Done" to continue further. After creating afree trial account here, you will be able to download kentucky revenue tax forms 765 gp or send it through email directly. The form will also be easily accessible from your personal account with all your edits. Here at FormsPal, we do everything we can to be sure that all your details are kept protected.