Dealing with PDF forms online is definitely very simple with this PDF editor. You can fill out myaccess nyc mta here effortlessly. In order to make our editor better and simpler to work with, we constantly come up with new features, with our users' feedback in mind. To get the ball rolling, take these simple steps:

Step 1: Hit the "Get Form" button above on this page to open our tool.

Step 2: The tool gives you the capability to work with your PDF form in many different ways. Enhance it by adding any text, adjust original content, and place in a signature - all possible in minutes!

It is actually simple to complete the pdf with this helpful guide! Here is what you have to do:

1. Fill out your myaccess nyc mta with a number of necessary fields. Note all of the information you need and ensure there's nothing overlooked!

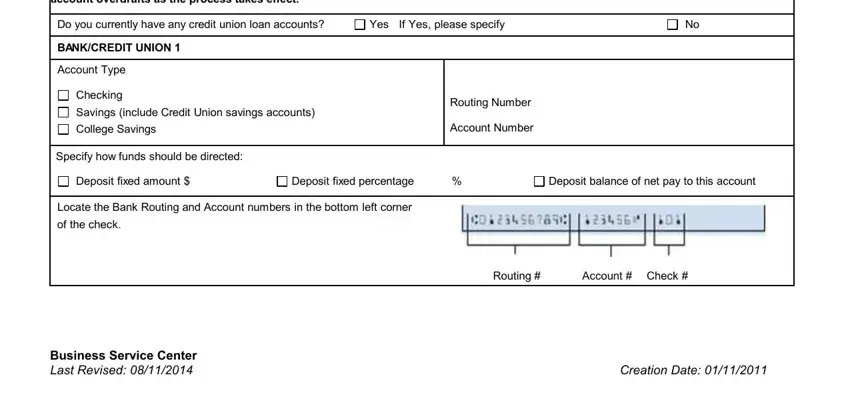

2. Once this section is finished, it is time to add the necessary specifics in Note It takes approximately to , Do you currently have any credit, Yes If Yes please specify, BANKCREDIT UNION , Account Type, Checking, Savings include Credit Union, College Savings, Specify how funds should be, Routing Number, Account Number, Deposit fixed amount , Deposit fixed percentage , Deposit balance of net pay to this, and Locate the Bank Routing and so that you can move on further.

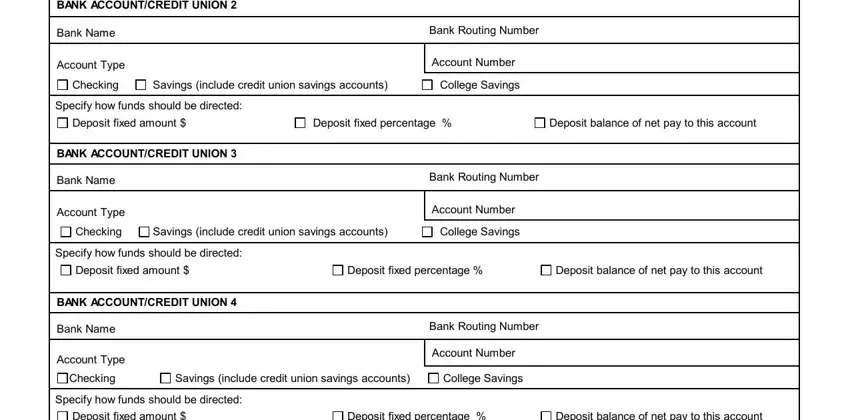

3. This step is usually hassle-free - complete every one of the fields in BANK ACCOUNTCREDIT UNION , Bank Name, Account Type, Bank Routing Number, Account Number, Checking, Savings include credit union, College Savings, Specify how funds should be, Deposit fixed amount , Deposit fixed percentage , Deposit balance of net pay to this, BANK ACCOUNTCREDIT UNION , Bank Name, and Account Type to conclude this process.

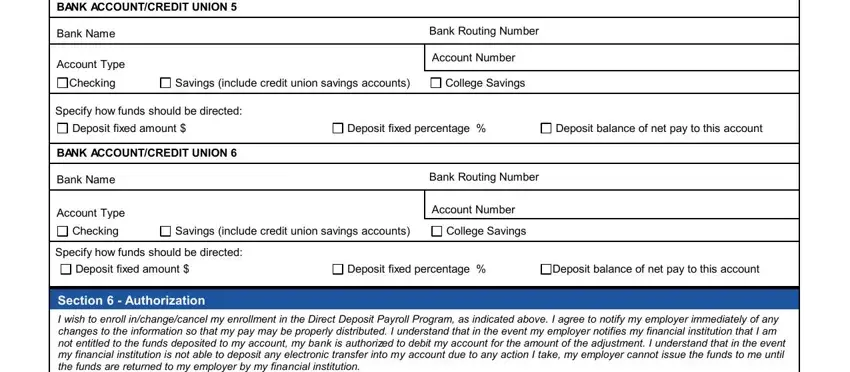

4. To move ahead, this next stage involves typing in a handful of fields. These include BANK ACCOUNTCREDIT UNION , Bank Name, Account Type, Bank Routing Number, Account Number, Checking, Savings include credit union, College Savings, Specify how funds should be, Deposit fixed amount , Deposit fixed percentage , Deposit balance of net pay to this, BANK ACCOUNTCREDIT UNION , Bank Name, and Account Type, which are key to going forward with this particular form.

As to Deposit fixed percentage and Deposit balance of net pay to this, make sure that you take a second look here. Both of these are thought to be the most significant fields in this PDF.

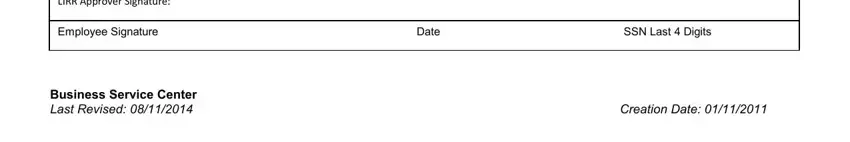

5. And finally, the following final segment is what you need to wrap up before using the form. The blank fields at issue include the following: LIRR Approver Signature, Employee Signature, Date, SSN Last Digits, and Business Service Center Last.

Step 3: Go through all the details you've inserted in the blanks and hit the "Done" button. Create a free trial account at FormsPal and get instant access to myaccess nyc mta - readily available in your FormsPal cabinet. FormsPal is invested in the privacy of all our users; we make certain that all personal data coming through our tool stays secure.