Using PDF forms online can be simple with our PDF editor. You can fill out nhs gp locum here effortlessly. To make our tool better and easier to work with, we consistently implement new features, with our users' suggestions in mind. If you are seeking to get going, this is what it will take:

Step 1: Simply press the "Get Form Button" above on this webpage to access our pdf editor. There you will find all that is needed to work with your document.

Step 2: With this online PDF file editor, you are able to do more than just fill out blanks. Try all of the functions and make your documents look great with custom textual content added, or tweak the file's original input to excellence - all backed up by the capability to insert any images and sign it off.

Completing this document demands focus on details. Ensure all necessary blank fields are filled out properly.

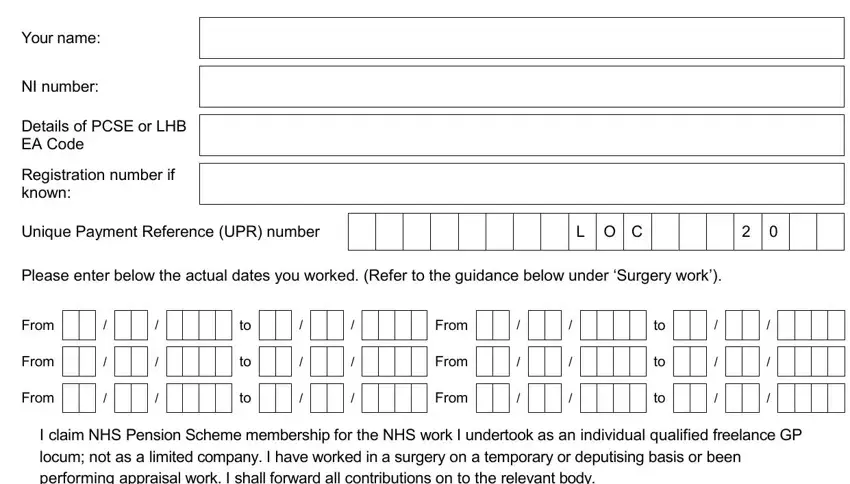

1. The nhs gp locum will require certain details to be typed in. Be sure that the next fields are finalized:

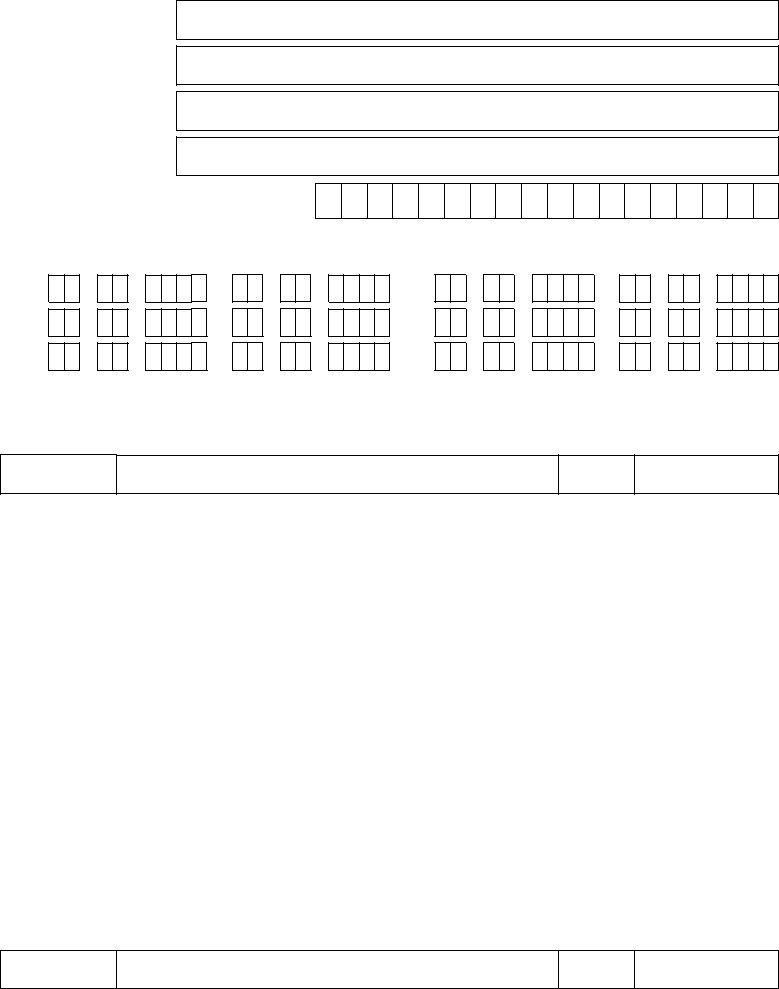

2. Once the previous segment is finished, you should put in the required details in Your name, NI number, Details of PCSE or LHB EA Code, Registration number if known, Unique Payment Reference UPR number, L O C, Please enter below the actual, From, From, From, From, From, From, and I claim NHS Pension Scheme so you're able to go to the next step.

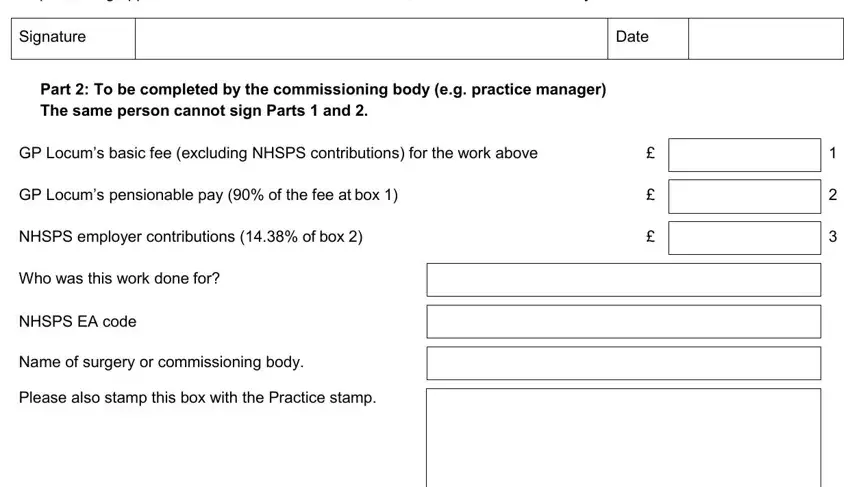

3. The following portion will be about I claim NHS Pension Scheme, Signature, Part To be completed by the, GP Locums basic fee excluding, GP Locums pensionable pay of the, NHSPS employer contributions of, Who was this work done for, NHSPS EA code, Name of surgery or commissioning, Please also stamp this box with, and Date - type in every one of these empty form fields.

You can certainly get it wrong while filling in the I claim NHS Pension Scheme, and so make sure that you look again prior to deciding to finalize the form.

4. This next section requires some additional information. Ensure you complete all the necessary fields - Signature, Date, and NHS PensionsGP Locum A V - to proceed further in your process!

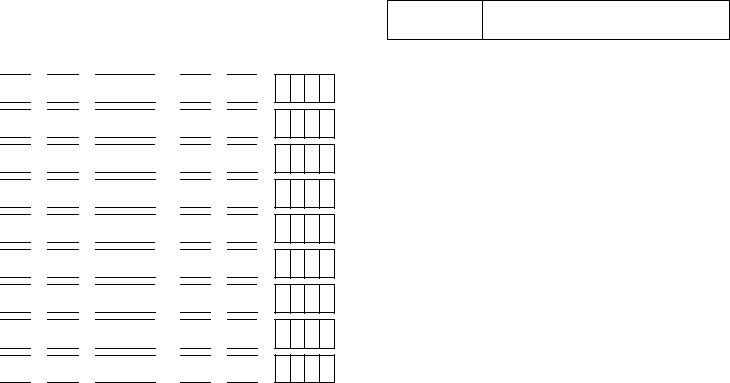

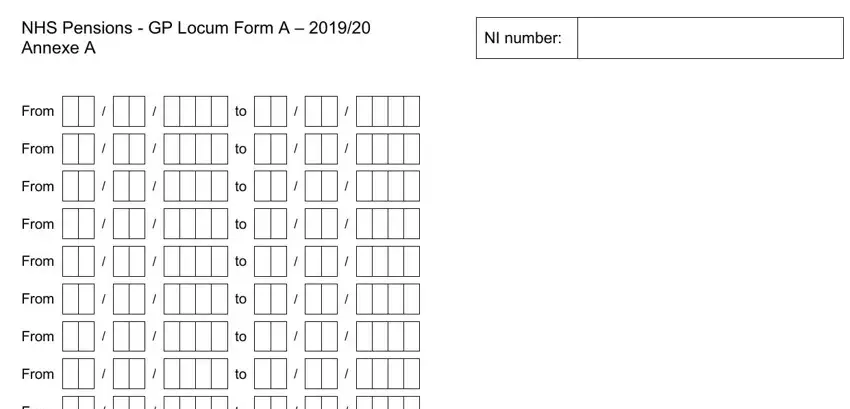

5. While you come close to the end of your document, there are just a few extra requirements that should be satisfied. Specifically, NHS Pensions GP Locum Form A, NI number, From, From, From, From, From, From, From, From, and From should be done.

Step 3: Proofread all the information you've entered into the form fields and then click the "Done" button. Obtain the nhs gp locum as soon as you register online for a 7-day free trial. Instantly use the form within your FormsPal cabinet, with any edits and changes automatically synced! We don't sell or share the information you type in whenever filling out forms at FormsPal.